📊 PRO: This Week in Visuals

SNOW HPE IOT DOCU RBRK HQY PATH S ASAN AI

Welcome to the Saturday PRO edition of How They Make Money.

Over 250,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

❄️ Snowflake: RPO Surge

🖥️ HPE: Networking Pivot

🔐 Okta: AI Identity in Focus

🌐 Samsara: Profitable Scale

✍️ DocuSign: IAM Acceleration

🔷 Rubrik: Cyber Resilience Breakout

🏥 HealthEquity: Assets Swell

🤖 UiPath: Agentic Surge

👁️ SentinelOne: AI Traction & CFO Exit

📝 Asana: AI Teammates Arrive

🧠 C3.ai: Stabilization Signs

1. ❄️ Snowflake: RPO Surge

Snowflake’s Q3 revenue rose 29% Y/Y to $1.21 billion ($30 million beat), and non-GAAP EPS was $0.35 ($0.04 beat). Product revenue grew 29% to $1.16 billion, and Net revenue retention held steady sequentially at a best-of-breed 125% (only second to Palantir in public markets).

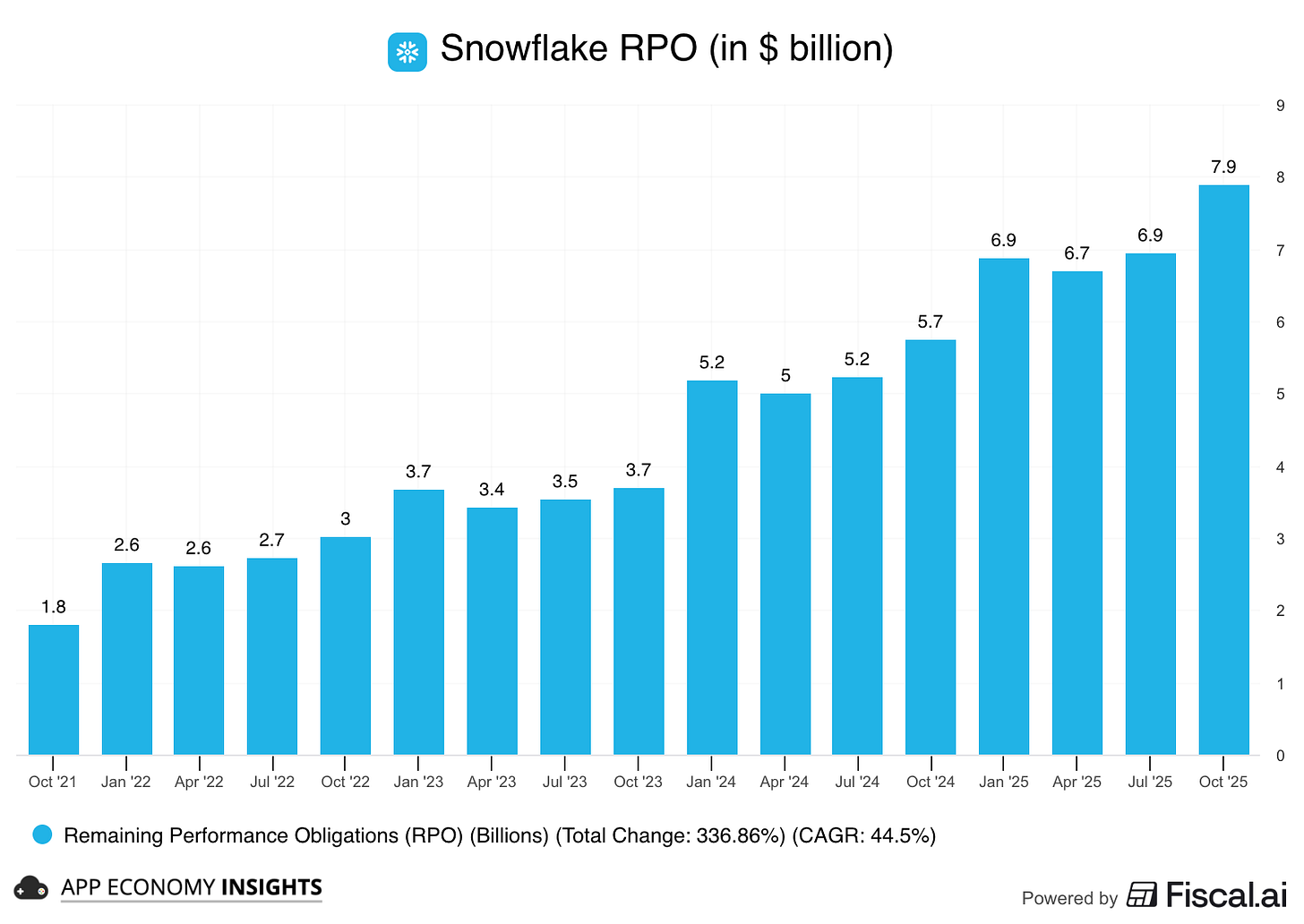

Remaining performance obligations (RPO) surged 37% Y/Y to $7.9 billion (an acceleration from 33% Y/Y in Q2), indicating large customer wins.

Adjusted operating margin expanded to 11% (from 6% a year ago). On a GAAP basis, it remains ugly with an operating loss margin of -27%, though it improved significantly from -39% a year ago. The main difference is stock-based compensation, which remained huge at 34% of revenue.

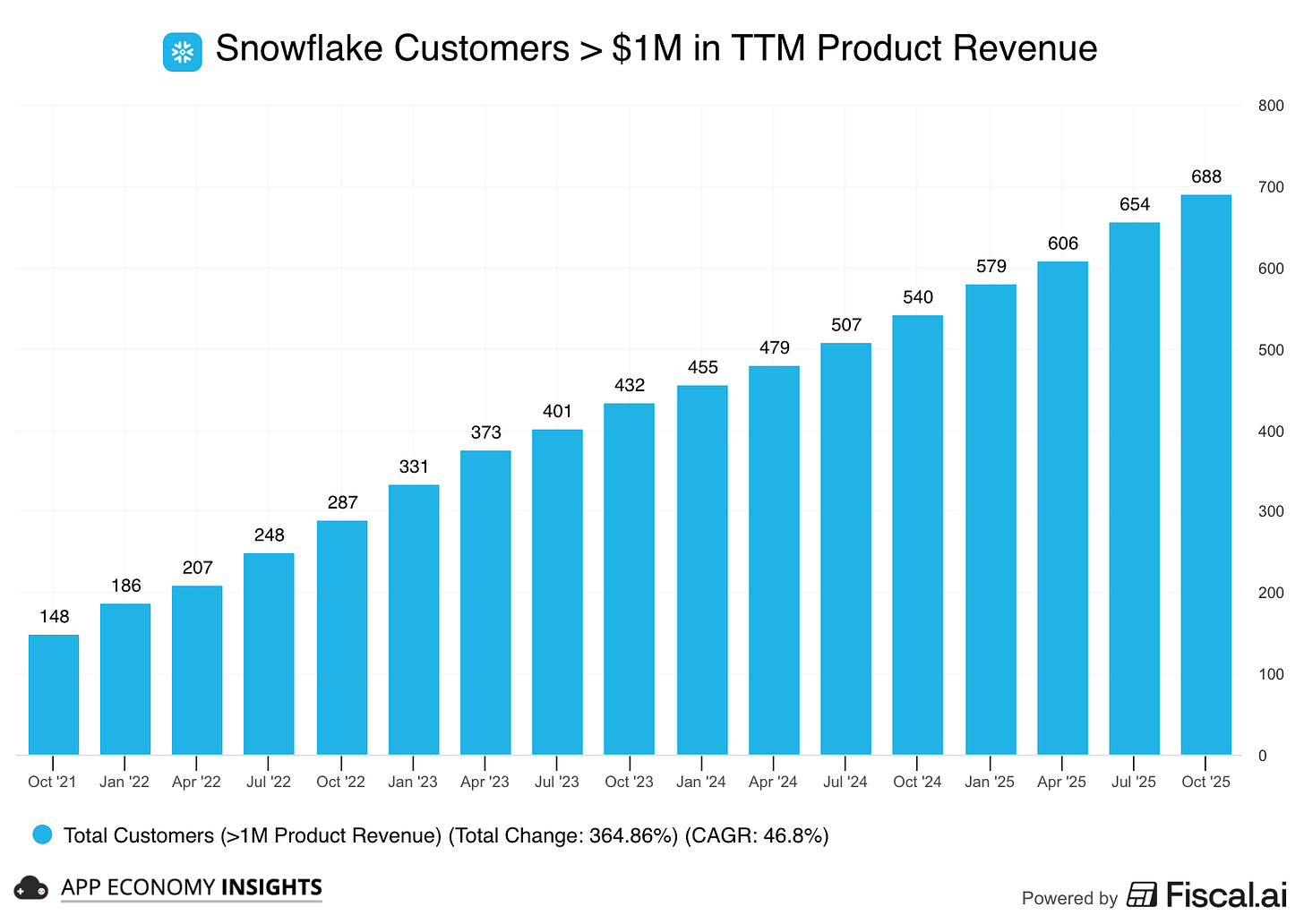

Large customer momentum was a standout. Snowflake signed a record four nine-figure deals in the quarter. Customers generating over $1M in product revenue grew 29% Y/Y to 688, and the company’s total customers rose 20% Y/Y to 12,261 (both metrics accelerating).

Management raised the full-year FY26 product revenue guidance by $41 million to ~$4.45 billion. However, shares fell as the Q4 operating margin guide of 7% missed consensus, implying a significant margin compression with continued AI investment.

CEO Sridhar Ramaswamy highlighted that Snowflake hit a $100 million AI revenue run rate one quarter ahead of schedule. To be sure, this is still a tiny portion of overall revenue at this stage.

Snowflake Intelligence (agentic AI) is seeing the fastest adoption ramp in company history. To bolster this, Snowflake announced a $200 million partnership with Anthropic to bring Claude models to the platform. While the margin outlook for Q4 is concerning, the acceleration in RPO and tangible AI monetization suggests the product strategy is delivering results.