☁️ Amazon: Still Day 1 For AI

AWS and ads drive margins upward

Welcome to the Premium edition of How They Make Money.

Over 160,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members love our latest Earnings Visuals report!

Digest the performance of hundreds of companies in seconds.

Amazon (AMZN) reported its Q3 results, and they didn’t disappoint.

AWS—Amazon’s cloud computing powerhouse—makes up less than 20% of total revenue but accounts for over 60% of operating profit. As always, AWS is the signal amid the noise.

CEO Andy Jassy shared:

““Our AI business is a multibillion-dollar business that's growing triple-digit percentages year over year and is growing three times faster at its stage of evolution than AWS did itself. We thought AWS grew pretty fast.”

☁️ AWS hit a $110 billion run rate, with AI already a meaningful contributor

Like other Big Tech players, Amazon is ramping up its investments in AI and infrastructure to capture long-term tailwinds, a trend we've also observed in Google and Microsoft’s recent earnings.

Yet, AWS isn’t the only segment driving momentum. Advertising is also delivering steady growth and reinforcing the margin expansion story.

Let's dive into the numbers and visualize Amazon’s market share.

Today at a glance:

Amazon Q3 FY24.

AI tech stack update.

Key quotes from the earnings call.

Advertising market share and Kuiper.

1. Amazon Q3 FY24

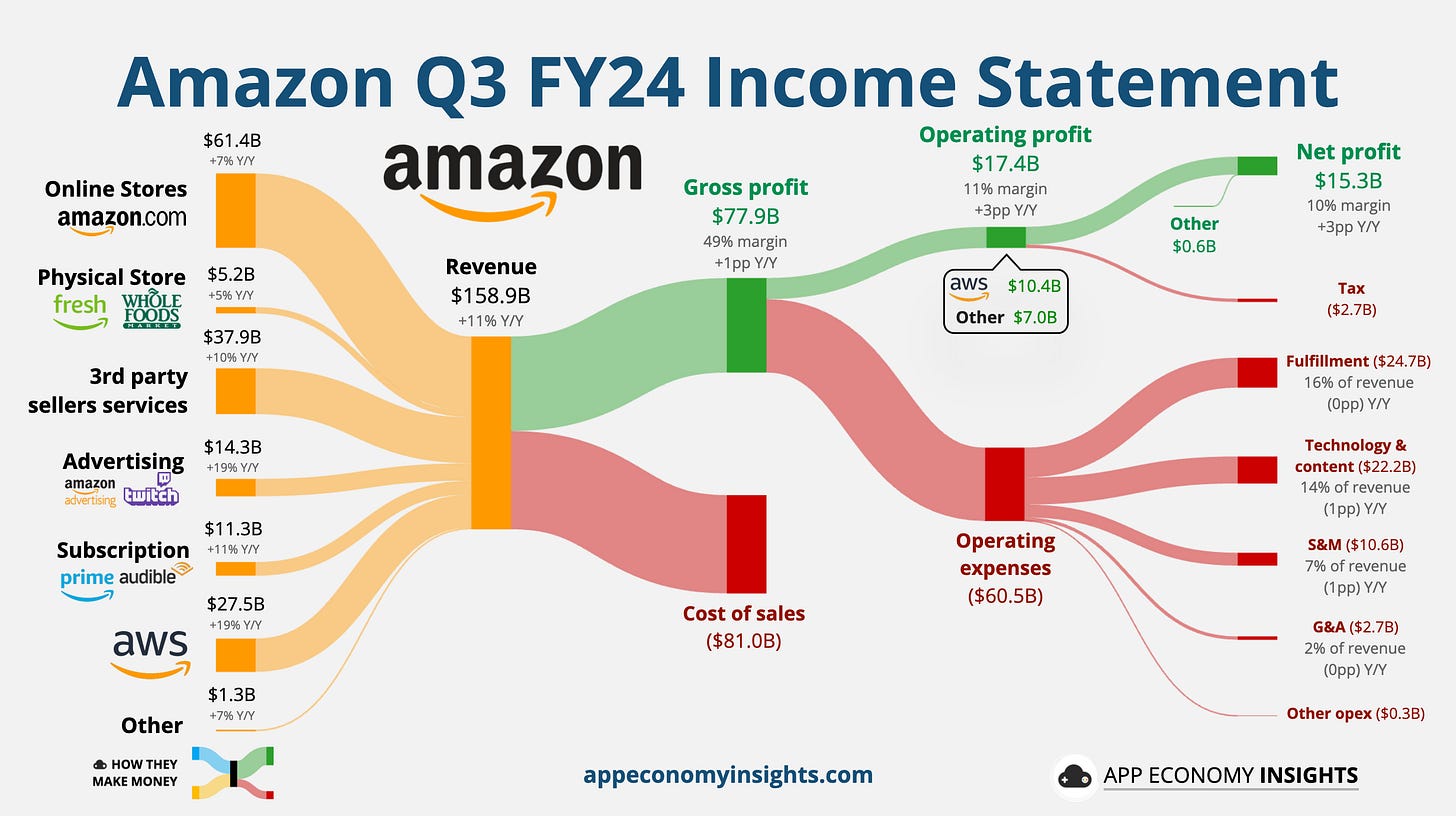

Income statement:

Revenue breakdown:

💻 Online stores (39% of overall revenue): Amazon.com +7% Y/Y.

🏪 Physical store (3%): Primarily Whole Foods Market +5% Y/Y.

🧾 3rd party (24%): Commissions, fulfillment, shipping +10% Y/Y.

📢 Advertising (9%): Ad services to sellers, Twitch +19% Y/Y.

📱 Subscription (7%): Amazon Prime, Audible +11% Y/Y.

☁️ AWS (17%): Compute, storage, database, & other +19% Y/Y.

Other (1%): Various offerings, small individually +7% Y/Y.

Revenue grew +11% Y/Y to $159 billion ($1.6 billion beat).

Excluding AWS:

North America grew +9% Y/Y to $95 billion.

International grew +12% Y/Y to $36 billion.

Gross margin was 49% (+1pp Y/Y).

Operating margin was 11% (+3pp Y/Y).

AWS had a 38% margin (+8pp Y/Y).

North America had a 6% margin (+1pp Y/Y).

International had a 4% margin (+4pp Y/Y).

EPS $1.43 ($0.29 beat).

Cash flow (trailing 12 months or TTM):

Operating cash flow TTM was $112 billion (+57% Y/Y).

Free cash flow TTM was $48 billion (+123% Y/Y), primarily driven by the operating cash flow improvement.

Balance sheet:

Cash, cash equivalent, and marketable securities: $87 billion.

Long-term debt: $58 billion.

Q4 FY24 Guidance:

Revenue ~$185 billion or +9% Y/Y (~$1.3 billion miss).

Operating income $16-$20 billion ($0.5 billion beat), or 10% margin.

So what to make of all this?