☁️ Microsoft: AI at Scale

AI doubles its impact and Gaming overtakes Windows

Greetings from San Francisco! 👋

A warm welcome to the recent additions to our community!

Over 85,000 How They Make Money subscribers turn to us weekly for business and investment insights. Glad you're here.

Microsoft (MSFT) released its Q2 FY24 report (ending December 2023).

CEO Satya Nadella explained in his prepared remarks:

“We’ve moved from talking about AI to applying AI at scale.“

Adding "at scale" to anything might sound like an eye-roll-worthy cliché, but in Microsoft's case, it's less hot air and more jet fuel. Their global reach and diverse products make them uniquely positioned to supersize their AI impact.

We have a special edition today with a look into:

☁️ AI’s impact on Azure’s growth.

🧠 Small Language Models (SLMs).

⚙️ Microsoft’s new custom AI chips.

🔎 Copilot rebranding and Search market share.

The company delivered an impressive revenue growth of 18% year-over-year, but we must dig deeper. The growth was 16% in constant currency and only 12% if we exclude the contribution from the newly acquired Activision Blizzard.

Let’s look closer at what helped MSFT reach a new all-time high.

Today at a glance:

Microsoft Q2 FY24.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

1. Microsoft Q2 FY24

The company divides its business into subcategories that can feel like a set of Russian dolls:

Microsoft Cloud represents all of Microsoft's cloud offerings across multiple segments. It grew +22% Y/Y in constant currency to $34 billion, representing 54% of the company’s total revenue.

Intelligent Cloud is a specific segment focusing on public, private, and hybrid cloud solutions. It grew +19% Y/Y in constant currency to $26 billion.

Azure—Microsoft’s cloud computing platform and infrastructure—is included in Intelligent Cloud, making it the focal point for investors.

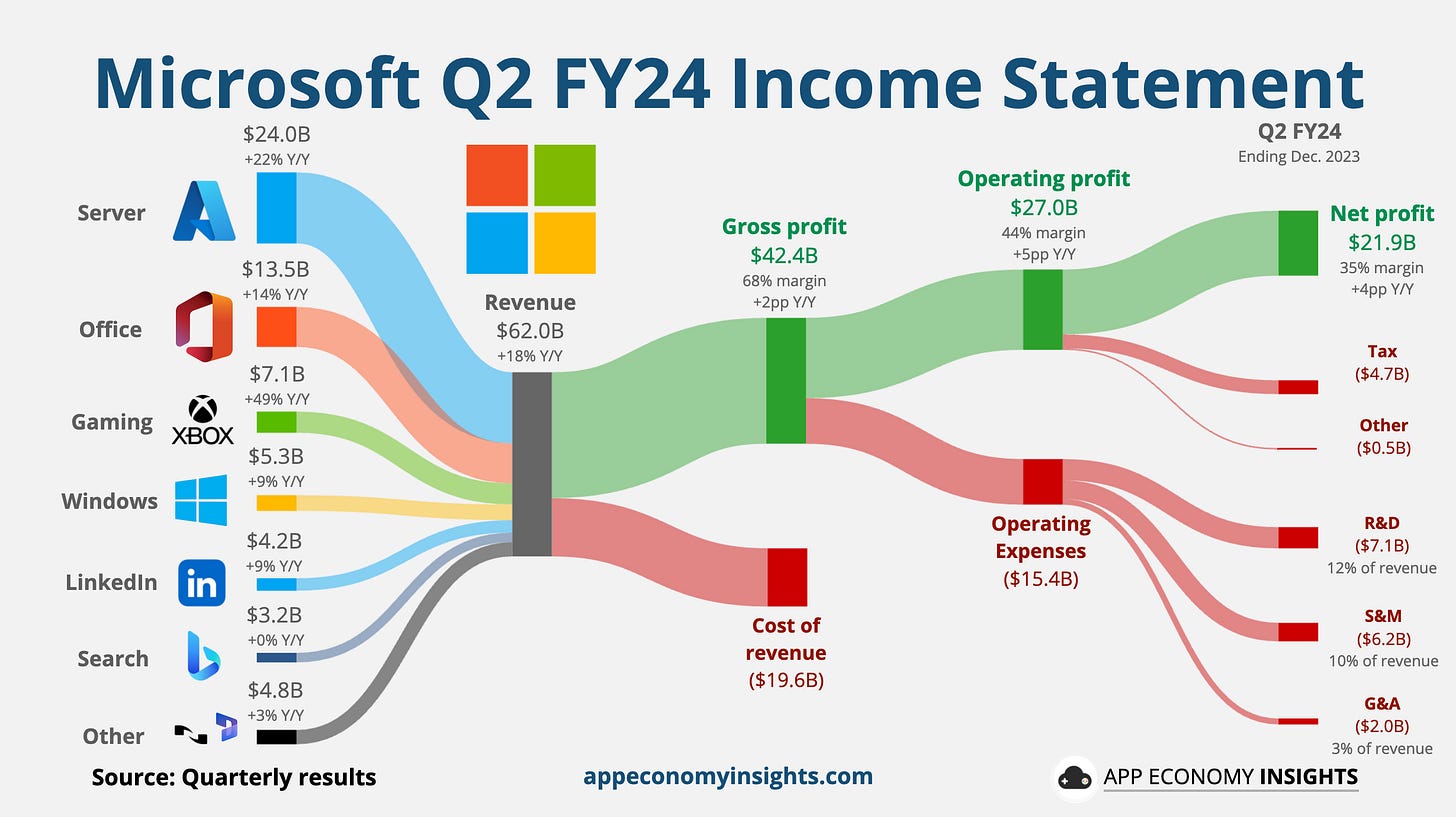

The company also breaks down its revenue by significant products and services. Azure is included in “Server products and cloud services.” Gaming is now the third largest segment, ahead of Windows, following the Activision acquisition in October.

☁️ Server products and cloud services $24.0 billion (+22% Y/Y).

📊 Office products and cloud services $13.5 billion (+14% Y/Y).

🎮 Gaming $7.1 billion (+49% Y/Y).

🪟 Windows $5.3 billion (+9% Y/Y).

👔 LinkedIn $4.2 billion (+9% Y/Y).

🔎 Search and news advertising $3.2 billion (+0% Y/Y).

🔒 Enterprise and partner services $1.9 billion (+1% Y/Y).

📈 Dynamics $1.6 billion (+21% Y/Y).

💻 Devices $1.3 billion (-9% Y/Y).

Let’s turn to a view of the income statement focusing on the three core business segments.