📊 PRO: This Week in Visuals

WMT BABA BKNG ANET MELI ADI CDNS NTES NU NET XYZ OXY DDOG LYV TOST LENOVO GRAB KVYO GLBE ETSY LYFT TRIP

Welcome to the Saturday PRO edition of How They Make Money.

Over 190,000 subscribers turn to us for business and investment insights.

In case you missed it:

📧 Free members get our Friday articles and sneak peeks.

💌 Premium members receive monthly reports with 200+ companies visualized, one extra weekly article, and access to our archive.

💼 PRO members enjoy everything in Premium, plus our timely coverage of the past week's most important earnings on Saturday.

Today at a glance:

🛒 Walmart: Digital Strength

📦 Alibaba: AI Powers Growth

🏝️ Booking: Travel Demand Still Strong

🌐 Arista Networks: AI-Driven Growth

🤝 MercadoLibre: Expanding Ecosystem

⚙️ Analog Devices: Gradual Recovery

💡 Cadence: AI Momentum

🎮 NetEase: Marvel Rivals Boost

🏦 Nu Holdings: FX Headwinds

☁️ Cloudflare: Acceleration Ahead

🔲 Block: Weak Quarter

🛢️ Oxy: Weak Pricing

🐶 Datadog: Cautious Outlook

🎤 Live Nation: Record Concert Demand

🍞 Toast: Profitable Growth

💻 Lenovo: AI Servers Fuel Growth

🛵 Grab: Rising Competition

🏴 Klaviyo: Scaling Upmarket

🛍️ Global-E: Record Growth & Profitable

📦 Etsy: GMS Decline Continues

🚘 Lyft: Record Growth

🍽️ Tripadvisor: Experiences Drive Growth

1. 🛒 Walmart: Digital Strength

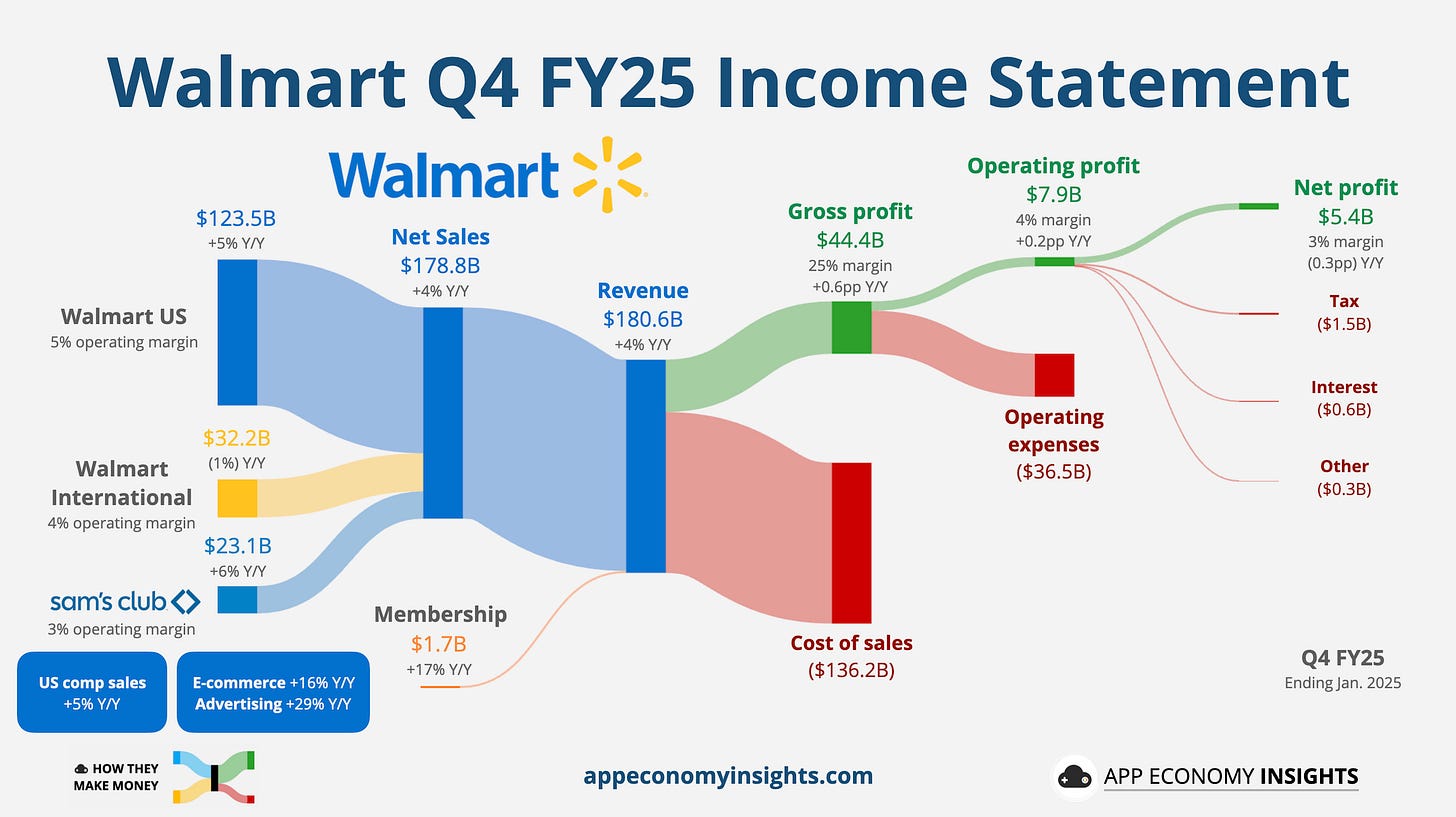

Walmart’s revenue grew 4% Y/Y to $180.6 billion ($1.6 billion beat) in its Q4 FY25 (ending in January 2025), with US comparable sales up 5%. E-commerce remained a standout, rising 16% Y/Y and now comprising 18% of total sales. Higher-income households continued driving growth, and global advertising revenue jumped 29%.

However, FY26 guidance disappointed, with projected sales growth of 3%-4% and EPS of $2.50-$2.60 ($2.76 expected). Management cited economic uncertainty and potential tariff impacts, though it expects to outperform initial targets, as seen in prior years.

Walmart’s focus on digital expansion, automation, and new revenue streams like advertising (including the recent VIZIO acquisition) and membership growth positions it well, even as consumer spending remains cautious. Despite near-term headwinds, market share gains and e-commerce profitability continue to drive long-term momentum.

2. 📦 Alibaba: AI Powers Growth

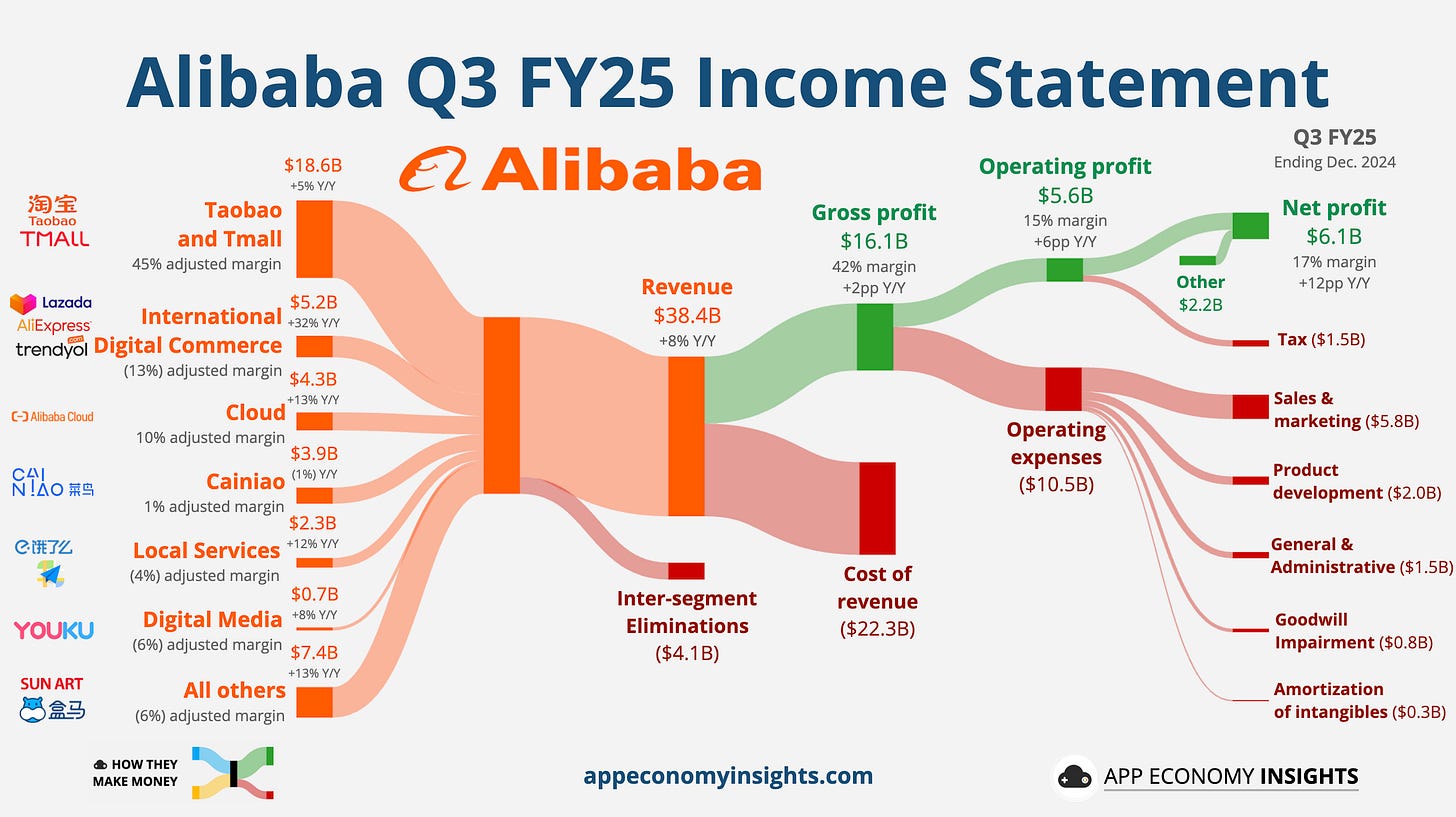

Alibaba’s revenue grew 8% Y/Y to $38.4 billion ($130 million beat), its fastest pace since 2023. Cloud revenue growth accelerated to 13% Y/Y (from 7% Y/Y in the previous quarter), fueled by six consecutive quarters of triple-digit AI growth. The company is doubling down on AI investments, with CEO Eddie Wu calling Artificial General Intelligence (AGI) Alibaba’s "primary objective."

E-commerce also rebounded, with Taobao and Tmall revenue up 5%, including a 9% rise in customer management revenue, signaling improving monetization. International commerce soared 32%, led by AliExpress and Trendyol.

Alibaba’s renewed focus on AI and infrastructure investments, coupled with a partnership with Apple to integrate its AI into iPhones in China, has fueled a $100 billion market cap surge in 2025. Despite fierce competition from PDD and ByteDance, Alibaba’s strategy is showing results.