🚦 Uber: Profitable at Long Last

But revenue missed expectations in a challenging environment

Greetings from San Francisco! 👋

Join the 46,000+ How They Make Money subscribers receiving insights on business and investing every week.

This Friday, our free edition will feature a full review of Amazon’s Q2 FY23 earnings, as requested by our community. Stay tuned!

Today, we unpack Uber‘s latest earnings for Premium subscribers.

After 14 years, the ride-hailing behemoth turned profitable for the first time. So we take another look at this marketplace giant.

Today at a glance:

Uber Q2 FY23.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

“For most of our history, profitable wasn't the first thing that came up when you asked someone about Uber. In fact, many observers over the years boldly claimed that we would never make any money. And I understood why they felt that way; the easy availability of capital over the past decade obscured the poor unit economics of many businesses. But we knew they were wrong about Uber as did many of our investors who backed us over the years.”

During the Q2 earnings call, Uber CEO Dara Khosrowshahi reflected on Uber's first-ever GAAP operating profit and a record free cash flow crossing $1 billion.

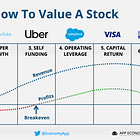

Recently, we discussed the importance of understanding a business's lifecycle when evaluating its worth.

We used Uber to illustrate a company in the self-funding phase.

The company is just breaking even, reinvesting for growth, and fine-tuning its business model. While some investors may perceive a faltering business, others focus on the unit economics and the long-term potential.

Uber offers interconnected apps to go anywhere or get anything.

Their colossal network powers movement from point A to point B. Despite a positive trajectory towards the end of 2019, the global pandemic brought unforeseen challenges.

The platform connects:

🙋♀️ Riders with Drivers 🚗.

😋 Eaters with Couriers 🛵.

→ Riders/Eaters are the end users of the service.

→ Drivers/Couriers earn a living on the platform.

Before we start, let’s discuss how Uber makes money:

Gross Bookings represent the total dollar value spent by end users on Uber apps (excluding tips), which indicates the platform's scale.

Take rate is a percentage % of Gross Bookings Uber keeps for facilitating the connection between end users and Drivers/Couriers.

Revenue is Uber’s take rate multiplied by Gross Bookings.

There are three main revenue segments:

🚗 Mobility: Ridesharing.

~46% of overall gross bookings.

~29% take rate.

🛵 Delivery: Pickup or delivery of food, grocery, and more.

~48% of overall gross bookings.

~20% take rate.

🚚 Freight: Logistics, connecting carriers with shippers.

~6% of overall gross bookings.

100% take rate.

Uber’s revenue is already net of Driver and Merchant earnings, and the take rate can fluctuate based on incentives (for drivers) or discounts (for users).

Costs and expenses include: