🔎 How to Analyze a 10-K

Making smarter investment decisions starts here

Greetings from San Francisco! 👋

Over 73,000 How They Make Money subscribers turn to us weekly for business and investment insights. Glad you're here.

“I just sit in my office and read all day.”

That’s Warren Buffett talking about the secret to his investing success.

What is he reading, you ask?

His favorite reading materials include annual filings, known as 10-K in the US. That’s where businesses reveal their secrets beyond the glossy summaries in marketing materials. Buffett explains:

“I read annual reports of the company I’m looking at and I read the annual reports of the competitors – that is the main source of material.”

Investing in a company without reviewing its 10-K is like like trying to assemble a complex puzzle without the picture on the box. These annual reports are mandatory financial disclosures and treasure troves of insights for investors.

In a world where short-term trends and media hype often influence investment decisions, a 10-K offers a grounding in the reality of a company's performance and potential.

This article was just added to our 💰 Investing Hub. That’s where you can find practical tips and guides on finance and investing concepts. All these articles are free. Enjoy!

Why 10-K Reports Matter

Unveiling the Full Picture: A 10-K provides the full view of a company's financial health over a year. It includes detailed financial statements, business and market overview, and much more, allowing for a thorough evaluation of a company's financial stability and performance trends.

Risk and Strategy Insights: The 'Risk Factors' and 'Management’s Discussion and Analysis' (MD&A) sections in a 10-K give investors a candid view of the company's challenges, opportunities, and risk management. These sections offer a narrative from the company's leadership, providing context to the numbers.

In the following sections, we'll dive into the essential parts of a 10-K, highlighting what to look for to help you glean meaningful insights.

Navigating the 10-K: Key Sections

A 10-K report may seem daunting at first glance due to its length. However, understanding its structure can make navigating and extracting essential insights easier.

The typical structure of a 10-K follows this format:

PART I: Business and risk factors.

PART II: Financial statements and management’s analysis.

PART III: Executive compensation and security ownership.

Let’s use Apple as an example. Their 10-K is on their investor relations website.

The table of contents looks like this:

Here are the key sections you should focus on:

1. Business

This section provides a comprehensive view of the company's primary operations, including its products and services, key markets, and competitive landscape. Pay attention to how the company generates revenue and any significant changes in its business model or market position.

🔎 What to Look For: Understand the company's primary operations, revenue streams, competitive advantages, and strategic direction.

✅ Positive Signs: A well-diversified product line, significant market share, clear growth strategy, and strong competitive moats.

❌ Red Flags: Overdependence on a single product or market, declining industry trends, unclear business direction.

It’s critical to understand a business before considering investing. For example, Apple covers its long list of hardware products and services. That’s where you can learn that the company is primarily managed on a geographic basis and that 37% of its net sales are through direct distribution channels (its own retail and online stores).

The nature of business matters to define its potential and durability:

Is the revenue recurring?

Is there a segment or geography concentration?

Does revenue depend on a few large contracts or small purchases?

What kind of investments are required to maintain the revenue run rate?

Does the company file patents and other intellectual properties to compete?

The 10-K is often my primary source of information when I break down revenue streams in my visuals. You can learn what is included in each segment. For example, advertising, AppleCare, Cloud, and Apple Pay are included in Apple’s Services segment.

I use this information across my 📊 Earnings Visuals. In case you missed it, we just dropped the December report with the most significant earnings, all in one place. I spend hours gathering all the insights so you can digest them in seconds.

2. Risk Factors

This part outlines the risks and challenges the company faces. These risks can be operational, financial, regulatory, or market-related. Understanding these risks helps you assess the company's potential vulnerabilities and how they might impact future performance.

🔎 What to Look For: Comprehensive identification of potential business, financial, and industry risks.

✅ Positive Signs: Honest, detailed risk assessments with clear mitigation plans, showing management's proactive approach.

❌ Red Flags: Generic risk descriptions, ignoring industry-specific threats, overly optimistic views.

Apple has nine pages in its 10-K listing a wide range of risks:

Macro and Industry Risks: Includes global economic conditions, changing market trends, and technological advancements impacting Apple's industry position and revenue.

Business Risks: Focuses on operational challenges like production, supply chain, product quality, and reliance on critical personnel.

Legal and Regulatory Risks: Covers legal proceedings, intellectual property issues, changes in regulatory and tax laws, and data privacy requirements.

Financial Risks: Aspects like currency fluctuations, credit and liquidity risks, and other financial management factors.

General Risks: A broad category covering miscellaneous risks such as environmental factors, natural disasters, or global disruptions.

3. Financial Statements

The core of the 10-K. This section shows the profitability, solvability, and liquidity of the business.

🔎 What to Look For: Review revenue trends, profitability metrics, debt levels, and asset management efficiency.

✅ Positive Signs: Sustained revenue growth, stable or improving margins, manageable debt, efficient asset utilization.

❌ Red Flags: Erratic revenue patterns, shrinking margins, ballooning debt, poor return on assets.

This section of the 10-K includes the trifecta of financial statements. Click below for our series on how to analyze these three documents:

📊 Income statement: Revenue, expenses, and profit or loss.

⚖️ Balance sheet: Assets and liabilities snapshot.

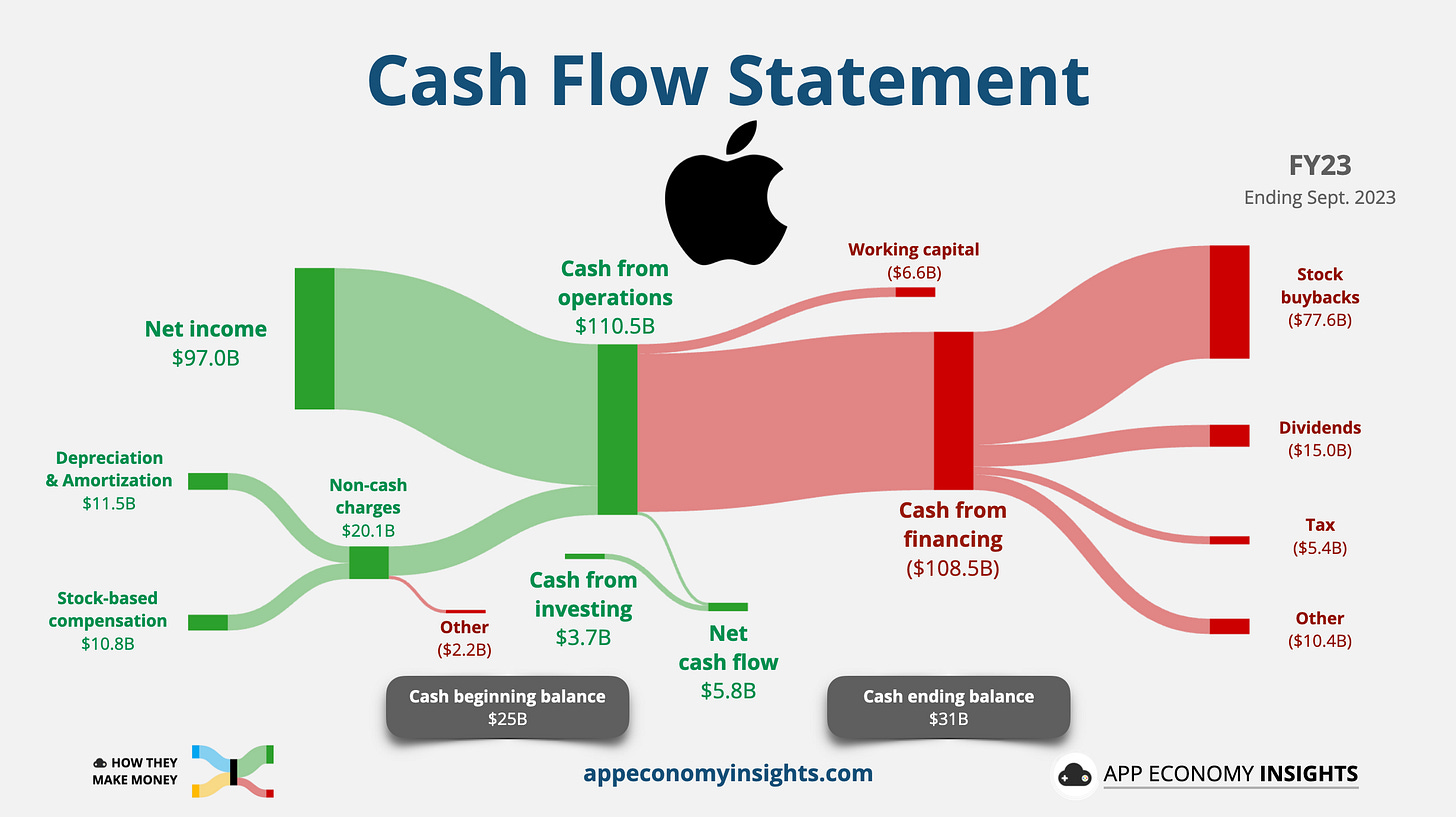

💵 Cash flow statement: How cash has moved over the period.

4. Management’s Discussion and Analysis (MD&A)

In MD&A, the company's management provides its perspective on the financial and operational results. This narrative can give context to the numbers in the financial statements, offering insights into management's strategy, future outlook, and areas of focus. It provides critical qualitative insights if you don’t have time to listen to earnings calls.

🔎 What to Look For: Management's narrative on past performance, future prospects, and strategy execution.

✅ Positive Signs: Clear correlation between strategy and results, realistic future guidance, acknowledgment of challenges with plans to address them.

❌ Red Flags: Discrepancies between management narrative and financial results, overly aggressive growth projections, lack of clarity on strategy implementation.

For example, Apple provides details on its product line-up, future expected releases, and explanations of the performance by geography and category.

Curious about the decline in iPhone sales in FY23? This section explains that lower revenue from non-Pro iPhone models was only partially offset by an improvement in revenue coming from Pro iPhone models. Management also provides color on margin trends.

5. Notes to Financial Statements

These notes provide critical details that supplement the financial statements, such as accounting methods, contingencies, legal proceedings, and detailed breakdowns of financial line items. Understanding these notes is crucial for a deeper analysis of the financial data.

🔎 What to Look For: Insight into accounting policies, revenue recognition practices, and significant financial commitments.

✅ Positive Signs: Consistent application of accounting principles, transparent revenue recognition methods, and reasonable financial obligations.

❌ Red Flags: Frequent changes in accounting methods, ambiguous revenue recognition, substantial off-balance sheet liabilities.

6. Executive Compensation

This section reveals how the company's top executives are compensated. Look for alignment between executive pay and company performance. A well-structured compensation plan can incentivize executives to focus on long-term value creation.

🔎 What to Look For: Alignment between executive pay and company performance; incentive structures promoting long-term growth.

✅ Positive Signs: Performance-based compensation models, reasonable pay compared to industry standards.

❌ Red Flags: Excessive pay unrelated to performance, complex compensation packages lacking clear incentives.

As best put by the late Charlie Munger:

“Show me the incentive and I will show you the outcome.”

7. Auditor’s Report

The auditor's report independently assesses the company's financial reporting. Look for any qualifications or concerns raised by the auditors, as these can be red flags about the company's financial practices.

🔎 What to Look For: Independent auditor’s perspective on the accuracy and fairness of the company's financial reporting.

✅ Positive Signs: An unqualified opinion indicating reliable financial statements.

❌ Red Flags: Qualified or adverse opinions, concerns about accounting policies, ongoing investigations.

I used to be a financial auditor at PwC. This section of the 10-K rarely offers anything spicy, but if it does, staying away is probably a good idea.

Applying Your Knowledge

After diving into the critical sections of a 10-K report, it's time to put your understanding to practical use. Analyzing a 10-K is about applying the knowledge gained to make informed investment decisions.

Here are some actionable tips to effectively analyze a 10-K report:

Start with a Purpose:

🔍 Define Your Goals: Before analyzing a 10-K, know what you're looking for. Are you assessing the company's financial health, growth potential, or management effectiveness? This focus will guide your analysis and help you quickly sift through the document.

Compare and Contrast:

📊 Historical Comparison: Look at previous years' 10-Ks to understand the company's trajectory. Is revenue growing? Is debt becoming more manageable? Such comparisons can reveal trends and patterns that are not immediately apparent.

🏢 Industry Benchmarking: Compare the company's performance with its peers. This can highlight strengths and weaknesses relative to competitors and provide a broader market context.

Read Between the Lines:

🔍 Management's Tone: Pay attention to the language used in the MD&A section. Optimistic language may indicate confidence, while cautious wording could hint at future challenges.

❌ Red Flags: Be wary of vague explanations, frequent changes in accounting methods, or overly complex financial structures. These could be signs of underlying issues.

Look Beyond the Numbers:

👀 Understand the Business Model: The numbers tell only part of the story. Understand how the company makes money, its competitive advantages, and its growth strategy. This understanding can provide crucial context for the financial data. Of course, this newsletter is here to help you do that.

✅ Evaluate Non-Financial Factors: Consider external factors like regulatory changes, market trends, and technological advancements that could impact the company's future. They can overshadow everything else.

Use Ratios Wisely:

📈 Financial Ratios: Utilize key financial ratios as tools, not just standalone figures. Ratios like debt-to-equity, ROE, and current ratio can provide quick insights into the company's financial health.

⚠️ Interpret Carefully: Remember that ratios can vary significantly between industries. Always consider industry norms when interpreting these figures.

Stay Updated:

👍 Follow-Up Reports: A 10-K is just a snapshot. Keep up with quarterly 10-Q reports, earnings calls, and company news to stay informed about ongoing developments.

🔴 Alerts for Changes: Set up alerts for company news and SEC filings. This can help you stay on top of any significant changes or updates.

Engage in Continuous Learning:

📚 Educate Yourself: The more you read 10-Ks, the better you'll become at understanding and interpreting them.

🤝 Seek Diverse Perspectives: Discuss your findings with other investors or financial professionals. This can provide new insights and help refine your analytical skills.

Applying these tips can transform your approach from simply reading a 10-K to actively analyzing it and making more informed investment decisions. Remember, the key is consistent practice and a willingness to learn and adapt your approach as you gain more experience.

Bottom Line

As we wrap up our guide on analyzing a 10-K, it's clear that these reports are more than just statutory documents. While diving into a 10-K might seem daunting at first, the insights gained are invaluable.

Here’s a recap of what we've covered:

⛏️ A goldmine of information: 10-K reports provide a comprehensive view of a company’s business model, risks, financial health and management strategy.

⚠️ Beyond the numbers: Navigating through the key sections with a critical eye can reveal both opportunities and potential pitfalls.

🧠 Get better over time: Applying your knowledge through practical tips and continuous learning can enhance your investment analysis skills.

Remember, the actual value of a 10-K lies in how you interpret and use this information to build a clearer picture of the company. This requires patience, practice, and a keen eye for detail. Each report you read adds to your understanding and makes you a more astute investor.

So, next time you consider an investment, take the time to open the 10-K. You might be surprised at the insights you uncover (that many others may overlook).

Do you have a company whose 10-K you'd like us to analyze in a future issue?

Drop us an email or comment below.

That’s it for today!

Stay healthy and invest on!

Learn more about App Economy Insights directly on our website.

Apply to Sponsor Us

We're offering new sponsorship opportunities for B2B and B2C brands to get in front of our audience of investors and business leaders. Click here to learn more.

Get Custom Visuals for Your Business

Interested in custom visuals for your organization or brand? Complete the form here, and we'll get in touch.

Disclosure: I am long AAPL in the App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter and across our social channels are solely our own and should not be considered financial advice or any other organization's views.

Last year I started reading these and as a non financial background person they can seem intimidating. This is an excellent breakdown on how to approach it.

What I particularly like about the 10-K as a German is their structure and that they are always structured in the same way for all companies. The annual reports of European or German companies always look different.