📊 PRO: This Week in Visuals

COST CRM PDD SNPS DELL MRVL ZS VEEV OKTA BBY ESTC PATH S AI

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🛒 Costco: Premium Still Intact

☁️ Salesforce: Data Power Play

📦 PDD: Temu, Tariffs, and Turmoil

💻 Dell: Riding the AI Wave

🧠 Synopsys: AI Demand vs China Risk

📶 Marvell: Custom AI Tailwinds

☁️ Zscaler: AI and MDR Momentum

🧑⚕️ Veeva: Beating Goals Early

🔐 Okta: Cautious Tone Spooks

🛒 Best Buy: Tariffs Trim Outlook

🔍 Elastic: Soft FY26 Guidance

🤖 UiPath: Slow AI Monetization

👁️ SentinelOne: Guidance Reset

🧠 C3 AI: Federal Tailwinds

FROM OUR PARTNERS

Navigating retirement, investments, or tax planning? Don’t go it alone.

Money Pickle connects you with a vetted fiduciary financial advisor for a free 45-minute video call — no pressure, no obligation. Whether you're managing a $250K+ portfolio, nearing retirement, or just want a second opinion, this is a simple first step toward clarity.

You’ll be matched based on your goals, risk tolerance, and financial priorities — all in under 2 minutes.

Appointments are limited.

1. 🛒 Costco: Premium Still Intact

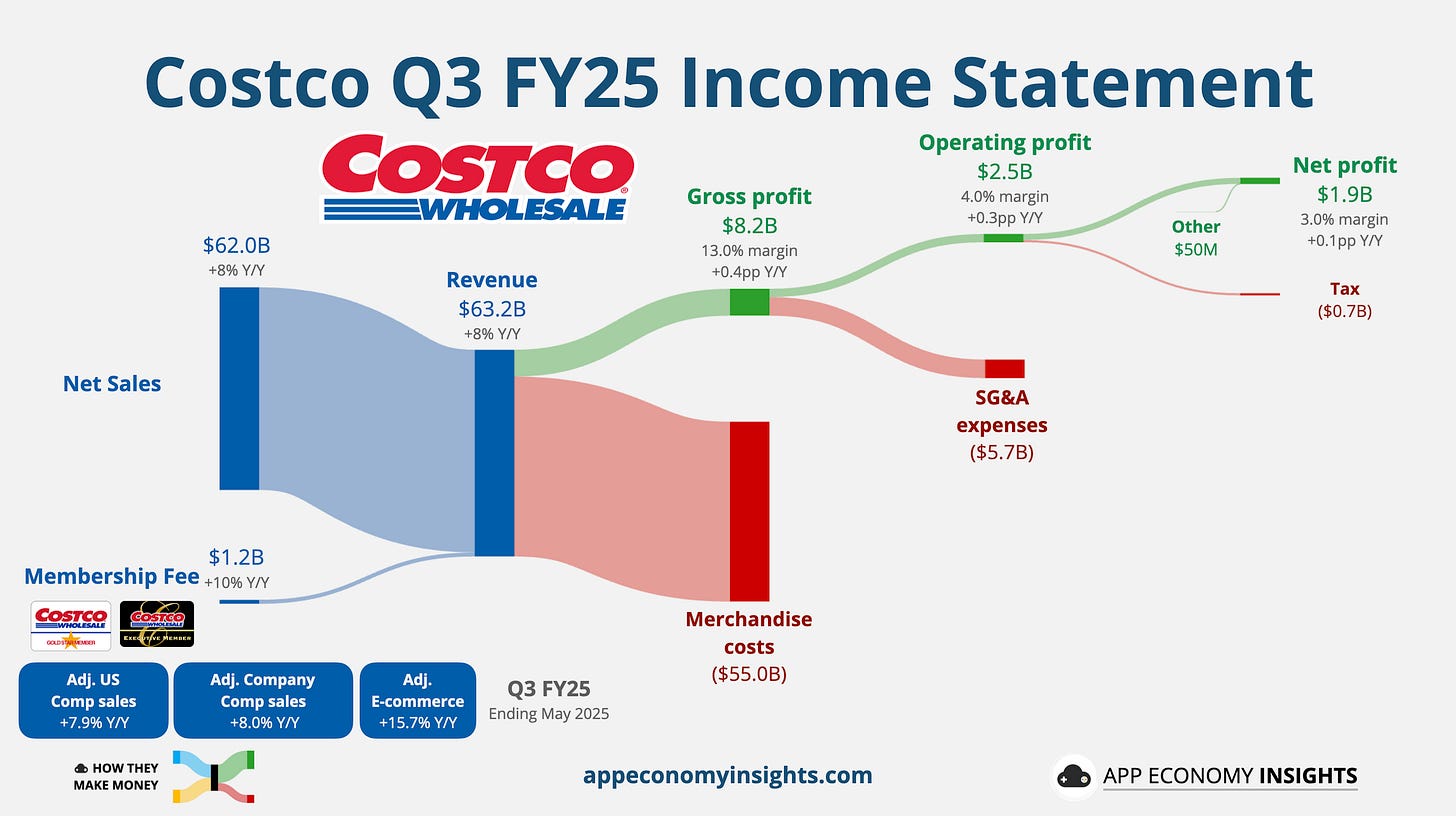

Costco’s Q3 FY25 (May quarter) revenue grew 8% Y/Y to $63.2 billion ($0.1 billion beat), with EPS of $4.28 ($0.05 beat). Adjusted same-store sales rose 8.0% overall and 7.9% in the US, while e-commerce jumped 15.7%. Membership fee income surged 10% to $1.2 billion, reflecting Costco’s loyal customer base. The warehouse giant continues to outpace rivals like Walmart and Target, gaining share in both physical retail and digital. With 905 warehouses globally (8 added in the quarter) and expanded hours for discounted fuel, the company is leaning into convenience and value.

Tariffs added a new wrinkle, but Costco is navigating the storm. Management preemptively shifted supply chains, sourcing more goods locally or rerouting from high-tariff countries. Despite cost pressures, Costco lowered prices on staples like eggs and butter, absorbing margin impact to protect member value. That playbook is why the stock commands a premium—currently 56x forward earnings. For now, Costco continues to prove it deserves the benefit of the doubt.

2. ☁️ Salesforce: Data Power Play

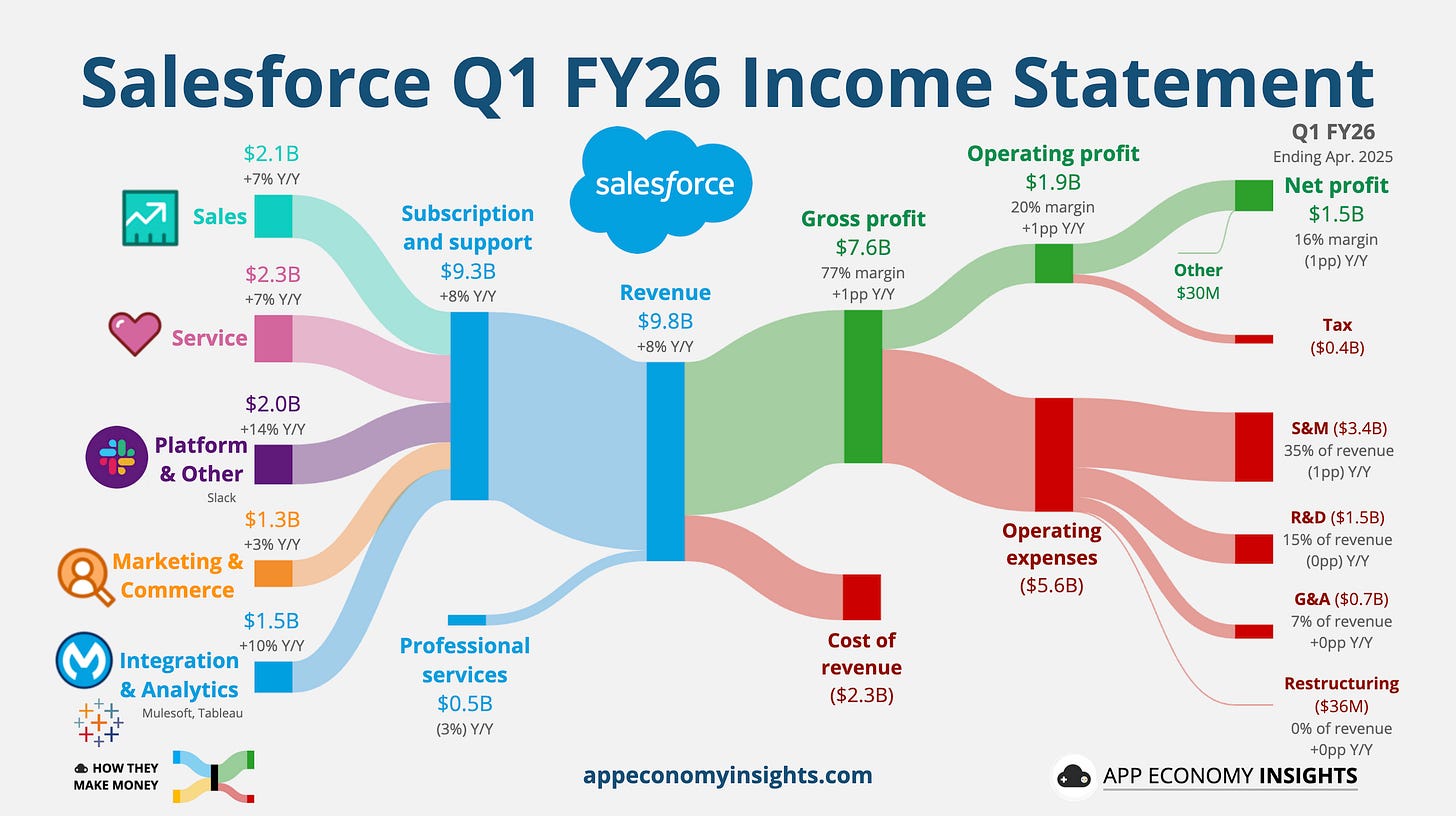

Salesforce beat expectations in Q1 FY26 (April quarter), with revenue up 8% Y/Y to $9.8 billion ($80 million beat) and adjusted EPS of $2.58 ($0.03 beat). Annual recurring revenue for its AI and Data Cloud offerings topped $1 billion, up 120% Y/Y, with over 8,000 Agentforce deals signed since launch. Management raised full-year revenue guidance by $0.4 billion to $41.3 billion on the high end, and Q2 guidance also came in above consensus, signaling building momentum in AI-led productivity.

To strengthen its position, Salesforce announced an $8 billion acquisition of Informatica, a leader in data integration and master data management. While the deal won’t impact FY26 results, it’s a clear signal Salesforce is serious about powering its “digital labor force” with cleaner, AI-ready data. Informatica complements MuleSoft and boosts Salesforce’s enterprise data stack, helping customers consolidate messy data pipelines—a key bottleneck for AI adoption. Investors appear cautiously optimistic, with shares rebounding.

3. 📦 PDD: Temu, Tariffs, and Turmoil

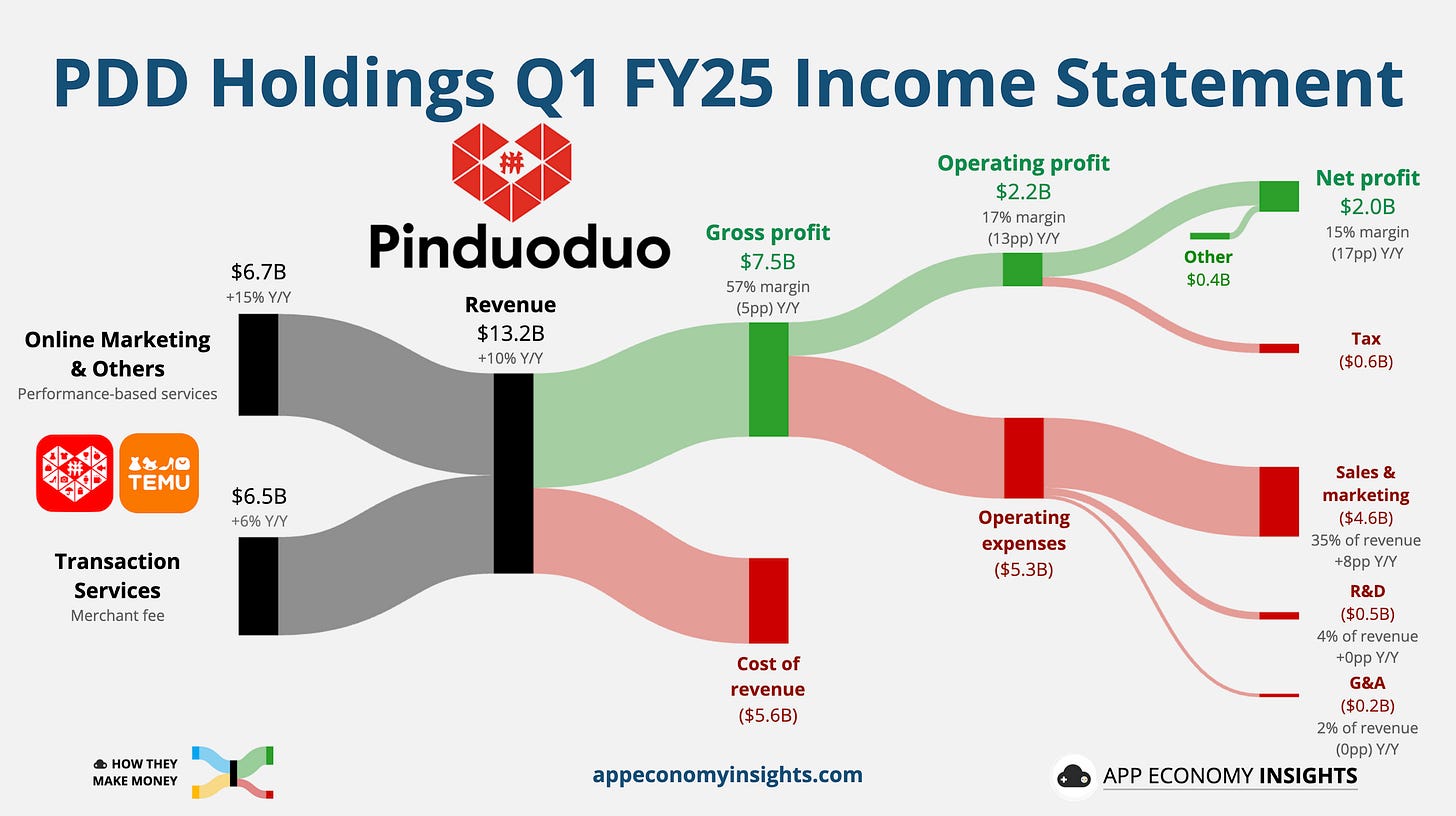

PDD’s Q1 revenue grew just 10% Y/Y to $13.18 billion ($1.2 billion miss), its slowest pace in three years. Net income plunged 47% to $2.0 billion, well below expectations, as Temu’s expansion was derailed by new US tariffs and the end of the de minimis exemption. The US scrapped its duty exemption for low-value packages and raised tariffs on Chinese imports in April, prompting Temu to increase prices and slash US ad spending. Online marketing revenue increased by 15%, while transaction services rose by only 6%.

Domestically, Pinduoduo is also losing momentum as subsidies favor rivals like JD.com and Alibaba. While PDD is pivoting to local fulfillment to mitigate the impact, the damage is already evident in slowing growth and declining margins. Management pledged $13 billion in ecosystem support over the next three years but warned of “prolonged pressure” on profitability. While PDD still boasts over $50 billion in cash, its growth story faces structural headwinds from geopolitical friction and fierce local competition.