📊 PRO: This Week in Visuals

TCEHY CSCO AMAT NTES NU JD ADYEN CRCL GLBE DLO

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

📱 Tencent: AI-Powered Gains

🌐 Cisco: AI Orders Double Target

⚙️ Applied Materials: China Digests

🎮 NetEase: Non-Gaming Mixed

🏦 Nu: Deeper Wallet Share

🚚 JD.com: Growth Acceleration

💳 Adyen: Mid-Term Targets Intact

⚡️ Celsius: Alani Supercharge

🛍️ Global-e: Profitable Again

🌎 dLocal: Broad-Based Surge

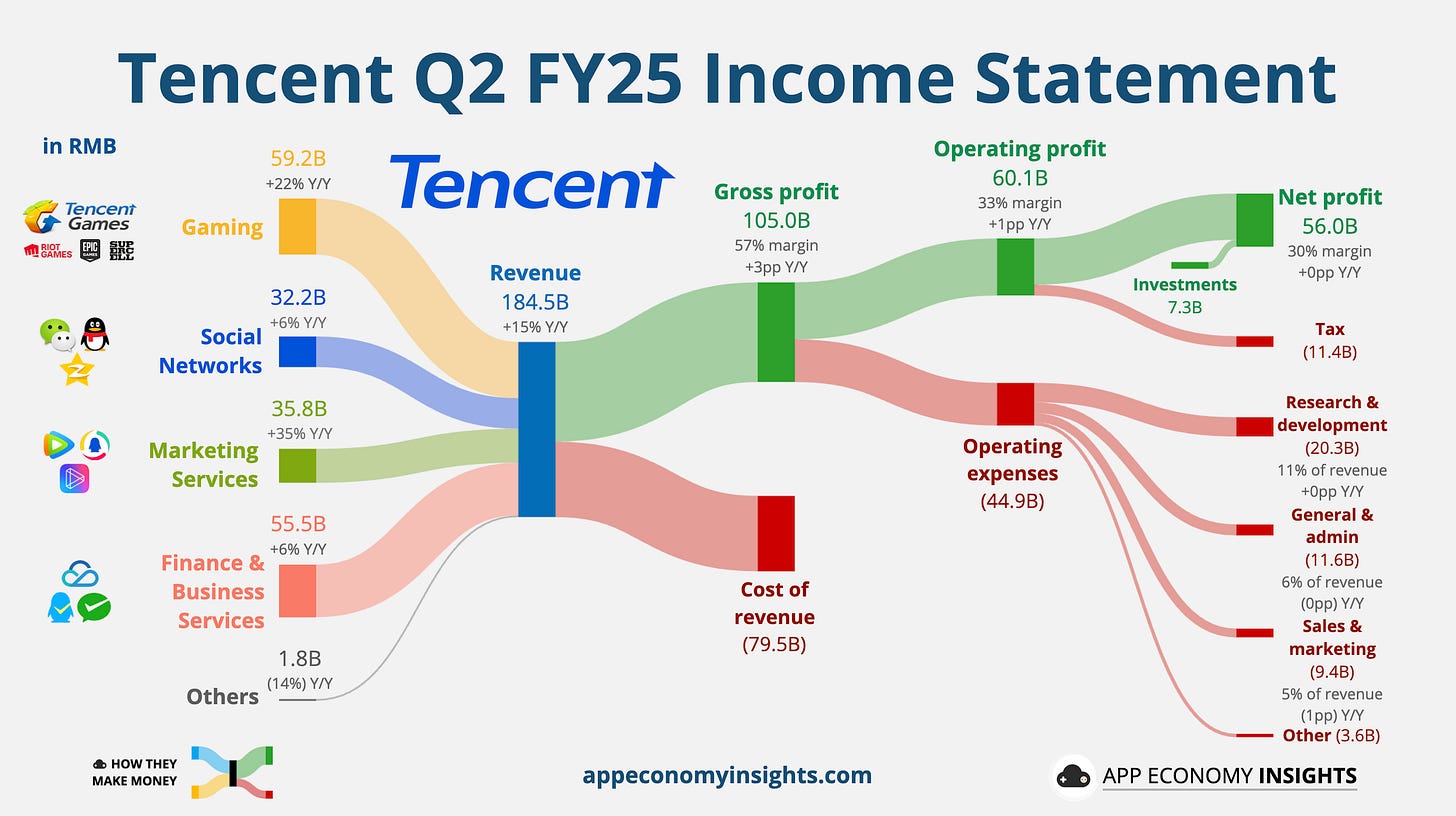

1. 📱 Tencent: AI-Powered Gains

Tencent’s Q2 revenue climbed 15% Y/Y to RMB 184.5 billion (~$25.7 billion), driven by gaming (+17% domestic, +35% international) and marketing services (+20%), boosted by AI-enhanced ad targeting. New hits like Delta Force and Dune: Awakening joined evergreen titles Honor of Kings and Peacekeeper Elite in fueling growth.

Net profit rose 17% to RMB 56 billion, beating expectations despite a 119% jump in capex to RMB 19.1B ($2.7 billion) for AI upgrades across gaming, advertising, and Weixin/WeChat.

Management stressed “spending in the right tempo” on AI, focusing on integrating its Hunyuan model into core products rather than overspending on chips or headcount. Weixin/WeChat’s 1.4 billion+ users continue to anchor monetization via search, video feeds, and mini-programs, while Tencent Cloud is pushing AI services into Europe.

With Valorant Mobile and other major titles in the pipeline, Tencent is balancing aggressive AI-driven growth while maintaining margin discipline.

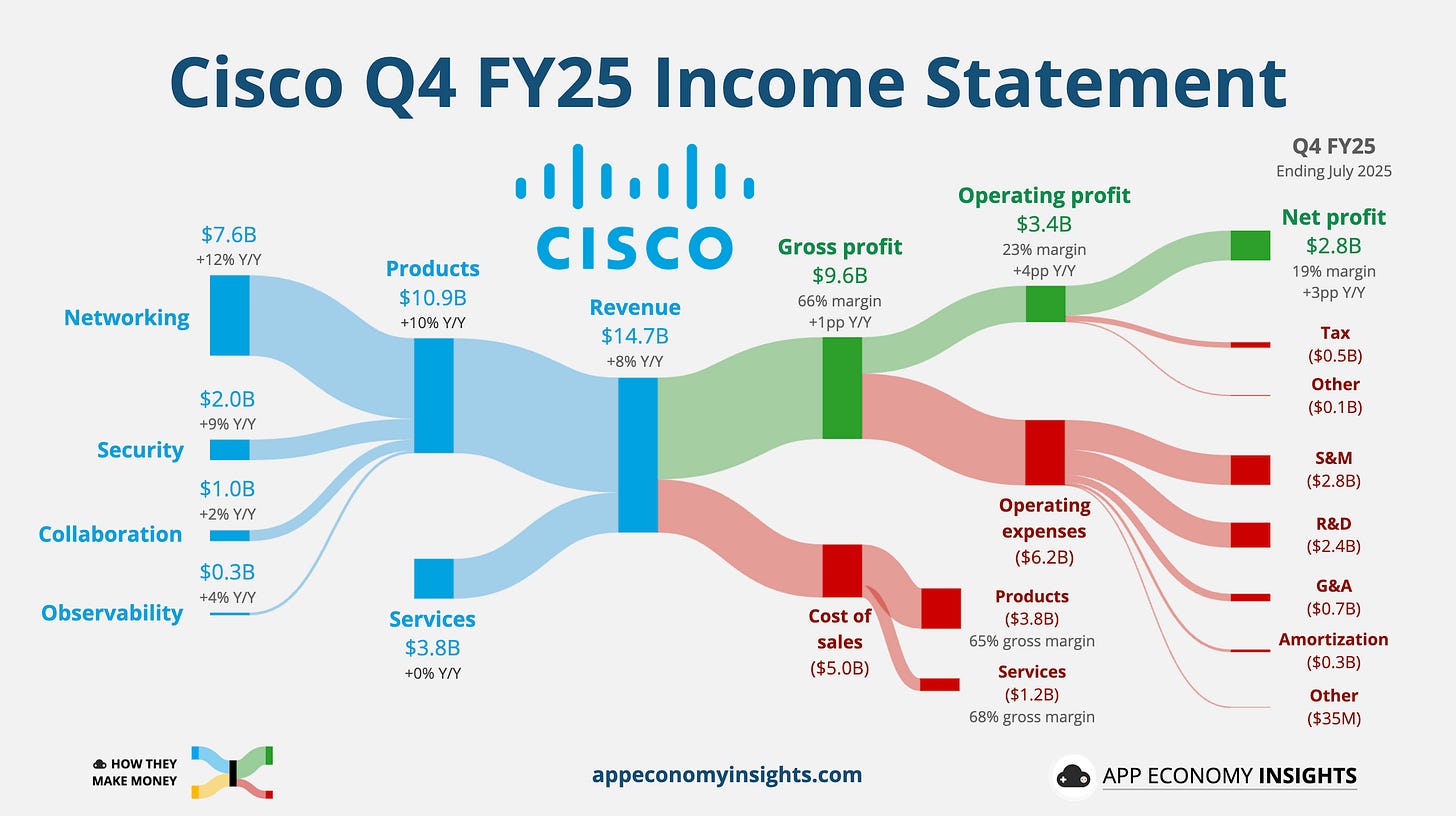

2. 🌐 Cisco: AI Orders Double Target

Cisco closed FY25 (ending in July) with Q4 revenue up 8% Y/Y to $14.7 billion ($50 million beat) and adjusted EPS of $0.99 ($0.01 beat). AI infrastructure orders hit $800 million in the quarter, bringing FY25 total to $2 billion—more than double its original goal. Product revenue rose 10% to $10.9 billion, with networking at $7.6 billion, while gross margin edged up to 66%.

Recurring revenue momentum continued, with security growth boosted by Splunk and SASE. Federal business is set to return to growth in FY26, supported by partnerships like the UAE’s Stargate project and Saudi AI firm Humain.

Cisco guided FY26 revenue to $59–$60 billion (vs. $56.6 billion in FY25) and adjusted EPS to $4.00–$4.06 (vs. $3.81 in FY25), reflecting steady AI momentum but a measured outlook amid rising competition from Broadcom and HPE.