🔍 How To Value A Stock: The Ultimate Guide

Price is what you pay, value is what you get

Welcome to How They Make Money.

Join our community to receive weekly insights on business and investing.

In our poll last week, valuations were the most requested topic for our Investing Hub.

You asked. We deliver.

Today at a glance:

What Drives Valuation.

Valuation Tools.

Categorizing The Business.

The Catch with DCF models.

Value is in the Eye of the Investor.

Comparative Analysis.

Premium on Optionality.

Other Factors Influencing Valuation.

Something of Value.

“Price is what you pay, value is what you get.” — Warren Buffett.

A company’s valuation is like a big price tag.

It's what someone would have to pay to buy it today.

Investing starts with a simple idea. You buy something because you think it'll be worth more later. But here's the catch: getting a good deal can greatly affect your returns. Pay too much, and you might not make as much as you hoped.

This is your guide to stock valuation. We'll start with simple steps. We'll walk through the tricky stuff together. By the end, you’ll understand how to value a stock.

Let’s dive in.

1. What Drives Valuation

Think of a company as an apple tree.

The value of the tree isn’t just based on the juicy apples hanging on it today. It's also based on the apples it'll grow later. The same goes for a company. It's not just about the money it's making now. It's also about its future profits. This is its 'intrinsic value.' That's just a fancy way of saying, 'What's it really worth?' based on what we can expect in the future. That's what drives a company's worth in the long run.

Innocence Capital put it perfectly in a tweet, saying we're “buying windshields, not rearview mirrors.” That's a clever way of saying we're more interested in where we're going than where we've been. Investing is all about the future, not the past or the present.

Predicting the future, though, isn't easy. How long will a business last? Will it grow over time? Nobody can say for sure. That's why company valuations are subjective.

Think of two NBA scouts assessing a promising young player; their perspectives might vary due to different focuses, like upside potential or injury risk. The truth only reveals itself as the player's career unfolds - the same goes for investing.

Buyers and sellers set stock prices. They might have different ideas about a company's worth. In the short run, things can get a bit crazy. Prices can shoot up or down, not reflecting a company's worth. But in the long run, the value of a company follows its earnings power.

The 'market cap' is a key metric, short for 'market capitalization,' representing the total value of a company's stocks. Think of it as a company's price tag.

Market Cap = Stock Price x Outstanding Shares

A low stock price doesn't necessarily mean a bargain. You must consider the market cap to understand the company's overall value.

Another important term is 'enterprise value,' which strips out the company's cash and debt from its total value.

Enterprise Value = Market Cap + Total Debt - Cash

Typically, when discussing a company's value, we refer to its market cap. For example, we recently covered on Twitter how tech giants Apple and NVIDIA reached significant milestones, crossing market caps of $3 trillion and $1 trillion, respectively.

2. Valuation Tools

For a thorough understanding of a company's value, various tools serve as your measurement yardstick:

Price-to-Book (P/B) Ratio compares a company's market cap to its book value (assets minus liabilities). Think of it like valuing an apple tree based solely on the trunk and branches while ignoring the present and future apples. Often, a company's market value exceeds its book value due to its earnings potential beyond its assets. To learn more, check out our article about analyzing a balance sheet.

Price-to-Earnings (P/E) Ratio compares a company's stock price to its annual earnings per share (EPS). It tells you how long it would take to get your money back, assuming the earnings stay the same. But remember, businesses change, and markets swing. Earnings are rarely ever constant. To learn more, check out our article about analyzing an income statement.

Price-to-Earnings Growth (PEG) Ratio refines the P/E ratio by factoring in expected growth rates. Forecasting growth, however, is challenging.

PEG Ratio = P/E Ratio ÷ Growth Rate

Discounted Cash Flow (DCF) Analysis tries to value a company based on future cash flows. It's like assessing a rental property for future rental income. But again, predicting the future is tough and relies on many assumptions.

Reverse Discounted Cash Flow (Reverse DCF) is DCF in reverse. It's like figuring out how much rent the market expects you to collect based on the current property price. It gives you a sense of market expectations and if they seem fair.

Each method has pros and cons, and none gives the complete picture. Think of them like different tools in a toolbox. A hammer might be great for some jobs, but you might need a screwdriver or a pair of pliers for others.

Understanding these valuation methods is a crucial step in making informed investment decisions. But let’s review why they can be misleading, if not entirely useless.

3. Categorizing The Business

Think of a business like a living thing. It's born, grows, matures, and eventually slows down and dies. Understanding where a business is in its lifecycle is critical when evaluating what a company is worth.

The PE ratio provides useful insights only when a business has been optimized for profitability and shows steady, predictable growth.

Brian Feroldi has done an amazing job breaking down each stage of a business's life cycle and how it is associated with the usefulness of the PE ratio. So I borrow from his chart to illustrate where some well-known companies currently sit.

Startup: If the company is still unprofitable, there are no earnings and, therefore, no denominator. PE and PEG are useless. The value often depends on an exit strategy (acquisition or IPO). Example: OpenAI.

Hyper-growth: When a company reinvests aggressively in the business and focuses on growth, earnings are suppressed by design. The value depends on the long-term earnings power and the durability of the growth. Example: Snowflake.

Self-funding: The company is just breaking even. Any valuation based on earnings remains useless. Management is usually still reinvesting in future growth and fine-tuning its business model. Some investors may see a broken business. Others will focus on the unit economics and long-term potential. Example: Uber.

Operating leverage: The company is expanding its margins through scalability and efficiency. In this stage, revenue grows faster than operating expenses. PE and PEG usually remain misleading if there is room for improvement. It can lead to missing great investment opportunities that look ‘overvalued’ based on trailing metrics. Example: Salesforce.

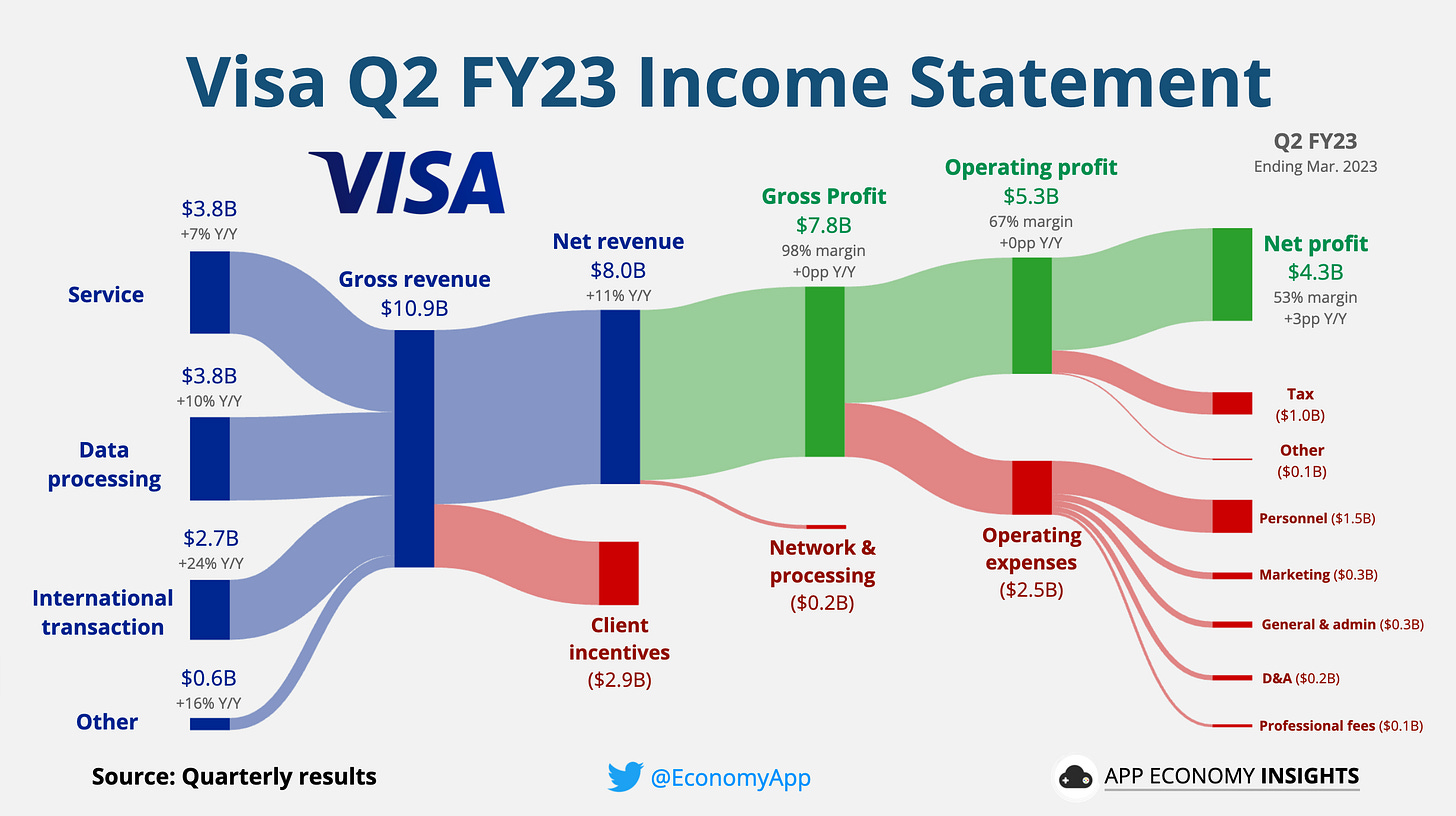

Maturity: These are the stalwarts. They have a steady, predictable business with normalized, predictable growth. The PE ratio is useful. Example: Visa.

Decline: When revenue and earnings decline, the PE ratio becomes artificially attractive. Why? Because if earnings (the denominator) continue to drop, the PE ratio will rise. Trailing metrics are misleading. All bets are off once a business turns unprofitable with no clear path for a turnaround. Most valuation metrics based on trailing earnings become useless. Example: Bed Bath & Beyond.

Companies may catch a second wind and see their growth reaccelerate through new ventures and M&A. But it’s crucial to remember that turnarounds seldom turn. We discussed this topic in our recent review of Peter Lynch’s 6 Stock Types Crucial For your Portfolio.

Evaluating a company’s valuation starts with understanding the type of business you are looking at and, more importantly, where it is in its lifecycle: context, always context.

4. The Catch with DCF Models

The DCF model is a favorite for estimating the intrinsic value of a business.

It's like trying to guess how much rent money a house will bring in the future. Sounds useful, right? But it's not perfect. It has some big catches.

The future is a tricky thing to predict. Will the neighborhood be as popular in 10 years? Will the house need costly repairs? DCF models face the same problem. They're based on predictions about a company's future profits. One wrong guess and the whole model can be off.

DCF models love to play with numbers. They use things like 'discount rates' to adjust future profits to today's value. But here's the catch: even tiny changes in these rates can make a big difference in the final value. It's like trying to hit a moving target.

DCF models don't like change. They assume a company will keep on making money at a certain rate. But what if a new competitor steps in? Or a game-changing technology pops up? The DCF model might not catch these shifts.

DCF models use a ‘terminal value.’ It's a way to guess the value of all the future profits a company will make beyond a certain point. Imagine it as a lump sum of all the rent money your property will bring in after 10, 20, or 30 years. But can we guess what a company will do in 10 or 20 years? If analysts cannot forecast accurately the next quarter, why would they be qualified to predict the next decade?

DCF models can help define what needs to go right for your investment to bear fruit. But remember, they aren't foolproof. Relying on them too much runs the risk of becoming a ‘spreadsheet investor’ and missing the forest for the trees.

5. Value is in the Eye of the Investor

A common saying is, “Beauty is in the eye of the beholder.”

Beauty can’t be judged objectively because what one person finds beautiful may not appeal to another.

Value, like beauty, is subjective. Investors' valuation perspectives depend on their goals, timelines, and personal circumstances. Let's explore these mindsets, shedding light on your investment philosophy and market dynamics.

Value Investors: Emulating Warren Buffett, these investors use fundamental analysis to find companies with steady cash flows and established reputations. They estimate the intrinsic value of a business and accumulate shares when they are undervalued for long-term appreciation.

Growth Investors: Represented by Cathie Wood of Ark Invest, these forward-looking investors focus on companies with significant growth potential. They focus on where the business might be several years in the future. They tend to focus on visionary management and disruptive innovators.

Event-Driven Investors: Like activist investor Carl Icahn, they base investment decisions on specific events or catalysts that could trigger significant asset value changes. They use event arbitrage and options strategies to gauge an event's potential impact on asset valuation.

Momentum Traders: Like the late William O’Neil, founder of Investor’s Business Daily, these investors rely on market trends and behavior. They use technical analysis to profit from short-term price movements.

Venture Capitalists: These investors focus on early-stage, high-growth tech companies. They base assessments on disruptive potential, market size, and management quality. Valuation methods include risk-adjusted net present value (rNPV) or the market approach. Their performance follows the power law (80/20), with only a few of their investments driving most of the returns.

Contrarian Investors: Epitomized by Michael Burry from "The Big Short," these investors seek undervalued or overlooked assets. They use techniques like asset-based valuation to find potential upsides.

Remember, these styles are not mutually exclusive. Many successful investors combine these approaches, tailoring them to their investment objectives, risk tolerance, and prevailing market conditions. It’s crucial to recognize where your own approach lies and adapt your strategies to align with your investment philosophy.

6. Comparative Analysis

Understanding a potential investment requires context. To achieve this, compare the company to its industry peers and other benchmarks using these steps:

Identify Comparable Companies: Select companies in the same sector with similar business models and market capitalization, like comparing Nike to Adidas and Under Armour. Our Industry Showdown reports offer a deep dive into this. We go through this exercise in our Industry Showdown reports, like the recent one on Cybersecurity.

Examine Key Metrics: Look at customer metrics, growth rates, and margins. Superior fundamentals could justify a higher valuation.

Investigate Past Performers: Review companies with similar past fundamentals. If examining a fast-growing tech startup, consider previous firms at a similar growth stage.

Benchmark Against The Market: Consider broader market and economic conditions. For example, most stocks are cheaper in a bear market, so our expectations change.

Account for Sector Trends: Identify industry trends, such as the e-commerce shift impacting brick-and-mortar retailers.

Assess the Valuation Spectrum: Recognize that a company's valuation shifts as it matures. It often "grows into its valuation" (as earnings appreciate over time) but occasionally offers more attractive entry points despite consistent potential. These are the opportunities to seize.

A comparative analysis doesn't dictate your investing journey but provides a roadmap to navigate the investment landscape.

7. Premium on Optionality

Nassim Taleb explains in his book Antifragile:

'“Optionality is the property of asymmetric upside (preferably unlimited) with correspondingly limited downside (preferably tiny).”

Investing is a game best played when the upside potential significantly outweighs the downside. The downside risk is to lose 100% of the capital invested, but the upside? It can be exponentially more than 100%.

Other bets: Companies with multiple 'shots on goal' or various paths for future growth often command a higher valuation. This is akin to betting on a soccer team stacked with excellent strikers — the probability of scoring a goal increases. Think Amazon, whose online bookstore has become an eCommerce, cloud computing, and media conglomerate.

History of Innovation: Companies with a strong track record of innovation can also attract a premium. They're like the chefs who constantly invent new dishes and push culinary boundaries.

Optionality as a Moat: Optionality can also serve as a protective moat. Companies that can pivot or tap into new markets have a safety net if their business faces challenges. Google’s diversification away from search through YouTube, Android, hardware, Google Cloud, and other technology bets provides a margin of safety.

The Uncertainty Factor: While optionality can be a boon, it also introduces an element of uncertainty. Not every 'shot on goal' results in a score. Investors must weigh this risk when factoring in optionality. For example, Meta has lost a staggering $30 billion on its investment in Reality Labs (RL), with a $4 billion loss for this segment in the latest quarter alone.

Optionality is a fascinating yet elusive aspect of valuation. It's challenging to pinpoint accurately and subject to debate, but often, it’s this very characteristic that grants the best businesses a higher valuation than their peers.

8. Other Factors Influencing Valuation

Investing in a business is a bit like picking a car to buy. You have to consider the car's make and model, fuel efficiency, overall driving experience, and even color. However, many elements can affect a stock's value beyond the business.

Management Quality: Like a skilled driver, an efficient, visionary management team can navigate a company through adversity, make strategic decisions, and enhance shareholder value. Their leadership style, track record, and reputation can significantly influence investor sentiment and stock value.

Economic Environment: Like road conditions, economic variables, such as interest rates, inflation, and GDP growth, can significantly sway a stock's value.

Investor Sentiment: Comparable to unpredictable weather conditions on the road, investor sentiment - bullish or bearish - can impact a stock's value.

Market Trends: Like traffic signals and road signs, trends such as changes in consumer behavior, technological progress, or regulatory shifts can shape a stock's value.

In short, don’t look at a valuation in a vacuum.

9. Something of Value

In his 2021 memo, “Something of Value,” Howard Marks presented a compelling perspective. He explored the intricacies of identifying a company's intrinsic value and the overlap between value and growth investing.

Marks emphasized that:

Low valuations are often indicative of underlying reasons,

Successful investing requires superior judgment on:

qualitative, non-quantifiable factors,

the trajectory of future developments.

Marks also underscored the trap of mean reversion — the notion that what goes up must come down, and vice versa. This concept can drive investors to sell prematurely, securing small gains and hunting for the next underpriced stock. This relentless quest for low valuations can result in a portfolio filled with average businesses that could see a 30% uplift when market sentiment changes.

Meanwhile, transformative returns (in the thousands of percent) are usually found in long-term holds. The longer the hold, the less the exact entry-point valuation matters. What's more crucial is the choice of investment and the holding period.

In investing, just as in life, you often get what you pay for.

In Marks’ words: “Value is where you find it.”

That's all for today!

Stay healthy and invest on!

Sponsor Us

We're offering new sponsorship opportunities for B2B and B2C brands to get in front of our audience of investors and business leaders. Click here to learn more.

Get Your Business a Custom Chart

Interested in custom charts for your organization or brand? Complete the form here, and we'll get in touch.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Disclosure: I am long AAPL, AMZN, CRM, GOOG, META, NVDA, UBER, SNOW, and V in the App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members here.

I think you will enjoy the optionality in this business, Doximity $DOCS. Also, there is a good comparative analysis one can make with M3 Inc.

https://heraldofthehudson.substack.com/p/long-doximity-inc-docs

I love comparative analysis. I wish I had gotten into that boat a little earlier, but I'm happy I'm here now.