📊 PRO: This Week in Visuals

ACN NKE FDX CCL GIS DRI

Welcome to the Saturday PRO edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🌐 Accenture: AI Scaling, Outlook Stalling

👟 Nike: Middle Innings

🚚 FedEx: Increased US Volume

🛳️ Carnival: Dividend Returns

🍪 General Mills: Price Cuts Pay Off

🫒 Darden: Traffic Returns

1. 🌐 Accenture: AI Scaling, Outlook Stalling

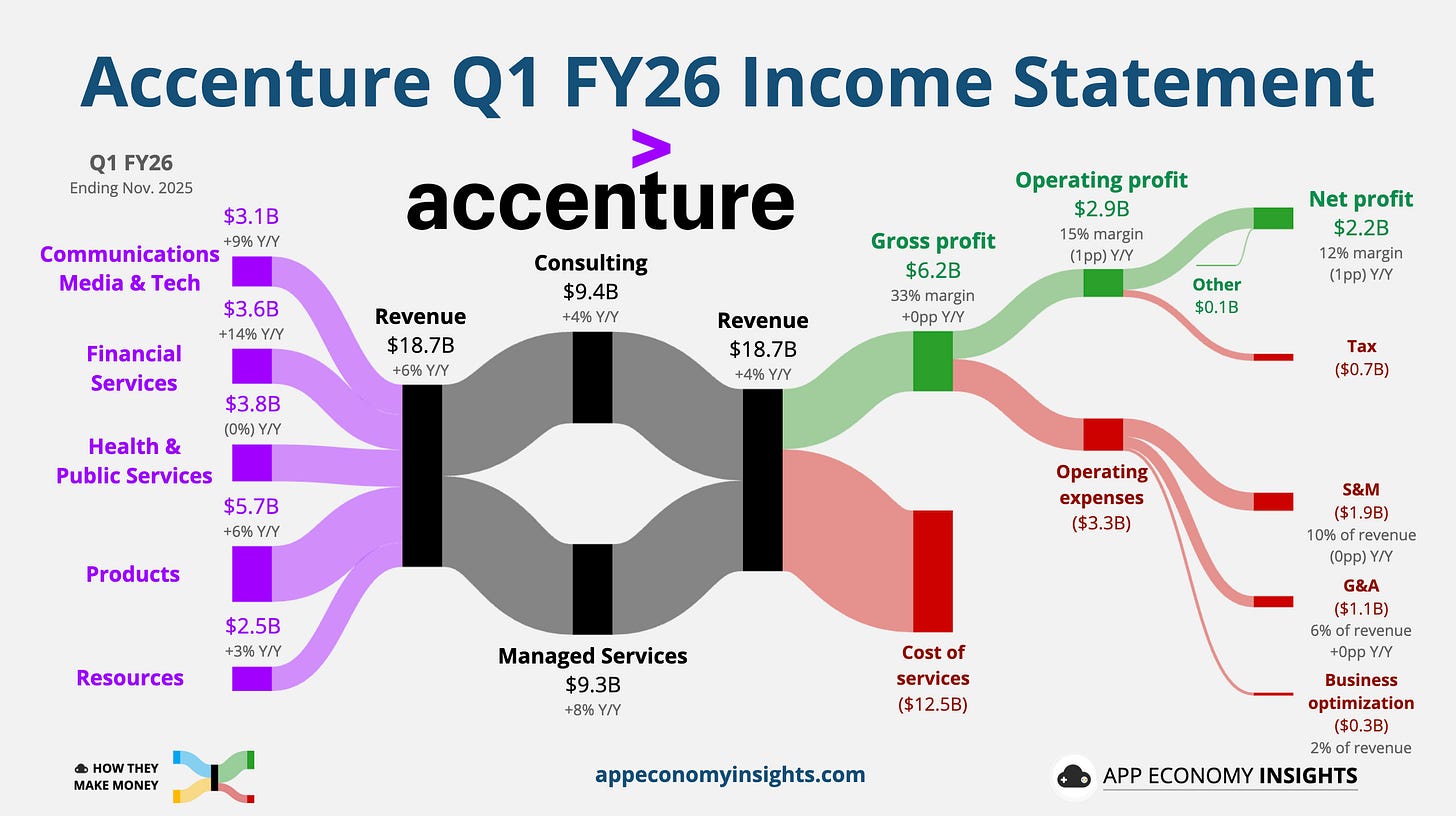

Accenture kicked off FY26 with Q1 revenue (November quarter) rising 6% Y/Y to $18.7 billion ($0.2 billion beat) and non-GAAP EPS of $3.94 ($0.22 beat).

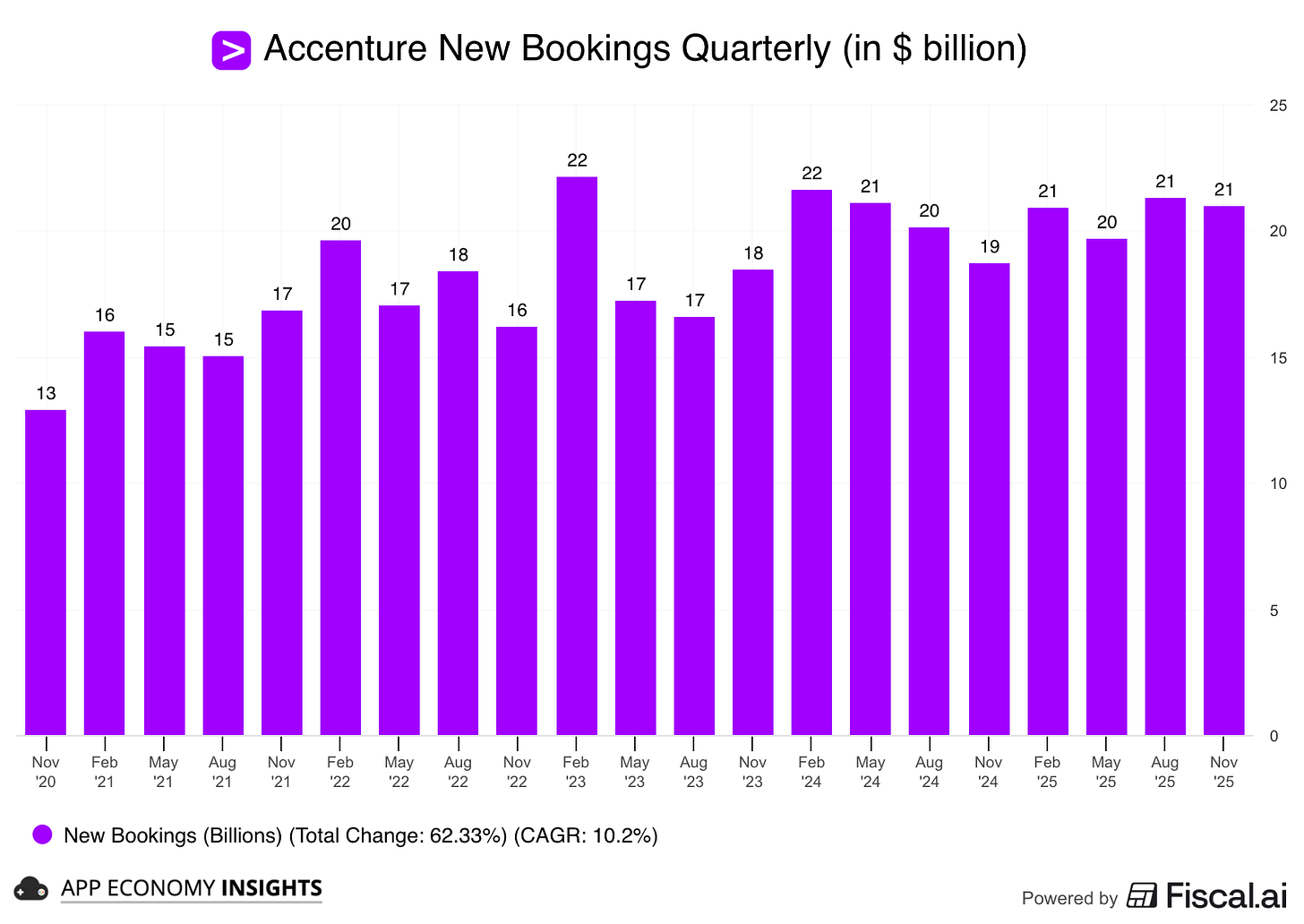

New bookings rebounded 12% Y/Y to $21 billion. They represent the value of new contracts signed during the quarter, which will fuel future revenue. A closer look at the past few quarters reveals a trend of stabilization rather than acceleration. New bookings have grown at a 10% CAGR in the past five years.

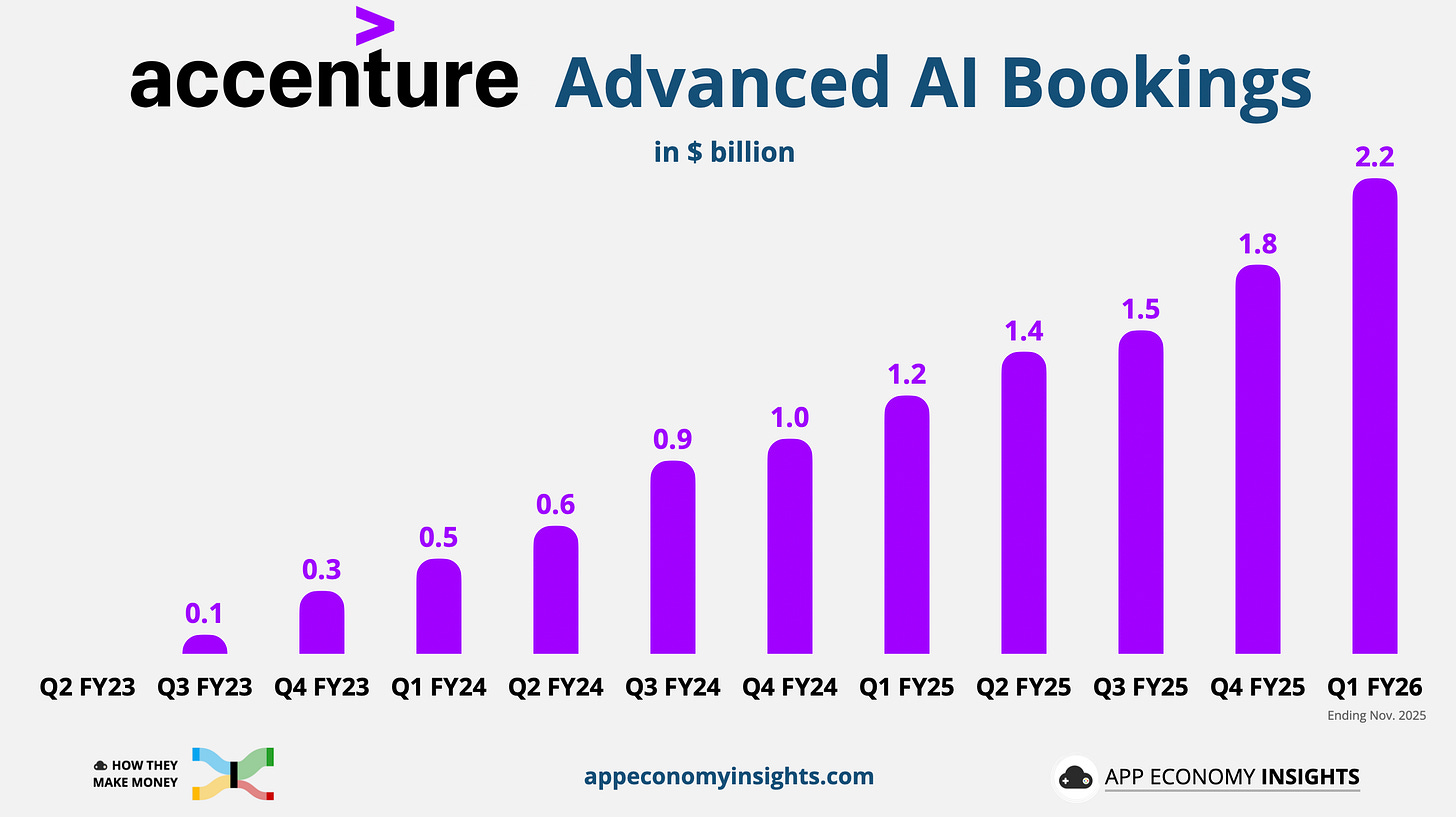

The drive behind the recent growth remains the same. Advanced AI bookings hit a record $2.2 billion for the quarter (up from $1.8 billion in Q4). This metric now includes not only GenAI, but also agentic and physical AI.

However, the stock dipped despite the beat, largely due to a tepid near-term outlook. Management guided Q2 revenue to ~$17.7 billion in the midpoint ($0.1 billion miss).

While they reaffirmed the full-year growth target of 2%–5%, CEO Julie Sweet noted that discretionary spending remains unchanged and there is no immediate catalyst for improvement. Management announced that Accenture won’t report Advanced AI metrics in future quarters, noting that AI is now embedded in every deal rather than as a standalone line item. This fits the narrative we covered yesterday about measuring AI revenue impact.

2. 👟 Nike: Middle Innings

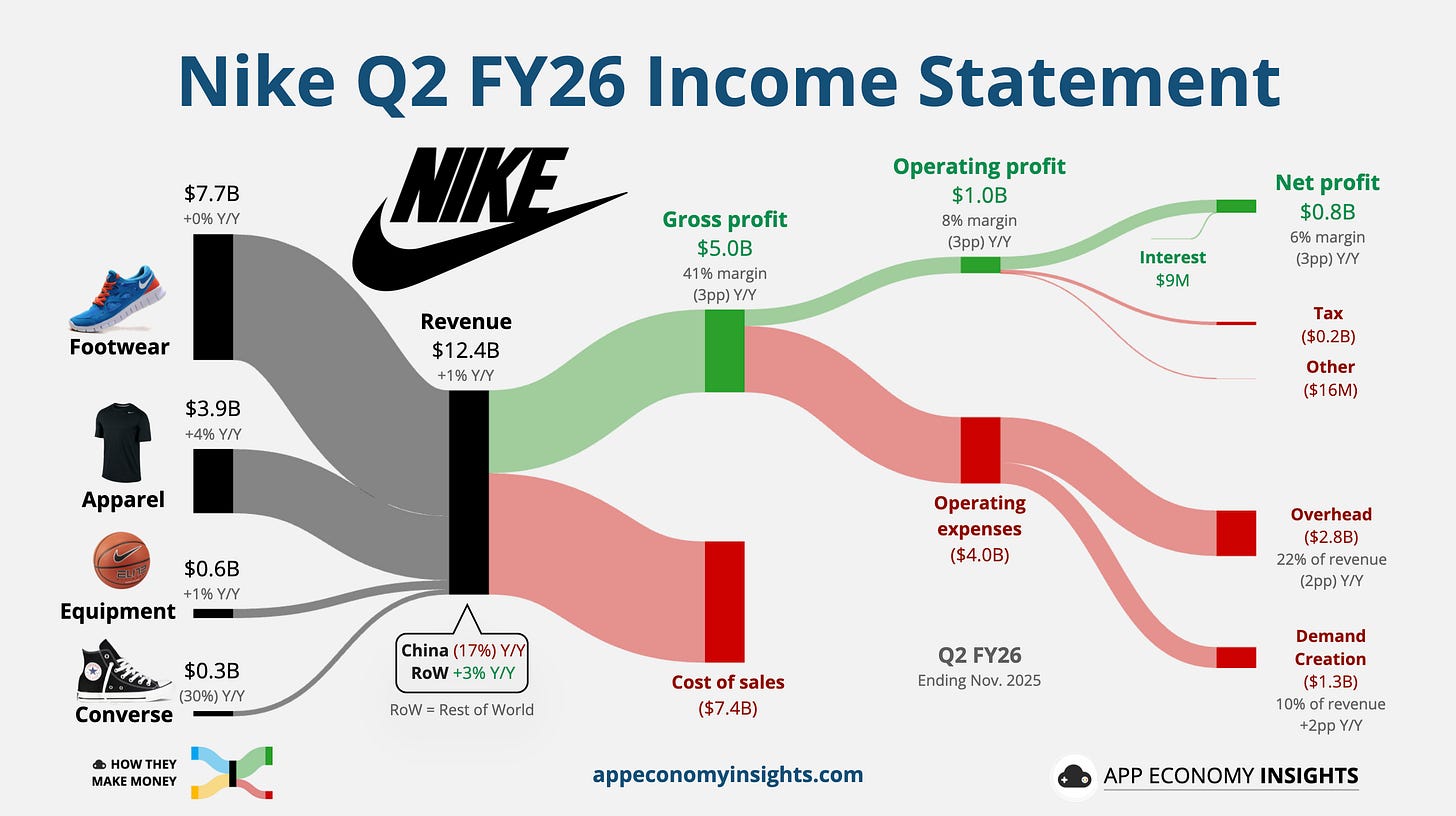

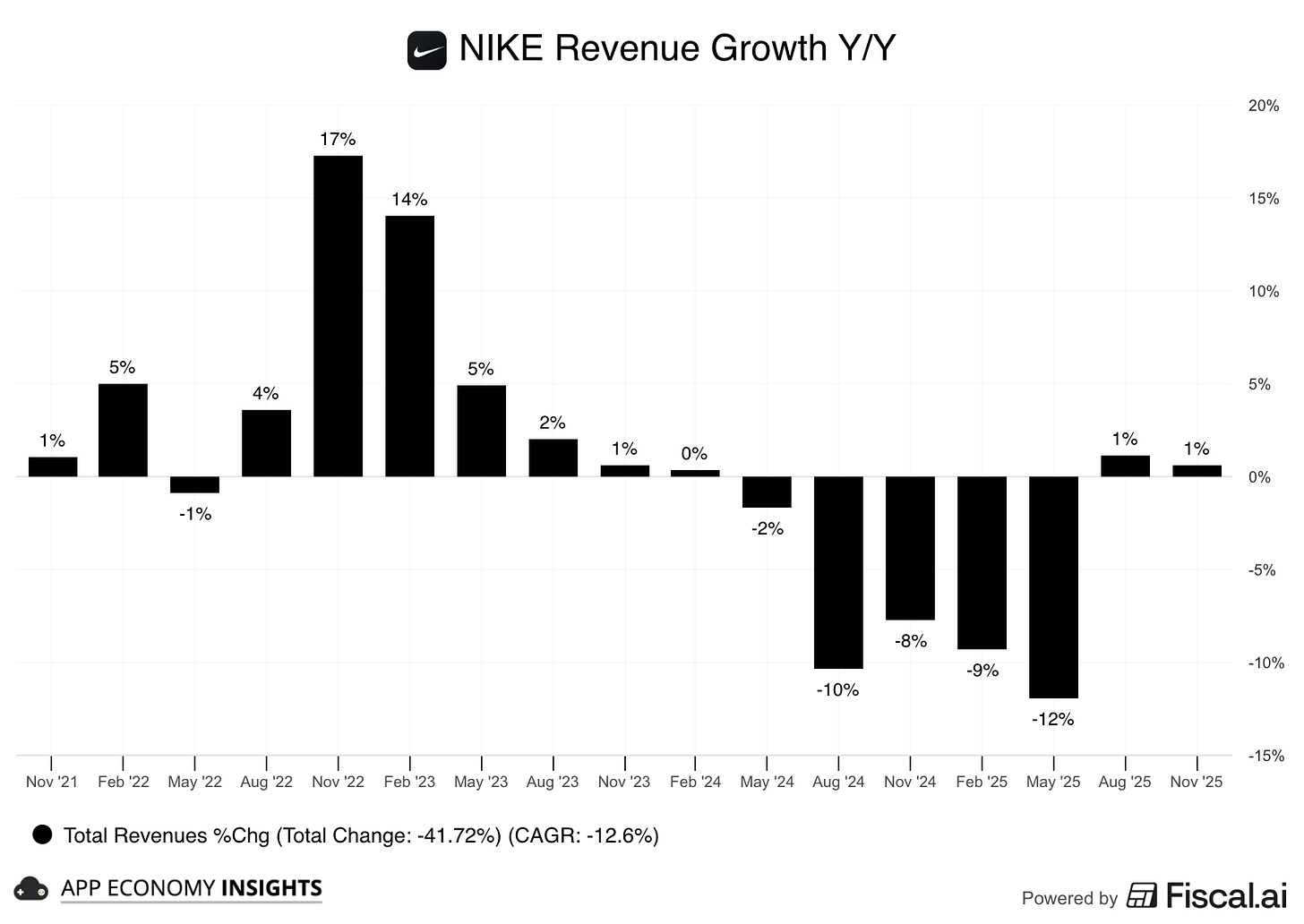

Nike’s Q2 FY26 revenue managed to stay positive, growing 1% Y/Y to $12.4 billion ($0.2 billion beat), while EPS declined 32% Y/Y to $0.53 ($0.16 beat).

The Wholesale vs. Direct pivot remains the central story. Wholesale revenue climbed 8% to $7.5 billion, as the company re-engages with retail partners to drive volume. This strength helped offset a continued slump in Nike Direct, which fell 8% to $4.6 billion.

CEO Elliott Hill described the turnaround as being in the “middle innings.” The strategy is clearly working for NIKE Brand in North America, where sales jumped 9% driven by momentum in Running and new products.

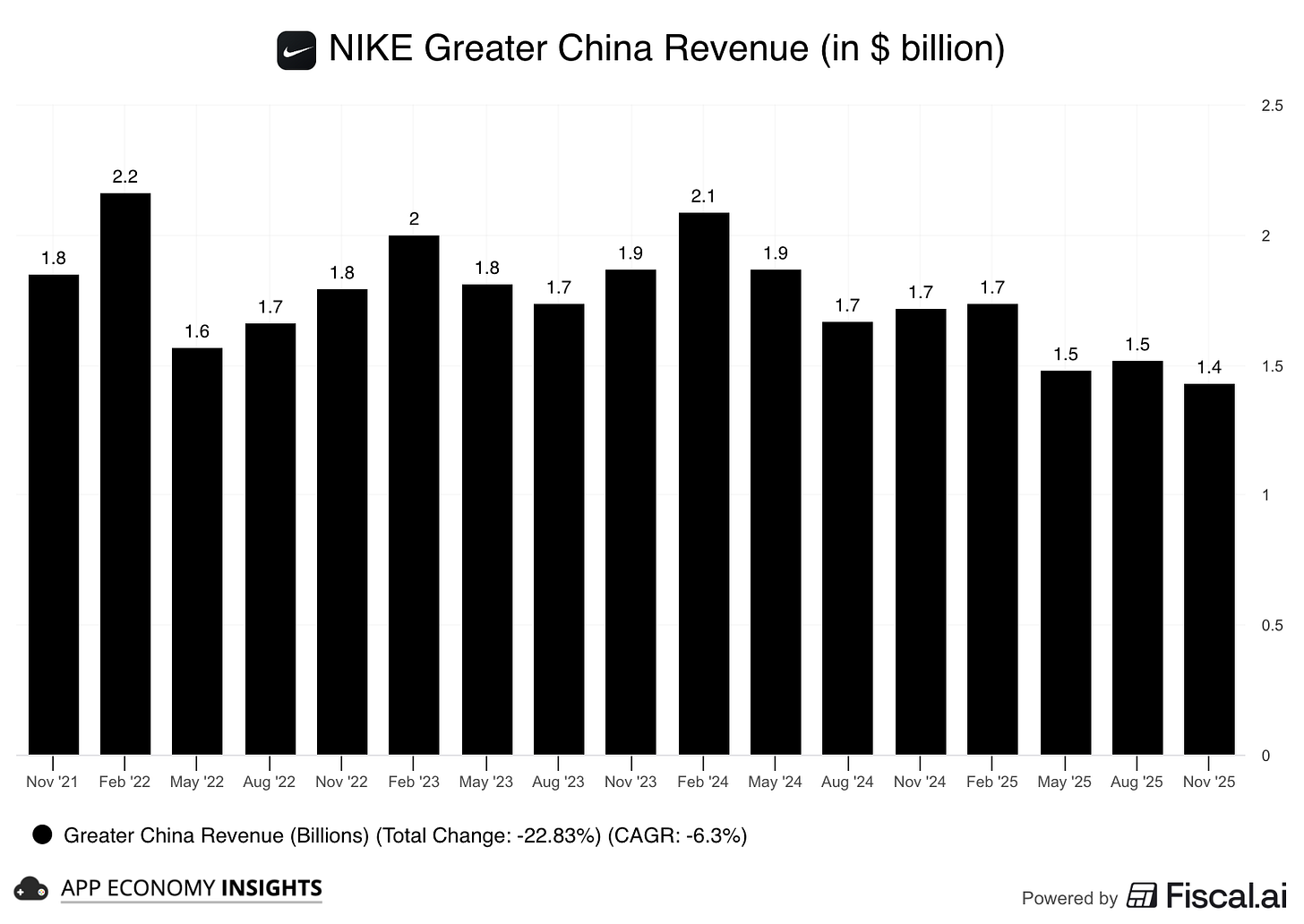

However, this success was sharply contrasted by severe weakness elsewhere. Greater China revenue plunged 17% Y/Y to $1.4 billion, and Converse sales collapsed 30%. Profitability also took a significant hit. Gross margins fell to 40.6% (from 40.9% a year ago), pressured by the “Win Now” aggressive promotions and the looming impact of tariffs, which management confirmed is a ~$1.5 billion annualized headwind.

Reflecting the uneven recovery, Nike’s stock fell over 10% post-earnings. Management warned that the comeback “won’t be a straight line,” and revenue is expected to decline by low single digits in Q3. While the North American rebound is encouraging, the global turnaround is far from complete.