📊 PRO: This Week in Visuals

WMT AIRBUS ADI BKNG CDN MCO DASH LYV GPN GRAB LENOVO FIG KLAR ETSY GLBE

Welcome to the Saturday PRO edition of How They Make Money.

Over 290,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium members get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO members get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🛒 Walmart: E-Commerce Leads the Way

🛩️ Airbus: Engine Dispute Dents Outlook

⚙️ Analog Devices: Industrial Power Ahead

🏝️ Booking: Stacking Savings

💡 Cadence: AI Amplifies the Backlog

💼 Moody’s: AI Resilience

🥡 DoorDash: Local Commerce OS

🎤 Live Nation: A $25 Billion Encore

🌎 Global Payments: Pure-Play Pivot

🛵 Grab: Critical Proof Point

💻 Lenovo: AI Boom Meets Memory Crunch

🎨 Figma: AI Fears Fade For Now

💳 Klarna: Banking Pivot

📦 Etsy: Pure-Play Pivot

🛍️ Global-e: Scaling Through Intelligence

1. 🛒 Walmart: E-Commerce Leads the Way

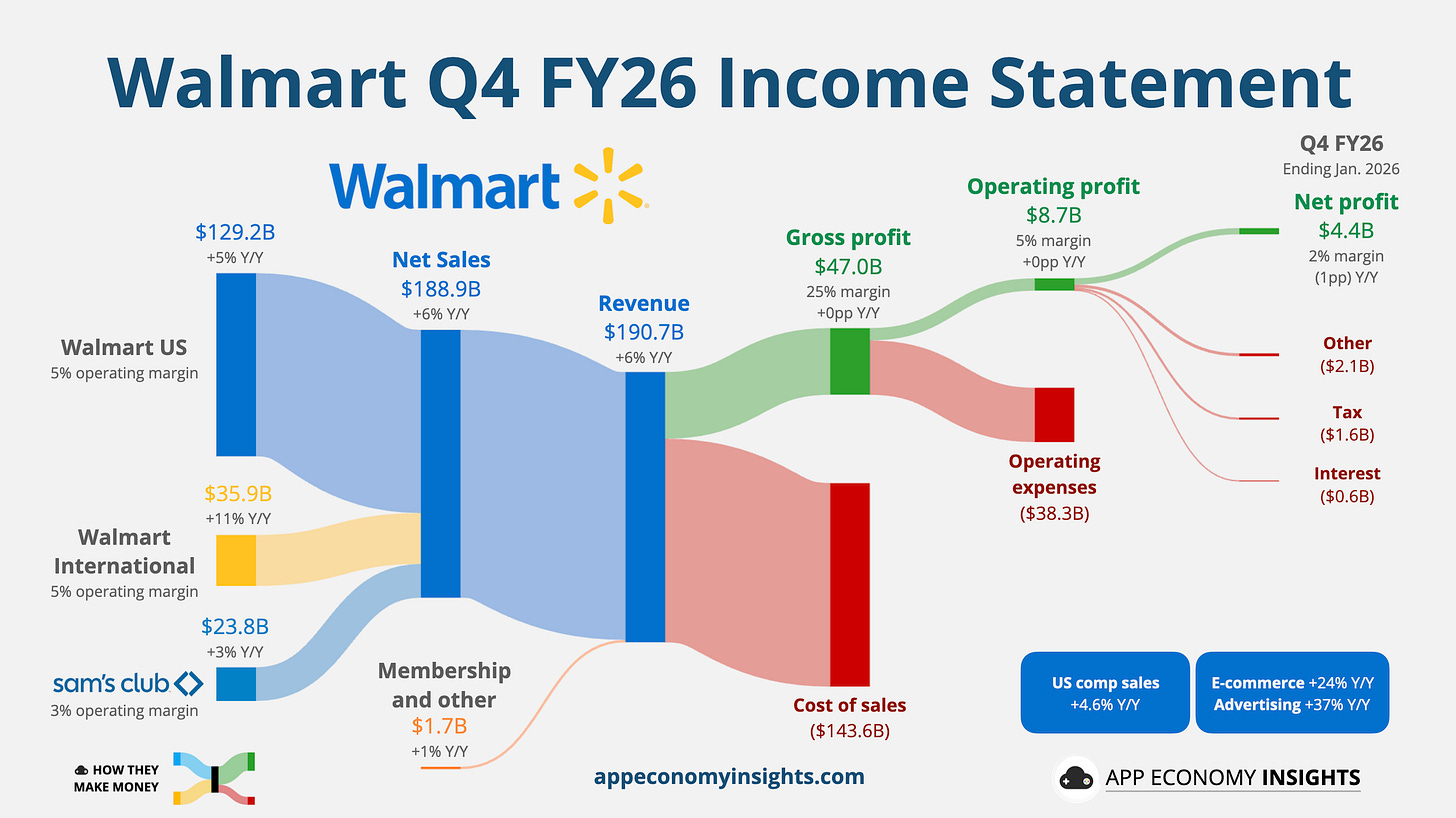

Walmart just reported its January quarter (Q4 FY26), and revenue grew 6% Y/Y to $190.7 billion ($2.4 billion beat). Adjusted EPS narrowly topped expectations, marking a resilient holiday season despite a compressed shopping window.

Walmart US comps rose 4.6%, matching consensus, driven by a 2.6% increase in transactions. International sales were a standout, climbing 11.5% to $35.9 billion, led by strength in China, Mexico (Walmex), and India (Flipkart).

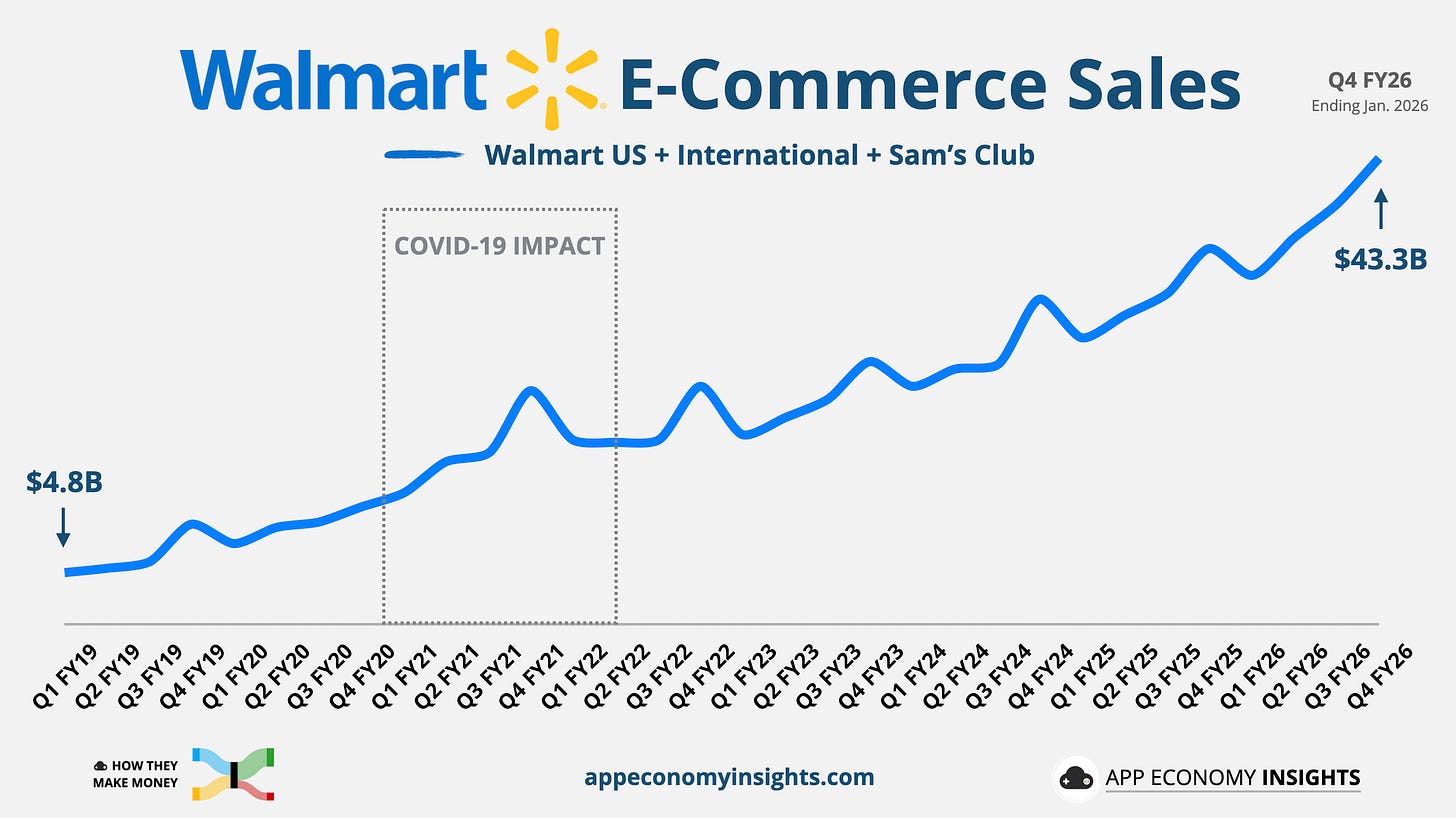

The steady shift toward digital continued:

E-commerce momentum: Global e-commerce sales grew 24%, now representing 23% of total revenue. In the US, online sales jumped 27%, fueled by store-fulfilled delivery and a growing marketplace.

Profit diversification: High-margin streams (advertising and membership) now account for nearly one-third of total operating income. Global advertising grew 37% (bolstered by VIZIO), while membership revenue surged over 15%.

AI integration: The AI shopping assistant, Sparky, is showing early success. Customers using the tool have an average order value 35% higher than those who do not.

The Walmart US boss, John Furner, officially took over as CEO on February 1, 2026. Furner inherits a company with a healthy balance sheet, nearly $15 billion in free cash flow in FY26, and a massive new $30 billion share buyback authorization.

Inventory management remains a major win, with levels growing at just half the rate of sales growth, thanks to automation in 60% of US stores and 50% of fulfillment centers. This efficiency helped adjusted operating income grow 10.5%, significantly outpacing sales growth.

Despite the beat, shares saw some volatility due to a cautious FY27 outlook that missed analyst targets:

Sales growth: 3.5%–4.5% (vs. 5% consensus).

Adjusted EPS: $2.75–$2.85 (vs. $2.97 consensus).

Management cited an unpredictable macro environment, noting a widening spending gap between high-income households (earning over $100k) and stretched low-income consumers. While Walmart continues to gain share across all cohorts, it is bracing for potential headwinds from tariff-related cost pressures and normalized pricing.

2. Airbus: Engine Dispute Dents Outlook

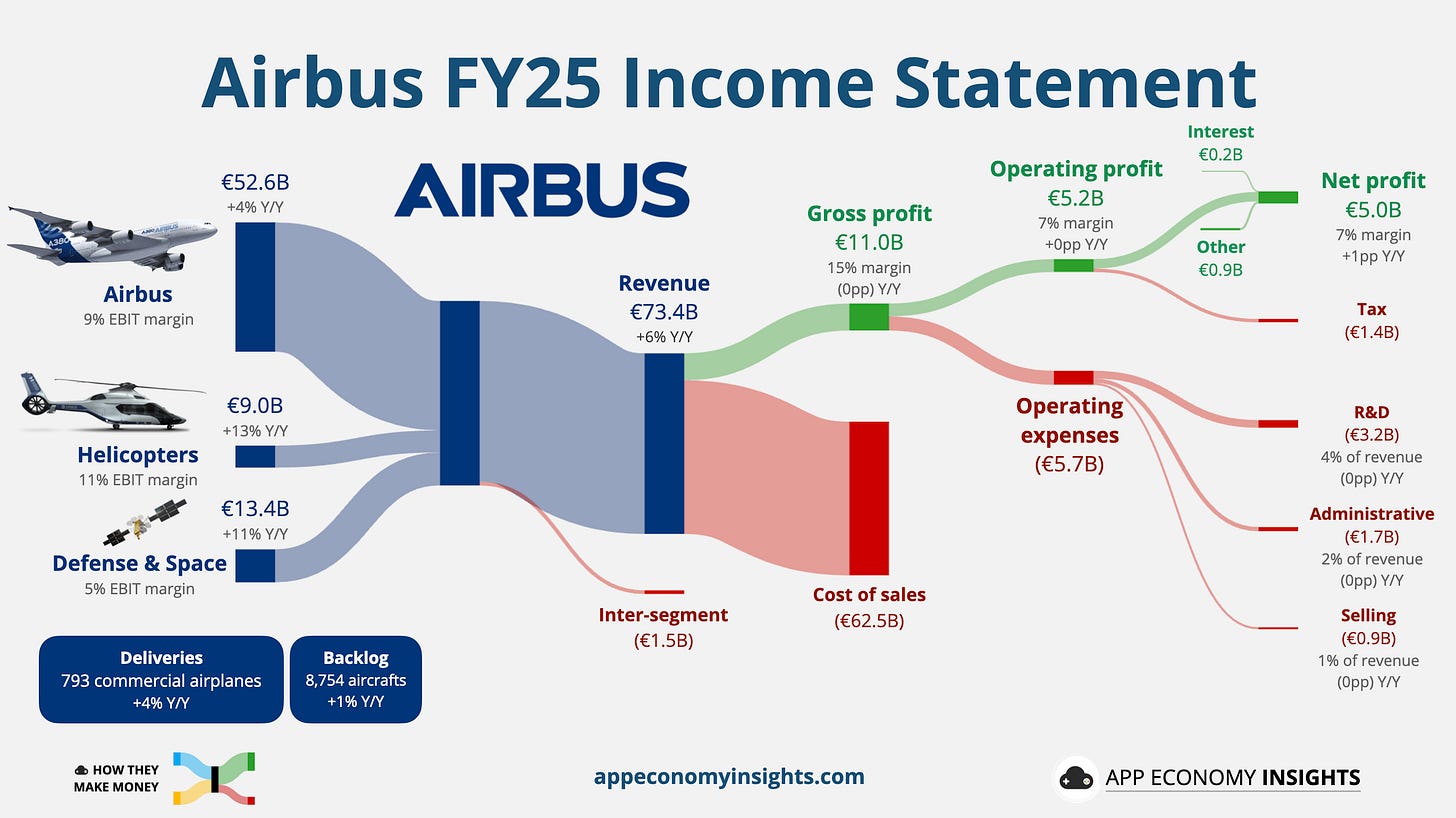

Airbus closed FY25 with a mixed quarter, beating on the bottom line but missing on revenue and delivering a disappointing outlook.

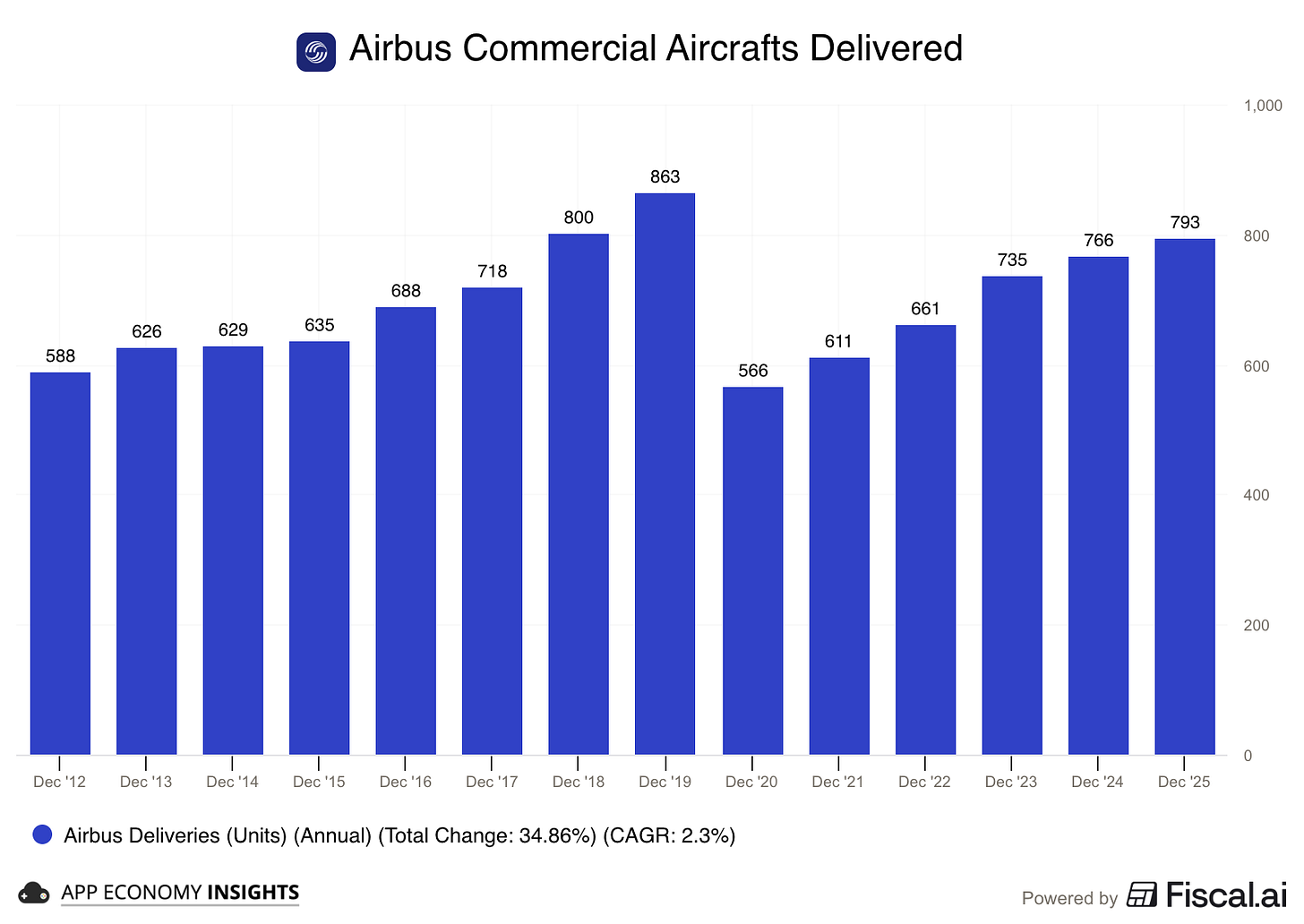

Q4 revenue rose 5% Y/Y to €26.0 billion (€0.8 billion miss), while GAAP EPS was €3.27 (€0.50 beat). For the full year, the company saw revenue rise 6% Y/Y to €73.4 billion and posted a record Adjusted EBIT of €7.1 billion. Airbus delivered 793 commercial aircraft in FY25, backed by a backlog of 8,754 jets.

However, shares tumbled following an unusually public and combative rebuke of engine supplier Pratt & Whitney (an RTX subsidiary). CEO Guillaume Faury explicitly accused Pratt of failing to meet its contractual commitments for engine deliveries, prioritizing the maintenance of existing airline fleets over supplying new jets. Airbus announced it has formally triggered a dispute clause in its contract to seek compensation for lost business.

As a direct result of the engine shortage, Airbus significantly slashed its 2026 production guidance. The company now expects to deliver roughly 870 commercial aircraft in 2026 (well below the Wall Street consensus of 900+ jets) and generate an Adjusted EBIT of around €7.5 billion (missing the €8.2 billion expectation). The long-held goal of producing 75 A320s per month has been delayed yet again, now targeted for the end of 2027.