📊 PRO: This Week in Visuals

MU NKE FDX CCL GIS

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

⚙️ Micron: Record Quarter Delivered

👟 Nike: Turning the Page

🚚 FedEx: Warning Signs

🛳️ Carnival: Sailing Ahead of Schedule

🍪 General Mills: Still Under Pressure

FROM OUR PARTNERS

Snagged.com: Acquire Impossible-to-Get Domain Names

Snagged helps clients acquire premium, hard-to-obtain digital assets.

Led by Rob Schutz (co-founder and former Chief Growth Officer at Ro), they help companies navigate the opaque and often confusing world of domain names.

They’ve worked with everyone from scrappy founders to public companies, securing deals like Kit.com, Slash.com, Kickstart.com, Bilt.com, World.org, and more.

Snagged offers a free initial assessment to gauge feasibility (budget, owner, etc), then handles research, outreach, negotiation, and transfer—so you don’t end up WhatsApp’ing a domain investor in the UAE at 2am.

Their reputation is top-tier, with endorsements from Garry Tan (Y Combinator), Alexis Ohanian (Reddit, 776), and John Zimmer (Lyft).

Dream domain in mind? Selling a premium one? Or just want to geek out on domains?

1. ⚙️ Micron: Record Quarter Delivered

Micron saw its May quarter (Q3 FY25) revenue surge 37% Y/Y and 15% Q/Q to $9.3 billion ($450 million beat), with EPS of $1.91 ($0.30 beat) and the highest free cash flow in six years at nearly $2 billion. DRAM (Dynamic Random Access Memory) drove the surge, accounting for 76% of total sales, while HBM (High Bandwidth Memory) revenue jumped almost 50% sequentially, crossing a $6 billion run rate. Data center sales doubled Y/Y, and management confirmed its HBM chips are sold out through 2025.

Guidance came in hot: Q4 FY25 revenue is projected at $10.7 billion ($0.8 billion beat) and EPS at $2.50 ($0.47 beat), both well above consensus. Management raised its DRAM bit growth outlook for 2025 to the high teens and expects gross margin to expand to 42%. Analysts cheered the AI momentum but noted that lofty expectations leave little room for upside surprises. Shares fell despite the beat, as the bar keeps rising. The stock rose nearly 50% in the first half of 2025.

2. 👟 Nike: Turning the Page

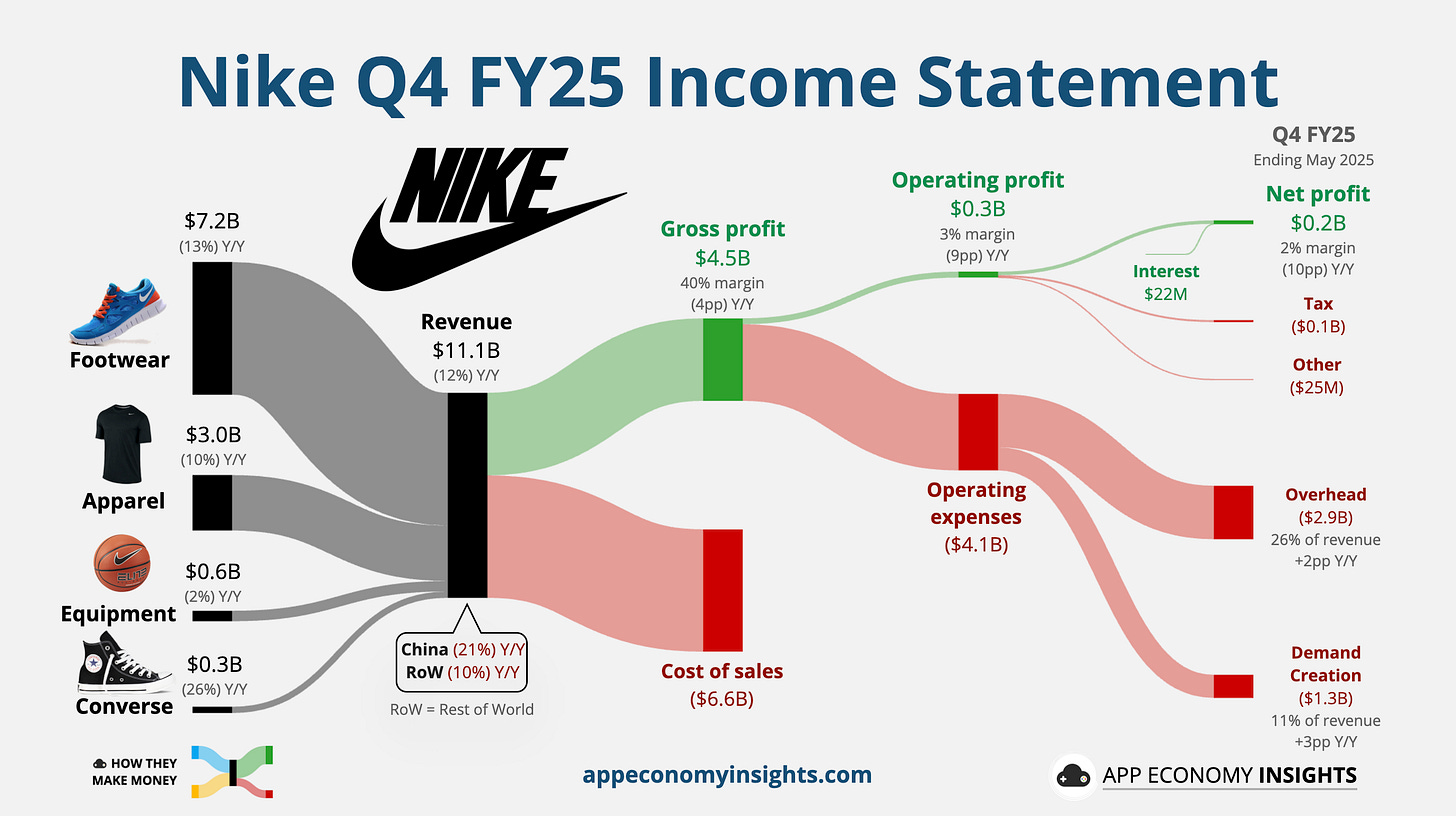

Nike’s May quarter results (Q4 FY25) showed signs of stabilization in a difficult turnaround. Revenue fell 12% Y/Y to $11.1 billion ($380 million beat), and gross margin declined 4 points to 40%, better than feared. Nike Direct dropped 14% while wholesale fell 9%, reflecting ongoing weakness in digital and core franchises, but also progress in rebuilding retail relationships. Revenue in Greater China dropped 21% to $1.5 billion, underperforming the rest of the world. EPS came in at $0.14, down 86% Y/Y but ahead of consensus ($0.02 beat).

CEO Elliott Hill pitched a “sport offense” strategy to accelerate the reset: streamlining leadership, creating sport-specific teams, and returning to Amazon with a featured store. The company also announced price hikes and production shifts away from China to combat a looming $1 billion tariff headwind. Encouragingly, performance categories like running and basketball are gaining traction, and the holiday order book is up.

While management expects more margin pressure in the first half of FY26, inventory was flat, and analysts see Q4 as the bottom. With shares rebounding from a 10-year low and sentiment improving, Nike may be lacing up for a long-overdue comeback.

3. 🚚 FedEx: Warning Signs

FedEx topped expectations in its May quarter (Q4 FY25) with revenue up 1% Y/Y to $22.2 billion and adjusted EPS of $6.07 ($0.22 beat). Cost cuts from its DRIVE and Network 2.0 programs helped lift margins, with Express improving thanks to higher export volumes and pricing. However, Freight remained weak, and the expiration of the USPS contract weighed on results. Management confirmed another $1 billion in permanent savings for FY26 and plans $4.5 billion in capex, focused on modernizing its network and fleet.