🔎 Alphabet: Cloud Rebounds

And subscriptions reach a new milestone

Greetings from San Francisco! 👋

Over 80,000 How They Make Money subscribers turn to us weekly for business and investment insights. Glad you're here.

Alphabet reported its Q4 FY23 performance earlier this week.

While price volatility shortly after earnings calls usually prompts analysts to decide whether a quarter is great or not, I often like to zoom out.

The stock is up 50% in the past three years.

🔎 The Innovator’s Dilemma: Once the unchallenged king of Search, Google must reinvent itself in the age of generative AI. It comes with execution risks, but the market has given the company the benefit of the doubt.

So, what happened in Q4? In short: Strong showings from Cloud and YouTube offset a slight miss on advertising revenue.

Let’s dig deeper and visualize the insights.

Today at a glance:

Alphabet Q4 FY23.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

🤝 Thanks to our partner, Borsa, the “Spotify for earnings calls.”

🎧 Simple: Borsa makes listening to an earnings call as easy as listening to a podcast. Your favorite companies are one tap away thanks to its simple feed.

📑 Full Context: Borsa’s incredibly simple platform provides transcripts, earnings releases, and presentation slides for the perfect earnings season companion.

📺 As seen on CNBC: Featured by Kelly Evans live on CNBC.

🚀 Obsessed Team: Borsa has been trusted by the world’s best investors for over 6 years and is 100% bootstrapped.

🌐 For All: Whether you're an investor, analyst, or journalist, Borsa is your go-to tool for earnings season.

Join me in using Borsa this earnings season. 👇

1. Alphabet Q4 FY23

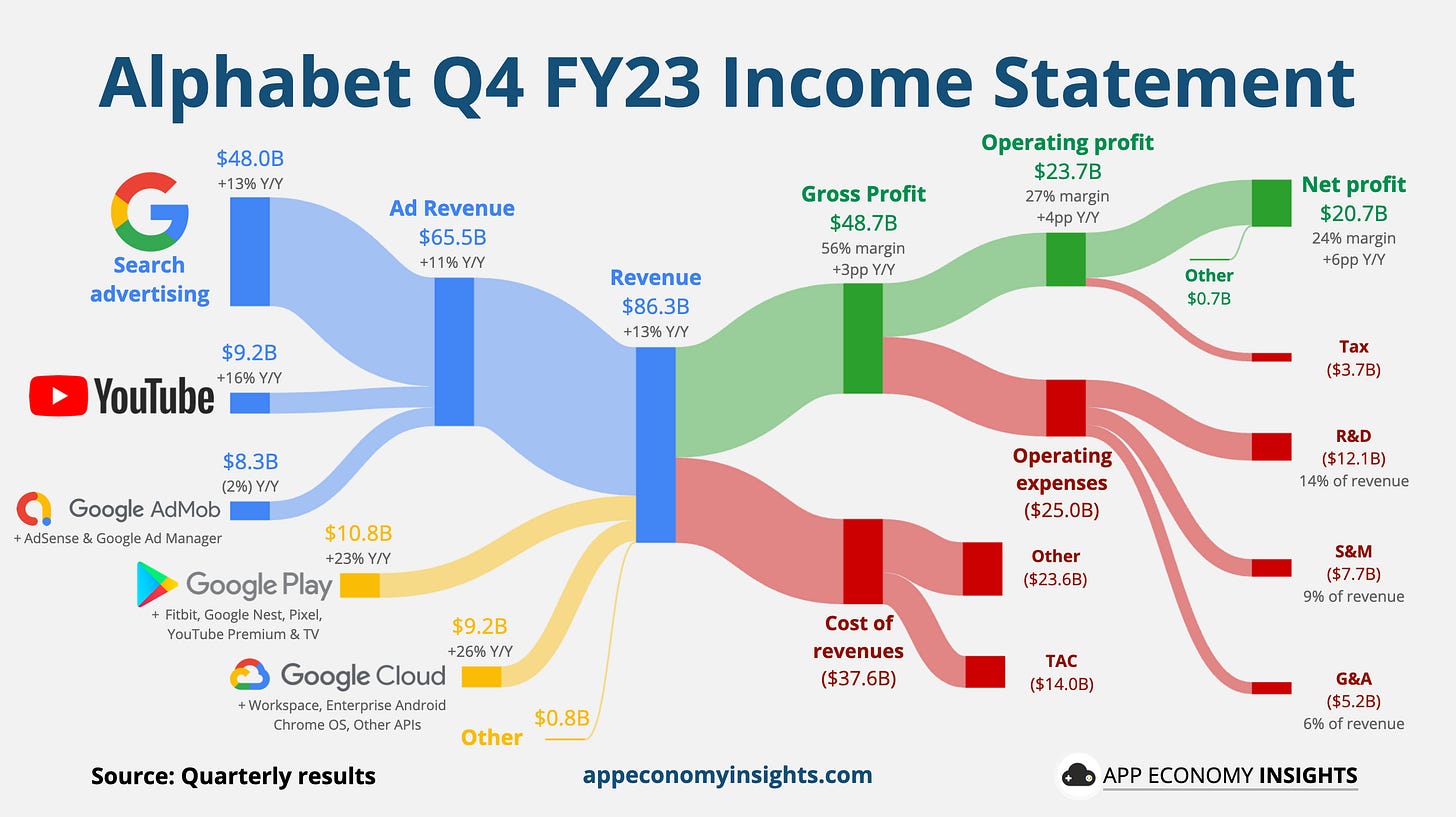

Income statement:

Here is a bird’s-eye view of the income statement.

Revenue by segment (growth Y/Y):

🔎 Advertising: $65.5 billion (+11%).

Search: $48.0 billion (+13%).

YouTube ads: $9.2 billion (+16%).

Network: $8.3 billion (-2%).

📱 Subscription, platforms, and devices: $10.8 billion (+23%).

☁️ Cloud: $9.2 billion (+26%, accelerating from +22% Y/Y in Q3).

Main highlights:

Revenue grew +13% Y/Y to $86.3 billion ($1.0 billion beat).

Gross margin was 56% (+3pp Y/Y).

Operating margin was 27% (+4pp Y/Y).

Services (Advertising & Other) was 35% (+5pp Y/Y).

Cloud was 9% (+12pp Y/Y, +6pp Q/Q).

Earnings per share $1.64 ($0.04 beat).

Cash flow:

Operating cash flow was $18.9 billion (22% margin, -9pp Y/Y).

Free cash flow was $7.9 billion (9% margin, -12pp Y/Y).

Balance sheet:

Cash, cash equivalent, and marketable securities: $110.9 billion.

Long-term debt: $13.3 billion.

So what to make of all this?

Revenue growth accelerated to its fastest since Q2 FY20, driven by an acceleration across all segments.

Ad miss: The headline was that Alphabet missed advertising revenue expectations by half a billion. Nonetheless, ad revenue growth accelerated in a more favorable environment:

Search grew +13% Y/Y (vs. +11% Y/Y in Q3), led by retail and the APAC region.

YouTube ads grew +16% Y/Y (vs. +12% Y/Y in Q3), driven by direct response and brand. It was a continued rebound after a decline earlier in FY23. For added context, Netflix grew its top line +12% Y/Y in the same quarter.

A surge in subscriptions, platforms, and devices: This category was previously named the “Other” segment. It grew +23% Y/Y, accelerating from +21% Y/Y in Q3. YouTube subscriptions (TV, Premium, and Music) and Google One (storage) were the highlights.

Cloud rebound: Cloud was once again the fastest-growing segment.

After a significant slowdown from +28% Y/Y in Q2 to +22% Y/Y in Q3, Cloud growth reaccelerated to +26% Y/Y. Better yet, this reacceleration was stronger than AWS and Azure (more on this in a minute).

In Q3, management blamed the slowdown on workload optimization. This time around, CEO Sundar Pichai said they have “mostly worked through” them.

Margins improved year-over-year primarily thanks to the cost structure optimizations earlier in FY23.

Free cash flow was $69 billion for the full year, with $59 billion going toward buybacks.

Stock buybacks increased to $16.2 billion in Q4, compared to $15.8 billion in Q3, illustrating management's confidence in the stock’s value.

Quick reminder: We just dropped our monthly Earnings Visuals report!

It’s the ultimate digest of January’s earnings, all in one place. I spend hours gathering all the insights so you can digest them in seconds.

2. Recent business highlights

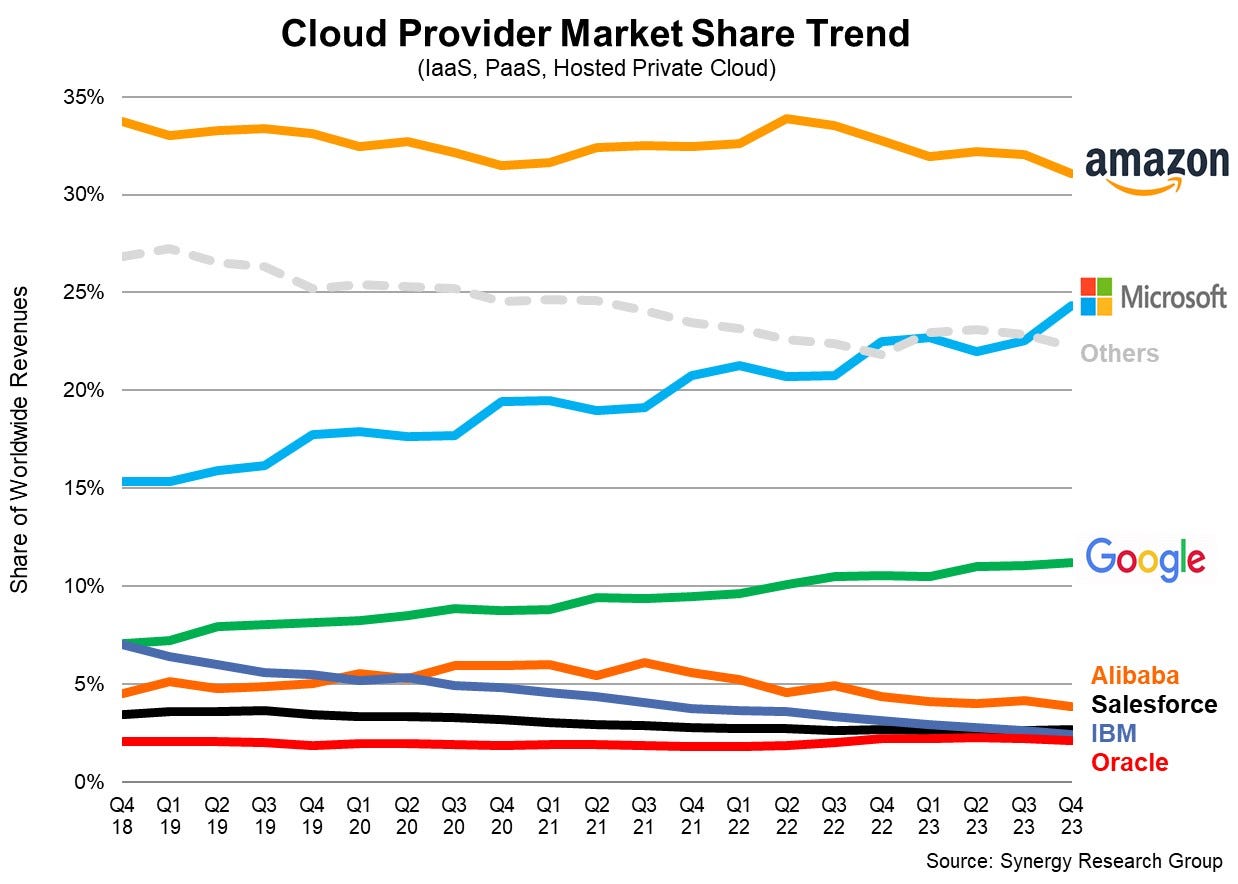

☁️ Cloud: Outpacing competition

Cloud revenue growth reaccelerated by 4 percentage points.

GCP + Workspace: Remember, Cloud includes GCP (Google Cloud Platform) and Workspace, making a direct comparison with AWS or Azure slightly complicated. Management shared previously that GCP growth is faster than the Cloud segment. GCP may be growing faster than Azure (albeit from a smaller base).

AWS and Azure show softer momentum: In the same quarter, Azure saw a flat growth at +28% Y/Y in constant currency. AWS saw a slight reacceleration to +13% Y/Y from +12% Y/Y in the prior quarter.

Cloud's operating margin expanded sharply. It was a six percentage point improvement sequentially to 9%. Meanwhile, AWS expanded its operating margin from 25% to 30% during the same quarter. The margin profile delivered by AWS at scale is a good reminder that there is a pot of gold at the end of the rainbow.

The critical role of co-sell: Pichai called out the number of co-sell deals with ISVs (independent software vendors) nearly tripling in 2023.

Increasing contribution from AI: CFO Ruth Porat specifically called AI a factor in GCP's growth momentum.

Google Cloud is still ahead of the market: According to Synergy Research Group estimates, cloud infrastructure spending grew +20% Y/Y to $74 billion in Q4, accelerating from 18% Y/Y in Q3. Amazon dominates (31% market share), followed by Microsoft (24%) and Google (11%). The big three make up 67% of the market.

▶️ YouTube is firing on all cylinders

The video-sharing platform contributes to two revenue segments:

YouTube ads: Advertising revenue generated on YouTube properties.

Subscriptions: YouTube TV, Music, Premium, and NFL Sunday Ticket. They reached a $15 billion annual run rate in FY23, including data storage. Subscription revenue is mixed with the Google Play store and device sales like Pixel.

YouTube ads alone make up 11% of overall revenue, but YouTube’s contribution is roughly 15% with subscriptions included.

After a slowdown induced by Apple’s App Tracking Transparency, YouTube ads rebounded throughout FY23 with easier comps.

For a sense of scale, YouTube ads accounted for 104% of Netflix's revenue in Q4, a rise from 101% the previous year.

Advertising is more volatile and seasonal than a premium subscription service. Ads still have a minimal impact on Netflix’s overall revenue, as discussed in our coverage of the company’s earnings last week. This could change over time, with 30% of new sign-ups opting for the ad-supported plan. In Q4, roughly 9% of Netflix members were on the ad-supported tier.

Management has prioritized growth in YouTube Shorts (short vertical videos similar to TikTok and Reels), subscriptions, and Connected TVs:

YouTube Shorts average over 70 billion daily views. Management is testing new formats that are less interruptive to viewers. If Shorts follows in Reels’ footsteps, monetization should continue to improve nicely.

YouTube TV offers the ultimate TV bundle for cord-cutters with the addition of the NFL Sunday Ticket in 2023. Features like multi-view (watching up to four streams at once), livestream reliability, and the lack of latency could improve subscriber loyalty.

YouTube dominates Connected TVs (aka “the living room”), with an 8.5% market share of US TV Time in December 2023 (excluding YouTube TV). That compares to 7.5% a year ago and 7.7% for Netflix in the same month. YouTube reaches over 150 million people on Connected TVs in the US.

3. Key quotes from the earnings call

To listen to Alphabet’s earnings call, you can use the Borsa app for free.

CEO Sundar Pichai on AI and Search:

“We're already experimenting with Gemini in search where it's making our Search Generative Experience or SGE faster for users. […] By applying generative AI to Search, we are able to serve a wider range of information needs and answer new types of questions, including those that benefit from multiple perspectives.

People are finding it particularly useful for more complex questions like comparisons or longer queries. It's also helpful in areas where people are looking for deeper understanding such as education or even gift ideas. We are improving satisfaction including answers for more conversational and intricate queries.”

On the conversational AI tool Bard:

"It's now powered by Gemini Pro and is much more capable at things like understanding, summarizing, reasoning, coding and planning. It's now in over 40 languages and over 230 countries around the world. Looking ahead, we'll be rolling out an even more advanced version for subscribers powered by Gemini Ultra.'“

On Subscriptions:

“It's now a $15 billion business annually. YouTube is the key driver of our subscription revenues. Available in over 100 countries and regions, YouTube Music and Premium have real momentum.”

YouTube announced on its blog yesterday it now has 100 million subscribers across Music and Premium. Pichai also revealed that Google One is also about to cross 100 million subscribers. The standard plan (200 GB) is $30/year, so that’s a $3 billion run rate.

On AI driving Cloud growth:

“Throughout 2023, we introduced thousands of product advances, including broad Gen AI capabilities across our AI infrastructure, our Vertex AI platform and our new Duet AI agents. In Q4, our product and Gen AI leadership enabled us to win and expand relationships with many leading brands including Hugging Face, McDonald's, Motorola Mobility and Verizon.”

On Other Bets:

“Waymo, which is deeply focused on safety, reached over 1 million fully autonomous ride-hailing trips. And Isomorphic Labs entered into strategic partnerships with Eli Lilly and Novartis to apply AI to treat diseases, which has great potential.“

CFO Ruth Porat on headcounts and efficiencies:

“We're focused on removing layers to simplify execution and drive velocity. Both product prioritization and the organization design efforts result in a slower pace of hiring.”

In addition, she indicated an increase in capital expenditures in FY24, focusing on technical infrastructure, predominantly for AI-compute investments.

4. What to watch looking forward

These three Gen AI initiatives are the most critical to watch:

🤖 Gemini is here

All these AI names can be confusing, but in short:

💬 Bard is a conversational AI, similar to ChatGPT, designed for engaging in natural conversation and completing user-specific tasks.

🧠 Gemini is a foundational model, similar in concept to GPT-4, focused on advanced reasoning.

Developed by DeepMind, Gemini is multimodal, meaning it can understand and combine text, images, audio, video, and code. It will power everything in the backend, from Ads to Search to Cloud capabilities.

🥸 ‘Fake’ demo backlash:

In December, Alphabet released a marketing video showcasing Gemini’s impressive real-time capabilities. Turns out, the video was heavily edited and misleading. Responses were sped up, and the model couldn't handle live video as shown. This sparked significant backlash for overhyping and misrepresenting the interaction. The company apologized and clarified, but the incident raised concerns nonetheless.

There are three Gemini models you should know:

🔹 Gemini Nano: Optimized for on-device tasks (mobile use cases) and already available on Pixel 8 phones.

⬛️ Gemini Pro: Versatile and powerful for various tasks, currently in early preview through Cloud and specific apps. ️It outperforms GPT-3.5 in most areas.

⚫️ Gemini Ultra: Most powerful for complex tasks. It outperforms GPT-4 in most benchmarks but is still under testing and safety checks. Ultra is expected to be released later in 2024. ⏳

Rollout and pricing:

The models are being updated and added to apps regularly. For example, Bard got a Gemini Pro update globally this week.

Gemini Ultra will require a paid subscription. Microsoft charges Enterprise customers $30 per user/month for Copilot, so it’s a good indication of what to expect.

💬 Assistant with Bard

Alphabet plans to supercharge Assistant with Bard, promising a leap in AI capabilities and user interaction.

🤖 Integration Details: Bard will be accessible through voice commands or double-tapping device side buttons, featuring full web functionality. It aims to offer improved reasoning and AI-driven interactions closely tied to the Gemini model update.

📱 Device Compatibility: Initially, this feature might be exclusive to Tensor-powered Pixel phones, excluding the Pixel Tablet and Pixel Fold. Availability on non-Pixel phones remains unclear.

🔄 User Interface: Users can interact with Bard through a half-screen window that pops up from the search bar, allowing for typed or spoken queries and responses.

📲 App Integration: Bard will be integrated with apps like Gmail, Maps, and Drive, and will also have access to the camera on Android phones.

🔒 Limited Release: The launch could be part of an Android feature drop in March, with a possible limited release to specific devices

🔎 SGE (Search Generative Experience)

SGE is disrupting the traditional '10 blue links' search format, introducing a dynamic AI-enhanced experience. Early phases show promising user engagement, with a richer variety of sources and AI-generated overviews enhancing the search experience.

Pichai said, “We are surfacing more links with SGE and linking to a wider range of sources on the results page.” Based on initial feedback, users find ads around the AI-powered overview helpful to their search.

Search remains 56% of Alphabet’s revenue, so SGE is the biggest needle mover. Like the transition from desktop to mobile, this new transition to an AI-enhanced experience is only getting started.

As more AI features come to boost existing Alphabet properties, it’s becoming evident that the company is willing to break things. Now, the question is whether they can move fast enough.

As we find the stock inches away from its recent new all-time high, it looks like the market is giving the company the benefit of the doubt.

Stay tuned for more reviews of big tech earnings in the coming weeks.

That’s it for today!

Stay healthy and invest on!

Sponsor Us

We're offering new sponsorship opportunities for B2B and B2C brands to get in front of our audience of investors and business leaders. Click here to learn more.

Get Your Business a Custom Chart

Interested in custom charts for your organization or brand? Complete the form here, and we'll get in touch.

Author's Note (Bertrand here 👋🏼): The views and opinions expressed in this newsletter are solely my own and should not be considered financial advice or any other organization's views.

Disclosure: I am long GOOG in the App Economy Portfolio. I share my ratings (BUY, SELL, or HOLD) with App Economy Portfolio members.