🎬 Streaming Giants Earnings

Subscriber trends and the future of legacy media companies

Greetings from San Francisco! 👋🏼

Welcome to the new members who have joined us this week.

Join the 47,000+ How They Make Money subscribers receiving insights on business and investing every week.

Stay tuned for a special free article coming up this Friday!

By popular demand, we’ll cover the Hedge Funds’ Top Buys in Q2 2023, shedding light on their investment strategies and the possible rationale behind their picks.

Today, we unpack Streaming Giants for Premium subscribers.

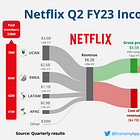

The dual strikes by Hollywood writers and actors could impact the timing of the release of shows and films for all market participants (more on that in a minute). However, not all players are impacted equally, as discussed in our recent review of Netflix’s Q2 FY23. 👇

So what did we learn from the latest earnings?

Who is showing signs of success in the battle for our attention?

For a full breakdown of how entertainment leaders make money, take a look at our Industry Showdown article, where we reviewed the state of the market and the key trends to watch.

That’s where we define terms like SVOD, AVOD, OTT, DTC, and all that good stuff.

Today at a glance:

Trends and market share.

Disney hikes streaming prices.

Peacock shines for Comcast.

Warner’s quest for synergies.

Paramount sells assets and consolidates.

1. Trends and market share

Competition is fierce in the SVOD category (Subscription Video On Demand).

And if you don’t keep up regularly, it’s easy to lose track of the services available:

Netflix now has a cheaper ad-supported tier (but no free plan).

Disney+ is available standalone or as a bundle with Hulu and ESPN.

Paramount+ now includes a version with Showtime at $11.99.

HBO Max has now rebranded to “Max,” integrating Discovery+ content.

Peacock has multiple paid tiers, including an ad-free Premium Plus plan.

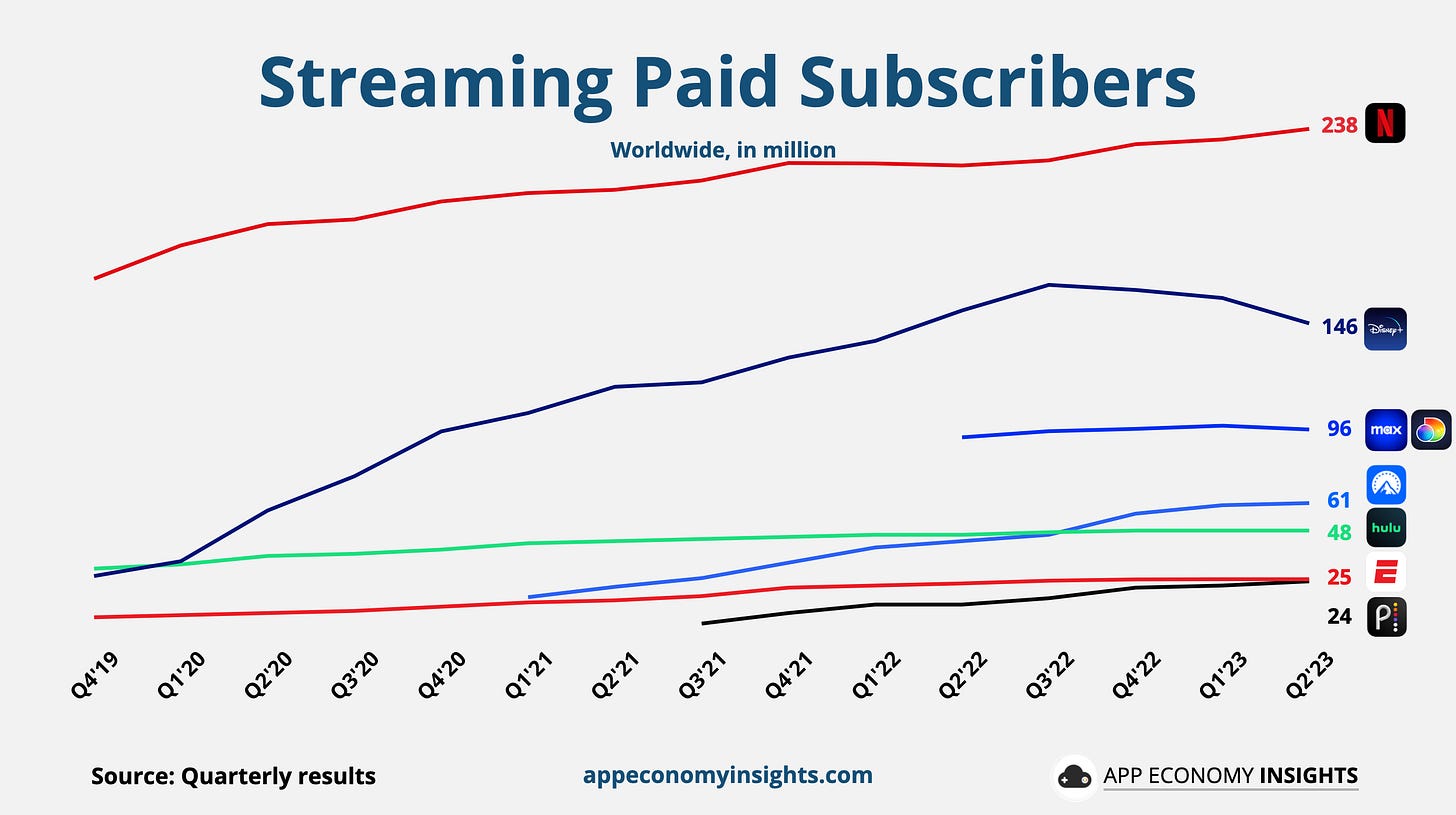

The chart below shows the current paid subscriber trends. Note that some of them only started sharing their DTC (Direct-To-Consumer) numbers only for a few quarters. We don’t have an exact paid subscribers count for YouTube Premium, Amazon Prime Video, or Apple TV+.

Looking at the chart, you might be wondering what is happening at Disney+.

As we covered in our review of the previous quarter, Disney+ Hotstar (in India) was bound to lose millions of paid subscribers in 2023 after losing access to the Indian Cricket Premier League to Viacom18. Excluding Hotstar, Disney+ “Core” just reached 106 million subscribers (+13% Y/Y).

While all streaming platforms had some success with customer acquisition over the years, they now all face the challenge of preventing churn (the percentage of paid subscribers who stop paying in a given month).

After all, the main benefit of the unbundling of legacy cable is to be able to pick and choose which service to subscribe to month-to-month based on the content we actually watch.