📊 10 Must-See Earnings Visualized

Visa, Spotify, PayPal, SoFi, and more

Welcome to the Premium edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

🗓️ Earnings season is heating up!

With the busiest week on deck, let’s cruise through some early reports. It'll make the coming wave easier to ride.

You’re welcome.

Stay tuned: Apple, Microsoft, Amazon, and Meta are coming later this week.

Today at a glance:

💳 Visa: Resilient Spending

🥤 Coca-Cola: Manageable Tariffs

💉 Pfizer: Cost Cuts Continue

🎧 Spotify: Price Hikes Pay Off

📦 UPS: 20,000 Job Cuts

💡 Cadence: AI-Driven Growth

📱 PayPal: Profitable Momentum

👟 Adidas: Tariff Impact Ahead

🍕 Domino’s: Delivery Push

🏦 SoFi: Fee-Based Flywheel

FROM OUR PARTNERS

Apple's New Smart Display Confirms What This Startup Knew All Along

Apple has entered the smart home race with its new Smart Display, firing a $158B signal that connected homes are the future.

When Apple moves in, it doesn’t just join the market — it transforms it.

One company has been quietly preparing for this moment.

Their smart shade technology already works across every major platform, perfectly positioned to capture the wave of new consumers Apple will bring.

While others scramble to catch up, this startup is already shifting production from China to its new facility in the Philippines — built for speed and ready to meet surging demand as Apple’s marketing machine drives mass adoption.

With 200% year-over-year growth and distribution in over 120 Best Buy locations, this company isn’t just ready for Apple’s push — they’re set to thrive from it.

Shares in this tech company are open at just $1.90.

Apple’s move is accelerating the entire sector. Don’t miss this window.

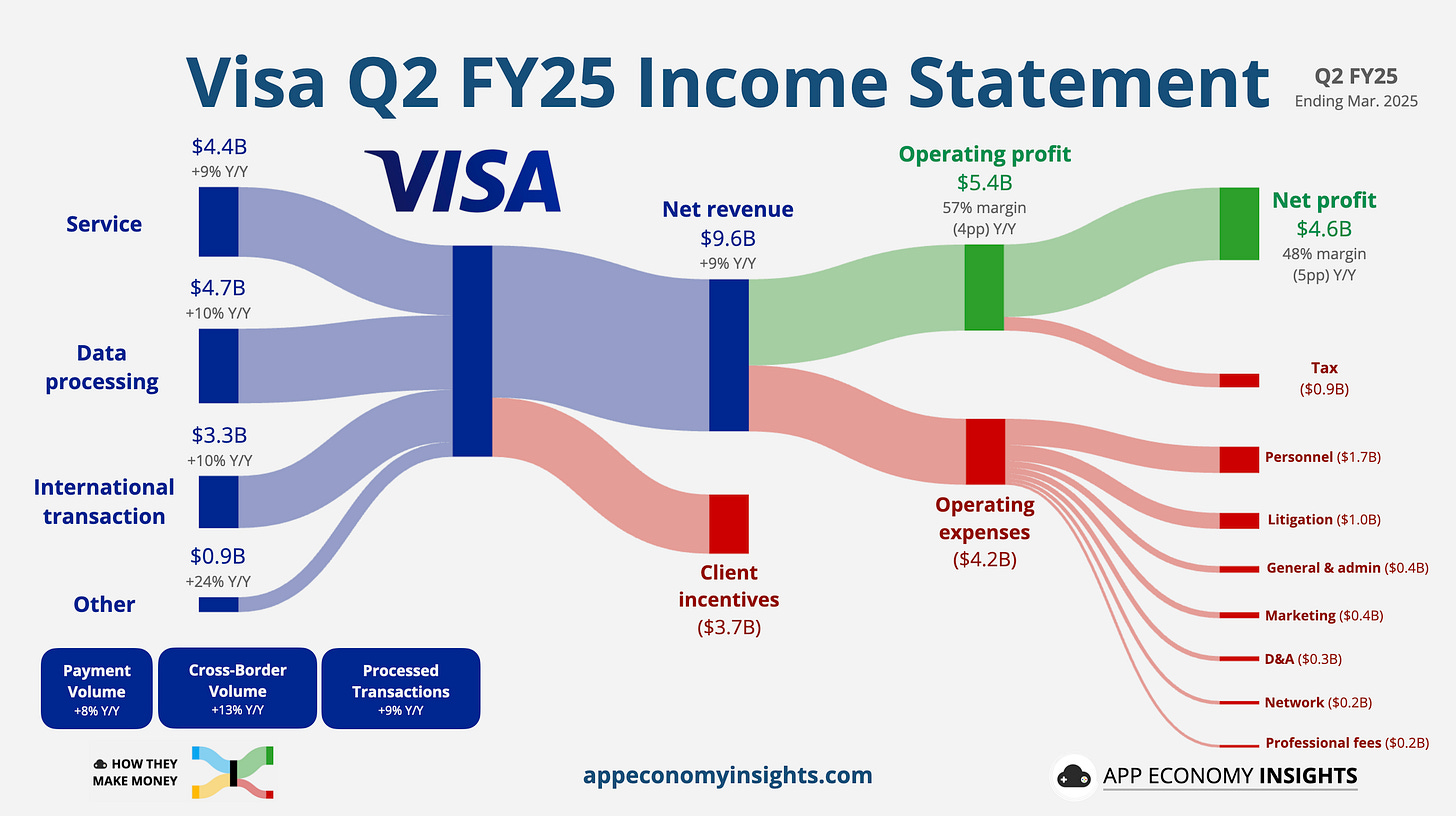

1. 💳 Visa: Resilient Spending

Visa’s Q2 FY25 (March quarter) delivered revenue growth of 9% Y/Y to $9.6 billion ($50 million beat) and non-GAAP EPS of $2.76 ($0.08 beat), driven by resilient consumer spending. Visa’s global network expanded 7% Y/Y to 4.8 billion cards. Cross-border volume rose 13%, processed transactions increased 9%, and total payment volume grew 8% to $3.94 trillion. The company authorized a new $30 billion share repurchase program.

Despite macro uncertainty and a slowdown from Q1 holiday peaks, Visa reaffirmed its FY25 outlook: low double-digit revenue growth and low-teens EPS growth. CEO Ryan McInerney emphasized strength across all segments and noted that US spending rebounded in March and April. Strong international volume trends and a growing services business keep Visa well-positioned for durable growth amid economic noise.

2. 🥤 Coca-Cola: Manageable Tariffs

Coca-Cola’s Q1 revenue declined 2% Y/Y to $11.1 billion (in line) due to currency headwinds and bottler refranchising, but organic revenue grew 6%, with unit case volume up 2%. Adjusted EPS came in at $0.73 ($0.01 beat), helped by strong organic growth in Latin America, EMEA, and Asia Pacific, while Coca-Cola Zero Sugar surged 14%. Pricing remained positive (+5%), though at a slower pace than last year, and comparable operating margin expanded on cost control and refranchising benefits.

Management reiterated 2025 guidance for 5%-6% organic revenue growth and 2%-3% EPS growth, despite warning of 2%-3% currency headwinds and modest structural drags. Tariff risks were flagged but described as "manageable," helped by Coca-Cola’s largely local production model. With steady global momentum and best-in-class market positioning, Coca-Cola continues to outperform consumer staples peers like PepsiCo and Keurig Dr Pepper, even amid shifting consumer dynamics and macro pressures.

3. 💉 Pfizer: Cost Cuts Continue

Pfizer’s Q1 revenue fell 8% Y/Y to $13.7 billion ($370 million miss), while adjusted EPS rose to $0.92 ($0.24 beat), driven by disciplined cost control. COVID-19 products remained a drag, with Paxlovid sales falling 76% Y/Y, below expectations, but Comirnaty surged 62% Y/Y and modestly beat estimates. The company maintained its 2025 guidance of $61–$64 billion in revenue and $2.80–$3.00 in adjusted EPS, though it warned that future tariff impacts are not yet reflected. Management now expects total cost savings of $7.7 billion by 2027, fueled by additional automation, AI, and process streamlining.

With its obesity pill program discontinued due to safety concerns, Pfizer is actively exploring acquisitions to rebuild its cardiometabolic pipeline. The company faces significant long-term pressures from patent expirations, regulatory risks tied to potential drug pricing reforms, and cooling investor sentiment. While cost cuts and pipeline investments aim to stabilize the business, Wall Street remains skeptical about Pfizer’s ability to replace its fading COVID-era windfall with new blockbuster products.