Hello there! 👋

Greetings from San Francisco!

Welcome to the new members who have joined us this week!

Join the fast-growing How They Make Money community to receive weekly insights on business and investing.

Taiwan Semiconductor Manufacturing Company (NYSE: TSM), or TSMC for short, made headlines in the past few days after increasing its investment in a manufacturing facility in Arizona from $12 billion to $40 billion.

So it’s an excellent opportunity to look at the company's recent performance and its importance for the global tech supply chain.

Today, we’ll cover the following:

TSMC is the world’s largest semiconductor foundry.

They supply chips for the likes of Apple, AMD, and NVIDIA.

They have developed some of the most advanced technology in the industry and are using it to revolutionize the way that chips are made. With cutting-edge processes and state-of-the-art equipment, TMSC is leading the charge in the world of semiconductors.

Whether it's for consumer electronics, industrial applications, or anything in between, TMSC has the expertise and the technology to get the job done right.

The demand for advanced chips has increased over time with the rise of smartphones and the shift to the cloud. Today, these chips are critical to progress in AI, which is still in its infancy.

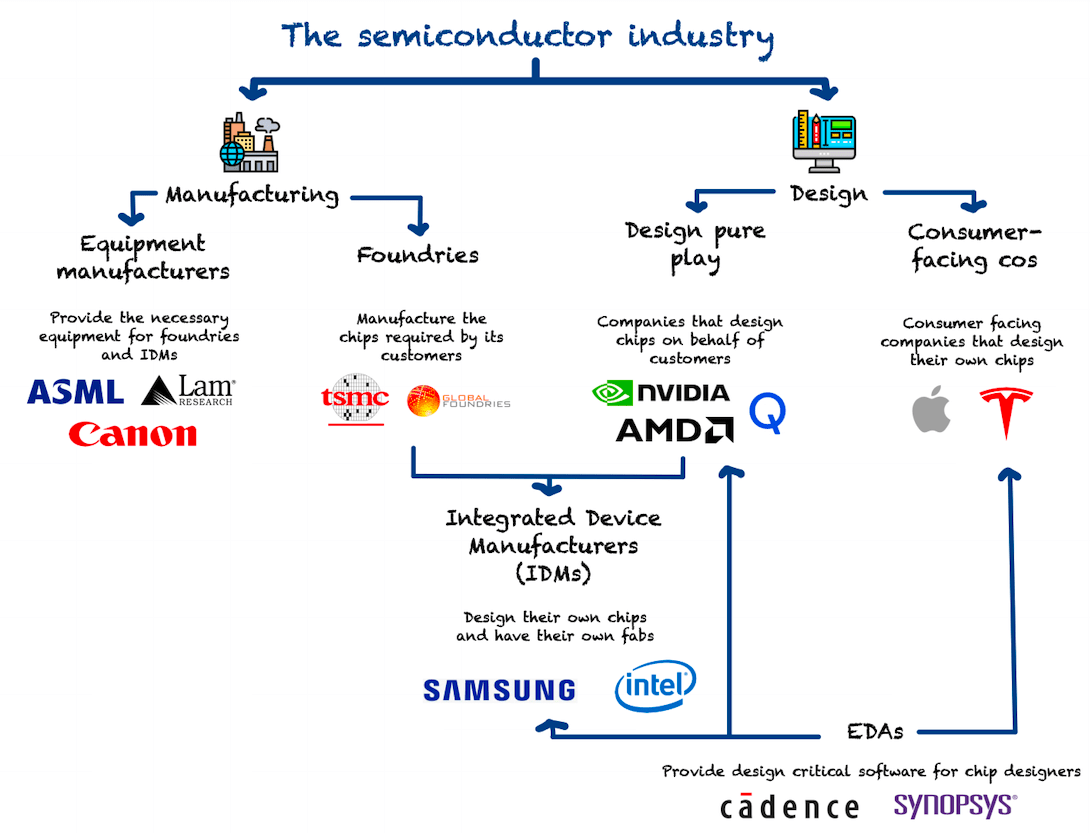

The semiconductor industry can get a bit overwhelming at first. To put TSMC on the map, the summary below, designed by Leandro (@Invesquotes), does a fantastic job of breaking down the main participants.

TSMC manufactures semiconductors based on designs provided by its customers. The company offers a comprehensive range of fabrication processes alongside packaging and testing services.

About 2/3rds of TSMC’s revenue comes from customers headquartered in North America. US-based fabless chip makers (who outsource their production) have increasingly relied on TSMC over the year, which has created new geopolitical risks.

The ongoing trade tensions between the United States and China could escalate and lead to restrictions on the movement of goods or materials, which could affect TSMC's ability to obtain the materials it needs to manufacture its products.

Before we start, let’s discuss how TSMC makes money.

The principal source of revenue is wafer fabrication (89% of revenue in 2021), with the rest coming from packaging and testing services, design, and royalty income.

The semiconductor industry innovates by creating smaller, faster, and cheaper products. A smaller semiconductor means more transistors can be placed on a chip. In addition, it allows for more computing tasks at a lower temperature. Therefore, the smaller the size, the better the performance.

The process technologies range from mature process circuit resolutions of 0.25 micron (or above) down to 5-nanometer chips (also called “N5”). The smaller the resolution, the more advanced the technology (and the higher the selling price).

The chart below shows the wafer revenue by technology in the past three years. Over time, the smaller semiconductors replace the larger ones. As they say in The Lion King, it’s the circle of life.

There are already more advanced technologies in the pipeline, all the way to 2-nanometer chips, coming to a device near you by 2026.

Revenue is broken down by use case at the platform level:

📱 Smartphone (~41% of overall revenue).

💻 High-Performance Computing (~39% of overall revenue).

💡 IoT (~10% of overall revenue).

🚘 Automotive (~5% of overall revenue).

🎮 Digital Consumer Electronics (~2% of overall revenue).

Others (~3% of overall revenue).

Costs and expenses include:

Cost of revenue: Cost of finished goods, inventory write-down, depreciation of property, plant, and equipment, right-of-use assets, amortization of intangible assets, and some personnel expenses.

Research & development: Continuing investment in process technologies. In recent quarters, higher levels of research for 2 to 4-nanometer are partially replacing research in the 5 to 7-nanometer category.

General, administrative, and marketing expenses: Employee-related costs, patents, depreciation expenses, and start-up expenses of overseas fab preparation.

Margins:

The gross margin fluctuates with capacity utilization, cost improvement, product mix, and exchange rate. In the year a new technology is introduced, the gross margin takes a temporary hit.

The operating margin has followed in the footsteps of the gross margin. It’s been north of 30% in the past decade.

Let’s look at the most recent quarter.