📊 PRO: This Week in Visuals

GS MS BLK DAL STZ TLRY

Welcome to the Saturday PRO edition of How They Make Money.

Over 270,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🏛️ Goldman Sachs: Trading Desk Roars

👔 Morgan Stanley: Integrated Machine

📈 Blackrock: Breaking $14 Trillion AUM

🛩️ Delta Airlines: Navigating Headwinds

🍺 Constellation Brands: Relief Rally

🌿 Tilray: International Surge

1. 🏛️ Goldman Sachs: Trading Desk Roars

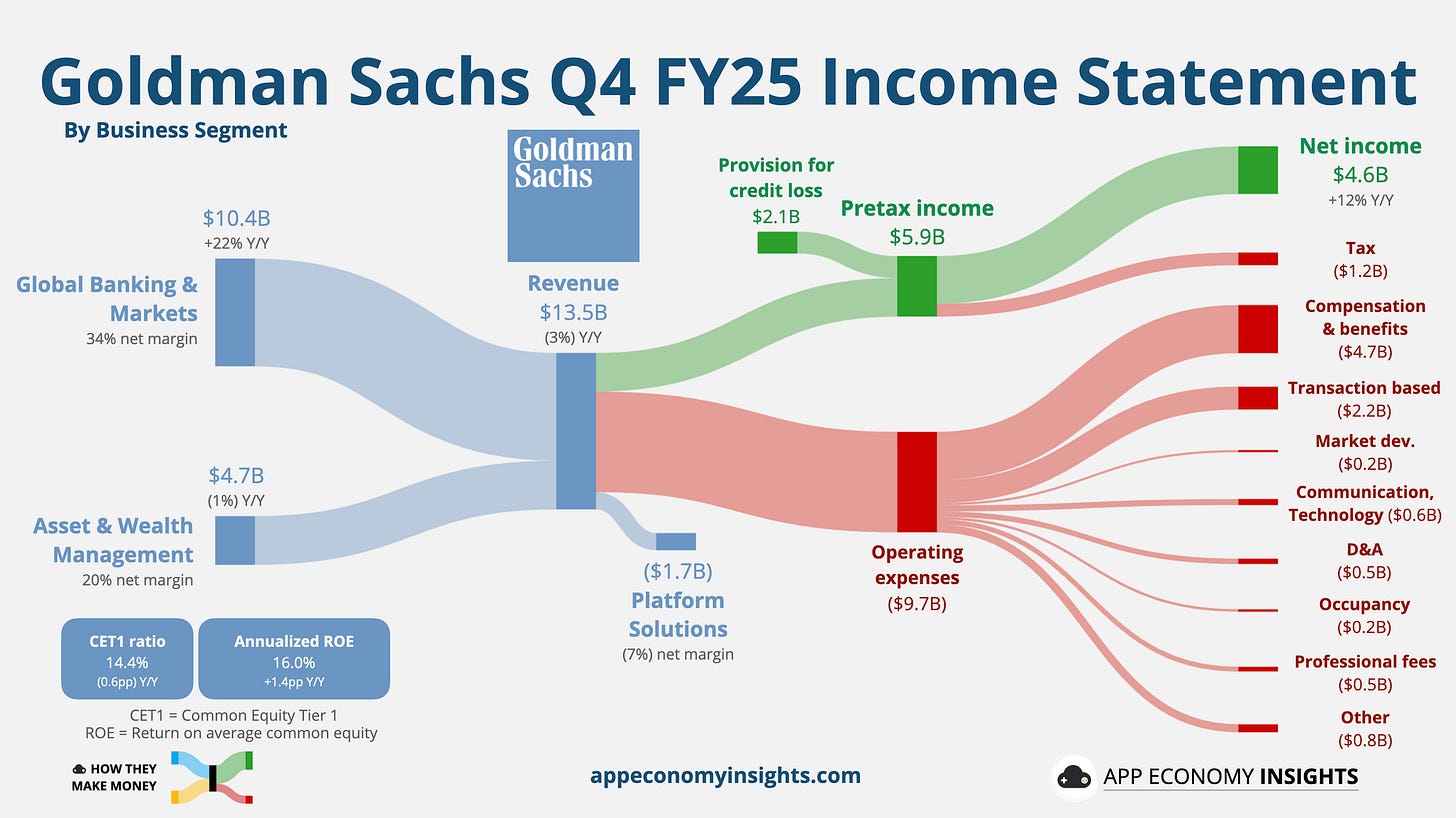

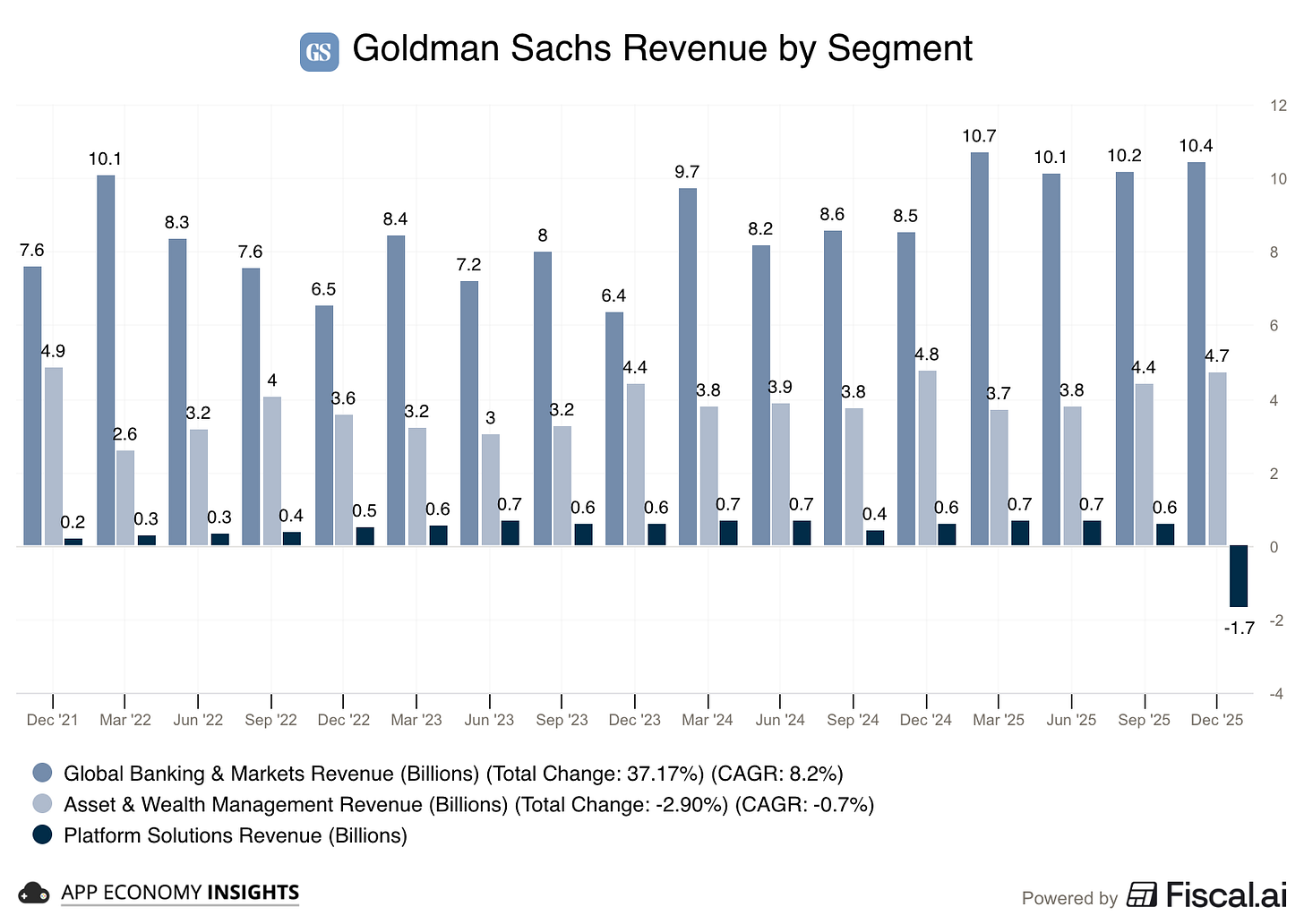

Goldman Sachs delivered a noisy but ultimately bullish quarter. Revenue fell 3% Y/Y to $13.5 billion ($400 million miss), largely due to a $2.3 billion markdown tied to the Apple Card portfolio exit we discussed here. This caused the revenue from the Platform Solutions segment to turn negative in Q4.

However, the bottom line told a different story. GAAP EPS of $14.01 crushed expectations ($2.25 beat), aided by a massive credit reserve release that more than offset the revenue hit.

Under the hood, the core franchise is firing on all cylinders. Equities trading revenue (included in the Global Banking & Markets segment) rose 25% Y/Y to $4.3 billion, cementing Goldman’s dominance in volatile markets. Investment Banking fees also climbed 25% Y/Y to $2.6 billion, driven by a resurgence in advisory and debt underwriting. The firm is successfully pivoting back to its Wall Street roots, with the Global Banking & Markets division posting record full-year revenues of $41.5 billion.

CEO David Solomon signaled that the strategic “narrowing” is complete, raising the quarterly dividend to $4.50 and unveiling ambitious new targets for the Asset & Wealth Management unit (aiming for a 30% pre-tax margin). With the consumer lending distraction largely resolved and an M&A backlog at a four-year high, Goldman is effectively clearing the decks to ride the wave of a potential 2026 IPO and dealmaking boom.

2. 👔 Morgan Stanley: Integrated Machine

Morgan Stanley capped off a record year with Q4 revenue rising 10% Y/Y to $17.9 billion ($140 million beat) and GAAP EPS of $2.68 ($0.26 beat).

The results demonstrated significant operating leverage, with the firm delivering a robust Return on Tangible Common Equity (ROTCE) of 21.8% and an improved efficiency ratio of 68%.