👟 Nike: Just getting it done

In times of turbulence, strong brands can get stronger

Hello there! 👋

Greetings from San Francisco!

Welcome to the new members who have joined us this week!

Join the fast-growing How They Make Money community to receive weekly insights on business and investing.

New year, new you!

It’s that time of year. Fitness is usually on everyone’s mind as we tackle new resolutions. So I got you covered today with the largest athletic brand in the world.

Nike (NKE) reported the second quarter of its fiscal year 2023 (ending November 2022) right before the holidays.

Before we enter earnings season in full force in the coming weeks, I want to take a closer look at the footwear giant and how well it has maneuvered the current challenging macro environment.

Today, we’ll cover the following:

Nike Q2 FY23.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

Nike recently celebrated its 50th anniversary.

While the company was founded by Bill Bowerman and Phil Knight in 1964 as “Blue Ribbon Sports,” it officially became Nike in 1971.

I came across this great quote by Phil Knight in my LinkedIn feed:

“Life is growth. You grow or you die.”

Knight started importing running shoes from Japan right after exiting Stanford business school. He argued at the time that these shoes could do very well in the US, so he started his own gig in Portland, Oregon. Nike was born.

Did you know Nike takes its name from the Greek goddess of victory? And today, it’s become one of the most popular brands worldwide.

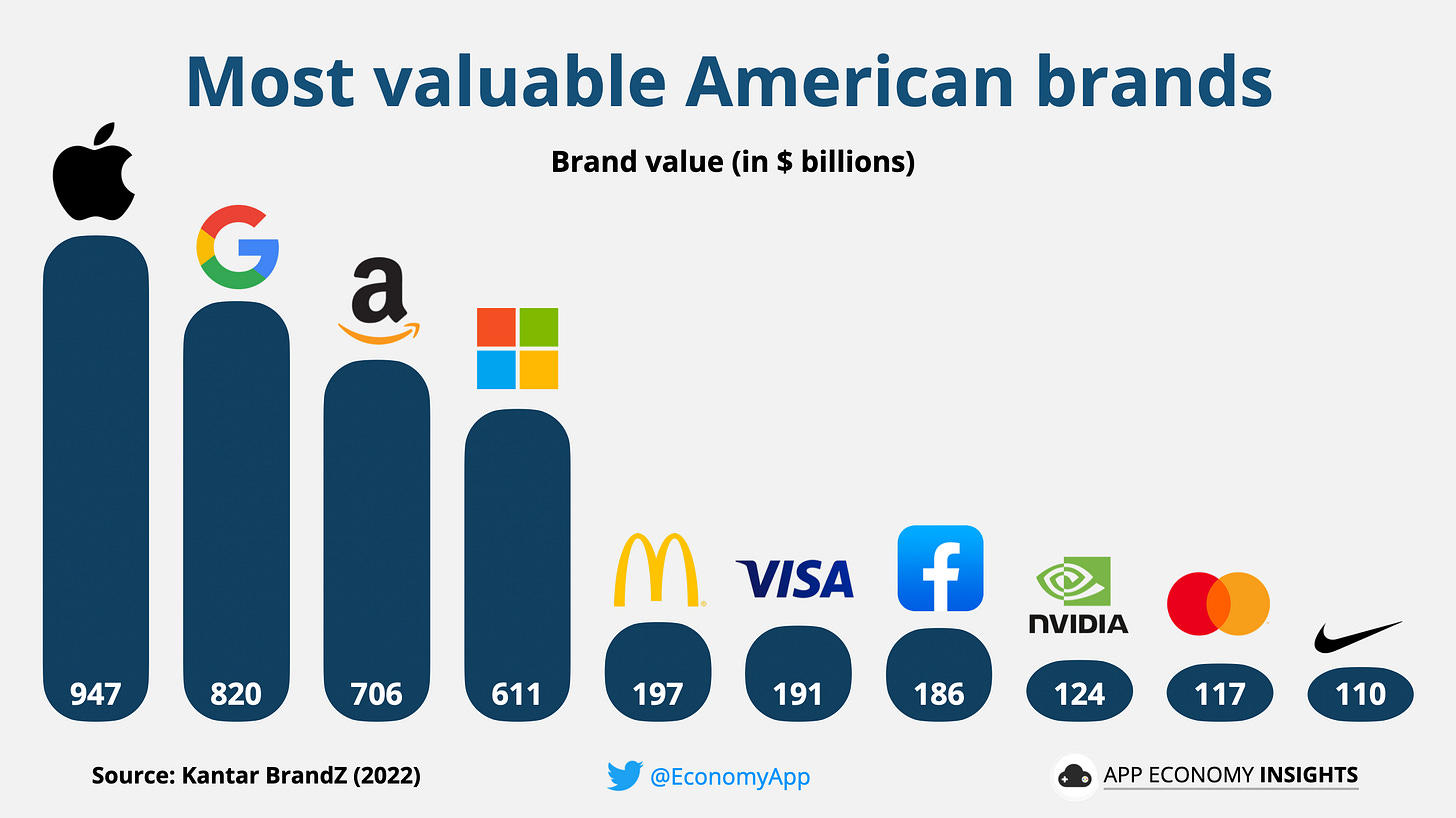

Every year, Kantar BrandZ ranks the most valuable global brands based on their financial contributions to their parent companies and consumer insights. According to the 2022 report, the most valuable American brands were:

Apple ($947 billion).

Google ($820 billion).

Amazon ($706 million).

Microsoft (611 billion).

McDonald’s ($197 billion).

Visa ($191 billion).

Facebook ($186 billion).

NVIDIA ($124 billion).

Mastercard ($117 billion).

Nike ($110 billion).

If we include the rest of the world, Nike falls in the 13th position after Tencent, Alibaba, and Louis Vuitton, which we recently discussed here.

That makes Nike the most valuable apparel brand in the world, about four times more valuable than its closest challenger, Zara (owned by Inditex).

Today, there are many brands under the Nike umbrella.

Nike Golf.

Nike Pro.

Nike+.

Air Jordan.

Nike Blazers.

Air Force.

Nike Dunk.

Air Max.

Foamposite.

Nike Skateboarding.

Nike CR7.

Air Jordan.

And you are probably familiar with the Jumpman logo inspired by Michael Jordan.

In addition, Nike acquired sneakers company Converse for $309 million in 2003.

Before we start, let’s discuss how Nike makes money.

Revenue is broken down by product:

👟 Footwear (~62% of overall revenue in FY22).

🎽 Apparel (~30% of overall revenue).

🏀 Equipment (~3% of overall revenue).

⭐️ Converse (~5% of overall revenue).

Revenue is also broken down by brand revenue type:

🏬 Wholesale (~58% of overall revenue in FY22, -3pp Y/Y).

📱 Nike Direct (~42% of overall revenue in FY22, +3pp Y/Y).

Nike Direct operations include Nike-owned retail stores and sales through digital platforms (Nike’s website and mobile apps).

More revenue breakdown from FY22:

🏃🏻♂️ Men’s: ~52% of overall revenue.

🧘🏽♀️ Women’s: ~23% of overall revenue.

🧒🏼 Nike Kids’: ~13% of overall revenue.

🏀 Jordan Brand: ~14% of overall revenue.

Costs and expenses include:

Cost of sales: Inventory costs, as well as warehousing costs (including the cost of warehouse labor), third-party royalties, certain foreign currency hedge gains, and losses, and product design costs. They also include shipping and handling costs.

Overhead: Technology investments and wage-related costs (general and administrative costs).

Demand creation: Advertising and promotion costs, including endorsement contracts, complimentary products, television, digital and print advertising and media costs, brand events, and retail brand presentation. Demand creation makes up around 8% of revenue, which is relatively low. It illustrates how strong the Nike brand is.

Margins:

The gross margin has been stable in the past decade, oscillating between 43% and 47%. It’s the best number to illustrate that Nike has maintained its brand proposition.

The operating margin has been consistently around 12%-13% if we exclude the COVID drop and subsequent rebound.

Let’s look at the most recent quarter.