📊 PRO: This Week in Visuals

AVGO, NIO, HPE, IOT, DOCU, GTLB, PATH, HQY, SMAR, ASAN, AI

Welcome to the Saturday PRO edition of How They Make Money.

Over 140,000 subscribers turn to us for business and investment insights.

In case you missed it:

Our PRO coverage includes timely updates on the recent big earnings.

📧 Free subscribers get our Friday articles and sneak peeks.

💌 Premium subscribers get:

Tuesday articles.

Access to our archive.

Monthly reports with 200+ companies covered.

💼 PRO members get all of the above, plus our Saturday coverage.

Today at a glance:

📈 Broadcom: Soft Outlook

🚗 Nio: Deliveries Surge

🌐 Samsara: Enterprise Momentum

🖥️ HPE: Weak Margins

✍️ DocuSign: AI-Powered Agreements

🛠️ GitLab: AI Demand Boost

🤖 UiPath: Beating Low Expectations

🏥 HealthEquity: Record HSAs Openings

✅ Smartsheet: Acquisition Talks

📝 Asana: New CFO

🧠 C3 AI: Soft Subscription Revenue

1. 📈 Broadcom: Soft Outlook

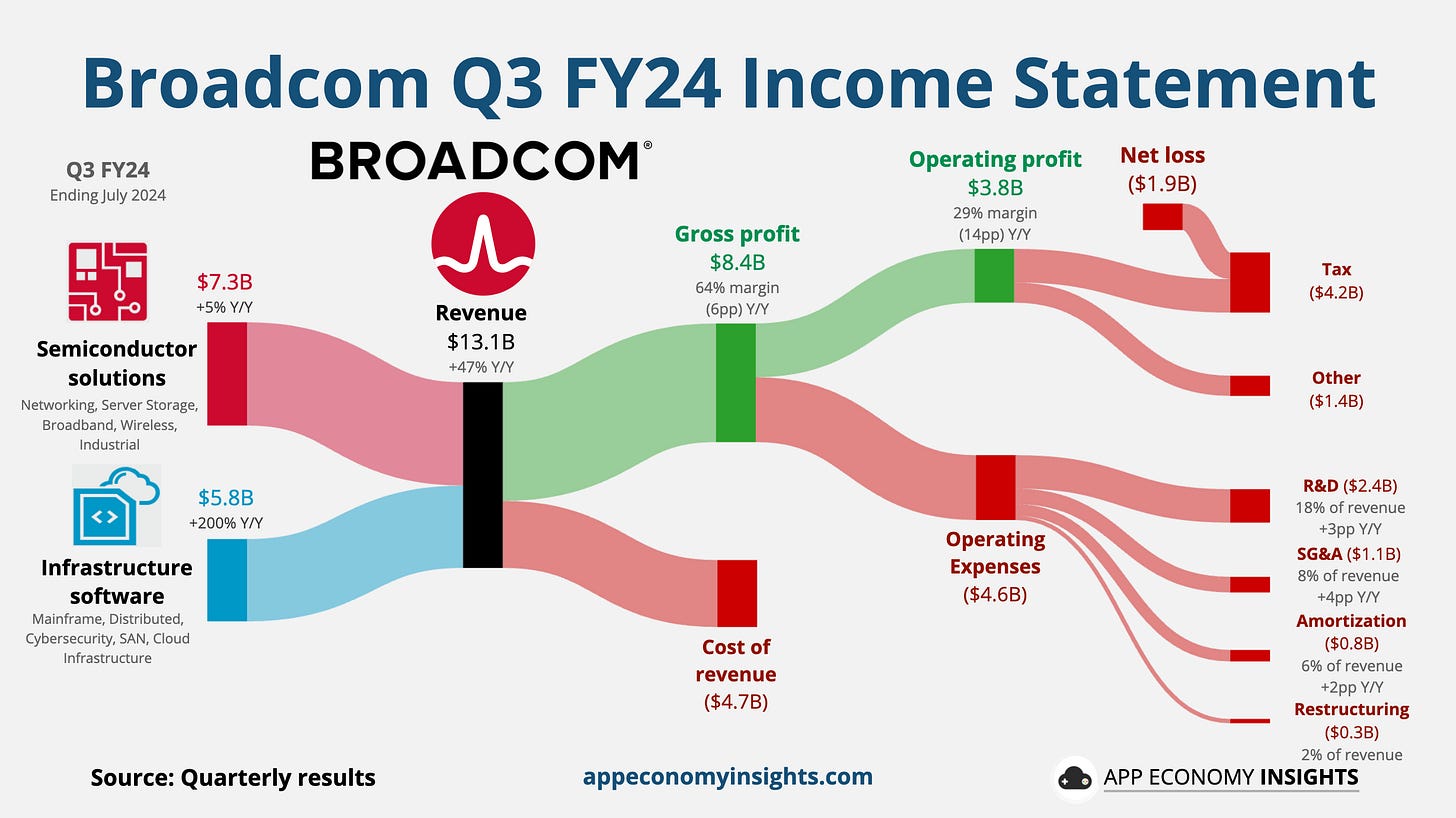

Broadcom delivered a strong Q3, with revenue growing 47% to $13.1 billion ($110 million beat) and adjusted earnings ahead of expectations. However, the company's Q4 revenue guidance of $14 billion fell short of the $14.1 billion consensus, causing the stock to drop nearly 10%.

Remember, Broadcom completed its VMWare acquisition last November, which explains most of the 200% growth in Infrastructure Software, reaching $5.8 billion. Management expects $12 billion in AI-related revenue in FY24 (unchanged). The softer outlook than expected and concerns about potential margin pressure from AI server sales have tempered investor enthusiasm.