🇺🇸 How America Spends Money

The US government’s financial blueprint

Welcome to the Free edition of How They Make Money.

Over 150,000 subscribers turn to us for business and investment insights.

In case you missed it:

By popular demand, we're taking a break from dissecting businesses to tackle a behemoth of a different kind: the US government. 🇺🇸

This one has been a long time coming and I know it will make many readers happy.

Just like a company, the government has financial statements:

💰 Money comes in (mainly through taxes).

💸 Money goes out (to fund various programs).

With a gross domestic product (GDP) of nearly $29 trillion1 expected in 2024, the United States is by far the largest economy, ahead of China’s $18.5 trillion.

Now, the US government isn't exactly turning a profit. In fact, it's been running a steadily growing deficit, raising questions about its long-term financial health.

With a general election just around the corner, understanding how America makes and spends money is more crucial than ever. So, buckle up as we dive into Uncle Sam's finances and what it all means for the nation's future.

Today at a glance:

Revenue: 50 Shades of Taxes

Spending: Fueling the Nation

Bottom Line: Operating Cost & Deficit

National Debt: A Growing Burden

The Future: America’s Finances

1. Revenue: 50 Shades of Taxes

The US government is a behemoth operation, and like any massive entity, it needs a steady flow of cash to keep the lights on. But instead of selling products or services, Uncle Sam generates revenue through taxes and fees.

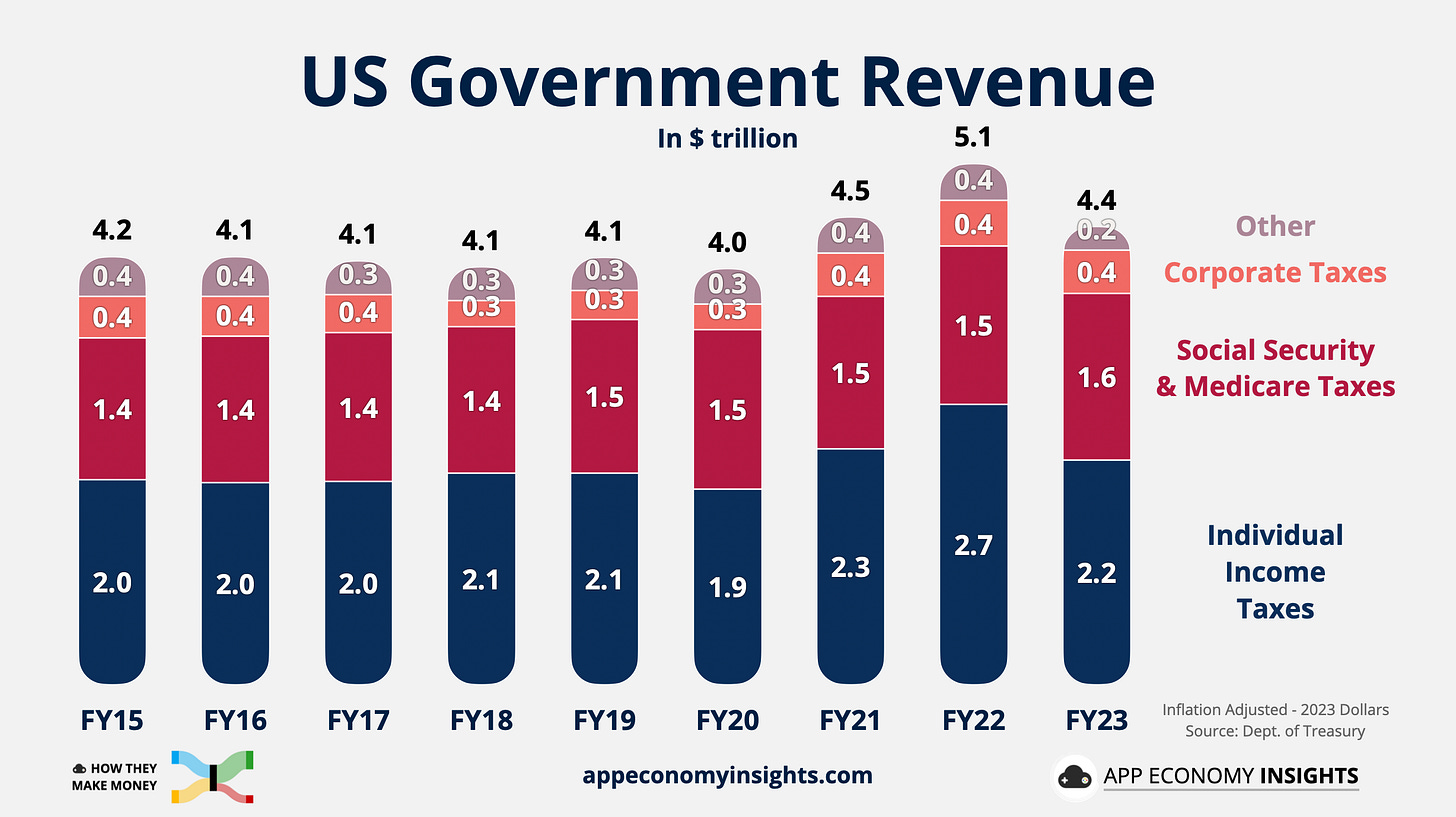

In FY23, the federal government raked in a staggering $4.4 trillion.

So, where does all this money come from? Let's break it down:

👥 Individual Income Taxes: Individuals account for nearly 50% of total revenue. Every time you get a paycheck, a portion goes straight to Uncle Sam's coffers. This category also includes taxes on capital gains.

🏦 Social Security and Medicare Taxes: At roughly 36%, these taxes fund the social safety net for retirees and older adults. It's a pay-it-forward system, with current workers funding benefits for those who came before.

🏢 Corporate Income Taxes: Businesses also chip in, nearly 10% of the total, contributing their share of profits. You see their income tax provision in all of our signature visuals.

🧩 Other Revenue: The remaining ~4% comes from a variety of sources, including excise taxes (think those extra charges on things like alcohol and tobacco), estate taxes, customs duties, and even fees from national park visits.

It's like a giant potluck: individuals, businesses, and even tourists contribute to funding the nation's operations.

Sidenote: It's worth noting that FY21 and FY22 saw a significant surge in individual income tax revenue, largely attributed to the economic recovery from the pandemic and strong stock market performance in 2021. This temporary boost contributed to the overall increase in government revenue during those fiscal years (ending in September).

2. Spending: Fueling the Nation

We've seen how the money rolls into the US Treasury, but now comes the fun part: figuring out where it all goes. The US government has a mammoth task: keeping the nation running smoothly, from national defense to healthcare to infrastructure. And that requires a whole lot of spending.

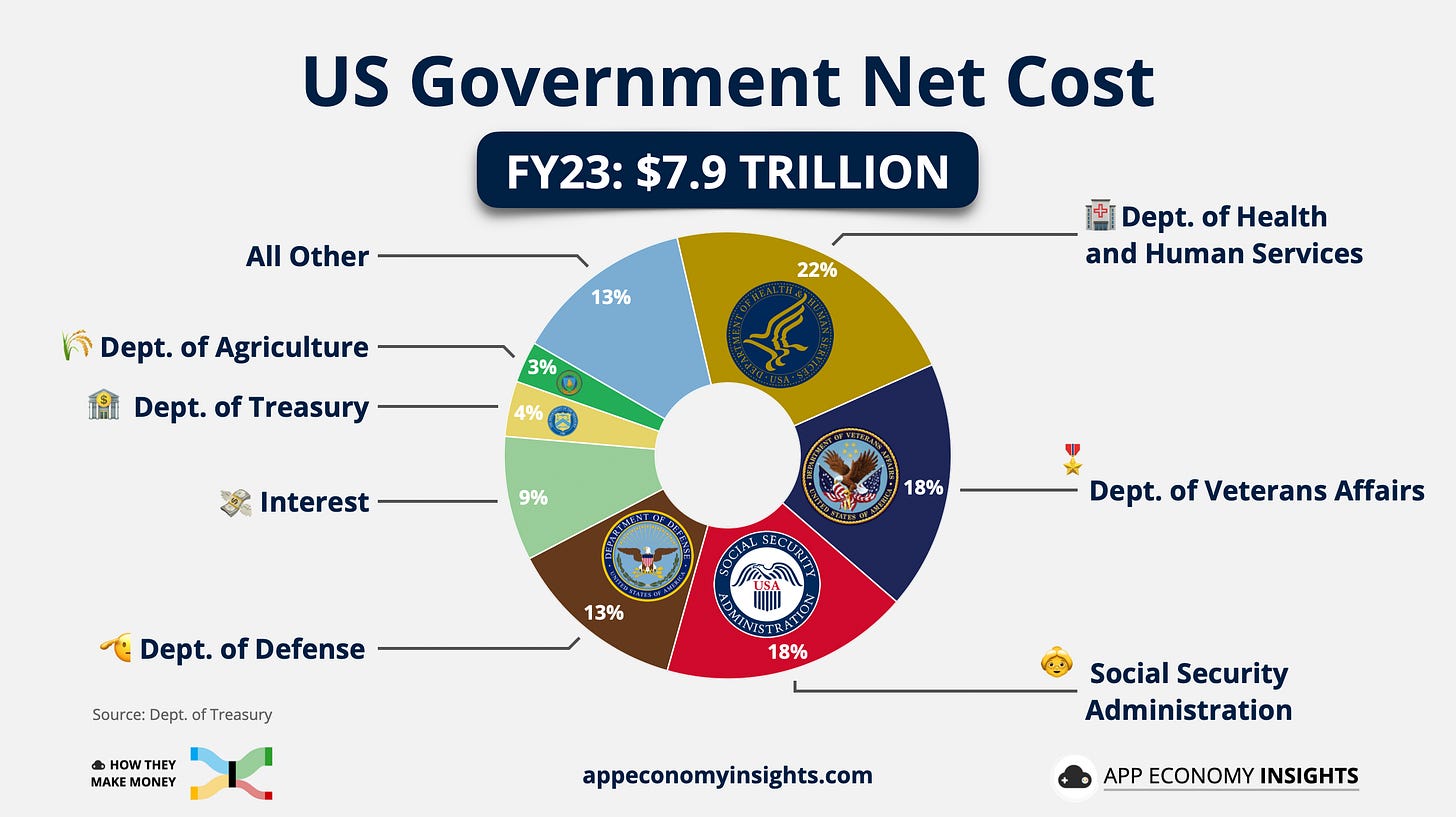

In FY23, the federal government's net cost was $7.9 trillion. That's nearly as much as the entire GDP of Germany and Japan combined, the world's third and fourth-largest economies!

Outlays vs. Net Cost: In FY23, the government's total outlays reached $6.1 trillion. Outlays represent the actual cash disbursements by the government, while the net cost, a broader measure, includes not only cash outlays but also accrual-based accounting adjustments, such as changes in the net present value of federal employee retirement benefits.

Who’s approving this:

So, how does Uncle Sam decide where to allocate all that cash? It's a giant balancing act, with Congress and the President engaged in a delicate dance:

The President's Pitch: The President kicks things off by proposing a budget and outlining their spending priorities based on requests from federal agencies. Think of it as a wish list but with many more zeroes attached.

House and Senate Take the Reins: Budget Committees then step in and hold hearings. They scrutinize the President's proposal, make adjustments, and ultimately craft the final spending bills. It's a complex process involving committees, debates, and plenty of political maneuvering.

The types of spending:

Mandatory Spending: Non-negotiable expenses required by law, like Social Security and Medicare. These programs account for a significant chunk of the budget, and their costs tend to rise as the population ages.

Discretionary Spending: Where Congress and the President decide how much to spend on things like defense and education. It's a yearly tug-of-war, with various agencies vying for their share of the pie. Discretionary represented roughly 28% of total outlays in FY23.

Supplemental Spending: When it's too urgent to wait for a new budget, Congress can enact supplemental appropriations, as it did for the COVID-19 pandemic in 2020.

Now, let's take a closer look at where all that money goes:

🏥 Healthcare Heavyweight: As you can see, the Department of Health and Human Services takes the lion's share, accounting for 22% of the net cost. This reflects the significant expenditure on programs like Medicare and Medicaid.

👵 Social Safety Net: Veterans Affairs and Social Security Administration both claim a sizable 18% chunk, highlighting the importance of these programs.

🫡 Defense and Security: The Department of Defense, responsible for national security, represents 13% of the spending pie.

💸 The Interest Burden: Don't forget about the cost of borrowing! Interest payments on the national debt are a growing share of the budget and consume 9% of government spending.

Government spending (outlays) represented 22% of the US economy (GDP) in FY23. This number has been slightly over 20% in the past decade if we exclude the impact of the COVID-19 pandemic.

3. Bottom Line: Operating Cost & Deficit

When the government spends more than it earns, a budget deficit occurs.

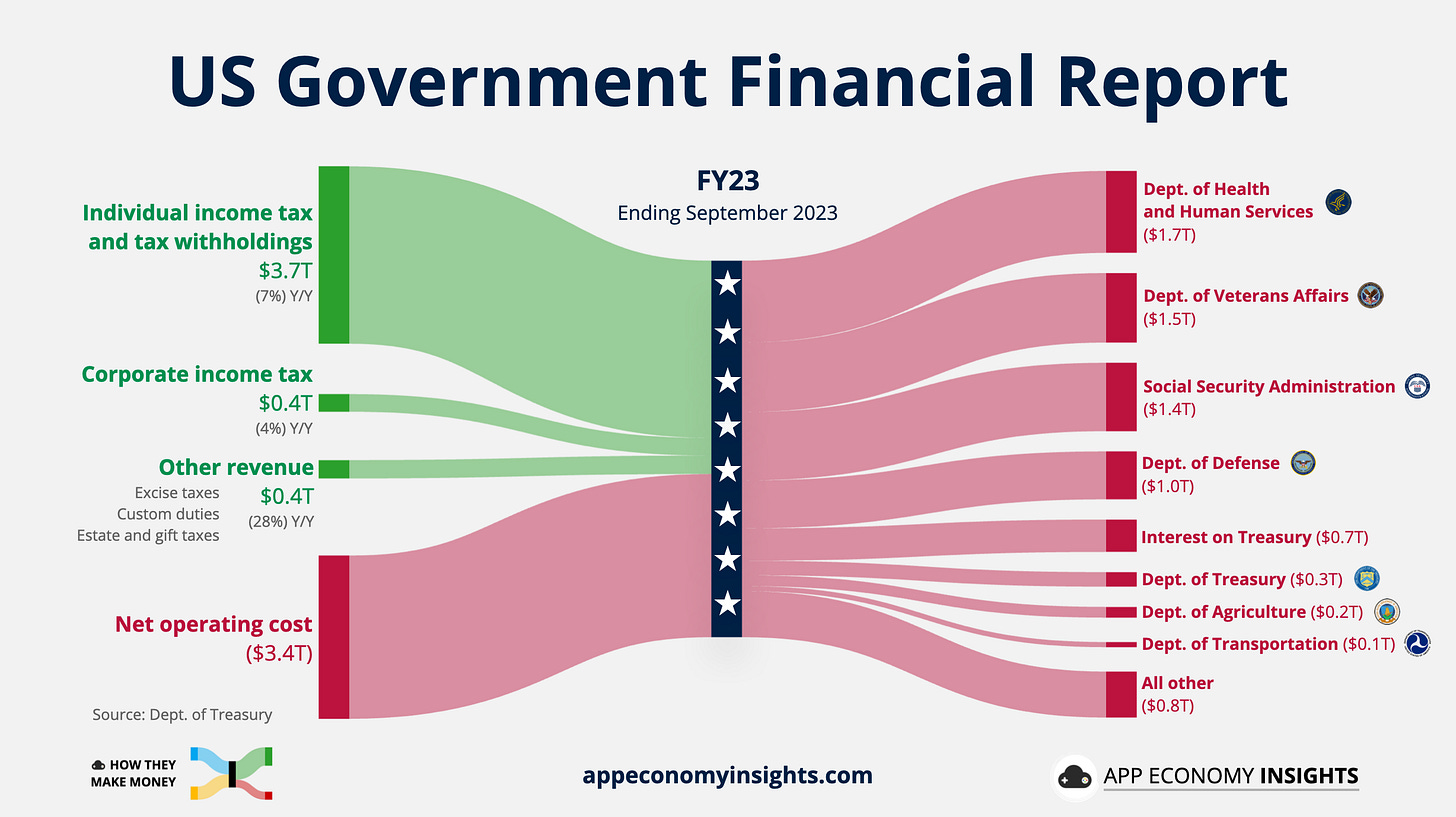

In FY23, the US government recorded a $1.7 trillion deficit (revenue less outlays).

Now, it's important to distinguish between two key terms here:

Net Operating Cost: This is the result of operations from an accounting standpoint. It includes costs the US government has incurred, but not necessarily paid. In FY23, the net operating cost was $3.4 trillion.

Budget Deficit: This is a narrower measure focusing solely on the difference between the government's cash receipts and outlays for the period. As mentioned earlier, the FY23 budget deficit was $1.7 trillion.

Both measures paint a picture of a government living beyond its means. And this isn't a new phenomenon. In the past 50 years, the US federal budget has run a surplus only four times, most recently in 2001.

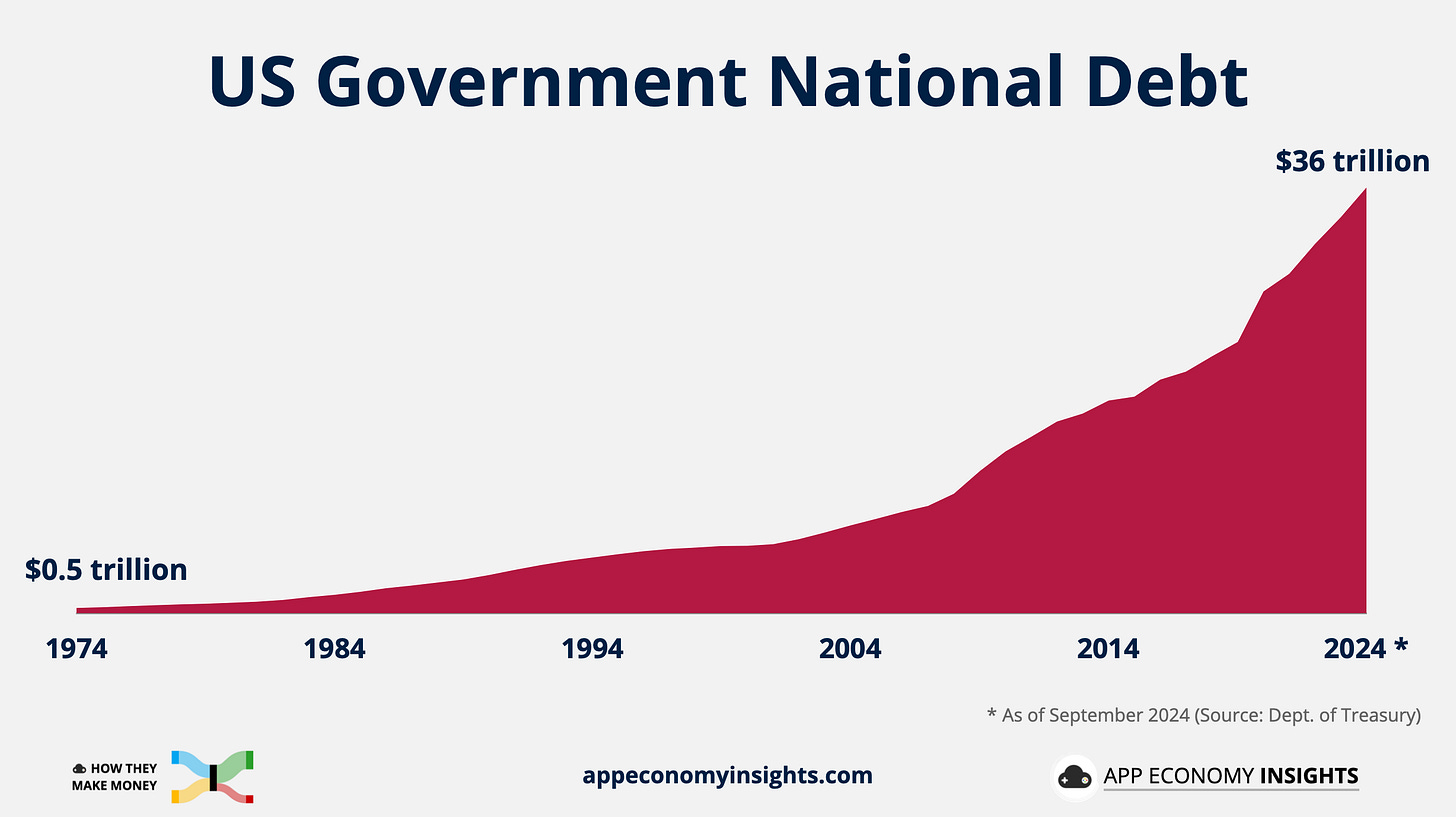

4. National Debt: A Growing Burden

So, how does the government keep the lights on when it's constantly in the red?

It borrows money, primarily by selling Treasury bonds, bills, and other securities. This borrowing adds to the national debt, a growing burden with significant implications for the nation's economic future.

As of September 2024, the national debt stands at a colossal $36 trillion. That's like every single person in America owing over $100,000 to someone else!

Every time the government spends more than it takes in, it adds the difference to the national debt, leading to more interest that must be paid.

Why the Debt Keeps Growing

Several factors contribute to the ever-expanding national debt:

Persistent Deficits: The government has consistently spent more than it has collected in revenue for decades, leading to continuous debt accumulation.

Wars and Economic Crises: Major events like wars (e.g., Iraq, Afghanistan) and economic downturns (e.g., the 2008 recession and the COVID-19 pandemic) often require significant government spending, further increasing the debt.

Tax Cuts and Spending Increases: Policy decisions that reduce government revenue (tax cuts) or increase spending (new programs or expansions) can also contribute to the debt.

The national debt is a complex issue with no easy solutions. It's a balancing act between funding essential programs and services and ensuring the nation's long-term financial health.

5. The Future: America’s Finances

The path ahead is fraught with challenges. The national debt continues to grow, with a debt-to-GDP ratio exceeding 100%, raising concerns about the nation's long-term economic stability and ability to meet financial obligations.

According to the Department of the Treasury, the current fiscal path is unsustainable. Projections assuming current policies continue indefinitely reveal a persistent gap between projected receipts and spending. Without significant policy changes, the national debt will likely continue its upward trajectory.

Several factors will shape the future of America's finances:

Economic Growth: A robust economy generates higher tax revenues, making it easier to manage the debt. Conversely, slower economic growth could exacerbate the deficit and further increase the debt burden.

Interest Rates: Rising interest rates would increase the cost of servicing the national debt, diverting funds from other essential programs.

Inflation: Excessive government debt can contribute to inflation, eroding the purchasing power of individuals and businesses.

Political Polarization: The deep partisan divide in US politics makes it challenging to reach a consensus on fiscal policy and implement long-term solutions to address the debt.

Demographic Shifts: An aging population puts upward pressure on entitlement programs like Social Security and Medicare, increasing government spending and potentially widening the deficit.

To address the challenges posed by growing debt and deficits, a combination of strategies is necessary:

Controlling Spending: Identifying areas for spending cuts or finding more efficient ways to deliver government services.

Increasing Revenue: Exploring options for raising revenue through tax reforms or other measures.

Fostering Economic Growth: Promoting policies that sustain long-term economic growth and increase tax revenues.

Encouraging Bipartisan Cooperation: Finding common ground across the political spectrum to implement lasting fiscal reforms.

The future of America's finances is uncertain, but one thing is clear: addressing the national debt and ensuring the nation's long-term fiscal health will require difficult choices and a commitment to responsible financial management.

What can be done?

It’s easy to feel overwhelmed by the magnitude of these issues, but meaningful change often begins with informed citizens. As we approach a new election cycle, understanding how the US government manages its finances is more important than ever. So, where do you think America’s financial priorities should lie?

Should policymakers focus on cutting spending, raising taxes, or fostering economic growth?

Join the conversation

Let us know your thoughts! Reply to this email or share your opinion in the comments section of this article. Your voice matters in shaping the discussions that could determine the future of America’s financial stability.

That’s it for today!

Stay healthy and invest on!

Get Your Business a Custom Visual

Interested in custom visuals for your organization or brand? Complete the form here, and we'll get in touch.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Disclosure: I do not own any stock discussed in this article in App Economy Portfolio.

Source: International Monetary Fund (IMF).

Very insightful. Thank you!

Just fantastic - you've presented succinctly and clearly what is for most Americans very difficult to understand in its entirety, even highly educated and/or with economic/finance backgrounds.