🔎 Google's Antitrust Loss

Quantifying the potential impact on big tech and beyond

Welcome to the Premium edition of How They Make Money.

Over 140,000 subscribers turn to us for business and investment insights.

In case you missed it:

“Google is a monopolist, and it has acted as one to maintain its monopoly.”

In one of the most significant antitrust rulings in recent history, Google’s grip on the search market has been challenged. This decision could have far-reaching consequences for the entire industry.

Judge Amit Mehta handed down the ruling, finding that the tech giant has been using its dominance in the search market to favor its own products and services, making it harder for rivals to gain a foothold.

The Justice Department had sued Alphabet over its multi-billion dollar deals with smartphone manufacturers and wireless providers to be the default search engine on mobile devices.

So, what's next for big tech, and what does this mean for the rest of us?

Today at a glance:

What is at stake in the antitrust ruling?

Who's feeling the heat?

Potential remedies and consequences.

Content licensing and AI threats.

1. What is at stake in the antitrust ruling?

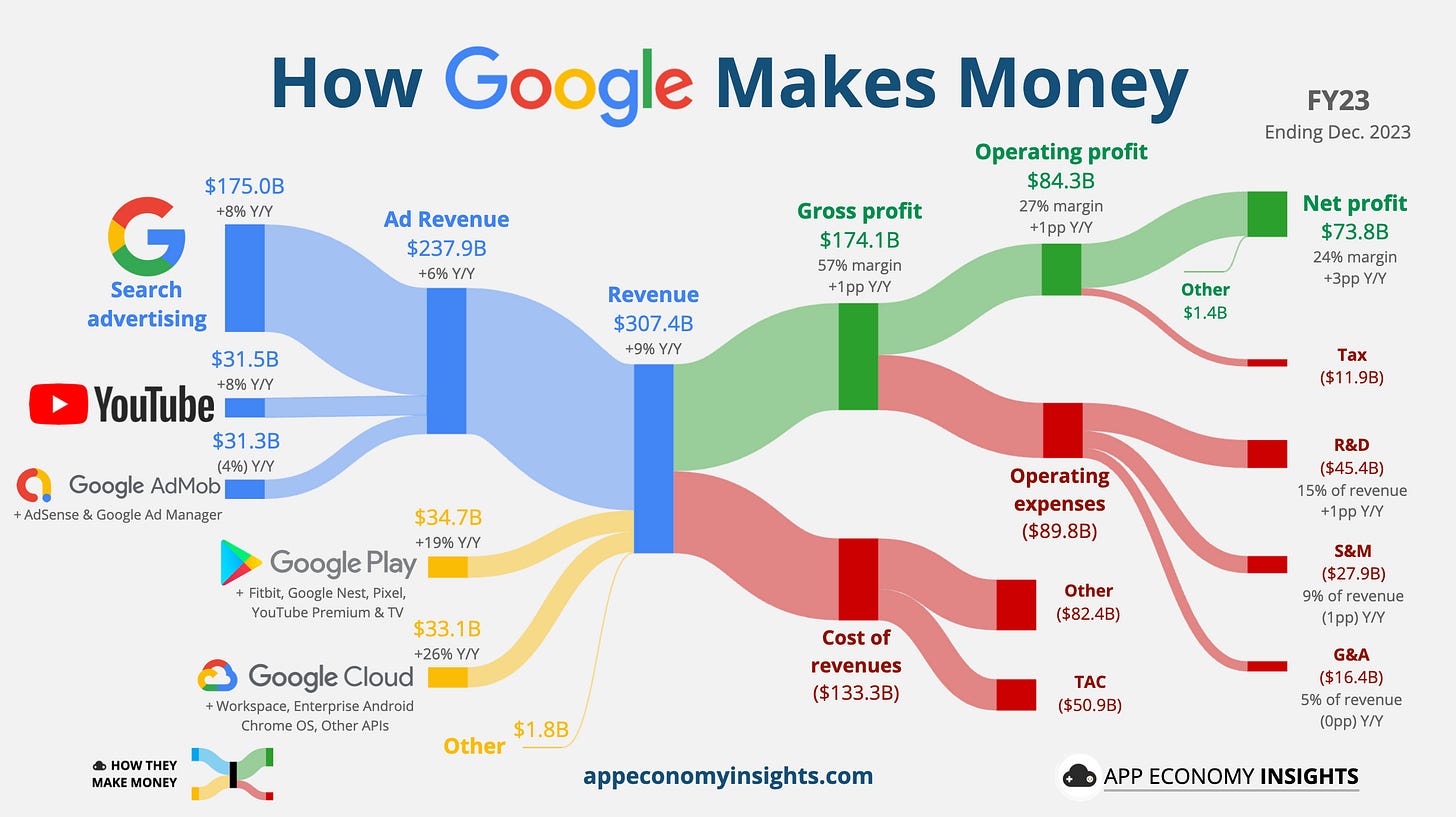

Let’s highlight the scope of Alphabet’s business based on 2023 data:

Search advertising represented $175 billion or 57% of overall revenue.

Network (3rd-party websites and apps where Alphabet displays ads via AdMob, AdSense, and Ad Manager) was $31 billion.

Traffic Acquisition Costs (TAC) for Search & Network were $51 billion.

💡 Traffic Acquisition Costs (TAC): Amounts paid to distribution partners who offer search access points. Partners include browser providers (Safari, Firefox), mobile carriers (AT&T, Verizon), original equipment manufacturers, and software developers. TAC also include amounts paid to Network partners, primarily for ads displayed on their properties.

According to court documents, Alphabet paid distribution partners $26 billion as a search revenue share in FY21. Turning to FY23, assuming 70% of Network revenue went to partners (roughly $22 billion), that leaves us with roughly $29 billion spent in TAC for search alone last year.

In short, Alphabet was able to buy its way into being the default search engine on browsers and mobile devices in exchange for a favorable cut of its advertising revenue, locking up “key access points” for competitors.

So, who received these $29 billion?

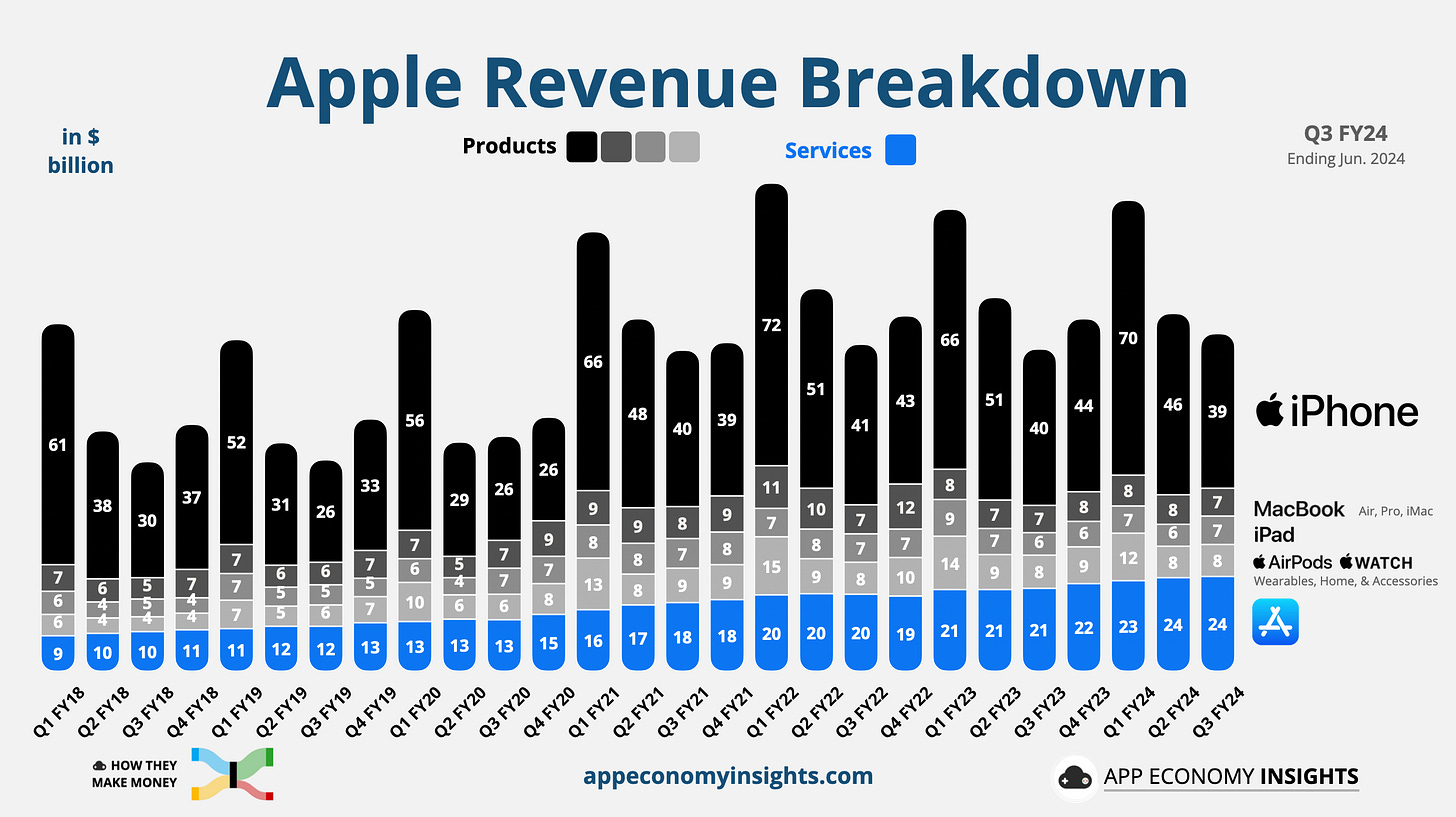

📱 Apple is the elephant in the room: The court documents mention an estimated $20 billion paid to Apple for a search revenue share in 2022. Assuming a high single-digit growth rate, that number was likely roughly $22 billion in 2023. As a result, the Cupertino giant likely represents roughly 75% of Alphabet’s TAC related to search. Based on the $87 billion in Services revenue for Apple in 2023, Alphabet accounted for 25% of Apple Services, and over 20% of the Apple’s net profit.

While Apple’s products are cyclical and depend on new releases, services have grown at a steady pace. This begs the question: could the juicy Services segment be at risk for Apple following the antitrust ruling?