📊 PRO: This Week in Visuals

V, LVMH, ABBV, SAP, AZN, KO, TXN, IBM, VZ, TTE, CMCSA, NOW, T, UPS, LMT, SNY, CDNS, STLA, CMG, GM, F, SPOT, ALGN, LUV, APPF, AAL

Welcome to the Saturday PRO edition of How They Make Money.

Over 130,000 subscribers turn to us for business and investment insights.

In case you missed it:

Our PRO coverage includes timely updates on the big earnings of the past week.

📧 Free subscribers get our Friday articles and sneak peeks.

💌 Premium subscribers get:

Tuesday articles.

Access to our archive.

Monthly reports with 200+ companies covered.

💼 PRO members get all of the above, plus our Saturday timely coverage.

Today at a glance:

💳 Visa: Rare Miss

✨ LVMH: Luxury Slowdown

💊 AbbVie: Patent Cliff

☁️ SAP: Cloud Momentum

💉 AstraZeneca: Oncology Boost

🥤 Coca-Cola: Outpacing PepsiCo

⚙️ Texas Instrument: Bottoming Out

🧑💻 IBM: AI Offsets Consulting

📱 Verizon: Growth Concerns

⛽️ TotalEnergies: Normalizing Market

📺 Comcast: Studio & Park Weakness

🧑💻 ServiceNow: AI Tailwinds

📞 AT&T: Subscriber Growth

📦 UPS: Weak Volumes

🛰️ Lockheed Martin: F-35 Delivers

🇫🇷 Sanofi: Dupixent Drives Growth

💡 Cadence: Tempered Outlook

🚙 Stellantis: Price Cuts Loom

🌯 Chipotle: Margins Expand

🚗 General Motors: EV Transition

🚘 Ford: Warranty Issues

🎧 Spotify: High Note

🦷 Align: iTero Lumina Delay

🛩️ Southwest Airlines: Shifting Strategy

🏡 Appfolio: AI-Powered Growth

🛫 American Airlines: Discounted Fares

1. 💳 Visa: Rare Miss

Visa (V) reported a rare revenue miss in its June quarter, with revenue growing 10% to $8.9 billion, falling $20 million short of expectations. The miss sparked concerns about the company's growth trajectory. Payments volume rose 7%, and processed transactions increased 10%, showing a slight slowdown.

The company attributed the revenue shortfall to a moderation in spending among lower-income US consumers and a slower recovery in Asia-Pacific travel. However, cross-border volumes jumped 14%, indicating robust international travel demand. Despite the miss, Visa maintained its full-year outlook for low double-digit net revenue growth.

2. ✨ LVMH: Luxury Slowdown

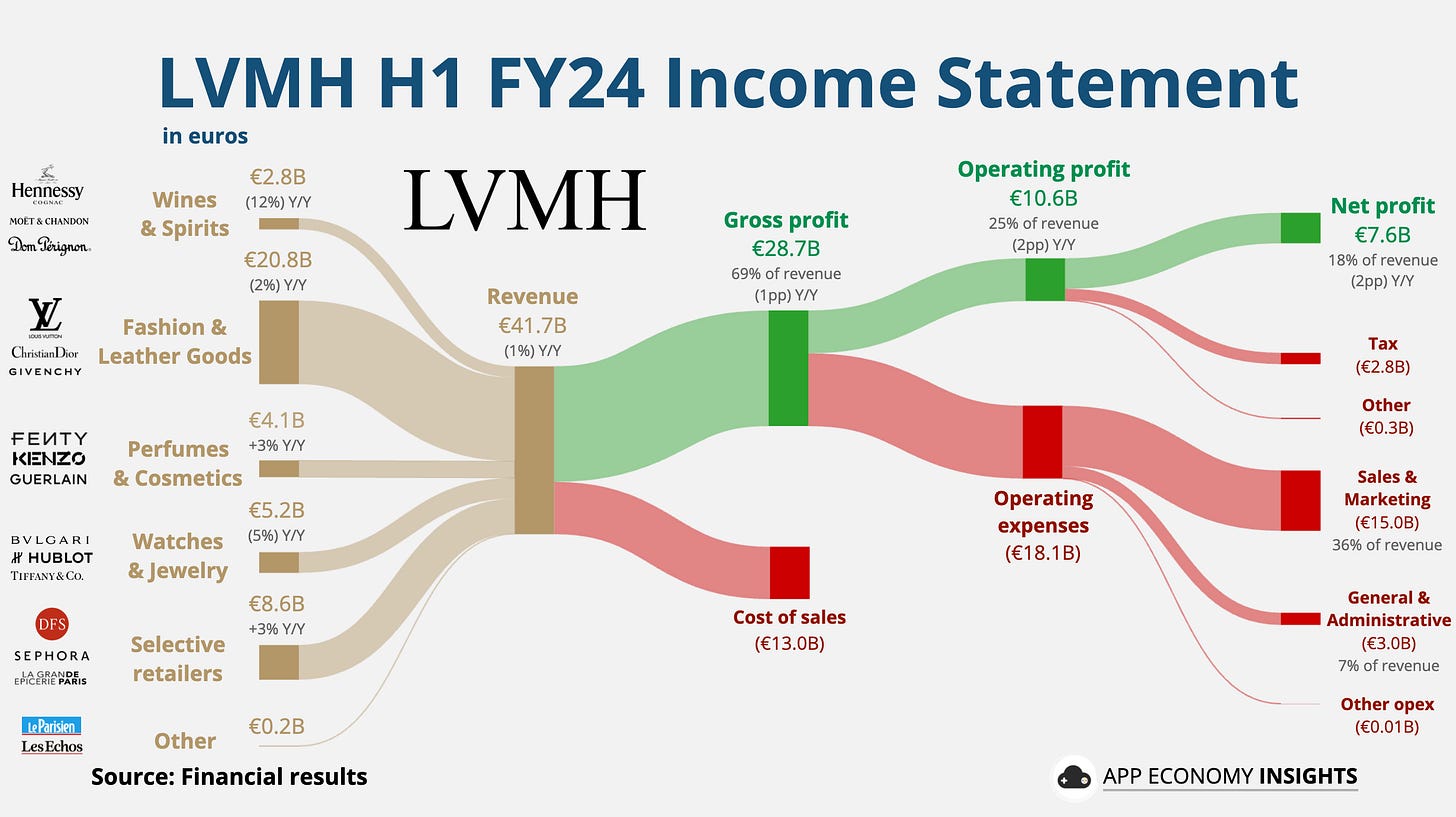

LVMH (LVMUY), the world's largest luxury goods conglomerate, reported a 1% revenue decline in the first half (up 1% organic), falling short of expectations and marking the lowest growth rate since 2009 (excluding the pandemic).

Weaker demand in China and the US contributed to the slowdown, with the fashion and leather goods division underperforming. Sales in Asia (excluding Japan) fell 14%, while sales in Japan surged 57%, driven by Chinese tourists taking advantage of the weak yen. As a result, LVMH's operating margin compressed by 2 percentage points.

Management refrained from providing any outlook for the second half of 2024, adding uncertainty to the company's near-term prospects.