📊 PRO: This Week in Visuals

INTU PANW ADI WDAY ZM AS

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

✅ Intuit: AI Engine Keeps Humming

🔒 Palo Alto: Platform Momentum

⚙️ Analog Devices: Recovery Firms Up

👔 Workday: “Completely Overblown”

🖥️ Zoom: AI-Fueled Rebound

⛷️ Amer Sports: Arc’teryx Comps Slow

FROM OUR PARTNERS

A Former Zillow Exec Targets a $1.3T Market

Austin Allison sold his first company for $120M. He also served as an exec for Zillow. But both companies reached massive valuations before regular people had the chance to invest. So he built Pacaso differently.

Pacaso has made $110M+ in gross profits to date by disrupting the $1.3T vacation home market. No wonder the same VCs that backed Uber, Venmo, and eBay already invested in Pacaso.

Unlike his previous companies, you can invest in Pacaso as a private company. Over 10,000 everyday investors have already invested. But time’s running out.

Invest before Pacaso’s investment opportunity ends on 9/18.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

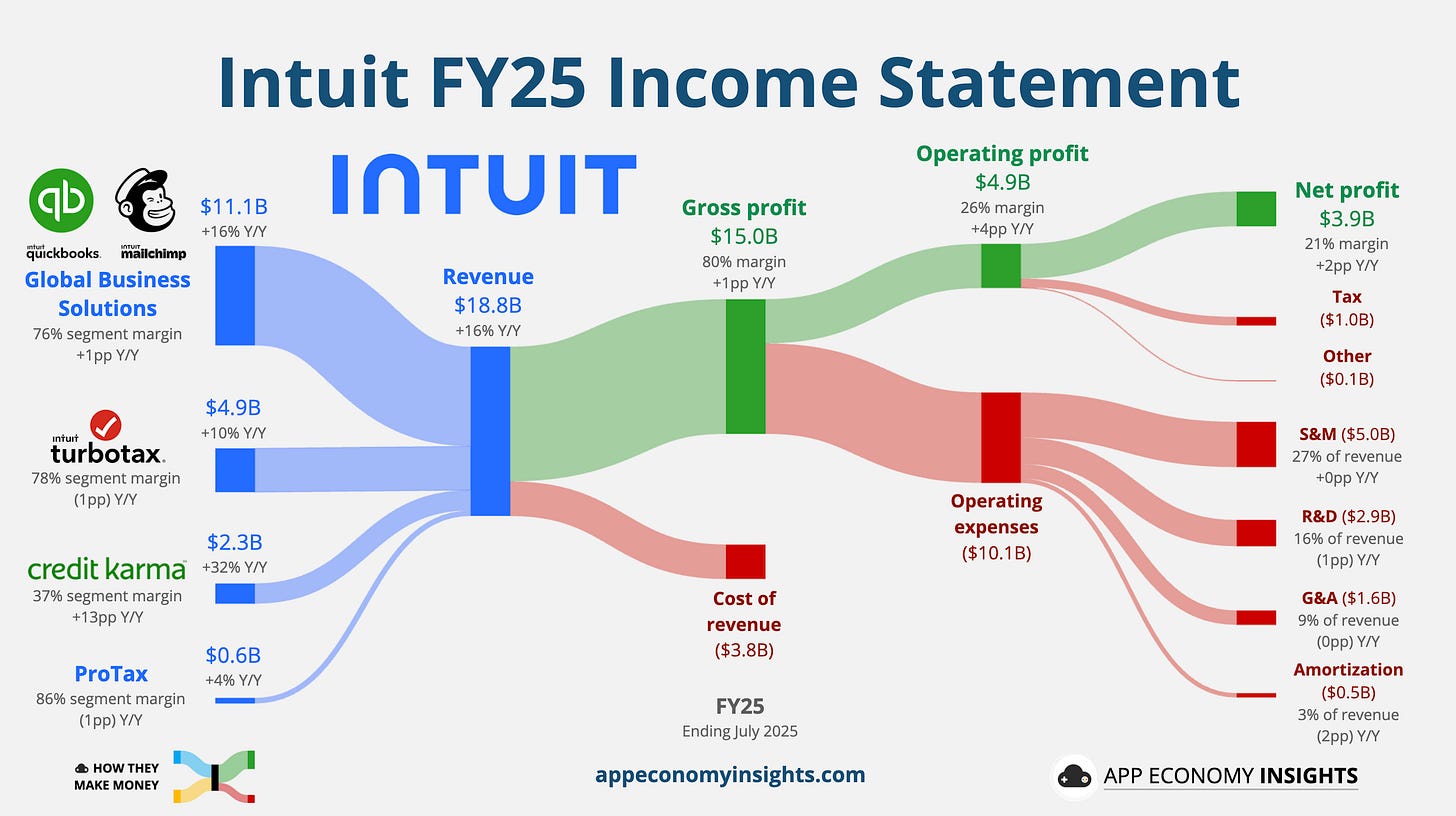

1. ✅ Intuit: AI Engine Keeps Humming

Intuit’s Q4 FY25 (July quarter) saw revenue surge 20% to $3.8 billion ($80 million beat), resulting in 16% Y/Y growth for FY25 to $18.8 billion. Adjusted earnings per share hit $2.75 ($0.09 beat).

The growth was broad-based, with the Global Business Solutions unit led by QuickBooks climbing 16% in FY25. But the fastest segment was Credit Karma, which saw a 32% jump in revenue this year, fueled by AI that more accurately matches users with financial products they’re likely to be approved for.

Intuit’s tax services are very seasonal, so here’s a look at the full year ending in July.

So why did the stock dip? It all comes down to the outlook. Management's forecast for FY26 (ending in July 2026) points to a slight slowdown, with revenue expected to climb 12-13% Y/Y. CFO Sandeep Aujla noted that they have a long track record of issuing "prudent" guidance, aiming for a classic underpromise-overdeliver. For context, Intuit also guided for a 12%-13% growth for FY25 a year ago, and ended up at 16%, beating the outlook by $0.6 billion.

The big picture remains the same. Intuit continues to execute on its mission to become the indispensable AI-powered financial platform for consumers and small businesses. With AI assistants now deeply integrated across its products to simplify everything from tax filing to financial analysis, Intuit is delivering the kind of results that are setting it apart from the rest of the software pack.

INTU was the largest investment in Fundsmith’s latest 13-F filing, as discussed earlier this week in our review of Wall Street’s top stocks in Q2.

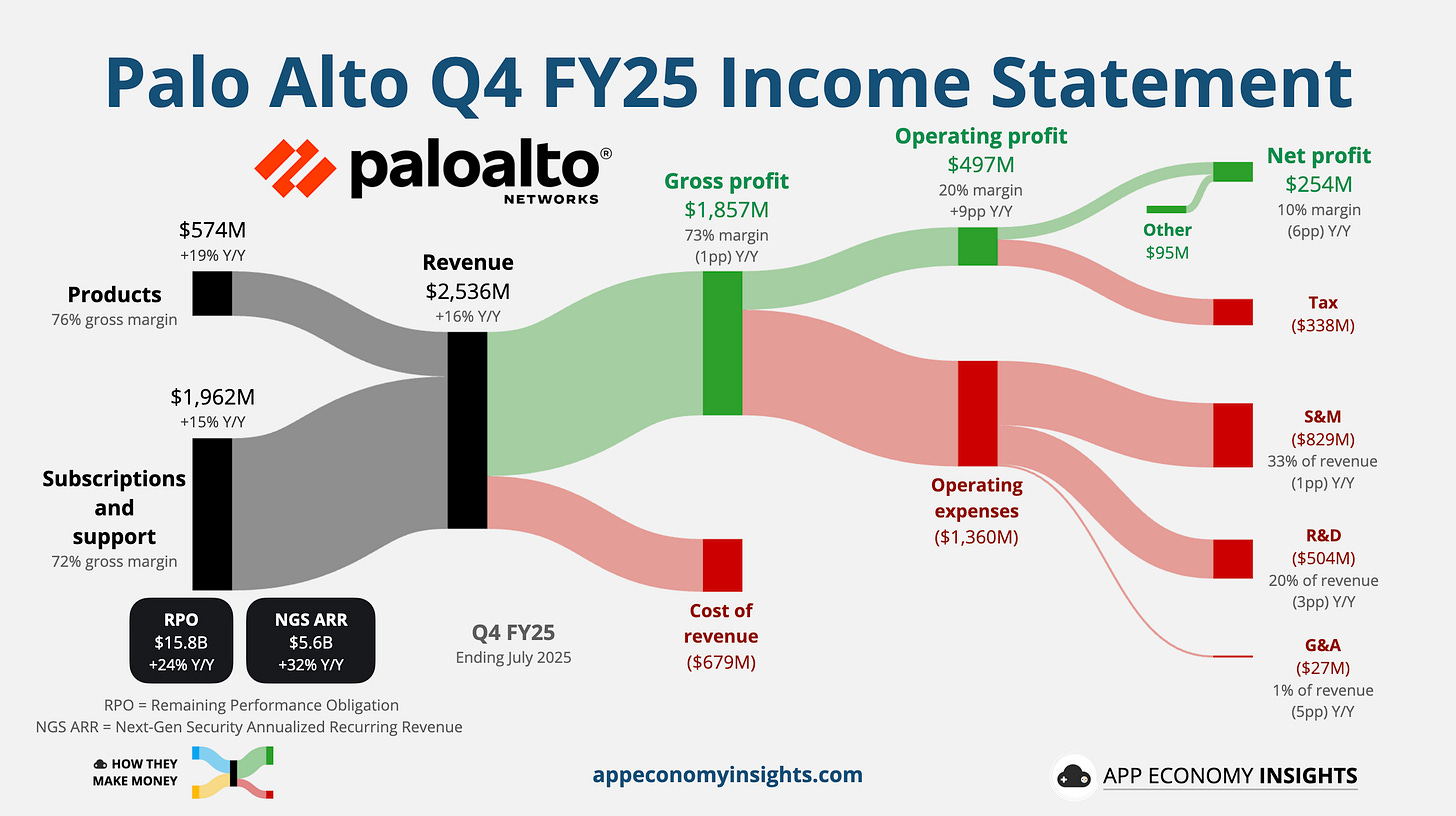

2. 🔒 Palo Alto: Platform Momentum

Palo Alto’s revenue in Q4 FY25 (July quarter) rose 16% Y/Y to $2.54 billion ($40 million beat), with product rising 19% and subscription & support up 15% as platform consolidation continued to drive larger deals. EPS was $0.95 ($0.06 beat)

Next-Generation Security (NGS) ARR surged 32% Y/Y to $5.6 billion, which is the portion of the business that deserves a premium valuation. RPO (a leading indicator of revenue growth) grew 24% Y/Y to hit $15.8 billion, providing better visibility into FY26.

Guidance was solid across the board. Full-year FY26 revenue growth is expected at 14% Y/Y, with NGS ARR to grow +26–27%. Management flagged continued AI-driven wins (Cortex Cloud, Prisma AIRS) and the planned acquisition of CyberArk for $25 billion (expected to close in the second half of Palo Alto’s FY26) to deepen identity security cross-sell.

Founder/CTO Nir Zuk is retiring after ~20 years. Longtime product leader Lee Klarich becomes CTO and joins the board. With ARR and RPO compounding and a clearer FY26 path, Palo Alto exits FY25 above a $10 billion run-rate and well-positioned as a consolidator of AI-era cybersecurity.