🎮 Tencent: Mastering the Game

How the Chinese giant became an unstoppable tech investment powerhouse

Greetings from San Francisco! 👋

Welcome to the new members who have joined us this week!

Join the 32,000+ How They Make Money subscribers receiving insights on business and investing every week.

Tencent (TCEHY) is a giant you need to know about.

It's not just any company – it's a powerful force in the tech world. Founded in 1998, Tencent has become a huge conglomerate through smart execution and savvy investments. It now has a market cap of nearly $500 billion. Enough to be the largest Chinese company and the 11th largest company in the world. 😮

What makes Tencent so special, you ask?

Tencent is a master of many trades. It has its fingers in social media, digital content, fintech, and more. You might have heard of WeChat, the app that does it all. Tencent made it! With over 1 billion users, WeChat (or Wexin in China) is a game-changer in how people communicate, shop, and have fun.

But wait, there's more!

Tencent is also a big player in gaming. Here are some of their ownership stakes:

100% of Riot Games, the folks behind League of Legends and Valorant.

84% of Supercell, the studio that made Clash of Clans and Clash Royale.

40% of Epic Games, the company behind the Epic Games store and Fortnite.

19% of Sea Limited that we recently covered.

11% of Ubisoft, the French gaming company behind Assassin’s Creed.

The list goes on.

When you put it all together, Tencent is the world's biggest gaming company! 🎮

Tencent is also making waves in AI, cloud computing, and fintech. They invest in hundreds of other companies, spreading their influence far and wide. It's a company that keeps growing and evolving, making it a must-watch for anyone interested in the future of tech.

Today, we’ll cover the following:

Tencent FY22.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

Tencent's success is backed by a team of experienced leaders. Pony Ma, its co-founder and CEO, is the driving force behind the company. He's been steering the ship since day one and knows Tencent like the back of his hand.

Additionally, two other key figures are Martin Lau (President) and James Mitchell (Chief Strategy Officer). These former Goldman Sachs executives are a driving force behind Tencent's acquisitive disposition.

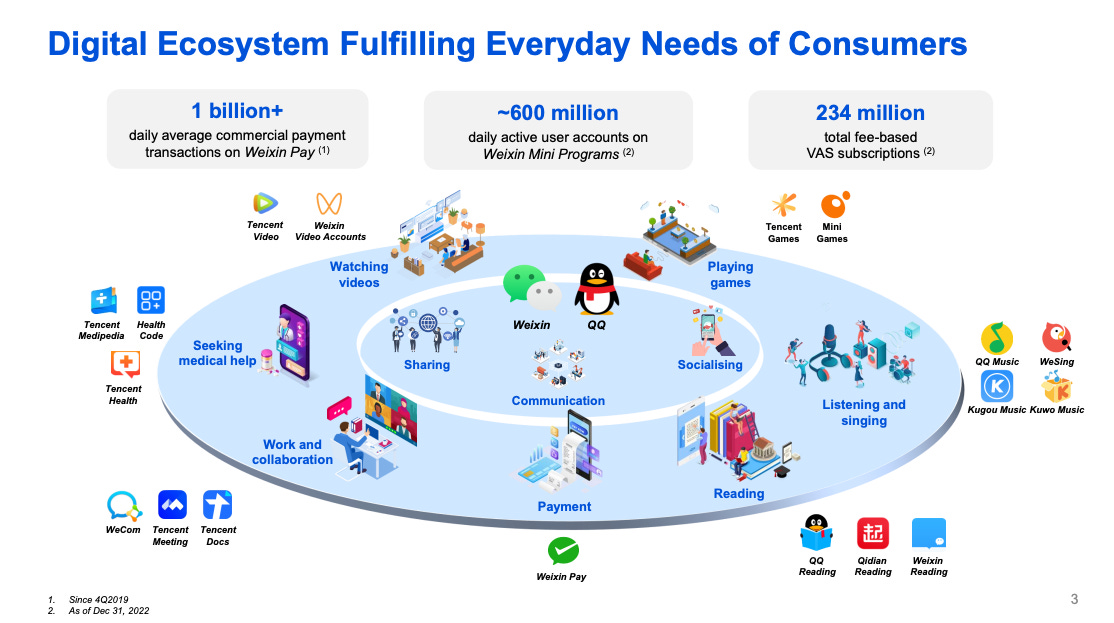

The chart below shows how Tencent’s segments are interconnected, with social platforms at the center.

Let’s break down how the company makes money:

🎮 Online Games: Tencent is the world's largest gaming company. Online games are almost a third of their revenue. They make money from in-game purchases, subscriptions, and advertising.

💬 Social Networks: Tencent's social media platforms, like WeChat and QQ, generate revenue through advertising, subscriptions, and sales of virtual items. As the user base grows, so does the potential for more revenue from these sources.

▶️ Online Advertising: Tencent makes money from online ads on their platforms and partner websites. This includes display ads, video ads, and sponsored content.

☁️ Fintech and Business Services: This segment includes revenue from WeChat Pay (Tencent's mobile payment system), wealth management, cloud services, and other financial services.

Other: Tencent generates additional income from other sources, such as licensing fees, e-commerce transactions, and content distribution.

The chart below gives an excellent overview of Tencent’s sprawling digital ecosystem:

Wexin (WeChat) and QQ (instant message mobile platform) are in the center. These platforms connect users, content, and services. Wexin alone has more than 1.3 billion monthly active users. 👀

Weixin Mini Programs (lightweight applications within the WeChat ecosystem across e-commerce, games, travel bookings, and more) count ~600 million daily active users.

Weixin Pay counts over 1 billion daily average commercial payment transactions.

Weixin Video Accounts (Tencent’s take on TikTok) is an increasingly crucial separate platform, ramping its monetization via in-feed ads, live streaming tipping, and e-commerce.

And so much more.

To measure Tencent's success, keep an eye on these factors:

👨👩👧👦 User Growth: Number of users on apps and services and how often they engage with the ecosystem. Keep an eye on MAU (monthly active users) and DAU (daily active users).

💳 Value Added Services (VAS) refer to extra features and services beyond essential functions. They include micro-transactions in free-to-play games, messaging add-ons, subscriptions, and more.

🛒 Gross Merchandise Value (GMV): Total value of transactions processed.

💰 Investments: The money Tencent puts into other companies and how those investments grow. Tencent unlocks shareholder value through its various stakes in smaller companies.

Tencent is constantly evolving. They're not afraid to try new things and keep pushing the limits. That's what makes it such an exciting company to watch! But there are critical regulatory risks that we’ll discuss in more detail.

Let’s look at the most recent quarter.

1. Tencent FY22

Key user metrics:

💬 Weixin & WeChat MAU: 1,313 million (+4% Y/Y).

🐧 QQ Mobile device MAU: 572 million(+4% Y/Y).

Income statement:

Here is the bird’s-eye view of the income statement.

Note: Tencent reports only some of its metrics in USD. For example, in FY22:

Revenue was $80 billion.

Operating profit was $34 billion.

The data in the chart below is in Renminbi (RMB). So you would have to divide the number by ~7 to get the dollar amount.