📊 PRO: This Week in Visuals

COST ACN

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🛒 Costco: Growth Moderates

🌐 Accenture: Federal Spending Cuts

1. 🛒 Costco: Growth Moderates

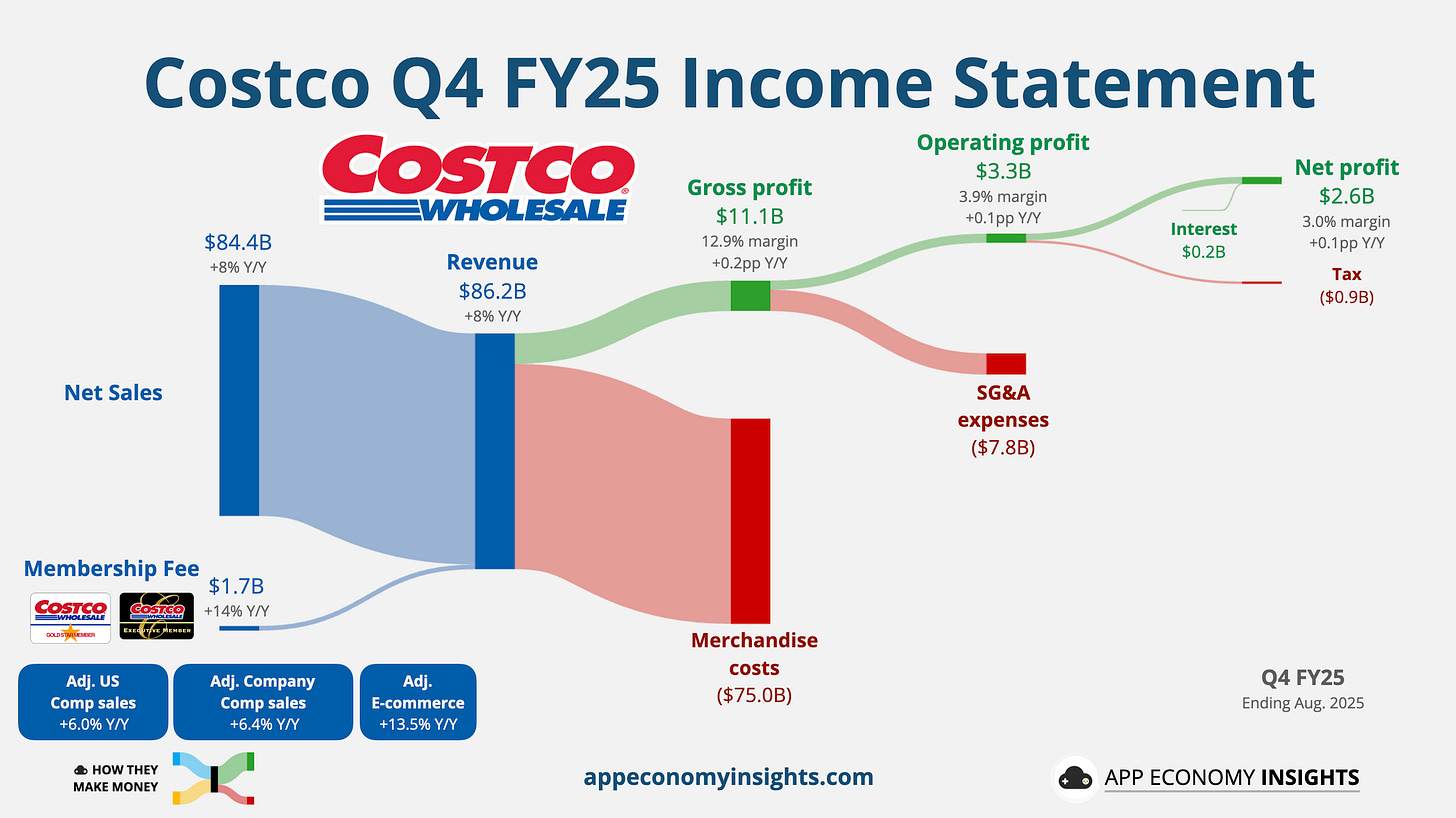

Costco closed out FY25 (ending in August) with Q4 revenue growing 8% Y/Y to $86.2 billion ($100 million beat) and EPS of $5.87 ($0.06 beat). However, the beat was overshadowed by moderating growth in adjusted same-store sales to +6.4% globally and +6.0% in the US (down from 8.0% and 7.9% last quarter, respectively).

In contrast, the fundamentals of the business model remained strong. Membership fee income surged 14% to $1.72 billion, driven by upgrades to its Executive tier following the rollout of new perks like exclusive shopping hours. E-commerce remained a bright spot, growing 13.5%. The company continues to navigate tariff pressures by increasing the penetration of its higher-margin Kirkland Signature private label, attracting younger members.

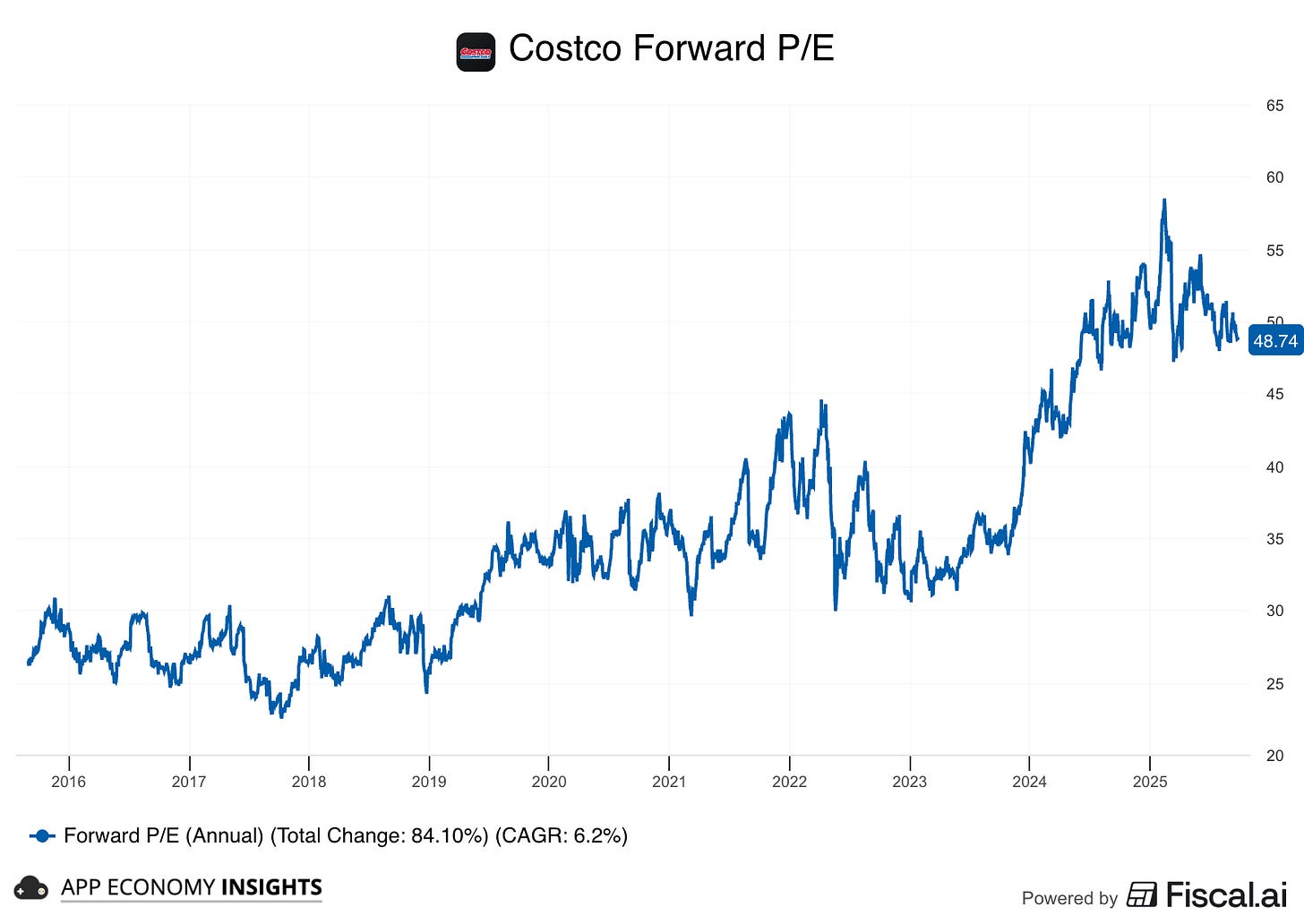

Looking ahead, Costco announced plans to open 35 new warehouses in FY26, a significant uptick from the 25 added in FY25. That said, the stock remains priced for perfection. The deceleration in comparable sales growth is testing Costco’s premium valuation of ~49x forward earnings.