📊 PRO: This Week in Visuals

TCEHY CSCO SONY AMAT SE NU CRWV JD FLUT CRCL ONON CART MNDY DLO

Welcome to the Saturday PRO edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our library: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

📱 Tencent: Global Gaming Surge

🌐 Cisco: AI Orders Surge

🖥️ Sony: Anime Offsets Gaming Profit Dip

⚙️ Applied Materials: Preps for AI Ramp

🌊 Sea: Profit Miss Tarnishes Growth

🏦 Nu: AI-Fueled Credit

☁️ CoreWeave: Supply Stumbles

🚚 JD.com: New Biz Drags Margin

🏈 Flutter: FanDuel’s Prediction Pivot

🪙 Circle: Rate Sensitivity

👟 On: Accelerating Beyond Shoes

🥕 Instacart: Order Growth Accelerates

📆 Monday.com: Guidance Haunts Again

🌎 dLocal: Margins Squeezed

1. 📱 Tencent: Global Gaming Surge

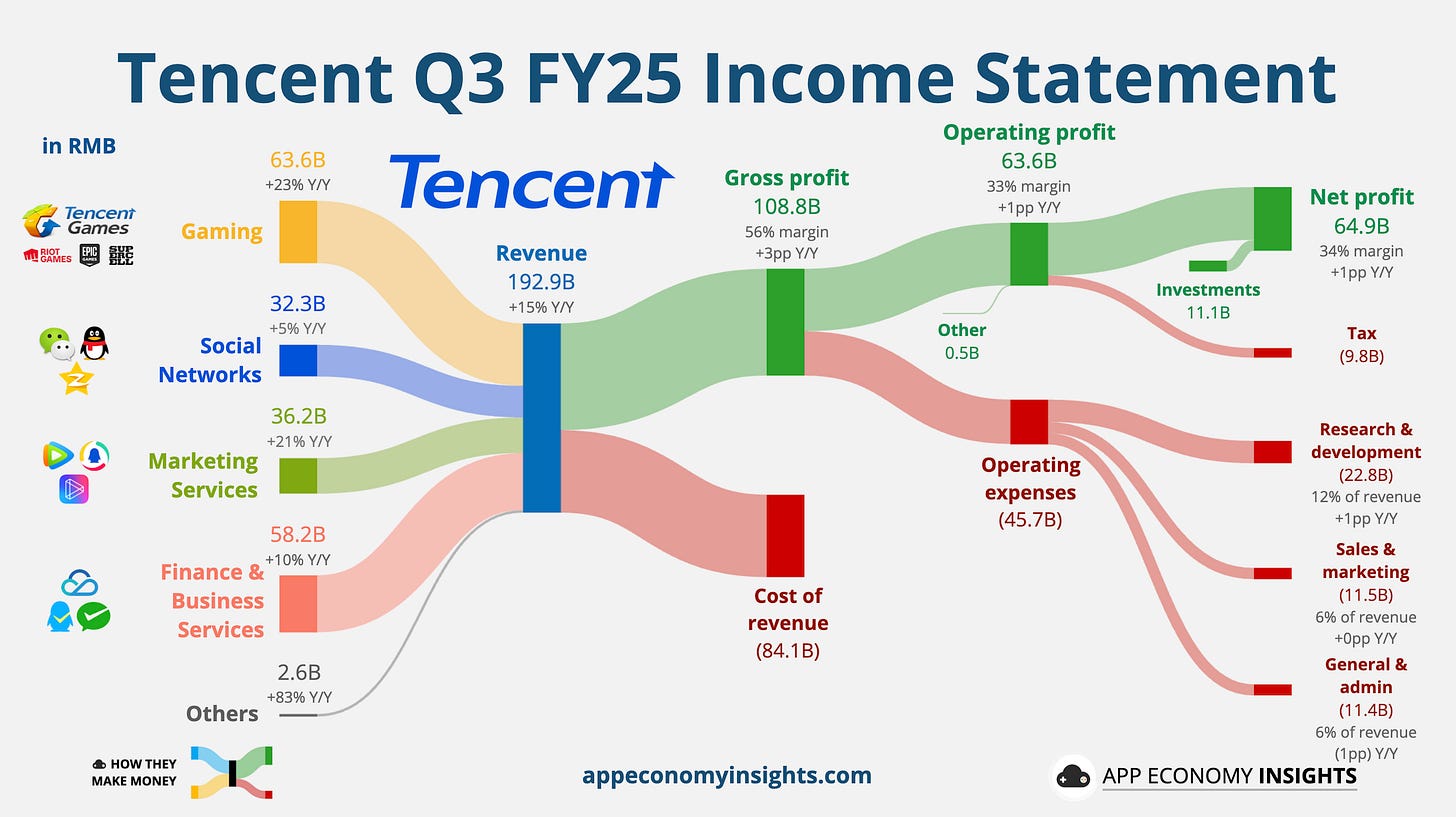

Tencent’s Q3 revenue rose 15% Y/Y to RMB 193 billion (~$27.2 billion), once again powered by a 23% rise in gaming. New blockbusters like Valorant Mobile (China’s biggest mobile launch of the year) and evergreen franchises like Honor of Kings and Clash Royale kept engagement high. Internationally, Tencent’s big bets are hitting: Delta Force surpassed 30 million DAUs, Dying Light: The Beast boosted PC revenues, and Supercell titles helped drive the huge overseas gaming beat, rising 43% Y/Y.

Net profit jumped 19% to RMB 65 billion, beating expectations. Capex fell 24% Y/Y to RMB 13B after a heavy AI build-out earlier this year. Free cash flow was flat at RMB 59 billion, while Tencent’s RMB 493 billion cash pile (including RMB 102 billion net cash) keeps it one of China’s strongest balance sheets.

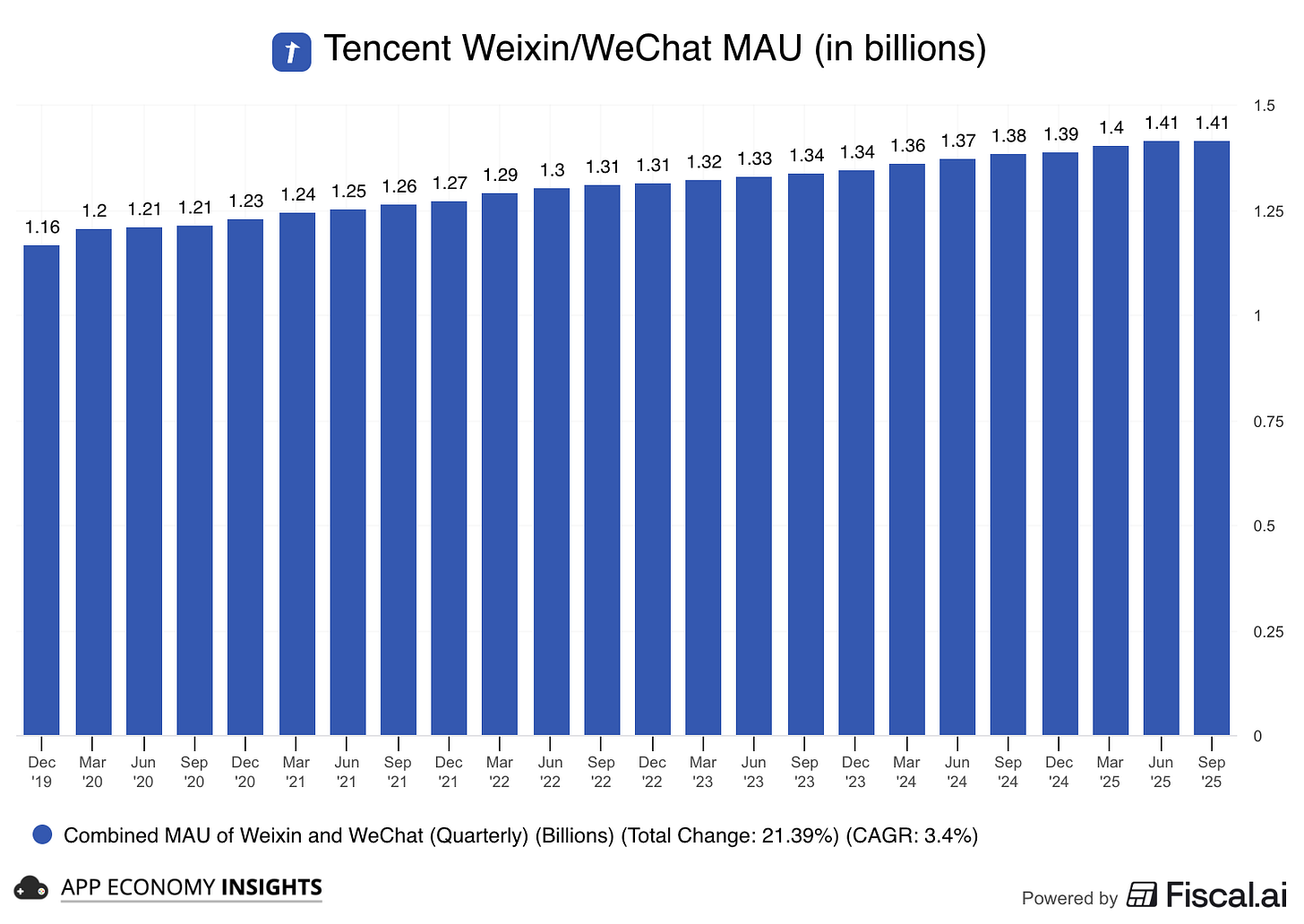

Management reiterated its “measured AI” strategy, integrating its Hunyuan model into Weixin/WeChat, gaming, and ad systems rather than chasing splashy infrastructure spends. AI is already lifting ad ROAS, game engagement, and coding productivity. Weixin’s 1.41 billion MAUs continue to support monetization via mini-games, video accounts, and expanding payments (now including TenPay Global Checkout).

AI-boosted ad targeting pushed marketing services revenue up 21%. Cloud revenue improved as AI-related workloads ramped, though management cautioned that AI chip shortages limit how much compute they can rent out externally.

With AI upgrades rolling out across advertising and gaming, and a slate of major titles ahead, Tencent is delivering steady growth while sticking to margin discipline. All this, without spending aggressively on AI infrastructure like US Big Tech.

2. 🌐 Cisco: AI Orders Surge

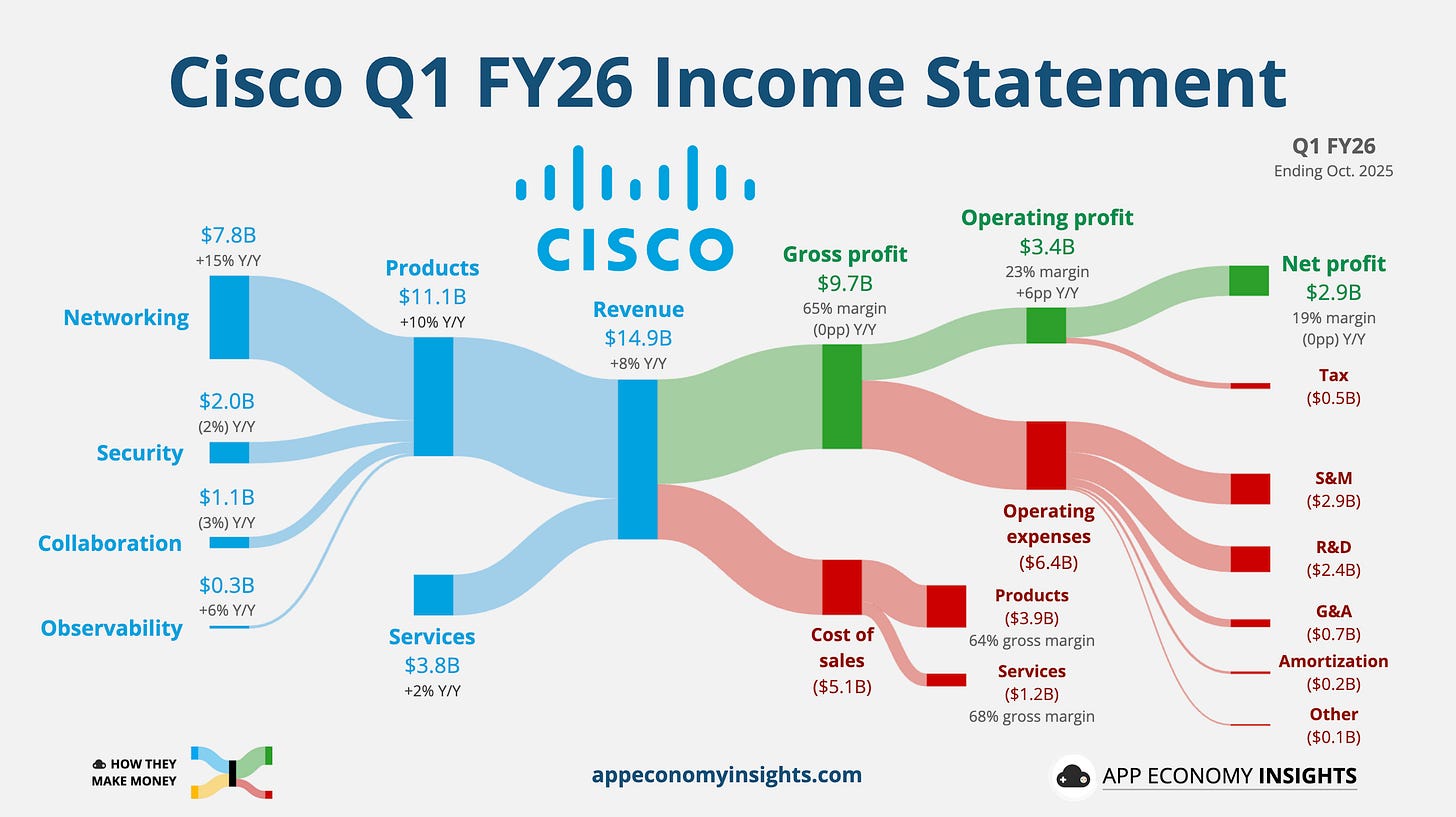

Cisco’s Q1 FY26 (September quarter) revenue rose 8% Y/Y to $14.9 billion ($100 million beat) and adjusted EPS was $1.00 ($0.02 beat).

AI infrastructure orders from hyperscalers surged to $1.3 billion in the September quarter (a massive uptick from $800 million in the June quarter). Products revenue rose 10% to $11.1 billion, driven by 15% growth in Networking.

Momentum in Networking (with product orders up 13%) and new AI partnerships (G42/UAE, NVIDIA N9100 switch) offset a temporary 2% decline in Security. Management attributed the security dip to platform transitions and a Splunk cloud-mix “timing issue.”

Cisco is now targeting $3 billion in AI revenue from hyperscalers for FY26, with a separate $2+ billion enterprise AI pipeline.

Cisco raised its full-year FY26 revenue guidance to $60.2–$61.0 billion (from $59–$60 billion) and adjusted EPS to $4.08–$4.14 (from $4.00–$4.06), citing accelerating AI demand. The Q2 outlook for both revenue and EPS also came in well ahead of consensus, as the company proves it can capture a significant share of the AI infrastructure spending.