📊 PRO: This Week in Visuals

KO, SAP, IBM, NOW, TMUS, VZ, T, LMT, BA, TXN, LRCX, SNY, UPS, FI, MCO, GM, LUV, AAL, ALGN, APPF

Welcome to the Saturday PRO edition of How They Make Money.

Over 160,000 subscribers turn to us for business and investment insights.

In case you missed it:

📧 Free members get our Friday articles and sneak peeks.

💌 Premium members receive monthly reports with 200+ companies visualized, one extra weekly article, and access to our archive.

💼 PRO members enjoy everything in Premium, plus our Saturday timely coverage of the most important earnings of the past week.

Today at a glance:

🥤 Coca-Cola: Pricing Power

☁️ SAP: AI Tailwinds

🌐 IBM: Consulting Comes Short

🧑💻 ServiceNow: AI Adoption Soars

📶 T-Mobile US: Brighter Outlook

📱 Verizon: Growth Concerns

📞 AT&T: Upgrade Cycle Questions

🛰️ Lockheed Martin: F-35 Delay

🛩️ Boeing: Exploring Space Sale

⚙️ Texas Instrument: Elusive Recovery

🧠 Lam Research: China Concerns Remain

🇫🇷 Sanofi: Opella Sale on Deck

📦 UPS: Return to Growth

💳 Fiserv: Organic Growth Boost

💼 Moody’s: Raised Guidance

🚗 General Motors: ICE Sales Deliver

🛩️ Southwest Airlines: Elliott Agreement

🛫 American Airlines: Cost Challenges

🦷 Align: Restructuring Announced

🏡 Appfolio: AI-Powered Outlook

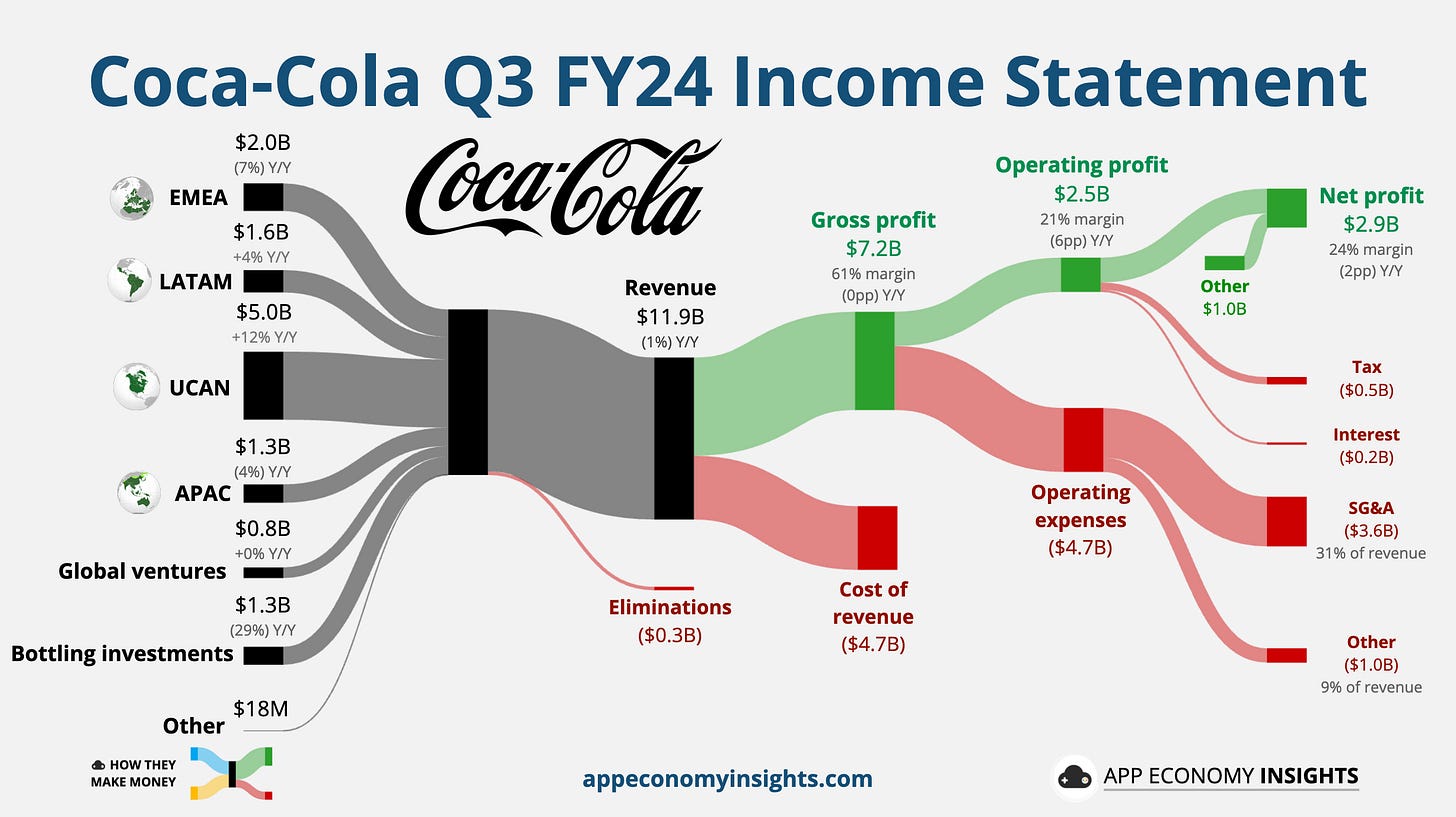

1. 🥤 Coca-Cola: Pricing Power

Coca-Cola’s revenue fell 1% to $11.9 billion ($290 million beat), and adjusted EPS was $0.77 ($0.02 beat). The revenue decline was primarily due to currency headwinds. However, organic revenue grew 9% (vs. 6% expected), far outpacing PepsiCo’s 1% organic growth we discussed two weeks ago. The main reason? A 10% increase in price mix (across all categories). Despite the price hikes, unit case volume only declined 1%, demonstrating the brand's resilience in maintaining consumer demand.

While Coca-Cola reaffirmed its full-year EPS growth forecast of 5% to 6%, the company anticipates a “more normalized level of pricing” going forward. Looking ahead, the company faces challenges from a stronger dollar and the growing popularity of obesity drugs, which could weigh on future demand, particularly in North America.

2. ☁️ SAP: AI Tailwinds

SAP's revenue grew 9% year-over-year to €8.5 billion (€0.1 billion beat), with earnings ahead of expectations. The company demonstrated continued cloud momentum, with the segment’s revenue growing 25% to €4.4 billion. SAP is transitioning customers to a subscription-based cloud model, and its investments in AI are paying off.

CEO Christian Klein called out “strong progress on Business AI with groundbreaking innovations such as SAP Knowledge Graph,” contributing to a significant part of new cloud deals.

SAP raised its FY24 revenue outlook by $400 million to roughly €29.7 billion and reaffirmed its cloud revenue guidance of €17.0 to €17.3 billion. The company's cloud backlog also grew 25% (or 29% in constant currency) to €15.4 billion, indicating strong momentum. Despite an ongoing restructuring program, SAP has joined the list of software companies with AI tailwinds boosting their growth profile.