🔍 Palantir: The New AI Frontier

Peeking behind the curtain of data intelligence and controversy

Greetings from San Francisco! 👋🏼

A warm welcome to the recent additions to our community!

Over 65,000 How They Make Money subscribers turn to us weekly for business and investment insights. Glad you're here.

Palantir (PLTR) has been one of the most requested companies by our community. They reportedly helped find Osama bin Laden. Given the secretive nature of the business, it’s particularly apt for a newsletter called How They Make Money to take a closer look. So here we go!

The company was co-founded by Peter Thiel, a prominent figure in Silicon Valley, co-founder of PayPal, Founders Fund, and early investor in Facebook. Thiel's influence is noticeable in the company's unconventional approach to technology and business. He named it after the indestructible crystal ball from The Lord of the Rings.

Palantir has become a powerhouse in big data and AI-driven analytics in the past two decades. Established in 2003, Palantir's innovative data integration and analysis approach has set new standards. The company went public via a direct listing in 2020.

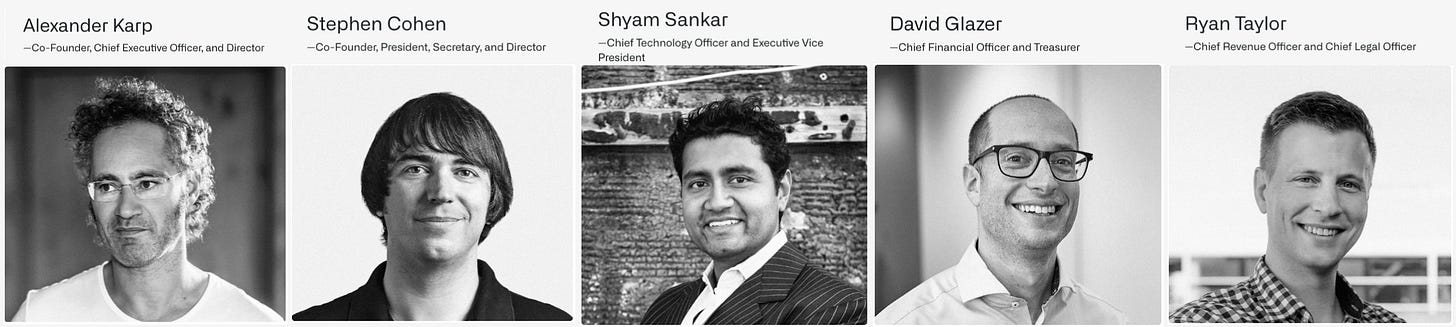

Let’s look at the leadership team:

Co-founder and CEO Alex Karp: With his distinctively long hair and PhD in neoclassical social theory, Karp defies the typical tech CEO mold. His commitment to ethical use of data and a philosophy-driven approach to technology sets a unique tone at Palantir.

Co-founder and President Stephen Cohen: He was instrumental in coding the initial prototypes of Palantir's software.

CTO Shyam Sankar: Sankar's journey at Palantir, starting from an entry-level position to becoming the COO and then CTO, reflects his deep alignment with the company's mission.

“We set a standard that the competition can never meet.” Alex Karp.

So, what differentiates Palantir in the tech universe?

Palantir rose to prominence with three platforms:

🕵️♀️ Gotham: An operating system that helps government agencies like the CIA and the FBI investigate and disrupt threats to national security.

📊 Foundry: A data analytics platform for commercial organizations like Airbus and Bank of America to make better decisions.

☁️ Apollo: A cloud deployment platform to deploy Palantir's software solutions in government environments.

These platforms enable users to make informed decisions rapidly and efficiently.

Why should you care about Palantir?

📈 Leader in data integration and analysis: Some of the world's largest organizations, including governments, financial institutions, and healthcare providers, use its software. The company integrates and analyzes data from various sources to provide actionable insights.

🤖 Pioneer in AI and Machine Learning: The company's AI software solves complex problems in national security, fraud detection, and drug discovery. They detect unusual patterns in large data sets to drive outcomes, leveraging AI for predictive analytics and decision-making.

🗽 Mission-driven company: Palantir is committed to using its technology to “help institutions protect liberty.” They focus on helping Western governments and their allies.

⚖️ Privacy and ethics: Palantir's work, especially with government agencies, has faced scrutiny over privacy and ethical implications, making it a polarizing company.

Today, we’ll cover the following:

Palantir Q3 FY23.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

1. Palantir Q3 FY23

Key concepts central to Palantir's operations:

🤝 Government and Commercial: The company operates extensively in government and commercial sectors, tailoring its solutions to each.

🔒 Unique position: Data sensitivity and security are paramount for government agencies and large organizations. Palantir’s platforms are designed to handle complex, large-scale data environments, making it a go-to solution. The company's ecosystem includes various use cases, from counterterrorism operations to commercial data analytics. This diversity in applications is a significant differentiator.

🎖️ Unpredictable business model: Palantir's business model heavily focuses on large-scale, long-term contracts, especially in the government sector. This approach results in a different revenue recognition pattern than typical SaaS models. Management said in the S-1 that their “sales cycle is often long and unpredictable.”

Key metrics to watch:

Billings: The total amount billed to customers for products and services during a specified period. Indicates near-term revenue growth and customer demand.

Remaining Performance Obligations (RPO): The total value of non-cancellable contracted work yet to be performed. It's a future revenue predictor. RPO reflects primarily commercial contracts since government contracts typically have termination for convenience clauses that exclude them from the RPO scope.

For an explainer on metrics like dollar-based retention, check out our explainer of the 7 traits to watch in cloud stocks.

Let’s look at the most recent quarter.