📊 PRO: This Week in Visuals

AVGO COST ADBE SNPS LULU CHWY GME

Welcome to the Saturday PRO edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

📈 Broadcom: The $73 Billion Backlog

🛒 Costco: Digital Breakout

🎨 Adobe: AI Ecosystem Expands

🧠 Synopsys: Ansys & AI Power Up

🧘🏻 Lululemon: CEO Exit & Reset

🐶 Chewy: Loyalty Pays Off

🎮 GameStop: Aggressive Cost Cutting

1. 📈 Broadcom: The $73 Billion Backlog

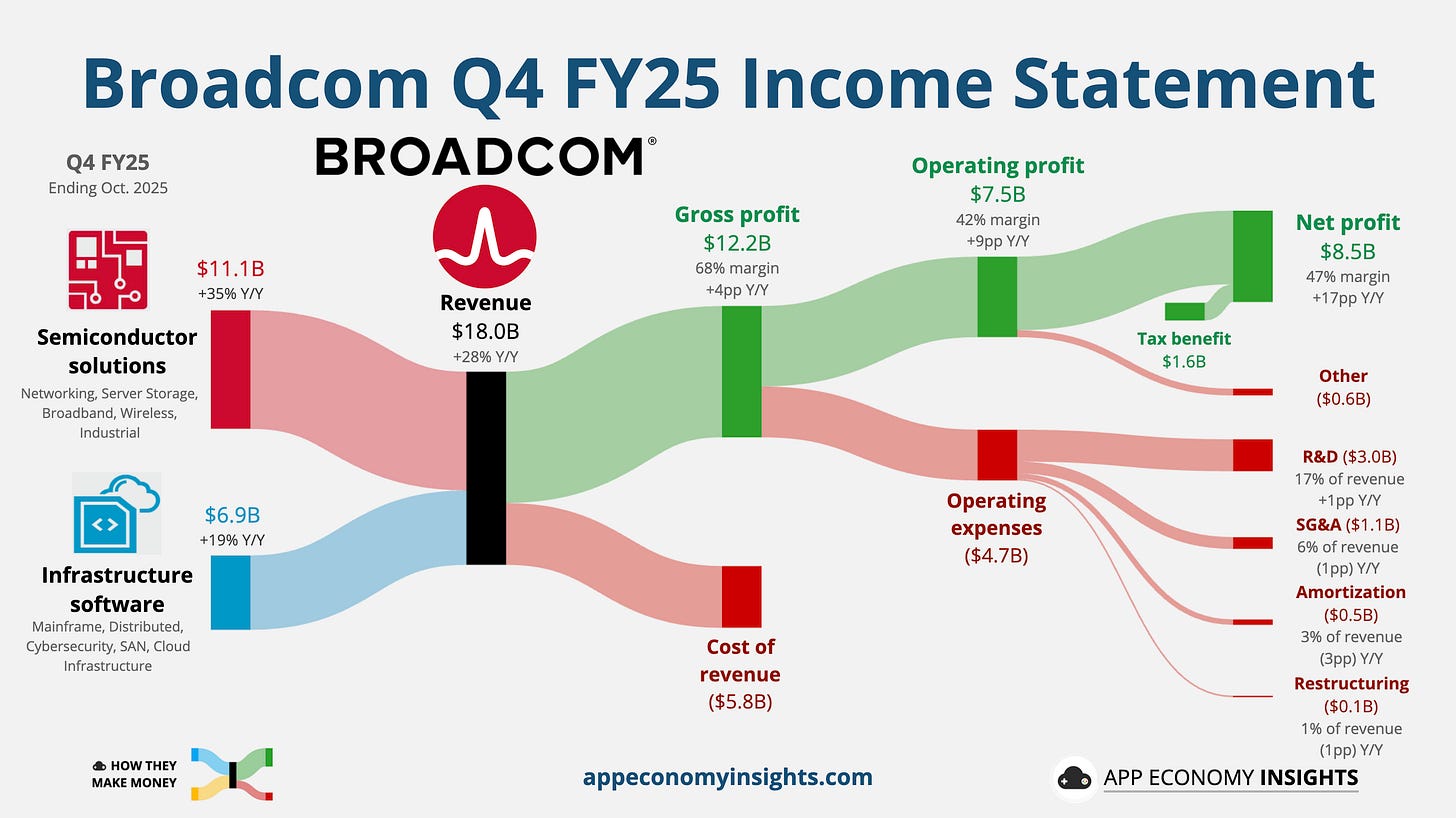

Broadcom’s Q4 FY25 revenue (October quarter) rose 28% Y/Y to $18.0 billion ($0.6 billion beat), and non-GAAP EPS was $1.95 ($0.08 beat).

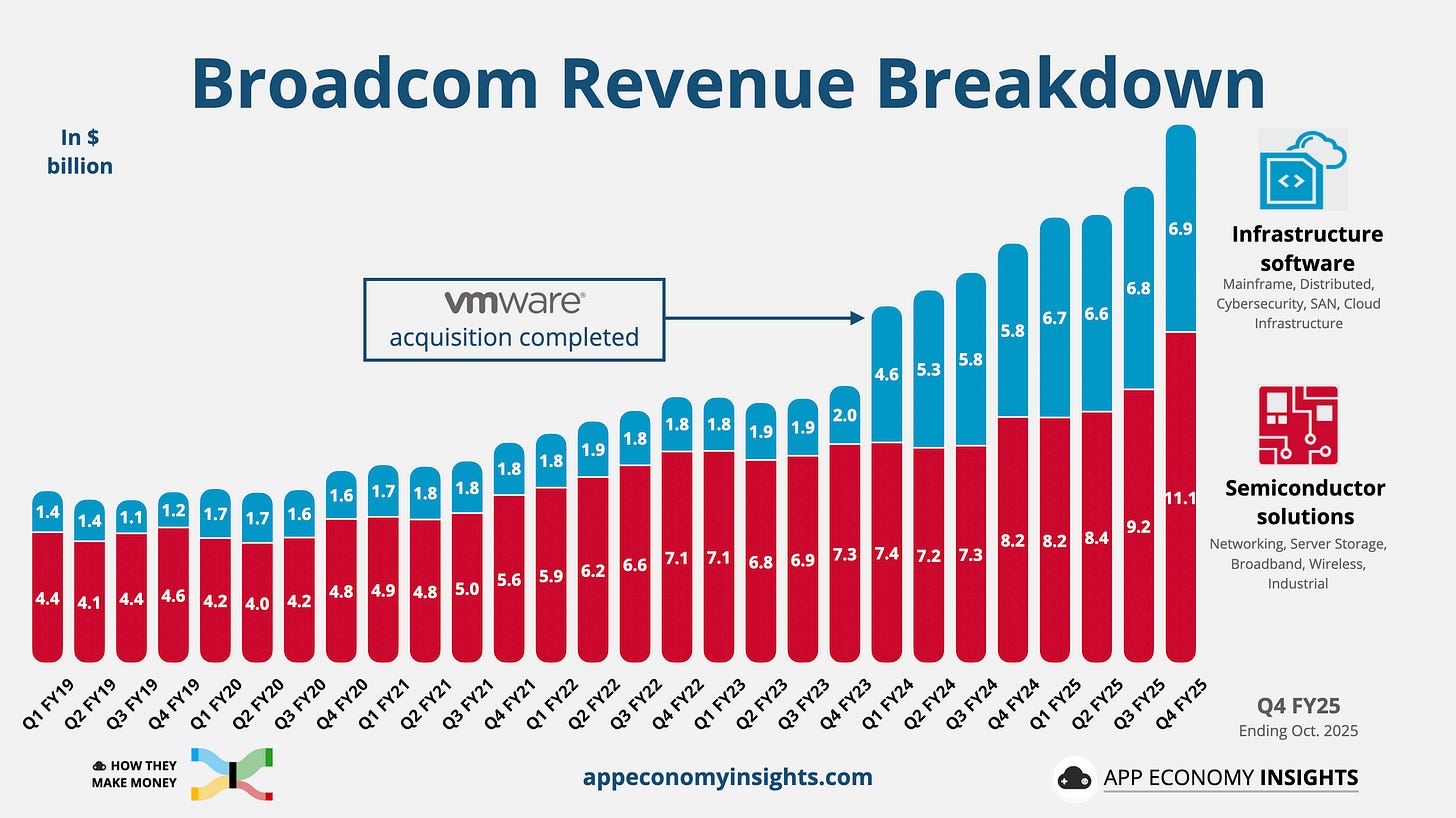

The AI growth story remains explosive. AI semiconductor revenue surged 74% Y/Y to $6.5 billion. That helped the Semiconductor solutions segment grow 35% Y/Y to $11.1 billion. The VMware integration continued to be successful, with the Infrastructure software segment rising 19% Y/Y to $6.9 billion.

CEO Hock Tan revealed a staggering $73 billion backlog for AI products (shipping over the next 18 months), including a new $11 billion order from an existing customer (likely Anthropic) and a $1 billion win from a fifth custom chip (XPU) customer.

Broadcom forecasts Q1 FY26 revenue of $19.1 billion (well above the ~$18.3 billion consensus) and expects AI revenue to double Y/Y to $8.2 billion next quarter, while non-AI chip revenue will be mostly flat.

However, shares slid nearly 11% post-earnings. Investors seemed spooked by management’s refusal to provide a specific full-year AI revenue outlook (calling it a “moving target”) and comments that the shift toward system sales (handling the entire rack) will naturally pressure gross margins. Despite the large beat, the market now demands clearer visibility into the long-term margin profile of this AI boom.

2. 🛒 Costco: Digital Breakout

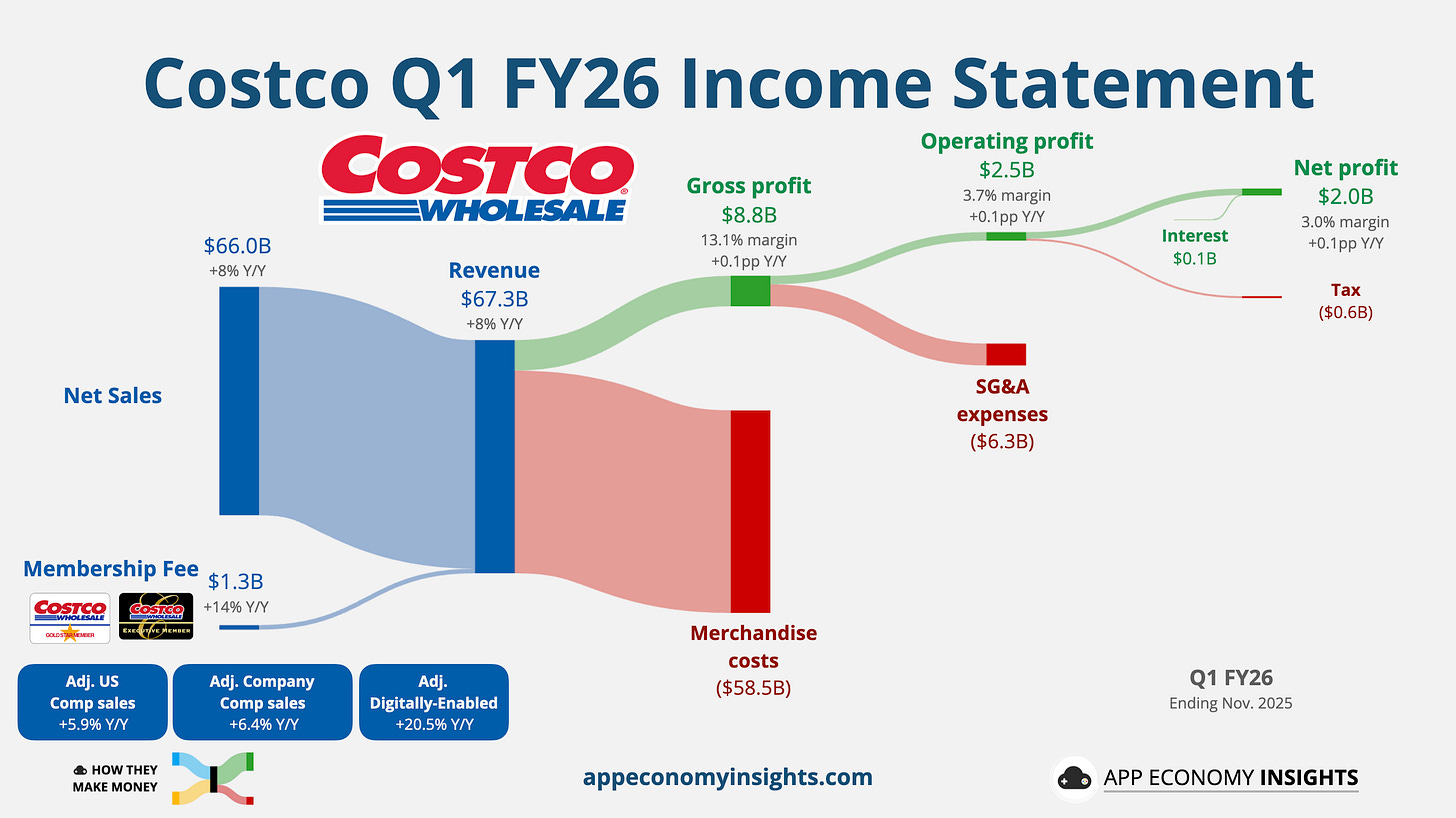

Costco kicked off FY26 with Q1 revenue rising 8% Y/Y to $67.3 billion ($0.2 billion beat) and GAAP EPS of $4.50 ($0.22 beat). Comparable sales held steady at +6.4% globally and +5.9% in the US, showing resilience despite a tough retail backdrop.

The big story was digital acceleration. Costco introduced a new metric, Digitally-enabled sales, which grew 20.5% (a sharp jump from the ~13% e-commerce growth last quarter). This new definition now captures Same-Day Delivery (via Instacart/Uber Eats) and global Costco Travel bookings.

Management noted that under this new definition, FY25 digital sales were over $27 billion (10% of overall revenue), roughly 40% higher than the $19.6 billion reported under the old metric.

The membership engine remains powerful but showed a slight crack. Fee income rose 14% to $1.33 billion, but the worldwide renewal rate ticked down 10 basis points to 89.7%. Management attributed this slight dip to a surge in younger members signing up online, who typically renew at lower rates than in-store signups. Margins held steady as the company successfully mitigated tariff pressures to keep prices low.

Looking ahead, the pace of physical expansion is slowing slightly. Management revised its FY26 target for 20–28 net new warehouse openings (previously targeting ~30), citing construction delays.

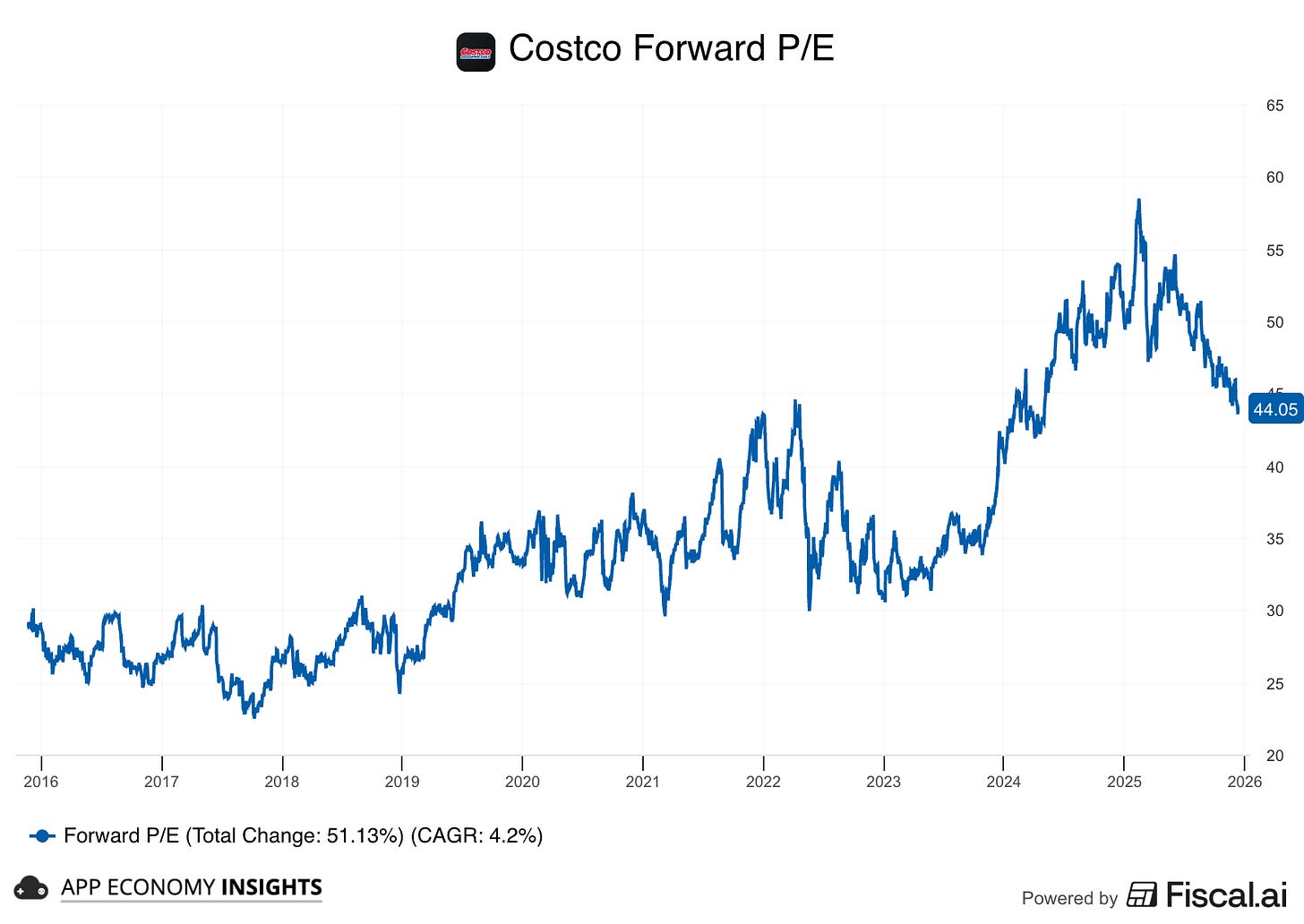

Despite a beat-and-raise quarter, the stock reaction was muted, reinforcing that at ~44x forward earnings, Costco’s valuation remains at a historically high level.