🏦 US Banks: Soft Landing?

Big lenders did better than feared as rate cuts bring new hope

Welcome to the Premium edition of How They Make Money.

Over 150,000 subscribers turn to us for business and investment insights.

Expect an avalanche of visuals in the coming weeks as the reports for the third quarter of 2024 trickle in!

In case you missed it:

US Banks always kick off earnings season, offering a first glimpse at the broader economy’s direction.

After four years of rate hikes, the Fed cut interest rates by half a point last month. Interest rates and economic growth play a massive role in banks' profitability. So before we dive into the numbers, let's recap the possible scenarios:

🛬 Soft landing: The economy slows down just enough to curb inflation, but avoids a recession.

💥 Hard landing: The fight against inflation triggers a recession with job losses and an economic downturn.

🚁 No landing: The economy keeps growing despite efforts to slow it down, and inflation remains high.

The view from the biggest lender: JPMorgan CEO Jamie Dimon maintained a cautious tone, particularly on the uncertainty around the M&A regulatory environment and geopolitics. However, CFO Jeremy Barnum hinted at signs of a Goldilocks economy:

“These earnings are consistent with the soft-landing narrative. […] Overall, we see the spending patterns as being sort of solid and consistent with the narrative that the consumer is on solid footing, and consistent with the strong labor market and the current central case of a kind of ‘no-landing’ scenario economically.”

So far, so good? As always, there were many moving pieces.

Today at a glance:

The Big Picture

JPMorgan: Surprise Outlook

BofA: Global Markets Accelerate

Wells Fargo: Fees Offset NII Pressure

Morgan Stanley: Wealth Unit Rebounds

Goldman Sachs: Pent-up Demand

Charles Schwab: Turning Point

Citigroup: Turnaround in Progress

The Big Picture

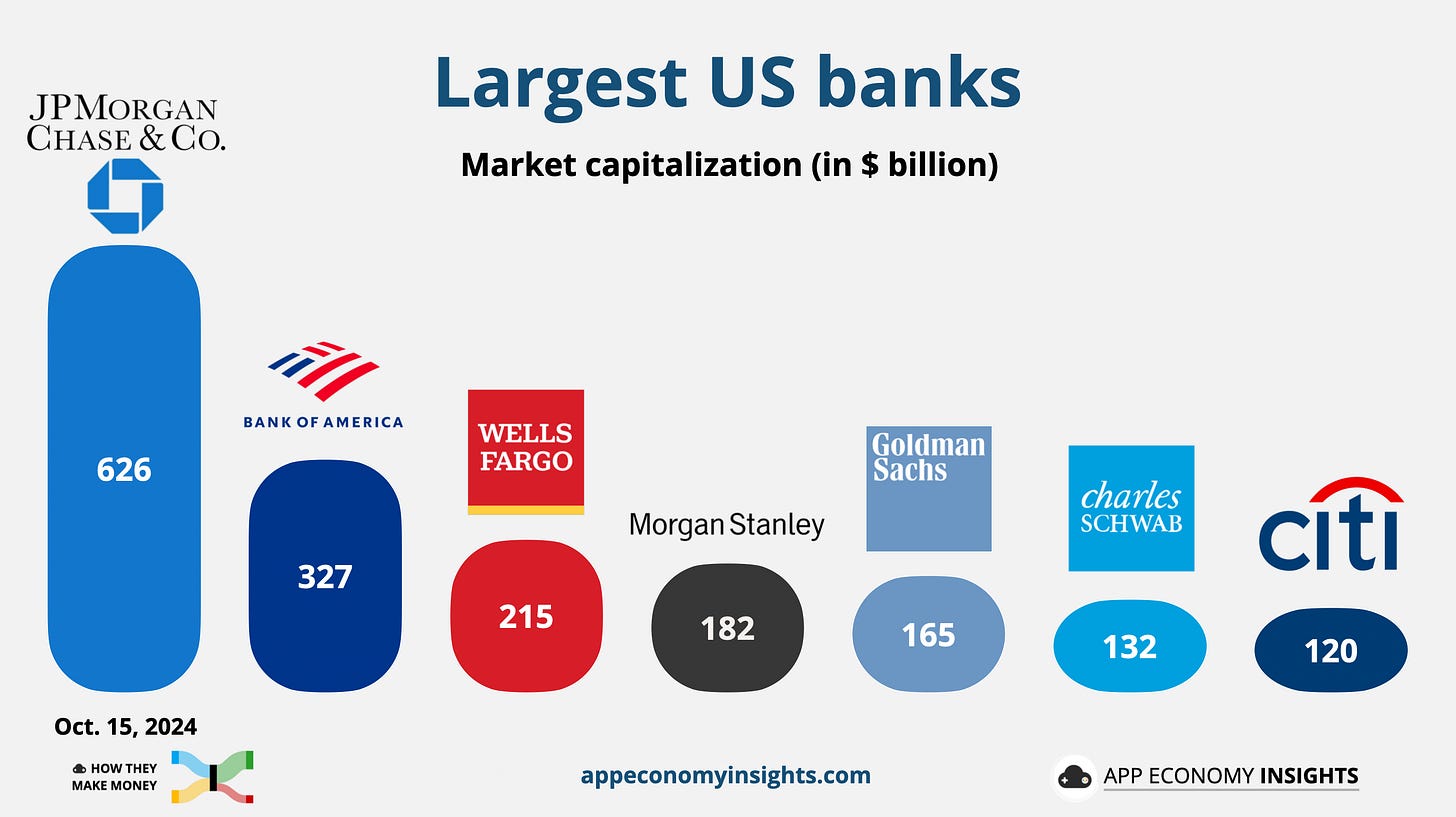

Here’s an updated look at the largest US banks by market cap.

As a reminder, banks make money through two main revenue streams:

💵 Net Interest Income (NII): The difference between interest earned on loans (like mortgages) and interest paid to depositors (like savings accounts). It’s the primary source of income for many banks and depends on interest rates.

👔 Noninterest Income: The revenue from services unrelated to interest. It includes fees (like ATM charges), advisory services, and trading revenue. Banks relying more on noninterest income are less affected by interest rate changes.

Here are the significant developments in Q3 FY24:

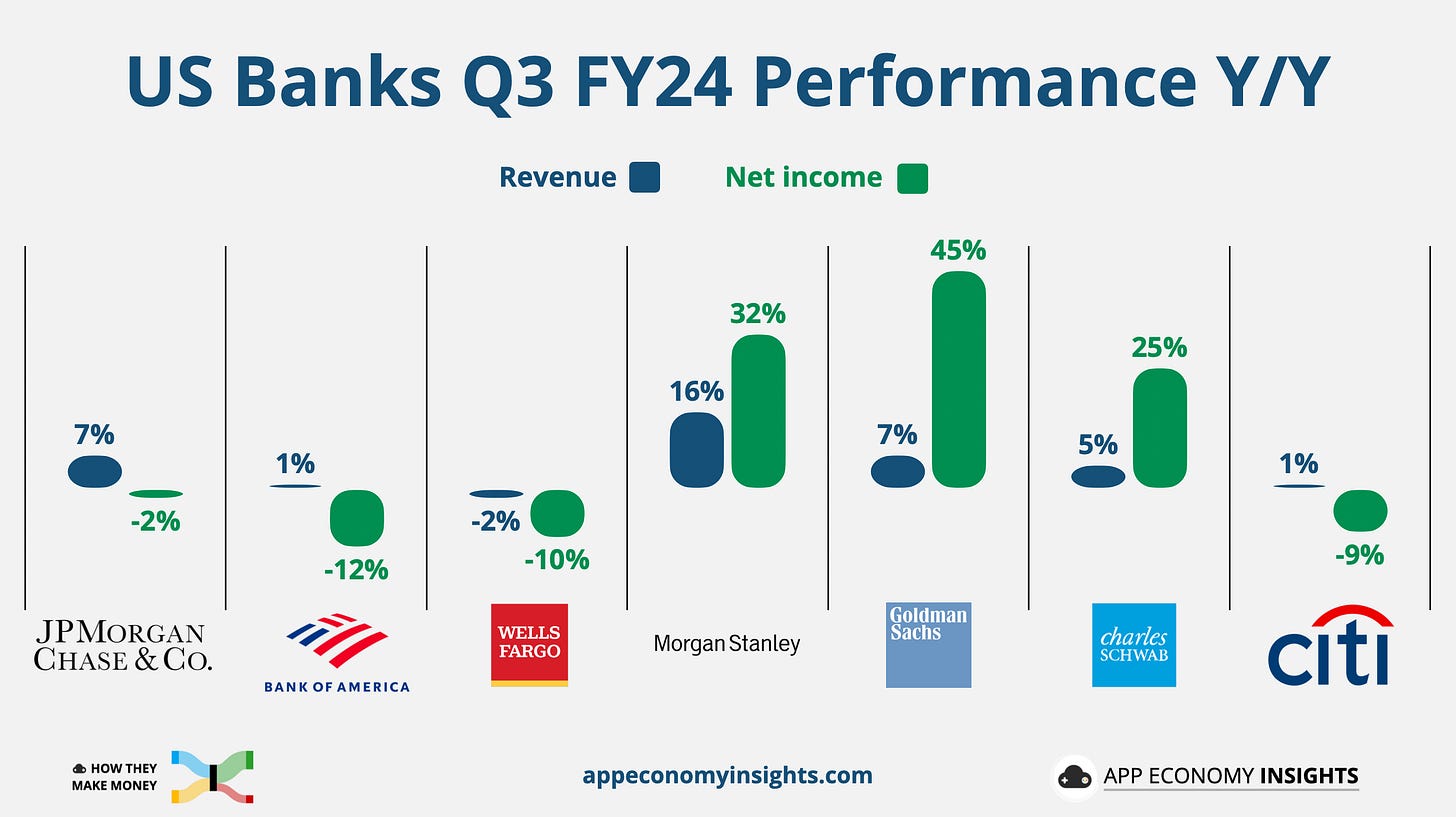

📉 NII pressure: The slowdown in net interest income (NII) continued in Q3—but less than anticipated. JPMorgan even raised its NII projection for 2024.

📈 Fees to the rescue: Banks were able to mitigate the NII slowdown with other revenue sources, showing their diversified revenue streams. Wells Fargo highlighted a 16% growth in fee-based revenue this year.

🏦 Investment banking shines: Investment banking activity rebounded strongly for some banks (albeit from a low base), driven by increased dealmaking and a recovering IPO market. Most analysts expect this trend to continue.

💹 Trading on the rise: BofA, Goldman, and Citigroup saw a surge in equity markets, boosted by strong volatility.

🇺🇸 Economy in good shape: Goldman CEO suggested the rate cut cycle has “renewed optimism for a soft landing.”

⚠️ Credit concerns rise: Credit loss provisions increased again across major banks, particularly against cardholder defaults. Some banks highlighted slowing card spending growth and rising late card payments.

🏢 Office buildings struggle: Landlords have a hard time with many companies adopting hybrid work. While substantial allowances cover the risk, losses could be lumpy and take a while to play out.

⚖️ Regulatory scrutiny persists: Regulatory challenges remained a key concern, notably at Citigroup, where a potential asset cap has been a focal point during the latest earnings call.

Here is the Q3 FY24 performance Y/Y at a glance.

Let’s visualize them one by one and highlight the key points.