Greetings from San Francisco! 👋

Join the 33,000+ How They Make Money subscribers receiving insights on business and investing every week.

This article is brought to you by:

For years on the show We Study Billionaires, The Investor’s Podcast Network has made a habit of chatting with the world’s best investors, like Ray Dalio, Joel Greenblatt, Howard Marks, and many more. With 100+ million downloads, they make podcasts by investors, for investors.

Now, they’re joining the newsletter space. Read The Investor’s Podcast Network’s full daily commentary and expert insights in the We Study Markets newsletter.

Click here to sign up (for free) today.

Want to advertise in How They Make Money? Book here.

In a 2013 letter to shareholders, Warren Buffett explained:

"The goal of the non-professional should not be to pick winners [...] but should rather be to own a cross-section of businesses that in aggregate are bound to do well."

How many stocks should you own to strike the perfect balance between risk and reward? While diversification is a pillar of prudent investing, finding the sweet spot between diversification and concentration is a topic of debate. I’ve struggled with this idea for a long time.

Legendary investors like Warren Buffett and Charlie Munger advocate for a concentrated portfolio of high-conviction bets, while modern portfolio theory suggests that owning a diverse array of assets helps manage risk and achieve optimal returns. So, how can you determine the right number of stocks for your portfolio?

This article will examine the diversification dilemma, and discuss the pros and cons of both concentrated and diversified portfolios. We will also explore the factors influencing the optimal number of stocks to own, helping you find the right balance for your unique circumstances and investment goals. So get ready to challenge your assumptions and redefine your approach to portfolio construction.

The diversification dilemma

"Don't put all your eggs in one basket" is a simple yet essential concept in investing. Nobel Prize laureate Harry Markowitz calls diversification “the only free lunch” in investing.

Diversification helps manage risk by spreading investments across various assets, sectors, and geographies.

You might be familiar with the concept of a single point of failure, originating from engineering. If a component fails, the entire system collapses. Diversification serves as a safeguard against single points of failure.

That’s why most retirement plans are allocated to a wide range of low-cost ETFs or mutual funds. The goal is for your nest egg to stay in the game under all circumstances.

However, the optimal level of diversification is often a subject of debate among investors. While greater diversification can reduce risk, it can also diminish the chance of outperforming the index (also known as “alpha”).

Diversification and risk management

Investing in equities involves several risks, such as:

Market risk: Boats move up and down with the tide.

Sector risk: See tech stocks in 2000 or banks in 2008.

Company risk: Even great businesses can fail.

So the question is not about how to avoid these risks, but how to manage them. And the best tool to do this is position sizing.

Diversification is rooted in the principle that the performance of various assets is not perfectly correlated, allowing investors to reduce the overall risk associated with their portfolio.

The pitfalls of over-diversification

Over-diversification occurs when an investor holds too many assets, diluting the potential impact of individual winners on overall returns. This can result in a portfolio that closely resembles the broader market, making it difficult to outperform.

Peter Lynch explains in One Up on Wall Steet:

“There's no use diversifying into unknown companies just for the sake of diversity. A foolish diversity is the hobgoblin of small investors.”

It’s a loser’s game to buy stocks only for the sake of diversification. Additionally, managing a large number of investments can be time-consuming and may lead to a lack of focus.

On the other hand, under-diversification exposes an investor to a greater risk of permanent loss of capital if one or more assets underperform significantly.

In his book Principles, Ray Dalio explains that all you need to monitor your downside risk is 15 uncorrelated assets:

“That simple chart struck me with the same force I imagine Einstein must have felt when he discovered E=MC2: I saw that with fifteen to twenty good, uncorrelated return streams, I could dramatically reduce my risks without reducing my expected returns. It was so simple but it would be such a breakthrough if the theory worked as well in practice as it did on paper. I called it the “Holy Grail of Investing” because it showed the path to making a fortune. This was another key moment in our education.”

Uncorrelated is the operative word here. The number of individual stocks matters less than the type of stocks in the portfolio.

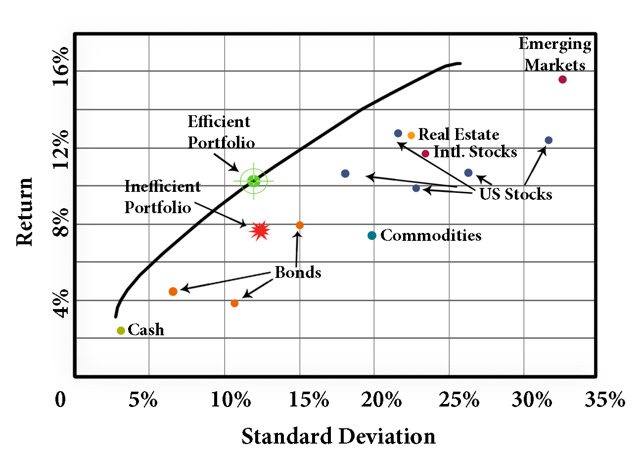

Limitations of the efficient frontier

The efficient frontier is a concept from Modern Portfolio Theory that represents the highest expected return for a given level of volatility (or the lowest volatility for a given expected return).

It can help investors construct a portfolio by guiding them to select a mix of assets that offer the best possible returns for their preferred level of risk, ultimately aiming to optimize their investment performance.

However, the efficient frontier has its limitations:

It relies on historical data and assumptions, which may not be accurate predictors of future performance.

It assumes that asset returns follow a normal distribution, which is not always true in real-world markets.

It overlooks the unique circumstances, preferences, and goals of individual investors.

It uses standard deviation (portfolio volatility) as a measure of portfolio risk. However, for many investors, the risk that genuinely matters is the permanent loss of capital. Although volatility can be unsettling, it doesn’t necessarily equate to a permanent loss. Understanding this distinction is crucial when considering the role of diversification in managing risk and the limitations of relying solely on the efficient frontier. In short, volatility and risk are not the same thing.

If you can stay focused on the long term and ride the market’s inevitable ups and downs, volatility is just part of the business we are in.

The factors to consider

Concentration builds wealth. Diversification preserves it.

The ideal number of stocks in a portfolio varies among investors, as personal preferences, risk tolerance, and investment goals heavily influence it. In this section, we will explore some key factors contributing to determining the optimal number of stocks for your investment strategy.

Risk profile

Each investor has unique personal circumstances, which play a significant role in determining the number of stocks they should own.

There are three types of risks to consider to evaluate your risk profile:

Risk appetite (goals): Your willingness to accept fluctuations in the value of your investments for the potential of higher returns.

Risk tolerance (temperament): The degree of uncertainty or loss you can handle, which may depend on your financial situation and emotional resilience.

Risk capacity (circumstances): Your ability to absorb losses without jeopardizing your long-term goals or financial stability.

These three factors play a critical role in determining the ideal level of diversification for your unique circumstances.

If your primary goal is capital preservation (implying a lower risk appetite), you may lean towards greater diversification. Of course, the answer may be different if you are in your 20s and investing money you can afford to lose.

Those with a higher risk tolerance may prefer a more concentrated approach, focusing on a smaller number of high-growth or high-risk investments.

If you need the money to put your kids in university in the next three years, investing in equities may be a terrible idea, regardless of the number of stocks in the portfolio.

Time horizon

The length of your investment horizon is another critical factor in determining the number of stocks in your portfolio. Long-term investors can generally afford to take on more risk and may opt for a more concentrated approach, given that they have more time to recover from potential losses. On the other hand, short-term investors might prioritize diversification to minimize the risk of sudden downturns affecting their overall portfolio value.

Market knowledge and expertise

Your market knowledge and expertise can also influence the optimal number of stocks to own. Investors with a deep understanding of specific industries or sectors may feel more comfortable concentrating their investments in those areas, leveraging their expertise to identify high-potential stocks. Knowing what you own can help you withstand inevitable downturns and stay the course.

Those with less market knowledge or who lack the time and resources to research individual investments thoroughly may prefer a more diversified approach, spreading their investments across various sectors and asset classes.

As best put by Buffett during the 1996 annual meeting at Berkshire:

“You know, we think diversification is - as practiced generally - makes very little sense for anyone that knows what they're doing.

Diversification is a protection against ignorance.

[…] If you know how to analyze businesses and value businesses, it's crazy to own 50 stocks or 40 stocks or 30 stocks, probably, because there aren't that many wonderful businesses that are understandable to a single human being, in all likelihood.”

For the record, Buffett does own about 50 stocks in his portfolio at Berkshire. More on that in a second.

Portfolio management style (active vs. passive)

Active investors, who frequently monitor and adjust their holdings based on market conditions and individual stock performance, may choose to concentrate their investments in a smaller number of stocks to capitalize on their in-depth research and market insights. Passive investors, who take a more hands-off approach to portfolio management, might lean towards greater diversification to minimize the impact of unforeseen events on their investments.

So how do I apply all this?

My approach is to be passively active (AKA, “long-term buy and hold”), a term I borrow from Rober G. Kirby and his idea of the Coffee Can portfolio.

The active part is the investment selection based on my research.

The passive part is my behavior. I sit on my hands and let the story play out.

Kirby explains:

“The Coffee Can portfolio concept harkens back to the Old West, when people put their valuable possessions in a coffee can and kept it under-the mattress. That coffee can involved no transaction costs, administrative costs, or any other costs. The success of the program depended entirely on the wisdom and foresight used to select the objects to be placed in the coffee can to begin with.”

This strategy is built to derive alpha over the long term via “home runs.” As a result, I lean toward greater diversification because the best-performing investments will tend to take a larger part of the portfolio organically through their performance. Winners and losers essentially take care of themselves over time.

The optimal number of stocks in a portfolio depends on a combination of factors, including personal risk profile, time horizon, market knowledge, and portfolio management style. By carefully considering these factors, you can balance diversification and concentration to create a portfolio that aligns with your unique preferences and objectives. Nobody can answer these questions for you.

Portfolio concentration: Pros and cons

While Buffett and Munger have achieved great success with concentrated strategies, it’s essential to understand the potential benefits and drawbacks before adopting this approach.

Benefits of a concentrated portfolio:

Potential for higher returns: With a concentrated portfolio, investors can allocate more of their funds to their highest-conviction ideas, increasing the potential for outsized gains. Buffett, for example, has consistently attributed much of his success to his concentrated positions in high-quality businesses, which he held onto for many years. Here’s a look at Buffett’s portfolio at Berkshire Hathaway. At the end of 2022, six stocks comprised 80% of Uncle Warren’s portfolio, even though he owns about 50 positions. As you can see, the exact number of stocks matters a lot less than the size of the top holdings.

Focus on the best ideas: Concentrated investing requires investors to carefully select and focus on their best investment ideas. This approach can lead to a more in-depth understanding of the businesses in the portfolio and the ability to make more informed investment decisions. To illustrate, Buffett explained to a group of University of Southern California students in 1994:

“I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it, so that you had 20 punches — representing all the investments that you got to make in a lifetime. And once you’d punch through the card, you couldn’t make any more investments at all. You’d really have to think carefully about what you did, and you’d be forced to load up on what you really think about. So you’d do much better.”

Long-term perspective: Concentrated investors often adopt a long-term perspective, allowing them to capitalize on market inefficiencies and ride out short-term volatility. This mindset can lead to a more disciplined approach to investing, as these investors are less likely to be swayed by market noise and speculation.

Drawbacks of over-concentration:

Risk of underperformance: Abnormal returns can go both ways. The potential to outperform comes with the risk of underperformance. With a smaller number of stocks, the underperformance of one or more holdings can substantially impact the overall portfolio’s value.

Potential for significant losses: A concentrated portfolio may be more susceptible to sharp declines in value if one or more holdings experience substantial losses. This risk is particularly pronounced when investing in high-growth or high-risk stocks, which can be more volatile than the broader market.

Emotional attachment: Investors with concentrated portfolios may become emotionally attached to their holdings, making it difficult to sell when necessary. This attachment can lead to poor decision-making and an inability to recognize when an investment thesis has changed. There is no correlation between how much work you put toward researching a business and what it can return to your portfolio. You don’t want to learn this lesson the hard way.

Letting winners run and knowing when to sell:

One of the keys to successful concentrated investing is knowing when to let your winners run and when to sell. To strike this balance, investors should regularly reevaluate their holdings to ensure that the original investment thesis remains intact.

So how do I apply all this?

My approach to this is to let my winners represent a more significant part of my portfolio over time without interrupting the power of compounding. My concentration level results from my investment returns, not my conviction. I rarely sell, so I tend to hold some stocks longer than I should. However, I don’t add to positions that turn against me. As a result, losers become a tiny part of my portfolio over time as they underperform, making them somewhat irrelevant. Winners organically take over the entire portfolio.

Portfolio diversification: Pros and cons

As with concentrated portfolios, diversified portfolios come with their own set of pros and cons. Understanding these aspects is essential to make informed decisions about your investment approach.

Benefits of a diversified portfolio:

Risk management: One of the primary benefits of diversification is risk management. By holding a larger number of stocks, investors can reduce company risk.

Downside protection: A diversified portfolio of uncorrelated assets can provide downside protection during market downturns. For example, when one sector underperforms, others in the portfolio may perform well, offsetting losses and potentially stabilizing overall returns.

Exposure to the broader market: Diversification allows investors to participate in the growth of various sectors and asset classes, improving the portfolio’s odds of success over multiple business cycles.

Drawbacks of over-diversification:

Dilution of returns: Over-diversification can lead to the dilution of returns, as the impact of high-performing stocks on the overall portfolio is diminished. In other words, the more stocks you own, the less likely it is that any single stock will significantly impact your portfolio’s performance. Your home runs won’t make a difference.

Potential for mediocrity: As the number of holdings in a portfolio increases, the portfolio’s performance may start to resemble that of the broader market. This may result in average or below-average returns.

Complexity: Managing a diversified portfolio can become complex, especially when holding many stocks. This complexity may make it difficult for investors to monitor and understand the underlying investments, increasing the potential for poor decision-making.

Understanding investments within a diversified portfolio:

Regardless of the level of diversification, it's crucial for investors to understand the investments within their portfolios. This involves grasping how a business makes money and analyzing its financial statements. That's where this newsletter comes in! And we got you covered with our articles breaking down how to analyze financial statements.

By the way, if you prefer a video format, we just launched a new video series on the How They Make Money YouTube Channel! We’ll cover all financial statements from scratch. Here’s the first one where we discuss Apple’s P&L.

Subscribe to make sure you don’t miss the next videos as they come out weekly.

With this knowledge, investors can make informed decisions, recognize potential risks, adjust their strategies, and adjust position sizing accordingly. In addition, avoiding unnecessary complexity can help ensure that investors remain poised and respond effectively to market changes.

So how do I apply this?

I have rules or safeguards to ensure my new investments remain diversified enough to avoid a single point of failure. I don’t allow myself to add more to an investment once I reach a “full” position based on the funds already invested.

In addition, I must write a 5,000-word investment thesis before investing in a specific business. Most ideas fail this test, so it keeps my standards high. In addition, it forces me to document why I’m investing and what would make me change my mind. Journaling is the most powerful way to keep emotions in check.

Striking the right balance

In his book, The Psychology of Money, Morgan Housel discusses being reasonable versus rational.

“Aiming to be mostly reasonable works better than trying to be coldly rational.”

While a rational approach to investing might involve making decisions based purely on mathematical optimization, a reasonable approach acknowledges that emotions, personal preferences, and biases play a significant role in financial decisions. When finding the right balance between diversification and concentration, it’s essential to recognize the difference between these two concepts.

Strive for a reasonable balance that considers your circumstances, goals, and temperament rather than solely focusing on a rational, mathematical solution.

I often reference the analysis of BlackStar funds shared by Meb Faber on his blog. They looked at more than 8,000 stocks over 23 years.

In short, out of a portfolio of 10 stocks, over 20 years:

2 stocks are going to return 300% or better.

2 stocks are going to be wiped out (down 75% or more).

The other 6 will cancel each other out.

So what to make of this?

For one thing, it does show how heavy concentration can be foolish. With less than 20% of stocks driving most of the market performance, trying to find winners can be a hazardous hobby.

Now, if you only invest in 10 stocks, assuming average luck, your performance depends on the outsized returns of only two positions. But, more importantly, these two outperformers will likely represent more than half of your portfolio allocation if you give them enough time. Would you be comfortable with that?

I love this Charlie Munger quote because it impacts my strategy so profoundly:

“The first rule of compounding: Never interrupt it unnecessarily.”

A portfolio concentration may appear reasonable at first. But its organic evolution could lead to a level that is unbearable to you. So it’s best to ask what the portfolio might look like in the future when making allocation decisions today. For example, if 40% of your portfolio in a single stock in 20 years sounds too high, then a starting allocation of 10% today is probably too high.

Suppose the key to success is to leave the power of compounding uninterrupted (following Charlie’s advice). In that case, forcing yourself to rebalance your portfolio and sell a winner too early solely because it has become too large of a position is not a recipe for success.

There are several approaches that investors can use to determine the appropriate level of diversification for their portfolios:

🛑 Setting maximum allocation limits: One approach is to set maximum allocation limits for individual investments or sectors. Doing so can prevent any single investment or sector from dominating your portfolio, ensuring a degree of diversification while still allowing for concentration in your best ideas. For example, you might limit your exposure to any single stock to no more than 10% of the funds added to your portfolio as a safeguard.

🛰️ Core-satellite strategy: Another method to achieve a balanced portfolio is the core-satellite strategy. In this approach, the core portion of the portfolio consists of diversified index funds or ETFs that track major market indices, providing broad market exposure. The satellite portion consists of individual stocks or sector-specific funds that you believe have the potential for outperformance. This strategy allows for both diversification and concentration, depending on the allocation between core and satellite holdings.

🎲 Quantitative methods: Some investors use quantitative methods, like the Kelly criterion, to determine the optimal allocation for individual investments. The Kelly criterion is a mathematical formula that calculates the ideal percentage of your portfolio to allocate to a specific investment based on the expected return and risk. This approach can be complex, and ignore the human element of investing. It may offer a rational approach, but not necessarily a reasonable one.

⚖️ Adapt to what is already in the portfolio: The nature of the businesses within your portfolio plays a crucial role in determining the right number of holdings. Companies with strong competitive advantages, solid financials, and a history of consistent performance can justify a larger position. High-quality businesses with predictable earnings and cash flows tend to be more resilient during market downturns. Understanding the quality and predictability of your investments can help you make more informed decisions on the right number of holdings and their respective allocations.

Practical examples and case studies:

Warren Buffett’s Berkshire Hathaway focuses on investing in businesses with demonstrated economic moats over decades, allowing for concentration in high-conviction ideas. Although he has significant exposure to specific sectors like banks, this approach mitigates risk by carefully selecting high-quality companies with proven track records, ensuring a lower chance of failure. In short, putting a large portion of your portfolio in a single stock is reckless if it’s a recent IPO of an unproven business. But if it’s Apple? Not so much. The size of an investment should be adapted to the probability of success.

Peter Lynch employed a mixture of concentration and diversification when he led Fidelity’s Magellan Fund from 1977 to 1990. He was known for holding hundreds of stocks (he had as many as 1,400 stocks at once) and concentrating on his highest-conviction picks (such as Fannie Mae or Ford). This approach allowed him to outperform the market consistently during his tenure.

By considering different approaches and learning from other investors, you can craft a portfolio that suits your unique risk profile.

Monitoring the portfolio

Regularly reviewing your holdings can help ensure that your investments align with your risk profile. So let’s discuss the importance of monitoring your portfolio and the role of emotions and discipline in managing your investments.

🧑💻 Regular review: It is essential to review your portfolio periodically to assess its performance, risk exposure, and alignment with your financial objectives. Market conditions and individual stock performances can change over time, potentially altering your portfolio’s diversification. By conducting a regular review, you can identify any imbalances or inconsistencies and take appropriate action such as tax-loss harvesting or learning from your past mistakes before making your next investment.

🧠 Emotions and discipline: Managing a portfolio requires discipline and emotional control. Investors often struggle with the temptation to chase high-performing stocks or hold onto losing investments hoping for a turnaround. Emotions such as greed, fear, and overconfidence can negatively impact your investment decisions and jeopardize your long-term strategy. Therefore, it is crucial to remain objective and disciplined when monitoring and adjusting your holdings, focusing on data and analysis rather than emotional reactions. Journaling and documenting decisions can save you some expensive lessons.

⚖️ Rebalancing vs. letting winners run: Rebalancing a portfolio is typically done to maintain a target level of diversification and risk. However, it can also be a double-edged sword, as it may require selling high-performing investments prematurely. Peter Lynch once said, "Selling your winners and holding your losers is like cutting the flowers and watering the weeds." In some cases, allowing your winners to run might lead to better results. When deciding whether to sell or hold a position, it's crucial to carefully evaluate the rationale behind each choice, taking into account factors beyond just the current allocation. Rebalancing should be approached thoughtfully, with a focus on the underlying investments' potential for future growth, rather than basing decisions solely on recent performance.

⚙️ Implementing a systematic approach: To help manage emotions and maintain discipline, consider implementing a systematic approach to monitoring and adjusting your portfolio. This might involve setting specific rules and safeguards. For example, I don’t add to my losers to avoid throwing good money after bad. In addition, I don’t sell unless the thesis is broken, which helps me lean toward inaction and ignore the noise. By adopting a systematic approach, you can reduce the impact of emotions on your investment decisions

By practicing discipline and managing emotions, you can make informed decisions that align with your risk profile, ensuring your portfolio remains well-balanced and positioned for long-term success.

Bottom line

In this article, we have explored the complexities of determining the ideal number of stocks to hold in an investment portfolio. Striking a balance between diversification and concentration is crucial for managing risk and maximizing returns.

Key takeaways from our discussion include:

There is no universal answer to the question of how many stocks to own. Instead, the optimal number of stocks depends on personal risk profile, time horizon, market knowledge, and portfolio management style.

Diversification helps protect against downside risk, but over-diversification can dilute returns and result in mediocrity.

Concentration can boost returns and focus but may expose investors to increased risk and potential losses without a proper selection process.

Different approaches can help achieve the right balance, such as setting maximum allocation limits, adopting a core-satellite strategy, using quantitative methods, or adapting to what’s already in the portfolio.

Key ingredients to success include regular portfolio monitoring, journaling, sitting on your hands, and a systematic, data-driven approach.

The right portfolio is the one you can make a lifelong commitment to.

As you reflect on this article, take the time to evaluate your investment portfolio. Assess whether your current holdings strike the right balance and if any adjustments are needed. Remember that the journey to achieving your investment goals is a dynamic process, demanding continuous learning, adaptation, and self-reflection.

It's less about the number of stocks you own and more about the composition and allocation of your top holdings. For example, my top ten holdings make up approximately half of my portfolio. But enough about me!

How many stocks are in your portfolio?

What’s your ideal number, and why?

Do you have safeguards, such as a maximum initial investment?

What lessons have you learned, and what changes would you make to your approach if you could start over?

Share your thoughts in the comments below!

That’s it for today!

Stay healthy and invest on!

Disclosure: I am long AAPL in the App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members here.

Stay up to date and give us a follow on Twitter, LinkedIn, Instagram, and YouTube.

![[chartzzzz.jpg] [chartzzzz.jpg]](https://substackcdn.com/image/fetch/$s_!uwZn!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F97dc0839-42b8-45fc-8c6d-b5bf5c59c463_628x457.jpeg)

What a great overview of the most fundamental portfolio idea. (Also, I appreciate the emojis ...)

Very helpful, thanks!