📊 PRO: This Week in Visuals

AAPL, AMZN, META, LLY, V, MA, ABBV, AMD, MCD, AMGN, UBER, CMCSA, PFE, BKNG, INTC, PYPL, CMG, CDNS, MRK, COIN, TEAM, KHC, EA, RBLX, GPN, HOOD, SNAP, RDDT, SOFI, TWLO, ROKU, PAYC, ETSY, PTON, TDOC

Welcome to the Saturday PRO edition of How They Make Money.

Over 160,000 subscribers turn to us for business and investment insights.

In case you missed it:

📧 Free members get our Friday articles and sneak peeks.

💌 Premium members receive monthly reports with 200+ companies visualized, one extra weekly article, and access to our archive.

💼 PRO members enjoy everything in Premium, plus our Saturday timely coverage of the most important earnings of the past week.

Today at a glance:

📱Apple: China Slowdown

☁️ Amazon: Margins Expand

♾️ Meta: AI Investments Ahead

💊 Eli Lilly: Zepbound Sales Miss

💳 Visa: International Restructuring

💳 Mastercard: Resilient Spending

💊 Abbvie: Immunology Shift

⚙️ AMD: Data Center Acceleration

🍟 McDonald: E. coli Outbreak

🧬 Amgen: MariTide Update

🚖 Uber: Record Profit With a Catch

🦚 Comcast: Cable Spinoff Considered

💉 Pfizer: Paxlovid Raise

🏝️ Booking: Demand Resilience

🧑💻 Intel: Turnaround Signs

💳 Paypal: Braintree Boosts Margins

🌯 Chipotle: Growth Moderation

💡 Cadence: Upgraded Outlook

💊 Merck: Keytruda Strength

📈 Coinbase: Lower Trading Volume

☁️ Atlassian: New CRO & Raise

🚙 Ford: EV Losses

🌭 Kraft Heinz: Lunchable Woes

🎮 Electronic Arts: Sports Titles Boost

👾 Roblox: Bookings Soar

🌎 Global Payments: Streamlining Continues

🪶 Robinhood: Promotion Drag

👻 Snap: Ad Revamp

👽 Reddit: Profitable Growth

🏦 SoFi: Financial Services Surge

💬 Twilio: AI Integration

📺 Roku: No More User Reporting

💻 Paycom: Guidance Reaffirmed

📦 Etsy: GMS Keeps Sliding

🚲 Peloton: New CEO (Already)

🧑⚕️ Teladoc: Better Help BetterHelp

1. 📱Apple: China Slowdown

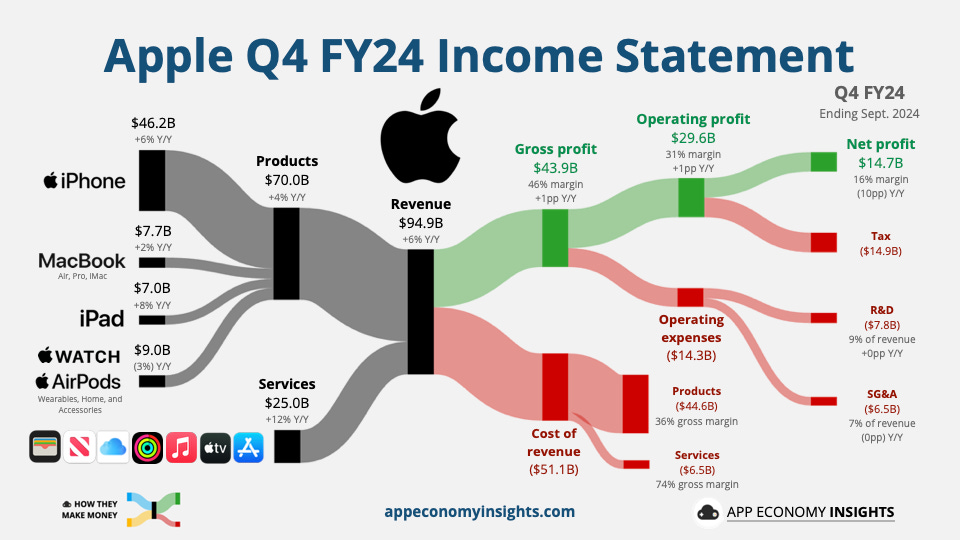

Apple reported a record-breaking September quarter, with revenue rising 6% to $94.9 billion ($0.5 billion beat). iPhone sales rebounded across all markets, growing 6% to $46.2 billion ($1.2 billion beat). However, other products, including iPads and wearables, fell short of expectations. The Services segment continued to gain momentum, now contributing 42% of Apple’s gross profit, up from 39% a year ago.

Despite these positives, concerns linger around sustaining growth, particularly given a slight year-over-year revenue decline in China. Apple provided a soft outlook for the holiday season, with expected low- to mid-single-digit revenue growth. Management remains optimistic about the upgrade cycle, bolstered by new Apple Intelligence AI features. Early signs are positive, with the latest iOS 18.1 getting adopted twice as fast as the year-ago software update.

Sidenote: Apple incurred a one-time charge of approximately $10 billion in unpaid taxes after losing a court case in Europe, contributing to a larger-than-usual tax expense this quarter.

2. ☁️ Amazon: Margins Expand

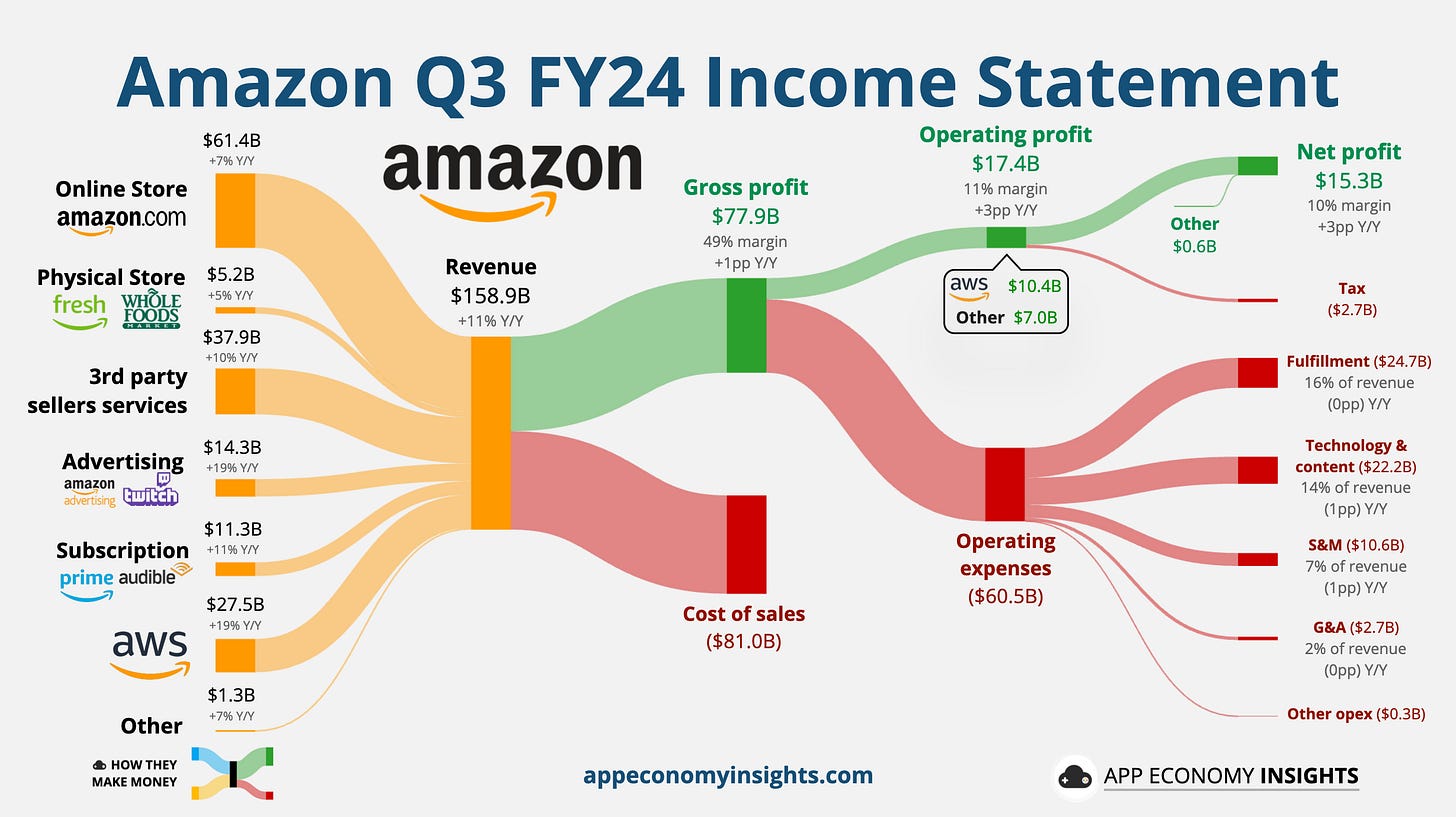

Amazon saw an 11% revenue growth, reaching $158.9 billion ($1.6 billion beat) and a record $17.4 billion operating profit. AWS, the cloud computing division, saw a 19% revenue increase (in line with projections) and exceeded operating income estimates, with an impressive 8-point margin expansion to 38%. The online retail business and advertising sales exceeded expectations, demonstrating robust growth across all segments.

Amazon’s cost-cutting and streamlined logistics have allowed for significant investments in tech infrastructure, especially in AI services. Management shared an upbeat Q4 outlook, projecting $18 billion in operating income (a $0.5 billion beat), which reassured investors amid ongoing AI investment. Next week, we’ll dive deeper into the report, visualizing market share shifts in cloud infrastructure and advertising—stay tuned!