📊 PRO: This Week in Visuals

BRK CRM INTU DELL WDAY ADSK SNOW CPNG HPQ ZM NTNX DUOL DPZ AS CART ESTC HIMS AI DOCN DLO DCBO AMC OLO

Welcome to the Saturday PRO edition of How They Make Money.

Over 190,000 subscribers turn to us for business and investment insights.

In case you missed it:

📧 Free members get our Friday articles and sneak peeks.

💌 Premium members receive monthly reports with 200+ companies visualized, one extra weekly article, and access to our archive.

💼 PRO members enjoy everything in Premium, plus our timely coverage of the past week's most important earnings on Saturday.

Today at a glance:

🦎 Berkshire: Equities Remain Priority

☁️ Salesforce: AI Potential, Tepid Outlook

✅ Intuit: Small Business Momentum

💻 Dell: Lower-Margin AI Deployments

👔 Workday: Reassuring Investors

🏗️ Autodesk: Workforce Reduction

❄️ Snowflake: AI-Powered Momentum

🇰🇷 Coupang: Farfetch Integration

🖨️ HP: Navigating Headwinds

🖥️ Zoom: AI-First Expansion

☁️ Nutanix: VMware Shift Tailwinds

🦉 Duolingo: Record Growth Continues

🍕 Domino’s: Aggregator Expansion

⛷️ Amer Sports: Sales Surge in Asia

🥕 Instacart: Soft Guidance

🔍 Elastic: Cloud Acceleration

💊 Hims & Hers: Weight-Loss Uncertainty

🧠 C3 AI: Expanding Partnerships

🌊 Digital Ocean: High-Value Customers

🌎 dLocal: Take Rate Compression

🎓 Docebo: AI-First Pivot

🍿 AMC: Box Office Rebound

🍽️ Olo: Expanding Personalization

1. 🦎 Berkshire: Equities Remain Priority

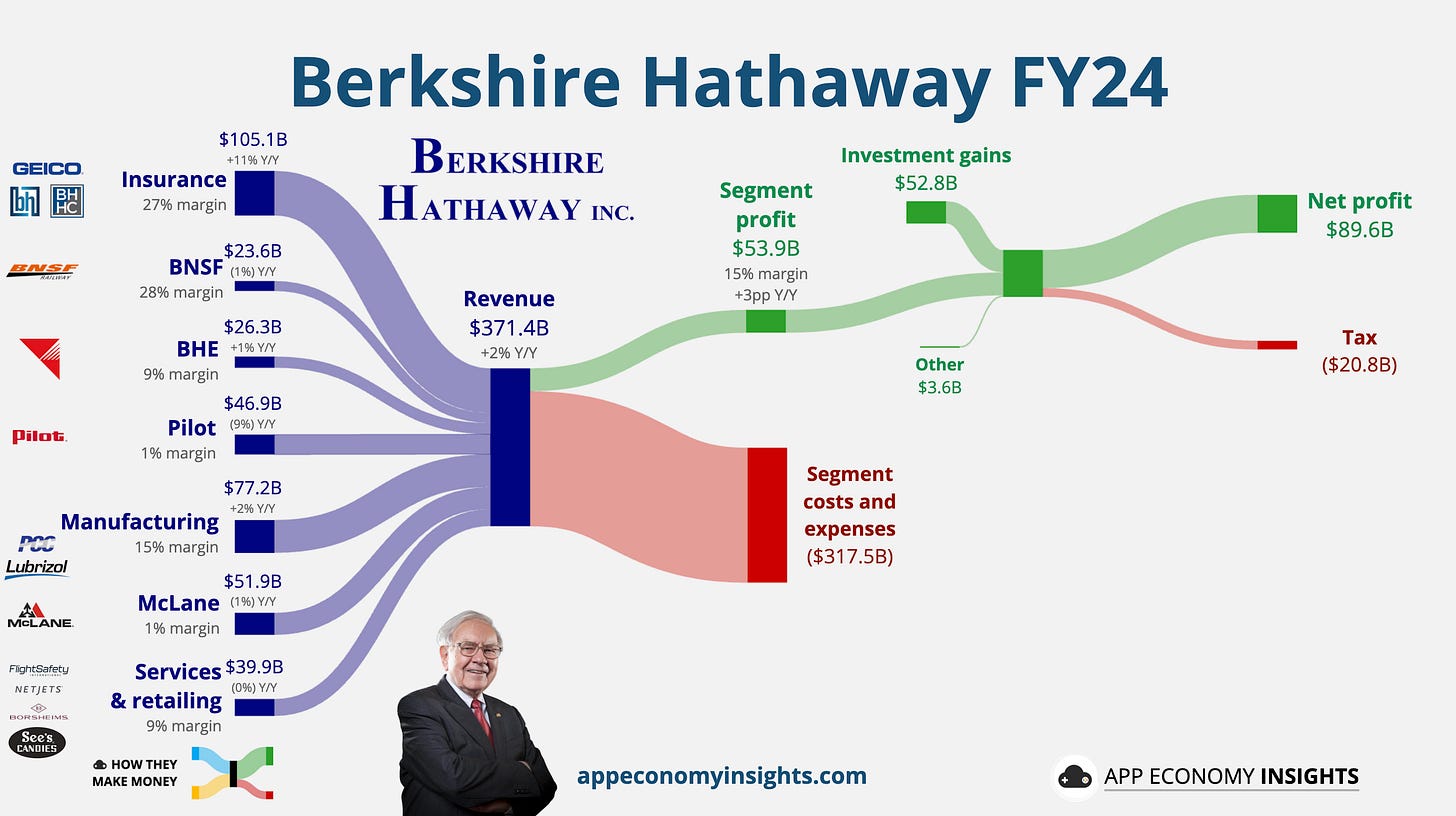

Berkshire Hathaway ended Q4 with a record $334 billion in cash, up from $325 billion in Q3, reflecting Warren Buffett’s patient approach amid limited acquisition opportunities. A large portion of the cash pile is driven by Berkshire’s property-casualty insurance business. Despite accumulating cash for the 10th straight quarter, Buffett reaffirmed that Berkshire will always prioritize equities over cash—with his stock portfolio reaching $272 billion—led by holdings in Apple, American Express, and Bank of America.

In his annual letter, Buffett reiterated confidence in the US economy, highlighting Berkshire’s role as America’s largest corporate taxpayer, contributing $20.8 billion in income tax in 2024. He also hinted at potentially increasing stakes in Japan’s five largest trading houses, signaling continued global investment expansion. Despite its massive cash reserves, Berkshire remained a net seller of stocks, trimming its equity portfolio by 23% Y/Y. The conglomerate also paused buybacks for the second consecutive quarter, suggesting Buffett doesn’t find the stock attractive. While Berkshire’s core businesses remain healthy, analysts noted Buffett’s cautious stance could reflect concerns about a softer US economy ahead.

2. ☁️ Salesforce: AI Potential, Tepid Outlook

Salesforce posted mixed Q4 results, with EPS of $2.78 ($0.17 beat) and revenue growing 8% Y/Y to $10.0 billion ($50 million miss). The company highlighted strong AI-driven momentum, with Data Cloud and Agentforce reaching $900 million in annual recurring revenue (+120% Y/Y) and 5,000 Agentforce deals signed since October. CEO Marc Benioff emphasized that Salesforce is uniquely positioned to lead the AI-driven "digital labor revolution." Current RPO rose 11% Y/Y—the best forward-looking growth indicator. However, Q4 marked Salesforce’s third straight quarter of single-digit revenue growth.

FY26 revenue outlook was ~$40.7 billion (+8% Y/Y), below the $41.4 billion consensus. While analysts remain optimistic about Agentforce and long-term AI monetization, they expressed concerns about near-term revenue softness and macro headwinds. Meanwhile, Salesforce is navigating leadership transitions, including a new CFO and Chief Revenue Officer. With AI adoption growing but not yet materially impacting revenue, investors will watch RPO to evaluate Salesforce's ability to return to double-digit growth.