📊 PRO: This Week in Visuals

Earnings season kicks off: JPM, WFC, C, PEP, DAL, MANU

Welcome to the Saturday PRO edition of How They Make Money.

Over 130,000 subscribers turn to us for business and investment insights.

A new earnings season is upon us!

Today, we celebrate the launch of our PRO coverage. 🙌

Let's visualize the performance of 6 companies that reported their earnings this week.

We’ll dive deeper into US Banks’ earnings next week once they have all reported.

Today at a glance:

🏦 JPMorgan: Investment Banking Shines

📉 Wells Fargo: Mixed Signals

💵 Citigroup: Cost-Cutting Pays Off

🥤 PepsiCo: Price-Conscious Snacking

🛩️ Delta Airlines: Turbulence Ahead

⚽️ Man United: Sir Jim Ratcliffe is Here

1. 🏦 JPMorgan: Investment Banking Shines

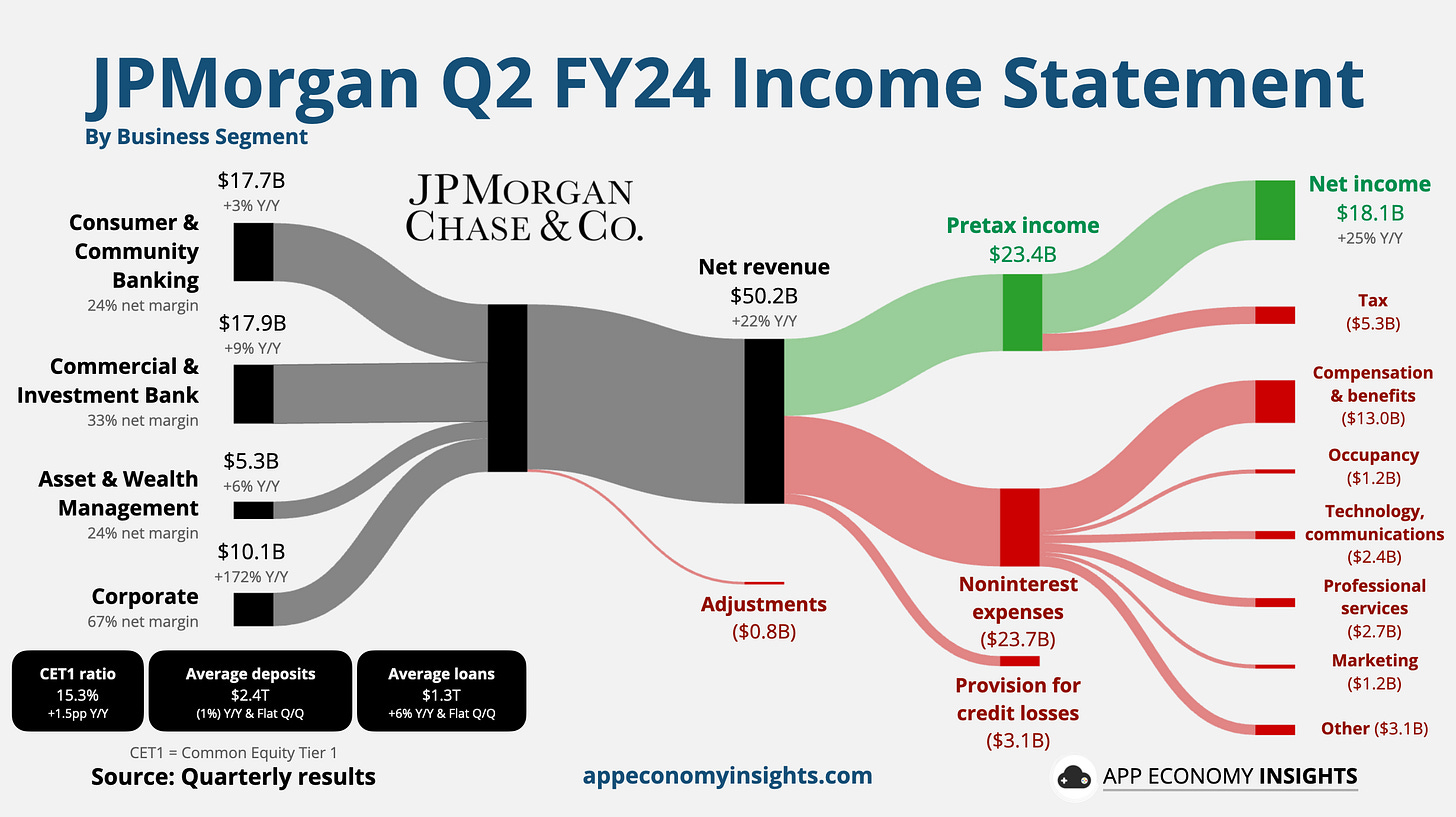

JPMorgan Chase (JPM) reported Q2 earnings that fell slightly short of expectations if we exclude a one-time gain of $7.9 billion from a share exchange deal with Visa (booked in the Corporate segment). The bank increased its provision for credit losses, signaling caution.

Despite this, investment banking fees surged by 50% (compared to 25%-30% expected) to $2.4 billion, driven by increased dealmaking and capital market activity, with a few large deals closing early.

Net interest income declined slightly compared to the previous quarter, reflecting the ongoing pressure on deposit margins. However, the bank reaffirmed its full-year guidance for a net interest income of ~$91 billion.