🏦 US Banks: JPMorgan's Dominance

And why earnings looked really bad this quarter

Greetings from San Francisco! 👋

Over 75,000 How They Make Money subscribers turn to us weekly for business and investment insights. Glad you're here.

As always, earnings season kicks off with US Banks.

It’s the perfect time to reflect on the current macro environment and set expectations for the upcoming flurry of earnings coming our way.

You can expect an avalanche of visuals in the coming weeks as we learn how businesses finished 2023.

So, what did we learn from the nation's top lenders?

JPMorgan has a strong showing, particularly relative to other banks. We’ll visualize the earnings of all the major players, including critical takeaways.

Today at a glance:

The Big Picture.

JPMorgan’s Record Year.

Bank of America’s One-off Charges.

Wells Fargo’s Office Loans Concern.

Morgan Stanley’s Leadership Change.

Goldman Sachs Boosted by Investments.

Citigroup Cuts 20,000 Jobs.

The Big Picture

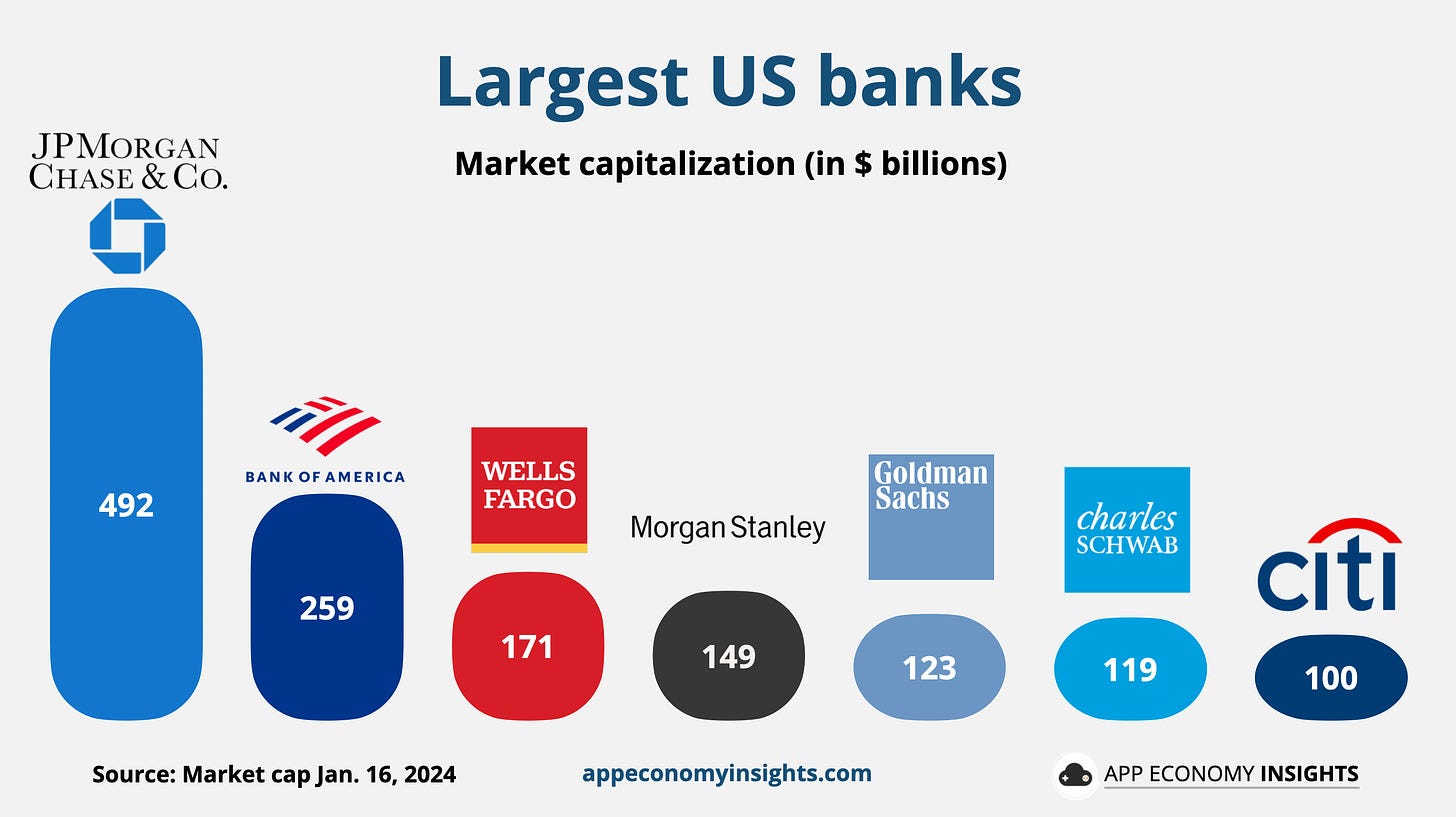

Here’s an updated look at the largest US banks by market cap.

JPMorgan CEO Jamie Dimon explained:

“Our record results in 2023 reflect over-earning on both NII and credit, but we remain confident in our ability to continue to deliver very healthy returns even after they normalize.”

In short, earnings are expected to decline throughout 2024.

Let’s review why.

Banks make money through two main revenue streams:

💵 Net Interest Income (NII): The difference between interest earned on loans (like mortgages) and interest paid to depositors (like savings accounts). It’s the main source of income for many banks and depends on interest rates.

👔 Noninterest Income: The revenue from services unrelated to interest. It includes fees (like ATM charges), advisory services, and trading revenue. Banks relying more on noninterest income are less affected by interest rate changes.

Here are the major developments in Q4 FY23: