💻 Microsoft: New Era of Computing

The AI bonanza continues and the latest on the Activision deal

Greetings from San Francisco! 👋

Welcome to the new members who have joined us this week!

Join the 35,000+ How They Make Money subscribers receiving insights on business and investing every week.

Microsoft (MSFT) released its Q3 FY23 report (ending March 2023) last week, resulting in an impressive 11% surge in shares. 👀

So what happened?

Today, we’ll cover the following:

Microsoft Q3 FY23.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

Maybe the most intriguing aspect of today's discussion will be what the financials don't reveal. We'll delve into new products, AI features, and the increasingly uncertain Activision Blizzard acquisition

We’ll highlight what investors should keep an eye on in the coming months.

Let’s dive in!

1. Microsoft Q3 FY23

The Microsoft Cloud continued to expand its footprint, growing +22% Y/Y to $28.5 billion, representing 54% of the company’s total revenue.

The standout segment, Intelligent Cloud (including Azure), contributed 42% of the overall revenue, marking an all-time high.

Here is a bird’s-eye view of the income statement.

Income statement:

Revenue grew +7% Y/Y to $52.9 billion ($1.9 billion beat), or +10% fx neutral.

📊 Productivity and Business Processes grew +11% Y/Y to $17.5 billion (+15% Y/Y fx neutral).

☁️ Intelligent Cloud grew +16% Y/Y to $22.1 billion (+19% Y/Y fx neutral).

🎮 More Personal Computing declined -9% to $13.3 billion (-7% Y/Y fx neutral).

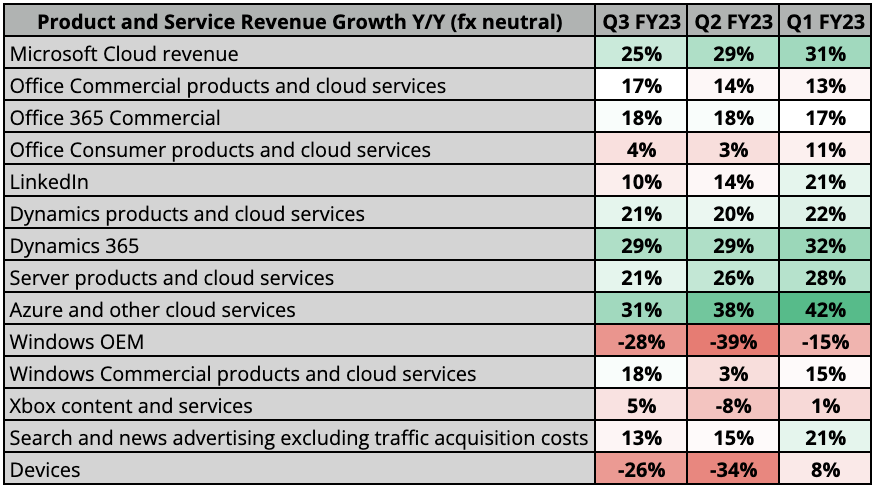

Management provided a table with revenue growth for selected products and services. For example, Azure and other cloud services grew +27% Y/Y on a GAAP basis, but +31% Y/Y in constant currency.

To add some context, below is a table comparing growth Y/Y (fx neutral) in the past three quarters. Azure remained the fastest-growing segment in Q3 FY23.

Important notes: