📊 PRO: This Week in Visuals

FDX, GIS, DRI

Welcome to the Saturday PRO edition of How They Make Money.

Over 150,000 subscribers turn to us for business and investment insights.

In case you missed it:

Our PRO coverage includes timely updates on the recent big earnings.

📧 Free subscribers get our Friday articles and sneak peeks.

💌 Premium subscribers get:

Tuesday articles.

Access to our archive.

Monthly reports with 200+ companies covered.

💼 PRO members get all of the above, plus our Saturday coverage.

Today at a glance:

🚚 FedEx: Delivering Below Expectations

🍪 General Mills: Declining Organic Sales

🧑🍳 Darden: Uber Partnership

1. 🚚 FedEx: Delivering Below Expectations

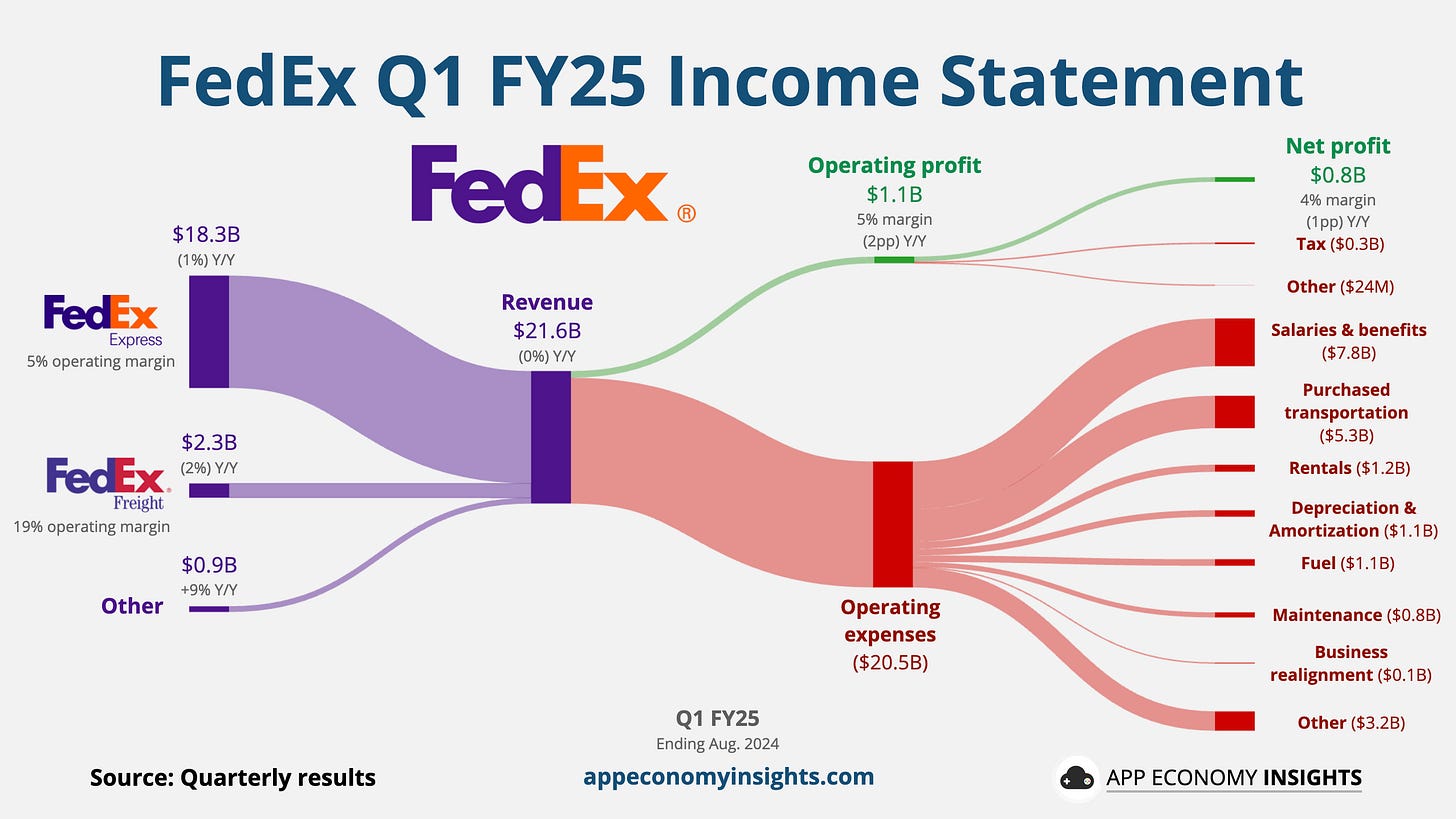

FedEx updated its financial presentation, consolidating Ground and Services into the Express segment. Q1 FY25 (ending in August) missed expectations with adjusted EPS of $3.60 (vs. $1.17 miss) and revenue mostly flat at $21.6 billion ($310 million miss), leading to a stock price drop of over 10%. The company attributed the weaker performance to a weaker demand for the more lucrative priority deliveries, increased operating expenses, and one fewer operating day.

Consequently, FedEx lowered its full-year outlook, revising revenue growth expectations to a low single-digit percentage and adjusted EPS to between $17.90 and $18.90 (down from $18.25 to $20.25 per share previously). Management focuses on cost reduction and network optimization to navigate the challenging environment and the weaker demand from industrial customers.