📊 PRO: This Week in Visuals

CRM, PDD, CRWD, LOW, DELL, TGT, VEEV, ADSK, HPQ, LULU, BBY, MDB, OKTA, NTNX, CHWY, BIRK, ESTC, S

Welcome to the Saturday PRO edition of How They Make Money.

Over 140,000 subscribers turn to us for business and investment insights.

In case you missed it:

Our PRO coverage includes timely updates on the recent big earnings.

📧 Free subscribers get our Friday articles and sneak peeks.

💌 Premium subscribers get:

Tuesday articles.

Access to our archive.

Monthly reports with 200+ companies covered.

💼 PRO members get all of the above, plus our Saturday coverage.

Today at a glance:

☁️ Salesforce: CFO Transition

📦 PDD Holdings: Quality Issues

🛡️ CrowdStrike: IT Outage Impact

🏠 Lowe’s: DIY Demand Dips

🎯 Target: Strong Discretionary Sales

💻 Dell: AI Servers Boost

🧑⚕️ Veeva: Soft Guidance Raise

🏗️ AutoDesk: New Go-To-Market

💻 HP: AI PC Focus

🎽 Lululemon: Americas Decline

🛒 Best Buy: Cautious Outlook

🌱 MongoDB: Consumption Rebounds

🔐 Okta: Soft Backlog Trend

☁️ Nutanix: Seizing its Moment

🐶 Chewy: Profit Uptick

👡 Birkenstock: Asia-Led Growth

🔍 Elastic: Sales Challenge

👁️ SentinelOne: Upgraded Outlook

1. ☁️ Salesforce: CFO Transition

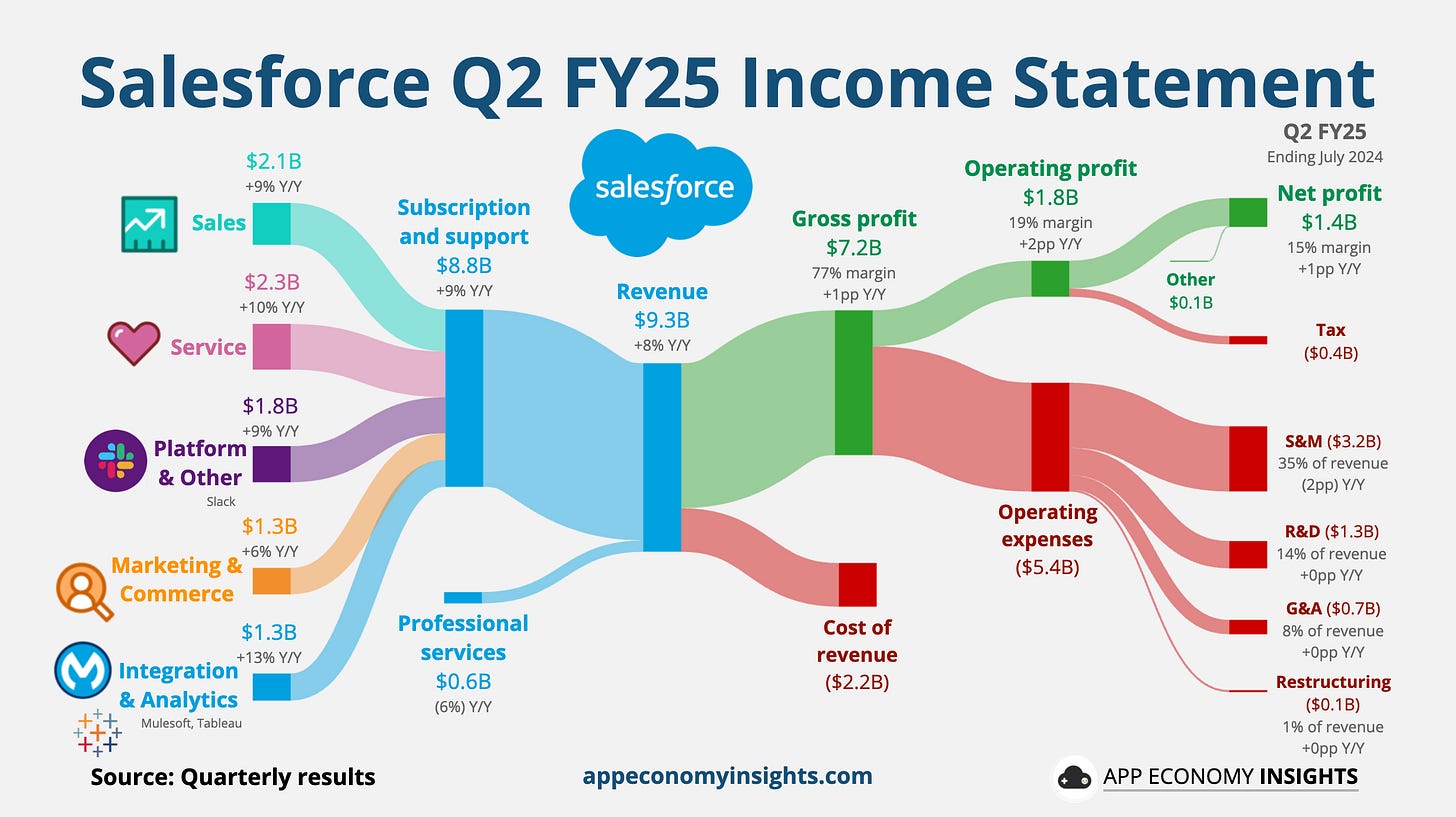

Salesforce grew its revenue by 8% to $9.3 billion ($100 million beat), driven by strong new business growth in Japan, India, and Canada. The enterprise software giant slightly raised its adjusted profit forecast for FY25 (ending in January), highlighting continued margin expansion. The current Remaining Performance Obligation—a critical leading indicator of future revenue growth—grew 11% in constant currency to $26.5 billion.

CFO Amy Weaver announced her departure, adding an element of uncertainty. But management sees significant potential for AI monetization through its new Agentforce platform, enabling customers to build and deploy AI-powered agents to automate tasks, improve productivity, and enhance customer experiences.

2. 📦 PDD Holdings: Quality Issues

PDD Holdings, parent of Pinduoduo in China and Temu internationally, experienced a record stock plunge. The company’s top line grew 86% to $13.4 billion, missing estimates by $0.6 billion. PDD has challenged giants like Amazon and Alibaba with its online marketplaces. According to recent estimates, Temu alone reaches nearly 200 million monthly active users.

However, investors are concerned about its ability to maintain outperformance and high margins. The main problem? Management said they would “firmly tackle low-quality merchants” with heavy fines. The company's outlook was particularly cautious, with executives anticipating intensified competition and potential declines in profitability due to heavy investments in trust, safety, and merchant support.