🚘 Tesla: Growth on autopilot

Price cuts, FSD investigations, brand favorability and more

Hello there! 👋

Greetings from San Francisco!

Welcome to the new members who have joined us this week!

Join the thousands of How They Make Money subscribers receiving insights on business and investing every week.

Tesla (TSLA) reported its Q4 FY22 earnings last week.

It’s one of the most requested companies by the community, so we got you covered with this update!

Today, we’ll discuss the following:

Tesla Q4 FY22.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

TSLA stock has been a rollercoaster, still ~60% off its 2021 peak but up more than 30% since Christmas Day.

The earnings report was the opportunity to look at recent developments:

Demand.

Price cuts.

Cybertruck.

Brand favorability.

Autonomous driving.

Next-generation vehicle.

So let’s dive in!

1. Tesla Q4 FY22

Tesla primarily makes money from selling/leasing electric vehicles (88% of revenue), followed by services (7%) and energy generation & storage (5%).

Revenue is impacted by the number of deliveries and the ASP (average selling price).

Key metrics:

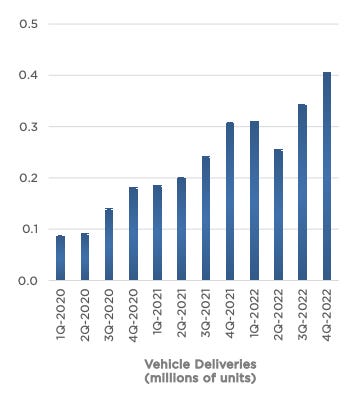

Total production 440K vehicles (+44% Y/Y).

Total deliveries 405K vehicles (+31% Y/Y).

Income statement:

Here is a bird’s-eye view of the income statement.

Data source: Shareholder Letter.

Main highlights:

Revenue grew 37% Y/Y to $24.3 billion (in-line).

Gross margin 24% (-4pp Y/Y).

Operating margin 16% (+1pp Y/Y).

EPS (non-GAAP) grew 40% Y/Y to $1.19 ($0.08 beat).

Some notes:

Auto revenue has a 26% gross margin. The other segments (energy and services) have a much smaller gross margin profile (12% and 6%, respectively).

Auto revenue included $0.3 billion from Full Self-Driving (FSD).

Tesla is very lean, with only $1.9 billion in operating expenses (8% of revenue), including $0.8 billion in research & development (3% of revenue).

My favorite financial metric is the operating margin. We want it to increase over time to show that the company is demonstrating operating leverage. Tesla’s margin profile (> 16%) is well ahead of the rest of the auto industry.

Cash flow:

Operating cash flow was $3.3 billion (13% margin).

Free cash flow was $1.4 billion (6% margin).

Balance sheet:

Global vehicle inventory (days of supply) was 13 (+225% Y/Y).

Cash, cash equivalent, and marketable securities: $22.2 billion.

Long-term debt: $6.9 billion.

FY23 Guidance:

Management continues to forecast a 50% CAGR (from the target set in 2021) over a multi-year time horizon — which is not the same as a 50% growth moving forward (more on that in a second). Cybertruck remains on track to begin production later this year at Gigafactory Texas. A next-generation vehicle will be discussed at Investor Day (Mach 1, 2023).

So what to make of all this?