🎬 Streaming: Awards Season

Can streaming platforms handle the spotlight?

Welcome to the Premium edition of How They Make Money.

Over 190,000 subscribers turn to us for business and investment insights.

In case you missed it:

The 97th Academy Awards marked a shift in how audiences experience Hollywood’s biggest night. For the first time, the Oscars streamed live on Hulu, reinforcing streaming’s growing grip on major live events.

But the performance didn’t earn a standing ovation. Viewers struggled to log in, and just as the night reached its climax—Best Actress and Best Picture—the Hulu stream cut out entirely. A déjà vu moment for those who remember Netflix’s Paul-Tyson boxing debacle in November: buffering, blurry signals, and frustration all around.

With streaming platforms racing to own live events, the stakes have never been higher. Live TV isn’t just about content anymore—it’s about execution. As more marquee broadcasts cut the cord, can streaming platforms handle primetime without a glitch?

Let’s dive into how the biggest players performed last quarter.

Today at a glance:

Trends and Market Share.

Disney: Streaming Profit Beat

Comcast: Broadband Struggles

Warner: Max Powers Up

Paramount: Merger in Motion

Roku: Platform Strength

For a glossary on SVOD, AVOD, OTT, DTC, and more, revisit our Industry Showdown article for an extensive market overview.

1. Trends and Market Share

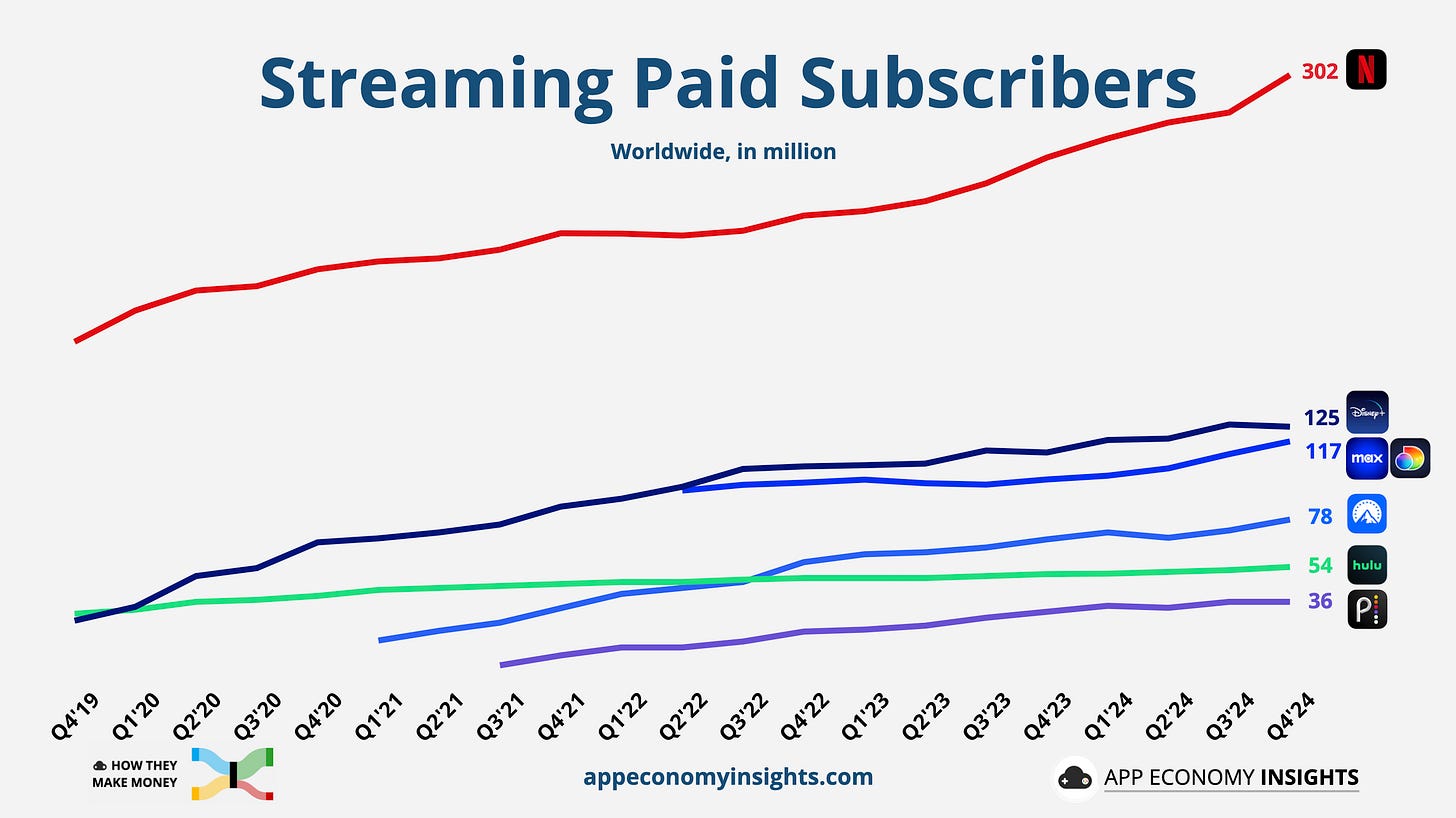

The chart below shows the paid subscriber trends in the past five years.

💡 Reminder: Some platforms, like YouTube Premium, Amazon Prime, and Apple TV+, don’t share quarterly numbers. Disney+ Hotstar is excluded following its merger with Reliance.

The shift from linear TV to streaming has been a high tide lifting all boats. According to Nielsen, streaming accounted for 43% of US TV Time in January 2025, representing a 7-point increase year-over-year, eating away at Cable and Broadcast.

For the first time, Nielsen consolidated Disney’s streaming entities (Disney+, Hulu, and ESPN+) into a single market share. Why? Because Disney made Hulu and ESPN+ directly available within the Disney app for some subscribers, affecting attribution.

Key trends to watch:

🛑 Password-Sharing Crackdown Expands: Following Netflix’s success, Disney began enforcing paid sharing in the US and will expand globally in 2025. Max is set to follow as Warner Bros. Discovery prioritizes streaming profitability. These changes could boost average revenue per user (ARPU) but also test subscriber retention.

📺 YouTube Dominate Streaming Time: YouTube still leads the pack, accounting for over a quarter of US TV streaming time (excluding YouTube TV). Even vertical video is making its mark, with 15% of Shorts viewing now on connected TVs.

▶️ Ad-Supported Streaming Gains Momentum: Ad tiers are now a key growth driver. Roku’s ad revenue outpaced the market, Disney’s streaming ad sales jumped 26%, and Warner and Paramount ramped up ad-supported plans to boost margins. Competition for ad dollars is heating up.

👨👩👧👦 Content Still Rules: Max added 6.4 million subscribers, fueled by True Detective: Night Country and global expansion. Paramount+ gained 5.6 million, driven by NFL broadcasts and Taylor Sheridan’s Yellowstone and Landman. Meanwhile, Disney+ lost 700,000, despite Moana 2’s success. Retention remains a challenge as prices rise.

💰 Profitability Takes Center Stage: Streaming is shifting from growth to profitability. Disney’s streaming unit turned a profit for the third straight quarter, Warner expects over $1 billion in streaming profits in 2025, and Peacock, Roku, and Paramount are closing the gap.

2. Disney: Streaming Profit Beat

Disney’s fiscal year ends in September, so the December quarter was Q1 FY25.

🍿 Moana 2's Box Office Splash: The Studio division posted $312 million in profit, reversing a year-ago loss. The success of Moana 2, which grossed over $1 billion worldwide, fueled the rebound. Disney reaffirmed its dominance, producing the top three highest-grossing films of 2024: Inside Out 2, Deadpool & Wolverine, and Moana 2.

📈 Streaming Profits Hold Steady: Disney’s direct-to-consumer (DTC) segment, including Disney+ and Hulu, posted its third straight profitable quarter with $293 million in operating income—beating analyst expectations by over $100 million. Despite a modest 700,000 decline in Disney+ subscribers, Hulu added 1.6 million new accounts, highlighting strong engagement despite price hikes.

🏰 Parks Face Weather Setbacks: Operating income for Disney’s Experiences division, which includes theme parks and cruises, remained flat at $3.1 billion. Hurricanes Milton and Helene led to temporary closures, costing Disney $120 million in lost revenue and additional pre-opening expenses for its new Disney Treasure cruise ship.

📺 Linear TV's Ongoing Decline: Revenue from traditional TV networks fell 7%, with operating income dropping to $1.1 billion. ESPN’s domestic revenue rose 8%, offset by higher programming costs. CEO Bob Iger reiterated that Disney’s linear networks are still an asset despite the industry shift toward streaming.

🔮 Streaming Integration & Future Outlook: Disney is doubling down on streaming, adding more live ESPN programming to Disney+, launching an ESPN direct-to-consumer service later this year, and expanding its password-sharing crackdown to improve margins. The company reaffirmed high-single-digit earnings growth for FY25 and double-digit profit increases for FY26 and FY27.

What to make of all this?

Disney’s Q1 reinforced its turnaround, bolstered by strong theatrical releases and cost-cutting measures. However, traditional TV challenges and weather-related park disruptions highlight the complexity of its transformation. With aggressive streaming integration and a robust content pipeline, Disney is positioning itself for sustained profitability under Bob Iger’s leadership.