📊 PRO: This Week in Visuals

NKE CCL MTN

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

👟 Nike: Early Wins

🛳️ Carnival: Firing on All Cylinders

🎿 Vail Resorts: Strategic Reset

1. 👟 Nike: Early Wins

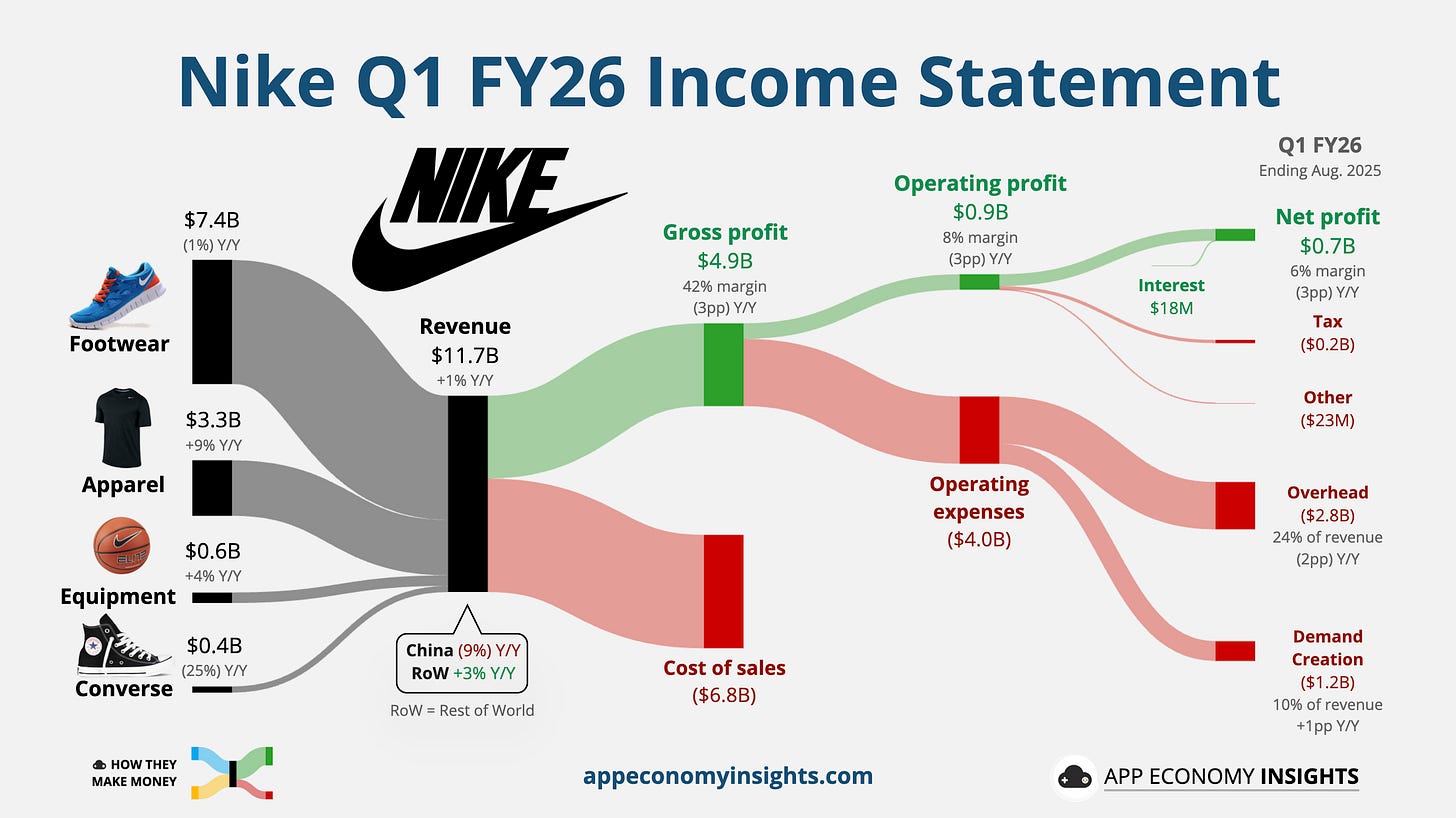

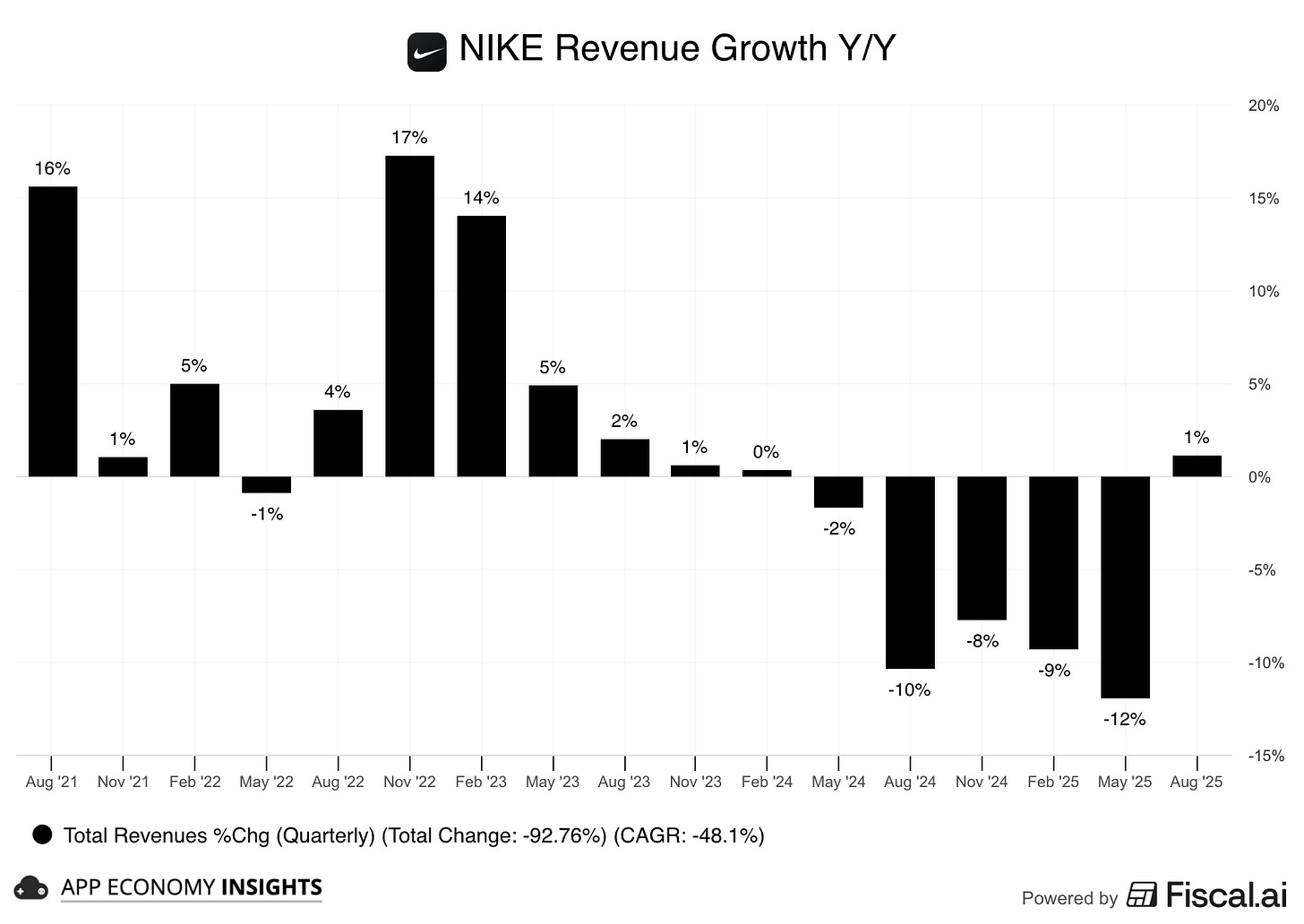

Nike’s turnaround showed its first tangible signs of success in its Q1 FY26 (August quarter), with revenue returning to growth, up 1% Y/Y to $11.7 billion (a massive $710 million beat). It was the first quarter of positive growth since February 2024.

The growth was driven by a sharp rebound in Wholesale (+7%) as Nike rebuilt its retail partnerships, which more than offset a continued decline in Nike Direct (-4%). EPS of $0.49 also crushed estimates ($0.22 beat). Apparel sales showed positive momentum (+9%), offsetting a continued decline in Footwear.

CEO Elliott Hill’s “Sport Offense” strategy is delivering early wins. The Running category, a key focus, grew an explosive 20%, and sport-focused store redesigns are driving double-digit sales increases. However, management warned the recovery will be uneven.

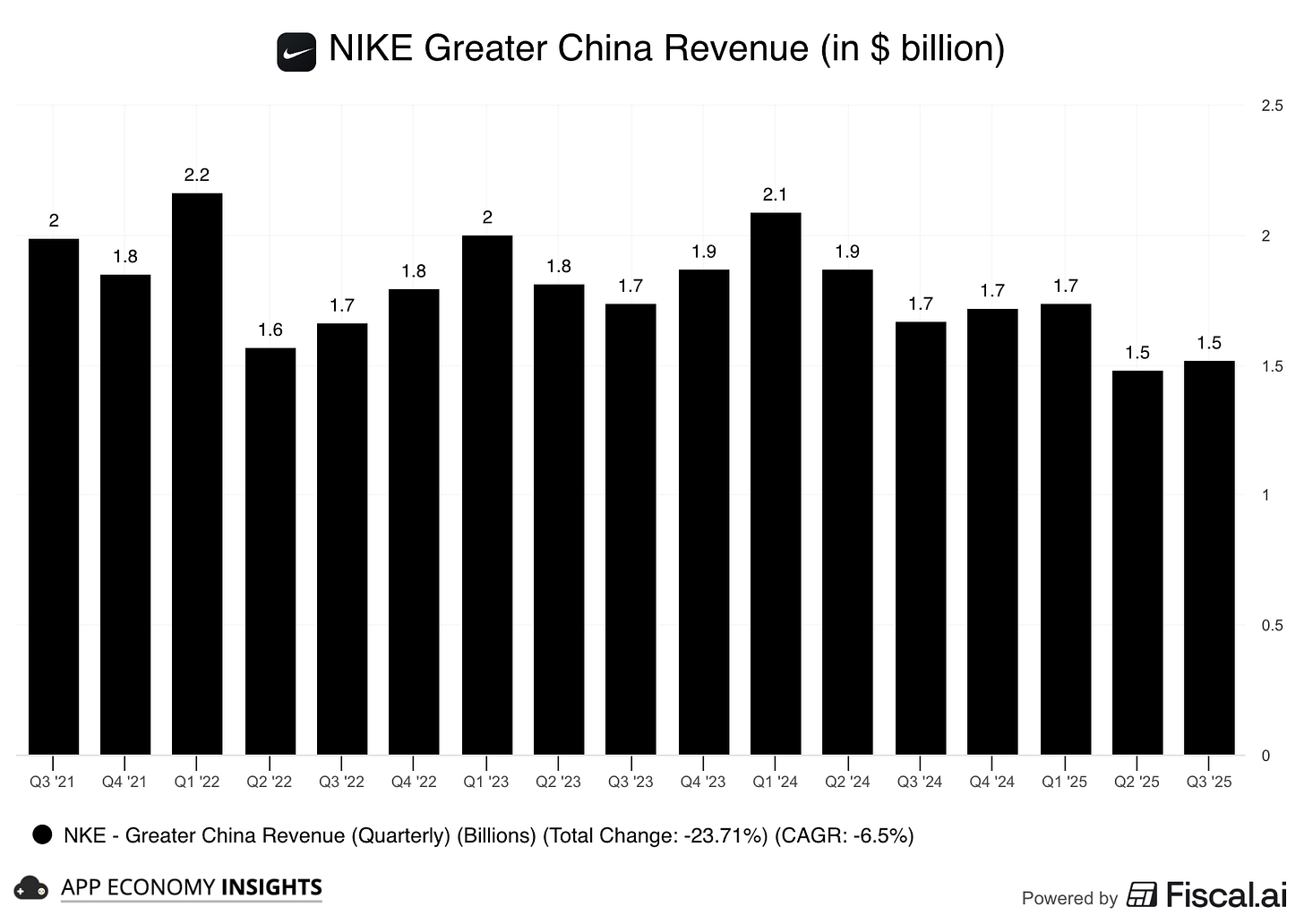

Greater China remains a major weak spot with sales falling another 9%, and the company does not expect its Nike Direct business to return to growth in FY26. Gross margin also dropped by 3 points to 42%, pressured by discounts and a worsening tariff situation, which is now expected to be a $1.5 billion annualized headwind.

Reflecting these challenges, Nike guided for another revenue decline in Q2 (November quarter) with continued significant margin pressure. While the strong beat and clear progress in Running and Wholesale are encouraging signs that the turnaround is taking hold, persistent weakness in China and digital, along with mounting tariff costs, show that Nike’s race back to greatness will be a marathon, not a sprint.

2. 🛳️ Carnival: Firing on All Cylinders

Carnival delivered a phenomenal Q3, marking its 10th consecutive quarter of record revenue. Revenue grew 3% Y/Y to $8.2 billion ($40 million beat), while adjusted EPS was $1.43 ($0.11 beat).

Adjusted EBITDA hit a record $3.0 billion, driven by strong close-in demand, higher ticket prices, and a 2.5% increase in onboard spending. Customer deposits reached a new third-quarter high of $7.1 billion, and the booking curve for the future is exceptionally strong.