🎬 Streaming Giants Visualized

A closer look at the latest quarter and subscriber trends

Greetings from San Francisco! 👋🏼

A warm welcome to the recent additions to our community!

Over 60,000 How They Make Money subscribers turn to us weekly for business and investment insights. Glad you're here.

Coming up this Friday: our anticipated quarterly review of Hedge Funds’ Top Buys. Don't miss out on uncovering what top money managers are investing in — catch up with our Q2 edition here. 👇

Today, we unpack Streaming Giants for Premium subscribers.

We'll visualize the recent performances of key market players and examine the broader landscape.

With the Hollywood strikes wrapped up and production soon back in full swing, we'll explore the implications of new contracts on AI, streaming residuals, and more.

The six-month strike hiatus temporarily boosted cash flow for companies unable to spend on production. However, delayed releases could shake up subscriber dynamics. How did this play out for industry leaders like Netflix? Find out in our latest quarter review. 👇

So, what did we learn from other media giants?

Who is showing signs of success in the battle for our attention?

For a glossary on SVOD, AVOD, OTT, DTC, and more, revisit our Industry Showdown article for an extensive market overview.

Today at a glance:

Trends and market share.

The new deal after Hollywood strikes.

Comcast’s Peacock narrows down its losses.

Disney’s new “building” phase.

Barbie can’t save Warner.

Roku’s ad momentum.

Paramount’s DTC investment has peaked.

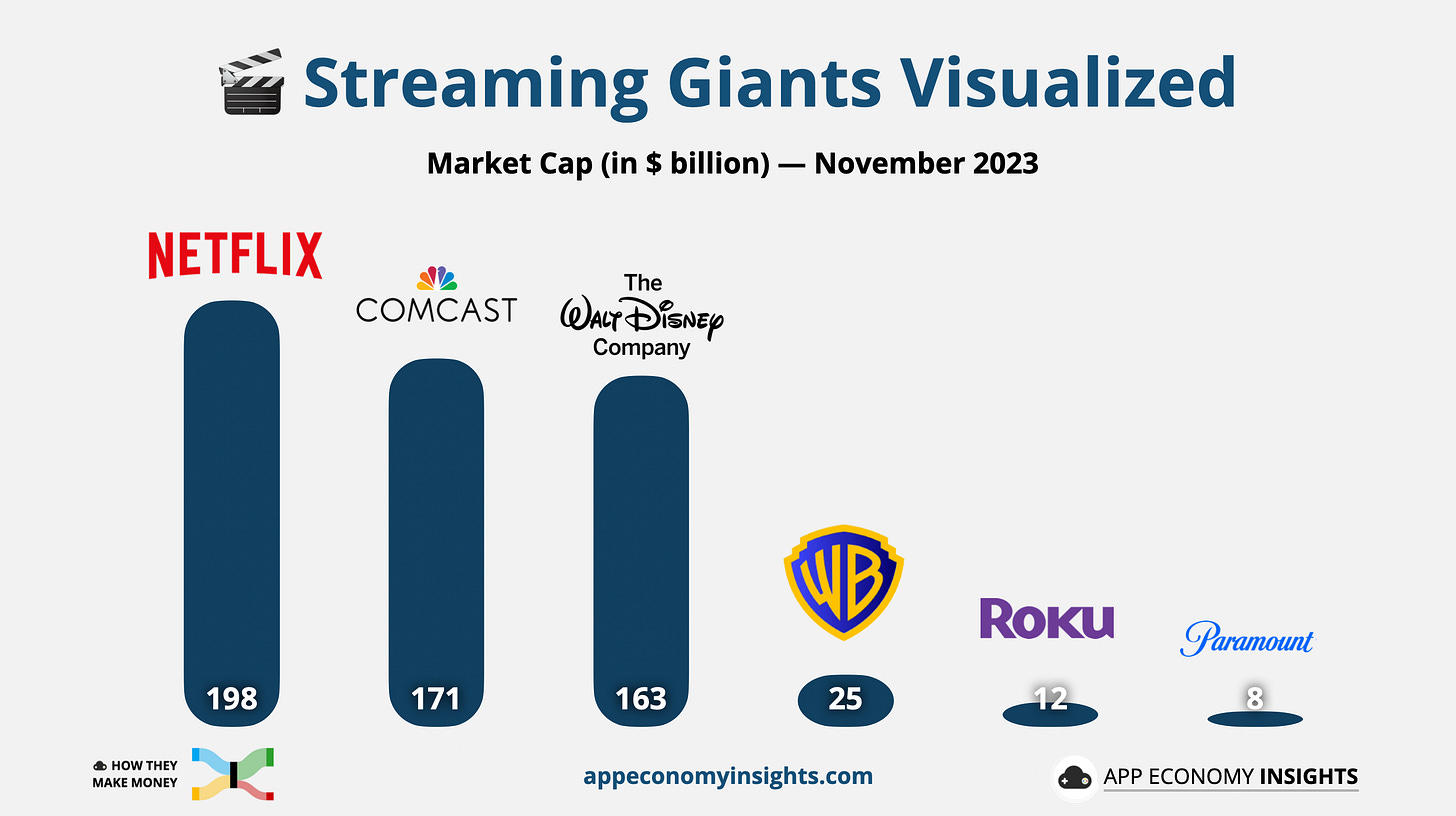

1. Trends and market share

In recent months, we've seen all streaming services hiking their prices. Netflix's premium plan now costs $22.99, while Disney+ and Hulu have increased their ad-free tiers. Even Apple TV+ has recently jumped from $6.99 to $9.99. This marks a shift away from the era of heavily subsidized content

The chart below shows the current paid subscriber trends in the past four years. Some only started sharing their membership numbers recently. YouTube Premium, Amazon Prime Video, or Apple TV+ don’t share their numbers.

Disney’s fluctuating subscriber numbers are primarily due to losing rights to the Indian Cricket Premier League. Excluding Disney+ Hotstar in India, Disney+ Core's paid subscribers hit 113 million in Q3 2023, a 9% year-over-year increase.

This scenario underscores the importance of user retention and churn in today’s streaming market. As customers find it easy to hop between services, maintaining subscriber loyalty is becoming a key challenge for providers.

Conversely, the shift from linear TV to streaming has been a high tide lifting all boats, as illustrated by the following chart.