🍿 Netflix: Crushing It Again

Paid sharing worked like a charm. What's next?

Welcome to the Premium edition of How They Make Money.

Over 160,000 subscribers turn to us for business and investment insights.

In case you missed it:

Netflix (NFLX) added 5 million paid members in Q3.

Despite the headwinds from last year’s Hollywood strikes, the streaming giant crushed expectations on all metrics: members, ad momentum, revenue growth, margins, cash flow, you name it.

But how did they do it? And what should discerning investors look for?

Today at a glance:

Netflix Q3 FY24.

Ad monetization.

Key quotes from the earnings call.

What to watch looking forward.

1. Netflix Q3 FY24

Netflix's revenue growth depends on two main factors:

👨👩👧👦 Paid memberships: Number of users paying for the service.

💵 ARM (Average Revenue per Membership): How much revenue they generate per subscriber.

Metrics shift: Recent initiatives like tiered pricing, paid sharing, and advertising make subscriber numbers less indicative of the company's performance. Starting in 2025, Netflix will stop sharing membership and ARM. Instead, the focus will be on revenue and operating margin as the primary success metrics.

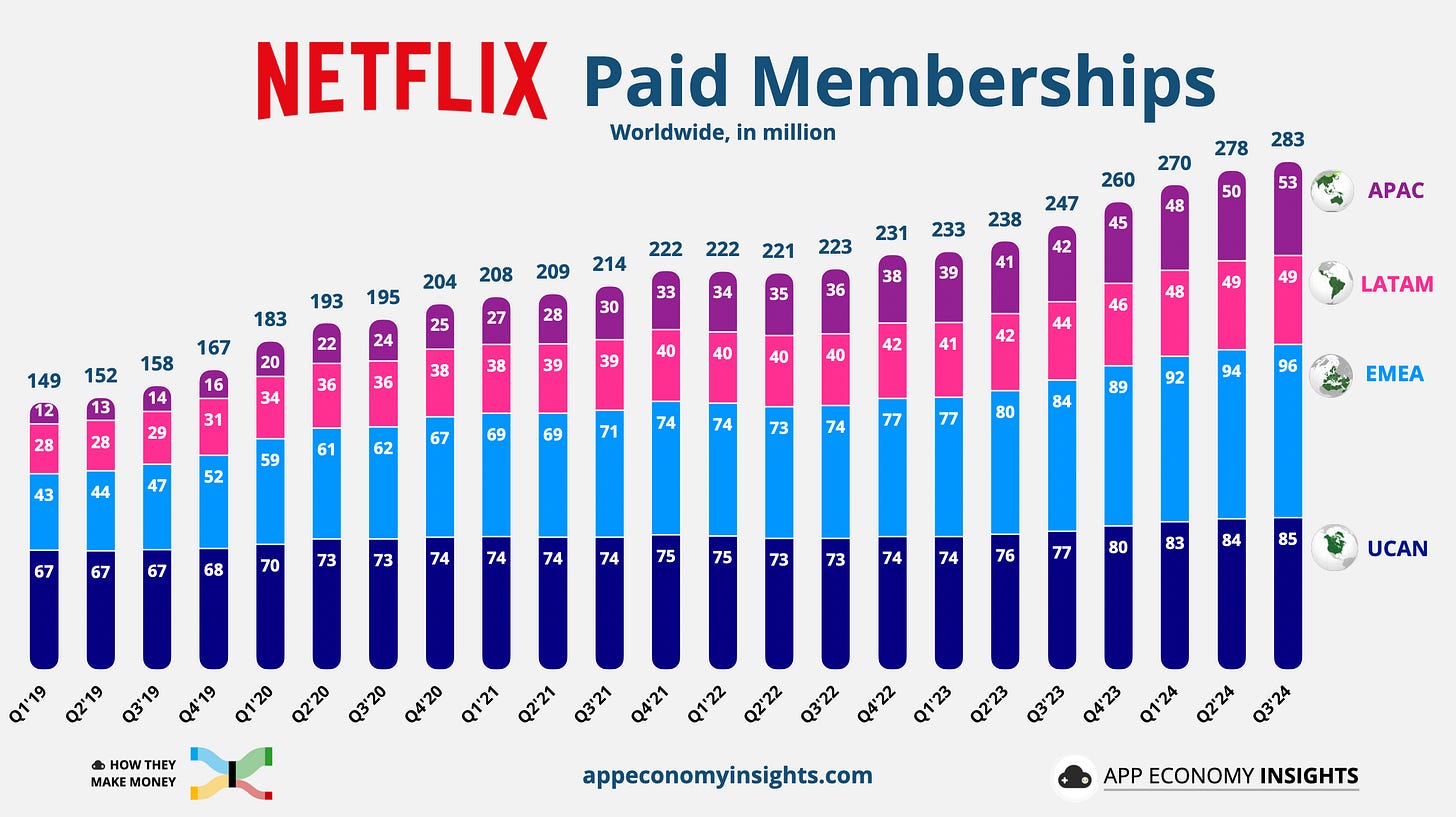

Paid memberships trends:

Since May 2023, Netflix has cracked down on password-sharing in the US and parts of EMEA, leading to a surge in new sign-ups:

283 million paid memberships at the end of Q3 FY24 (+14% Y/Y).

5 million added in Q3 (~0.5 million beat). APAC and EMEA were the main drivers.

North America now accounts for 30% of memberships, down from 42% five years ago. It illustrates the successful international expansion.

Success in APAC is critical, with management calling out countries like Japan, Korea, Thailand, and India. It’s the fastest-growing region, responsible for nearly half of the paid net additions in the quarter.

LATAM saw a slight decline in paid members sequentially, primarily due to recent price changes in big markets and a softer content slate in the region. They already rebounded in early Q4.

ARM was flat year-over-year, or up 5% in constant currency. This growth is relatively soft, given the price hikes in October last year in the US. But there is a simple explanation. The ad-supported plan monetization has yet to reach its full potential, creating some ARM headwinds (we’ll get to this in a minute).