📊 PRO: This Week in Visuals

LULU CHWY GME

Welcome to the Saturday PRO edition of How They Make Money.

Over 200,000 subscribers turn to us for business and investment insights.

In case you missed it:

Premium subscribers get:

📊 Monthly reports: 200+ companies visualized.

📩 Tuesday articles: Exclusive deep dives and insights.

📚 Access to our archive: Hundreds of business breakdowns.

PRO subscribers get everything PLUS:

📩 Saturday PRO reports: Timely insights on the latest earnings.

Today at a glance:

🧘🏻 Lululemon: Soft Outlook

🐶 Chewy: Autoship Unleashed

🎮 GameStop: Bitcoin To The Rescue

1. 🧘🏻 Lululemon: Soft Outlook

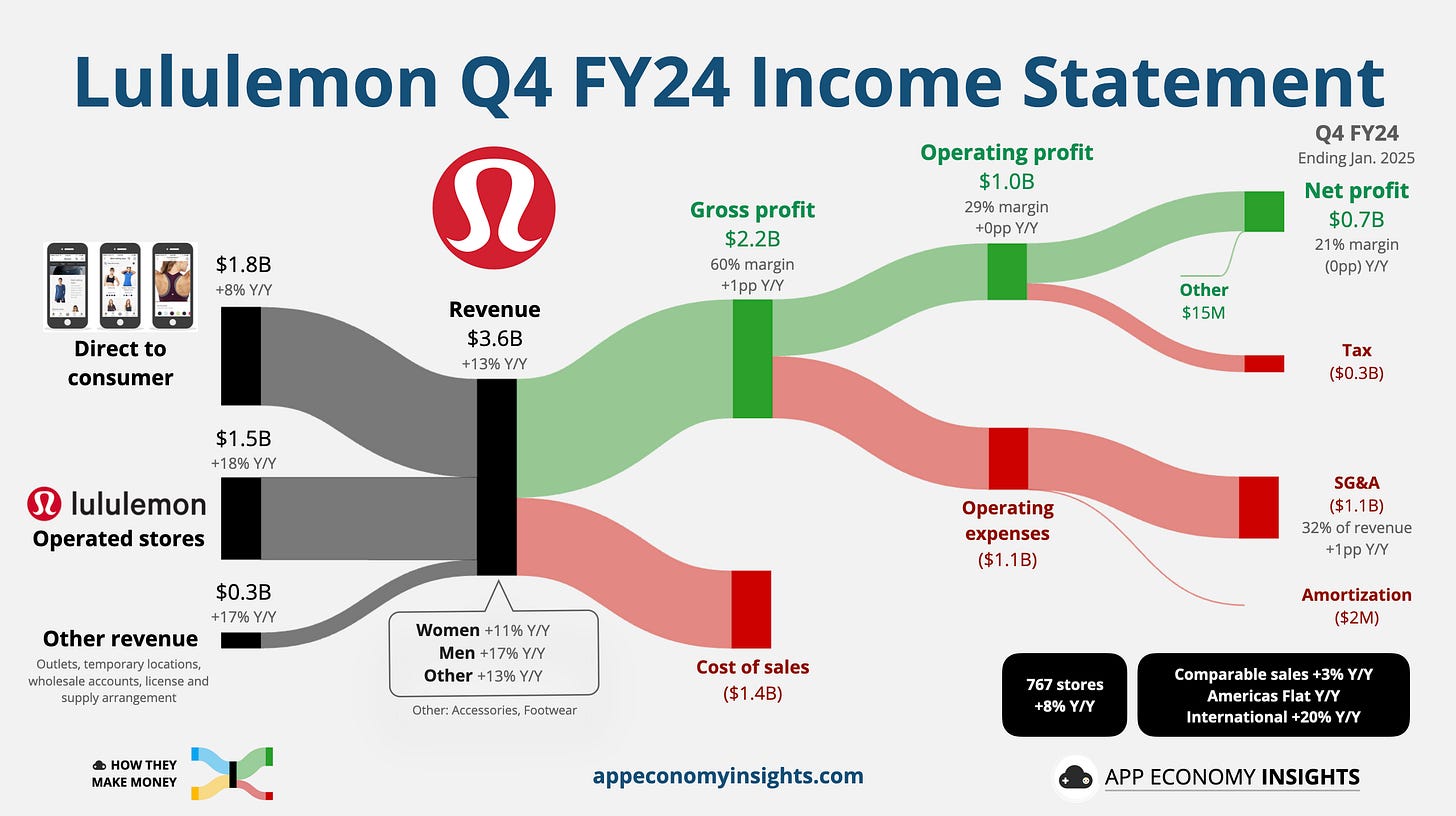

Lululemon closed FY24 with a 13% jump in Q4 revenue to $3.6 billion ($30 million beat) and EPS of $6.14 ($0.27 beat). Gross margin expanded 100 basis points to 60%. International revenue surged 38% Y/Y, much faster than the 7% Y/Y in the Americas. Comparable sales up 3%—driven by 20% growth abroad, including 27% in mainland China. Meanwhile, sales in the Americas were flat. The company ended the quarter with 767 stores, adding 18 net new locations.

However, the FY25 outlook disappointed, with revenue growth projected at just 5%–7% Y/Y and EPS of $14.95–$15.15—both below Wall Street expectations. Management cited cautious consumer behavior, inflation concerns, and rising tariffs as headwinds. North America sales are expected to grow in the low- to mid-single digits, while international expansion remains a key focus—especially in China, where 40 to 45 new stores are planned. Despite near-term pressure, product innovation and global growth continue to support the brand’s long-term ambitions. Lululemon also repurchased $332 million in stock during the quarter, bringing FY24 buybacks to $1.6 billion (+192% Y/Y), signaling management’s confidence in the current valuation.