📊 PRO: This Week in Visuals

WMT, TCEHY, BABA, AMAT, CSCO, NU, SE, JD, ADYEY, DDOG, ONON, MNDY, Z, NYT, GLBE, STNE, DLO, SEMR

Welcome to the Saturday PRO edition of How They Make Money.

Over 140,000 subscribers turn to us for business and investment insights.

In case you missed it:

Our PRO coverage includes timely updates on the big earnings of the past week.

📧 Free subscribers get our Friday articles and sneak peeks.

💌 Premium subscribers get:

Tuesday articles.

Access to our archive.

Monthly reports with 200+ companies covered.

💼 PRO members get all of the above, plus our Saturday timely coverage.

Today at a glance:

🛒 Walmart: Value Over Margins

🎮 Tencent: Gaming Rebound

📦 Alibaba: Intensifying Competiton

⚙️ Applied Materials: AI-fueled Demand

🌐 Cisco: Workforce Reduction

🏦 Nu Holdings: Profit Surge

🌊 Sea Limited: Shopee Trending Up

🚚 JD.com: Improving Margins

🇳🇱 Ayden: Volume Rebound

🐶 Datadog: Multi-product Adoption

👟 On: Accelerating Growth

📊 Monday.com: Raised Outlook

🏠 Zillow: New CEO

🗞️ The NYT: Digital Drives Growth

🛍️ Global-E: Large Customer Loss

💳 StoneCo: Efficiency Gains

🌎 dLocal: Margin Challenges

☄️ Semrush: Profitable Growth

1. 🛒 Walmart: Value Over Margins

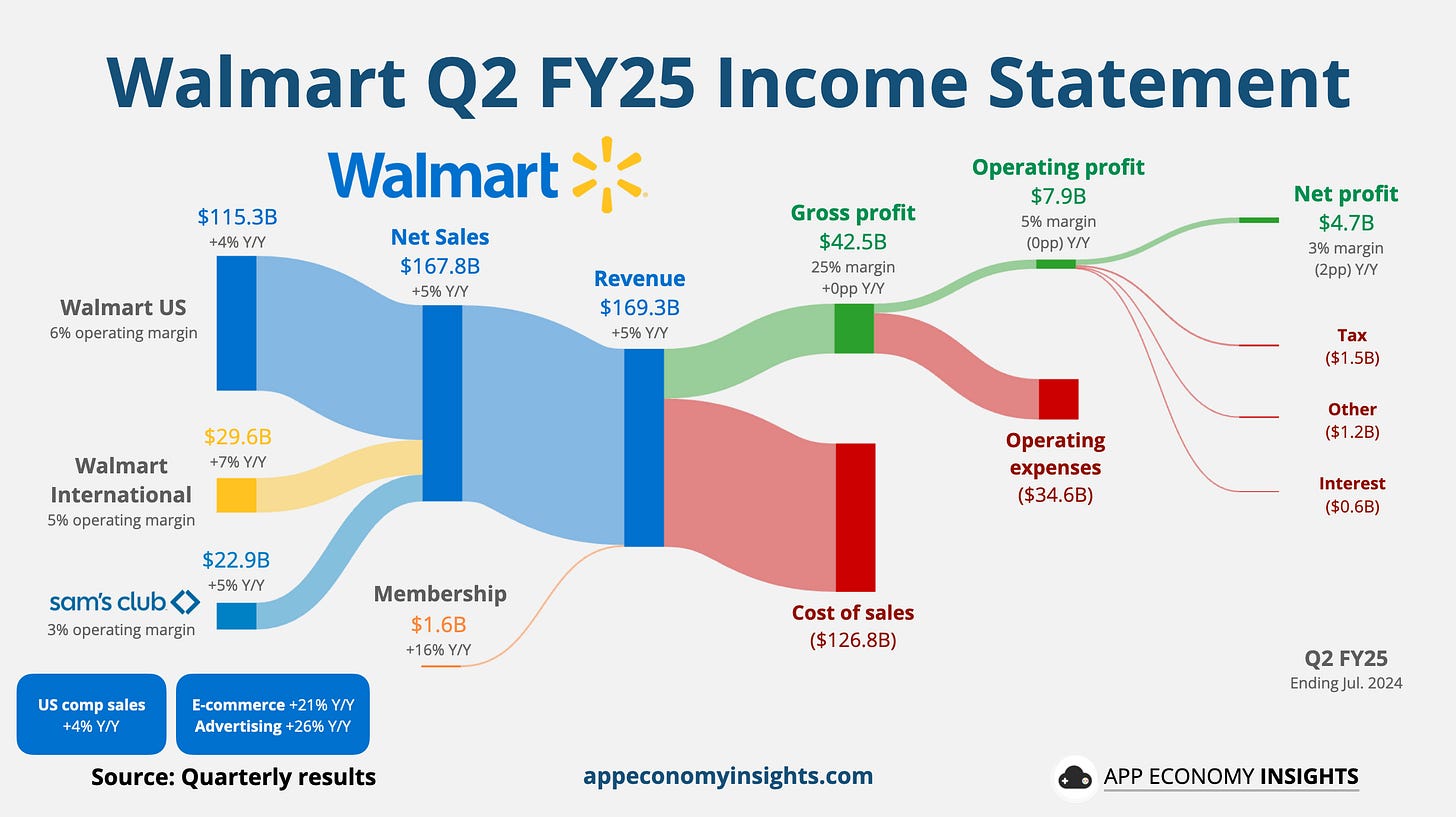

Walmart reported a 5% revenue growth to $169 billion ($1.9 billion beat) for Q2 FY25 (ending in July). A focus on lower prices attracted bargain-hunting shoppers across all income levels. Management said US stores and Sam’s Club were "slightly deflationary" in the quarter, prioritizing value over higher margins.

Additionally, Walmart is actively incorporating AI and automation to improve operational efficiency and enhance the customer experience. The e-commerce segment showed progress, with narrower losses and 21% sales growth (stable sequentially), driven by AI-powered product recommendations. The positive results led management to raise the full-year outlook from 4% to 4.75% revenue growth on the high end.

2. 🎮 Tencent: Gaming Rebound

Tencent's Q2 net profit surged 82% to 48 billion yuan (equivalent to $6.7 billion), driven by the successful launch of the blockbuster game DnF Mobile (developed by Nexon), which revived the domestic gaming segment after two quarters of decline. The new title could generate $2 billion in player spending by the end of 2024, according to Niko Partners.

Online advertising grew by 19%, fueled by the growing popularity of video accounts on WeChat (Weixin in China). Despite a slowdown in fintech and business services due to a decline in consumer loans, Tencent's overall performance exceeded expectations. The Chinese giant has leveraged its massive Monthly Active User base across Weixin/WeChat (1.4 billion) and QQ (571 million).