💊 Hims & Hers: Surging Telehealth

Savvy marketing and GLP-1 bring accelerating growth

Welcome to the Premium edition of How They Make Money.

Over 150,000 subscribers turn to us for business and investment insights.

In case you missed it:

Hims & Hers (HIMS) has emerged as a dominant player in the telehealth space.

After several requests from our Premium community, it’s time for a closer look at the company with our signature visuals and insights.

Why should you care?

🧑⚕️ Hims & Hers is on track to become a US telehealth leader.

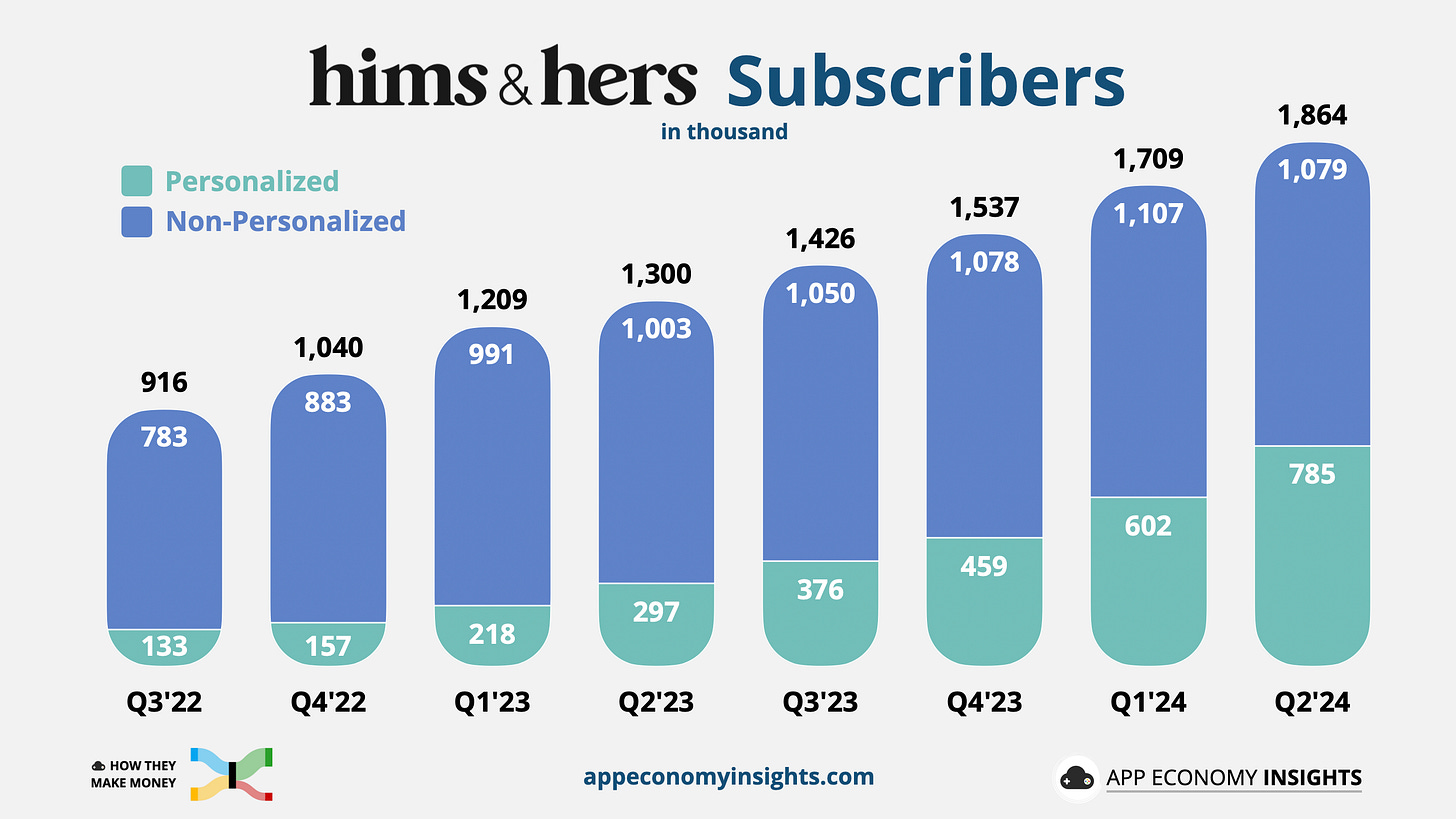

📈 Nearly 2 million subscribers, doubling in the past two years.

💉 Weight-loss treatments are a new growth tailwind.

To be sure, telehealth comes with various risks & challenges, from regulations to intense competition (more on this in a minute).

Andrew Dudum and Hilary Coles founded Hims in 2017, initially focused on erectile dysfunction and hair loss treatments. A year later, they launched Hers, a brand targeted to women.

The company went public in January 2021 through a SPAC merger led by co-chairman of Oaktree Capital Management Howard Marks, raising over $280 million. The team includes seasoned executives with expertise in healthcare, technology, and consumer brands.

Hims & Hers leverages a digital-first platform to provide convenient, personalized, and discreet healthcare solutions where individuals feel empowered to take control of their well-being.

But is it steak or just sizzle?

To answer this question, we have to look at the business model and understand what’s behind the recent growth acceleration.

Today at a glance:

How Hims & Hers makes money.

GLP-1 risks & opportunities.

Key quotes from management.

What to watch looking forward.

1. How Hims & Hers Makes Money

What is Hims & Hers?

Hims & Hers is a telehealth platform that offers personalized consultations and treatments for various health concerns, including sexual health, hair loss, skincare, and mental health.

The first thing you should know is that Hims & Hers operates as a subscription-based telehealth platform.

🩺 Telehealth: The use of digital technologies to deliver healthcare services remotely, including online consultations, diagnosis, and treatment.

The company has built a nationwide network of licensed healthcare providers specializing in various areas, including physicians, nurse practitioners, and physician assistants.

Hims & Hers primarily generates revenue through subscriptions, which provide patients with ongoing access to consultations, personalized treatment plans, and medications. The company also generates revenue from selling individual products.

Key differentiators:

💻 Digital-First: Online consultations and discreet delivery prioritize convenience and privacy.

🤫 Destigmatization: Focus on sensitive health topics fosters a safe and judgment-free environment.

💊 Personalized Treatments: Plans tailored to each individual's needs, medical history, and preferences.

📱 Accessibility: Affordable pricing and subscription options enhance healthcare accessibility

Hims & Hers' success is built upon a range of products and services catering to diverse health needs.

Let's take a quick look at what they offer:

👨 Hims: Telehealth platform for men's health.

👩 Hers: Telehealth platform for women's health.

💊 Online pharmacy: Fulfillment and delivery of medications.

🧴 Skincare and wellness products: A range of branded products.

🧪 Personalized plans: Customized plans based on individual needs.

Key metrics:

Management shared several key business metrics for Q2 FY24:

🧑🤝🧑 Subscribers: The core driver of recurring revenue. They grew 43% year-over-year to 1.9 million.

🧪 Personalized subscribers: Highlights the adoption of personalized treatment plans, demonstrating the effectiveness of a tailored approach. An impressive 42% of subscribers have a personalized solution (up 19 percentage points year-over-year).

💵 Monthly Online Revenue per Average Subscriber: A key metric indicating the average monthly revenue generated from each online subscriber, demonstrating the value derived from the direct-to-consumer channel. It grew 8% year-over-year to $57.

📆 Payback period: The time it takes for the gross profit generated by new customers to exceed the acquisition costs. Management targets a payback period of under one year.

👥 Total net orders: Reflects overall demand for products and services. They grew 20% to 2.5 million.

🧾 Average Order Value (AOV): Online Revenue divided by Net Orders. It grew 27% to $121.

Let’s look at the financials of the most recent quarter.