♾ Meta: Better Sorry Than Safe

Zuck breaks down why the AI infrastructure race is unavoidable

Welcome to the Premium edition of How They Make Money.

Over 140,000 subscribers turn to us for business and investment insights.

In case you missed it:

All eyes will turn to NVIDIA’s earnings later this week.

So today, we look back at the earnings of one of NVIDIA’s largest customers: Facebook and Instagram parent Meta. If you recall, Meta expects to operate 600,000 H100 GPU equivalents by the end of 2024.

Zuck shared his thoughts on the state of the AI infrastructure race, which will involve heavy spending for the foreseeable future. He explained:

“I'd rather risk building capacity before it is needed, rather than too late, given the long lead times for spinning up new infra projects.“

Most Big Tech CEOs follow the same logic, leading to the sky-rocketing demand for NVIDIA’s data center solutions.

While some investments will take years to bear fruit, AI is already improving the two main leverages of revenue growth across Meta’s apps: engagement (more ad impressions) and ad efficiency (more revenue per ad).

Let’s visualize the quarter and gain insights from the recent announcements.

Today at a glance:

Meta Q2 FY24.

AI spending & market share.

Key quotes from the earnings call.

What to watch looking forward.

1. Meta Q2 FY24

As a reminder, Meta has two business segments:

💬 FoA: Family of Apps (Facebook, Instagram, Messenger, and WhatsApp).

🥽 RL: Reality Labs (virtual reality hardware and supporting software).

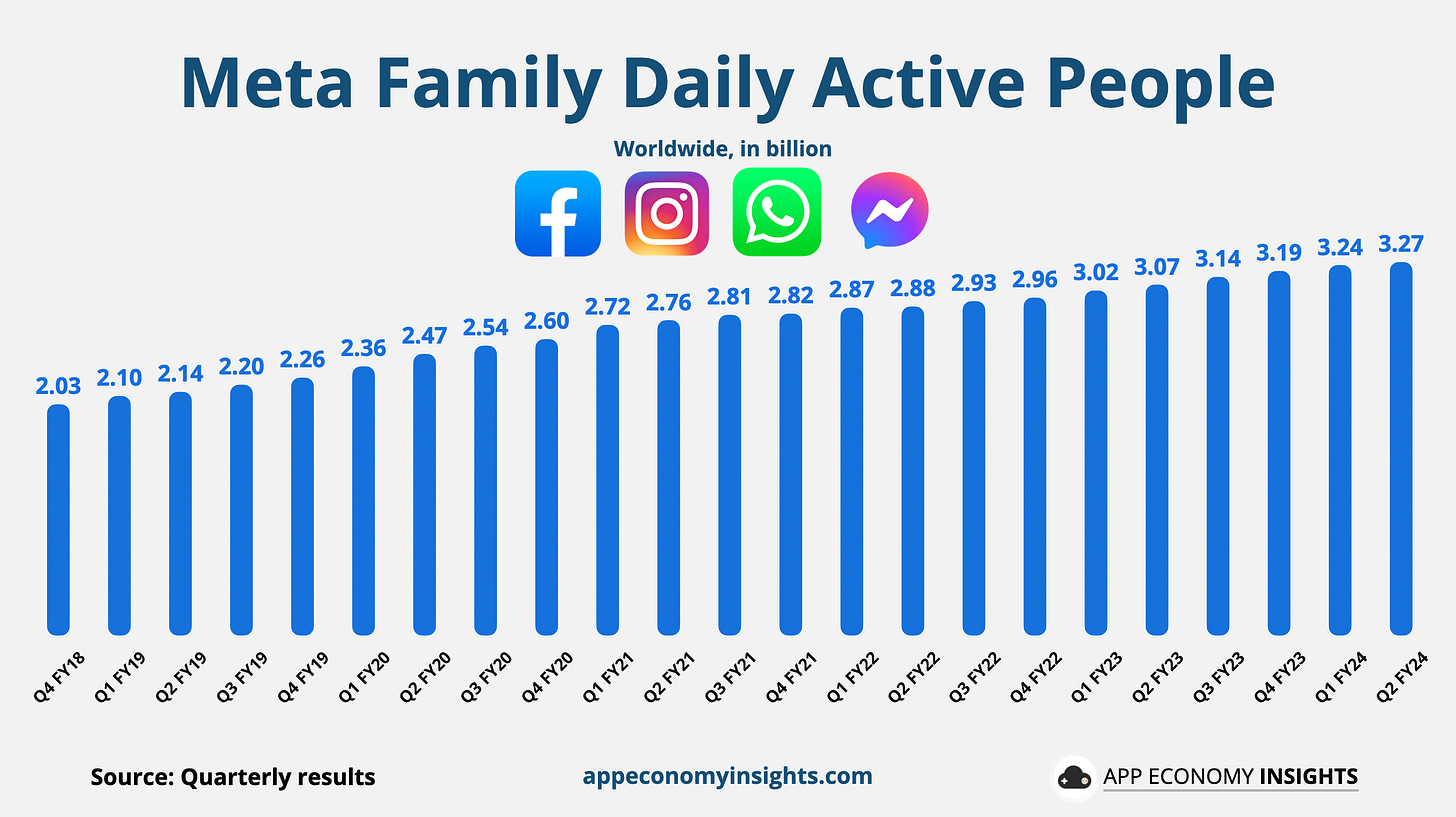

FoA Daily Active People grew +7% year-over-year to 3.27 billion.

Zuck called out:

100 million monthly actives on WhatsApp in the US. It’s a critical soundbite since US users have a much higher ceiling in terms of monetization potential.

Growth across Facebook, Instagram, and Threads—in the US and globally. That includes young adults (18-29 year-olds) on Facebook (notably with Groups and Marketplace), which goes against the narrative that Gen Z isn’t on Facebook.

Nearly 200 million monthly actives on Threads. That’s up from 150 million last quarter, implying a growth acceleration. Impressive for an app that launched 13 months ago. For perspective, Twitter had an estimated 368 million monthly actives in 2022 when Musk acquired it.

As a reminder, management doesn’t report Facebook standalone numbers anymore.

Ad impressions grew +10% Y/Y (vs. +20% Y/Y in Q1).

Average price per ad grew +10% Y/Y (vs. +6% Y/Y in Q1).

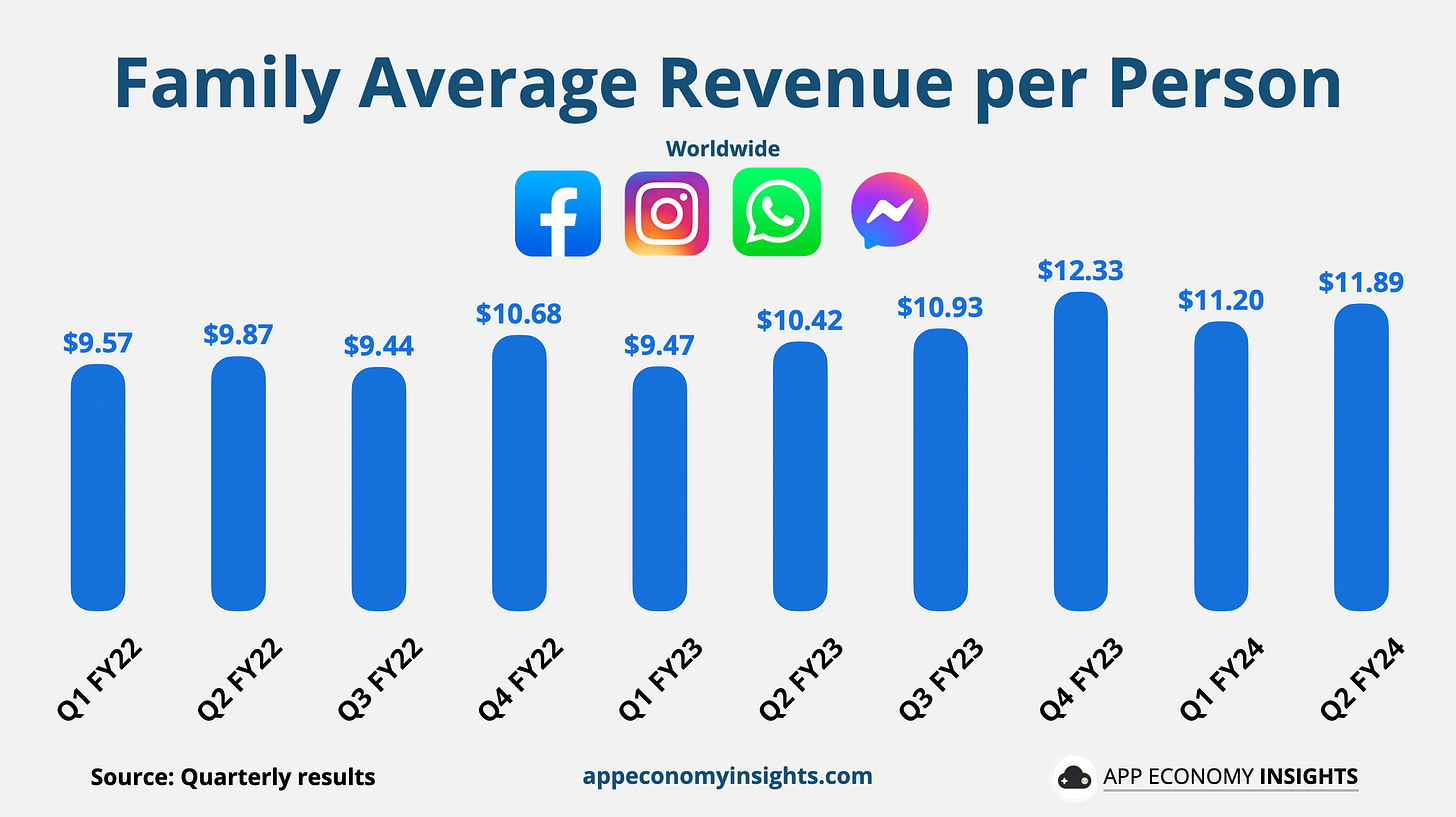

The average revenue per person grew +14% Y/Y to $11.89.

Higher engagement met continued strong advertising demand. For context, Snap’s ARPU rose only by 6% Y/Y to $2.86 in the same quarter.

Nay-sayers often suggest that an army of bots inflate Meta’s numbers. However, the revenue per person tells a different story. Advertisers would not spend this money if they didn’t see a direct return on their ad spend.

In short, you can fake users but not revenue.