📊 PRO: This Week in Visuals

FDX GIS DRI MANU

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🚚 FedEx: Parcel Demand Relief

🍪 General Mills: Sales Slump Continues

🫒 Darden: Inflation Bites

⚽️ Man United: Record Off The Pitch

1. 🚚 FedEx: Parcel Demand Relief

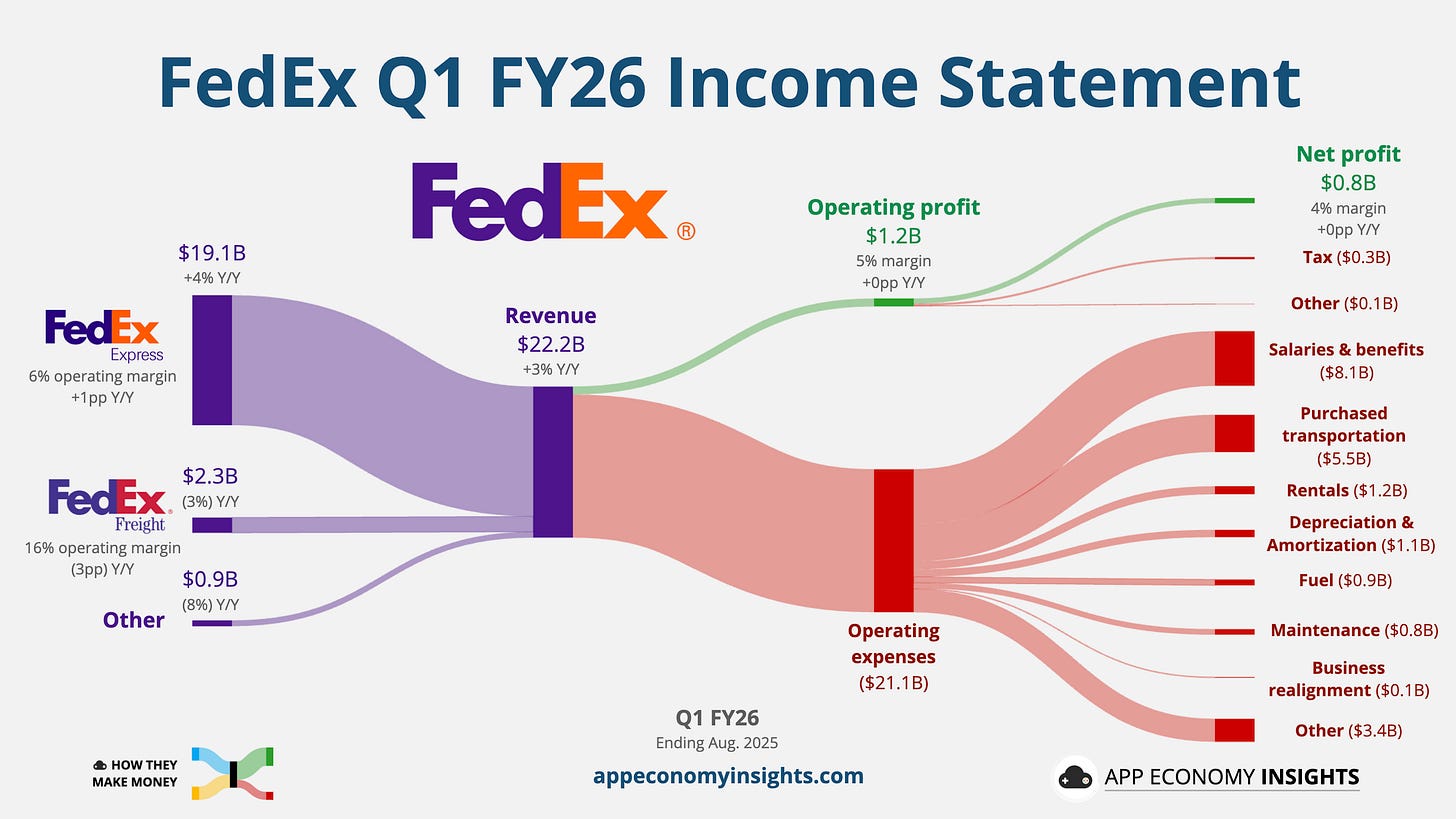

FedEx started FY26 on a strong note, with Q1 revenue rising 3% Y/Y to $22.2 billion ($550 million beat) and adjusted EPS of $3.83 ($0.22 beat).

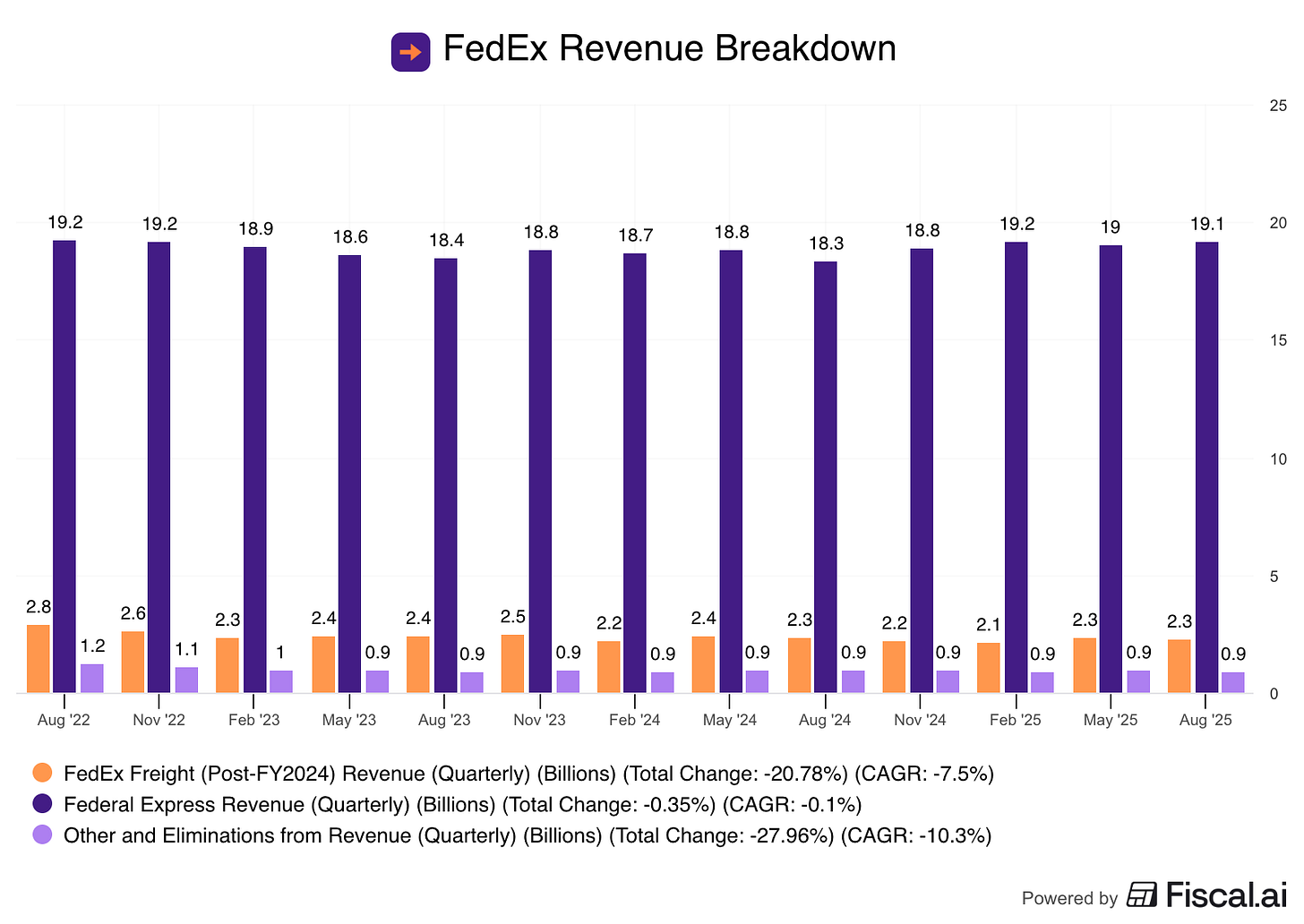

The Express segment again drove results, with higher yields on priority packages and increased US domestic volume offsetting ongoing weakness in the Freight segment. Cost-cutting programs continued to lift operating margin.

The key development was the reinstatement of full-year guidance, which had been withheld last quarter due to trade uncertainty. Management now forecasts revenue growth of 4% to 6% for FY26—well ahead of expectations—and adjusted EPS of $17.20 to $19.00. The confident outlook suggests a rebound in parcel demand and eased investor fears, sending the stock higher.

FedEx reaffirmed its plan to deliver another $1 billion in permanent cost savings this year and is advancing the planned spin-off of its Freight division, which is expected to be completed by June 2026. While tariff impacts on global trade remain a headwind, the FY26 guidance marks a significant reversal from last quarter’s uncertainty.

2. 🍪 General Mills: Sales Slump Continues

General Mills’ reset year is underway with Q1 revenue falling 7% Y/Y to $4.5 billion ($20 million miss), a decline that includes a 4-point headwind from its US yogurt business divestiture.