🍿 Netflix Steps into the WWE Ring

And a closer look at a potential revenue push in gaming

Greetings from San Francisco! 👋🏼

A warm welcome to the recent additions to our community!

Over 78,000 How They Make Money subscribers turn to us weekly for business and investment insights. Glad you're here.

🤼♂️ What happened?

Netflix landed a 10-year deal worth over $5 billion, securing exclusive rights to WWE’s flagship program ‘Raw.’ Starting in January 2025, this is Netflix's first major foray into live “sports entertainment.” It will include rights to other WWE shows outside the US, like Smackdown and Wrestlemania.

🌍 Global appeal

WWE's programming is available in over 180 countries and 30 languages, reaching over one billion homes worldwide. In 2023, the average viewership for Raw was 1.7 million, making it an excellent fit for Netflix and its international reach.

🤝 A perfect match

WWE Network moved exclusively to Peacock in 2021 in the US after mixed results with its own subscription. With Netflix, WWE will benefit from a much larger platform to reach fans old and new. In turn, Netflix gets exclusive content to mitigate churn and win back members with regular live events. Win-win.

TKO President Mark Shapiro said in a statement:

“This deal is transformative […] and locks in significant and predictable economics for many years. Our partnership fundamentally alters and strengthens the media landscape, dramatically expands the reach of WWE, and brings weekly live appointment viewing to Netflix.”

You might be wondering how WWE makes money. Can we visualize this?

Well, well, well, step into my office.

But first, what's the latest on Netflix as we analyze the last quarter of FY23?

Let's unpack the numbers and explore deeper.

Today at a glance:

Netflix Q4 FY23 overview.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

1. Netflix Q4 FY23

Two factors impact Netflix’s revenue:

👨👩👧👦 The number of paid memberships.

💵 The average revenue per membership (ARM).

Netflix has been cracking down on password-sharing since May 2023 in the US and parts of EMEA. It has led to a surge in new sign-ups since then.

👨👩👧👦 New paid memberships:

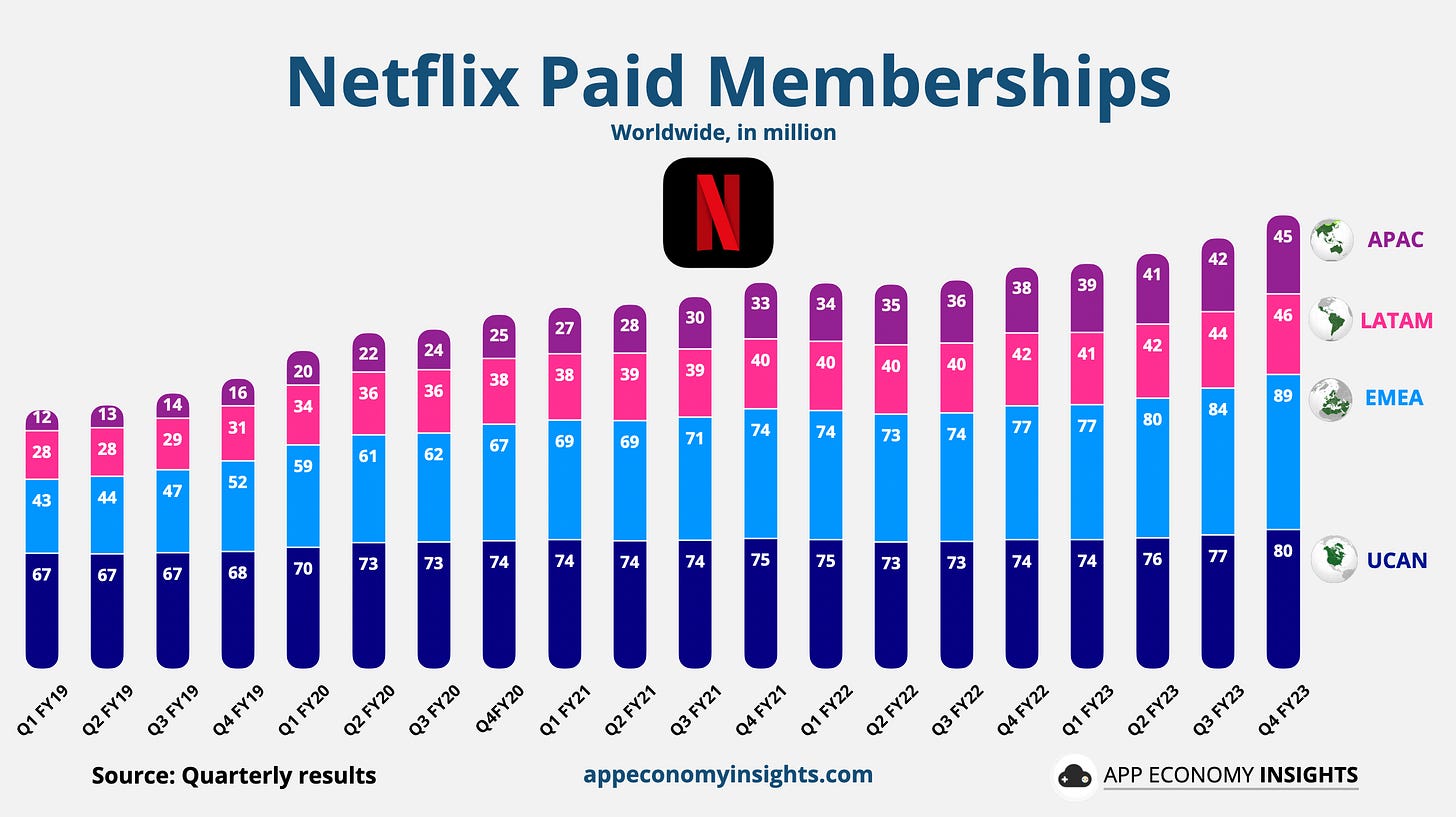

260 million paid memberships at the end of FY23.

Added over 13 million in Q4 (vs. ~9 million expected) +13% Y/Y.

It’s the best quarter in membership adds since early 2020 (boosted by the pandemic) and the largest Q4 ever.

Growth was most notable in the APAC region (+19% Y/Y) and the EMEA region (+16% Y/Y). All regions added over 2 million subscribers during the quarter.

💵 ARM (Average Revenue per Membership):

With variables like paid sharing and advertising, revenue growth is now a better performance indicator than paid membership.

ARM was up only 1% Y/Y, which was explained by a higher growth from lower ARM countries, partially offset by price hikes in the US, France, and the UK in October. For example, in the US:

Basic increased from $9.99 to $11.99/month (+20%).

Premium increased from $19.99 to $22.99/month (+15%).

Price hikes usually temporarily increase churn, but the negative reaction tends to be short-lived. Judging by the addition of nearly 3 million net new members in North America in Q4, the price hike was digested quickly.

It was also an effort to make the $6.99/month ad-supported plan more appealing. Remember, the ad plan requires sufficient reach to appeal to advertisers. In addition, after factoring in advertising revenue, Netflix makes more money on the ad-supported plan than its Standard plan ($15.49/month).

Let’s put today’s earnings in context by visualizing the financials of Netflix, WWE, and recent streaming trends.