🤝 MercadoLibre: One-Stop LATAM Shop

The commerce and fintech giant reached 100 million quarterly active users

Greetings from Bali! 👋

Welcome to the new members who have joined us this week.

Join the 37,000+ How They Make Money subscribers receiving insights on business and investing every week.

Have you noticed the recurring mention of MercadoLibre (MELI) among the top hedge fund investments in Q1 2023? It's time we zoom in on this intriguing company.

MercadoLibre stands at the intersection of e-commerce and fintech in Latin America (LATAM). Think of it as the Amazon.com and PayPal of LATAM, seamlessly combining retail and payment solutions.

Today, we’ll cover the following:

MercadoLibre Q1 FY23.

Recent business highlights.

Key quotes from the earnings call.

What to watch looking forward.

Morgan Stanley recently pointed out that MercadoLibre was "on the path to be a one-stop fintech provider." And it’s not just about fintech. The company has many tailwinds working in its favor, from advertising to logistics.

The LATAM region is vast with over 650 million people and a fast-growing internet penetration. So it’s no surprise other companies are vying for a share of this market, such as Sea Limited, Amazon, and Alibaba. Multiple winners could emerge.

The company delivered a three-digit revenue growth during the early phase of the pandemic. Despite challenging comps, revenue is still growing faster than pre-COVID today, and the business is profitable and capital efficient.

MercadoLibre breaks down its performance into four main businesses:

📦 Marketplace – MercadoLibre.

🚛 Logistics - MercadoEnvios.

💳 Payments - MercadoPago.

💰 Credits - MercadoCredito.

Let’s discuss how MercadoLibre makes money.

First, some key metrics you should know:

Unique Active Users: Users across the entire ecosystem during the period (including commerce buyers/sellers, and fintech users).

GMV (Gross Merchandise Volume): The total sum of all transactions completed through the MercadoLibre Marketplace.

TPV (Total Payment Volume): The total sum of all transactions paid for using Mercado Pago.

Take rate: the portion of GMV or TPV MercadoLibre keeps as revenue.

IMAL (Interest Margin After Losses): Revenues (interest from loans + late fees) net of provision for doubtful accounts. So IMAL is the net margin from Credit revenues after all risks have been factored in.

If we look at the income statement:

Revenue has two main components:

📦 Commerce (~53% of overall revenue).

Marketplace revenue: Generated from fees charged for listing and selling items on the MercadoLibre platform. Fees depend on the listing type and the final price of the item sold.

Non-marketplace revenue: Primarily comes from classified listings services (real estate and motor listings), advertising on their platform, and revenues from their shipping service, MercadoEnvios.

💳 Fintech (~47% of overall revenue).

MercadoPago: Payments platform, which provides digital payment solutions, both on their platform and off their platform. They generate revenue from transaction fees charged to merchants for these payment solutions.

MercadoCredito: Lending business offering both consumer loans and working capital loans to sellers. The revenue is generated from interest and fees charged on these loans.

Revenue by country in FY22:

🇧🇷 Brazil was 54% of revenue.

🇦🇷 Argentina was 24%.

🇲🇽 Mexico was 18%.

Other countries were 5%.

In the past two years, management started breaking down revenue by segment. The fintech category has been the main driver of growth, particularly MercadoCredito.

Costs and expenses include:

Cost of revenue: Direct expenses in generating revenue. Channel distribution cost, logistics and other value-added services, bank transaction fees, server and hosting costs, and cost of goods sold.

Operating expenses:

Sales & marketing: Advertising expenses, promotion expenses, staff compensation.

General & administrative: Costs associated with running corporate operations (legal, accounting, etc.), depreciation, and amortization.

Product development: Product development functions.

Provision for doubtful accounts: Mainly the current expected credit losses on loans receivable.

Margins:

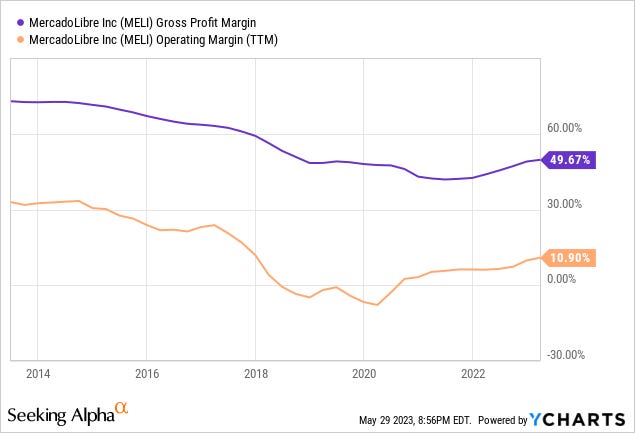

The gross profit margin has compressed in the past decade primarily as a result of the evolving revenue mix, but remains healthy at 50%. MercadoLibre has been aggressively investing in its business, particularly in fintech (to offer more services) and logistics (to improve delivery times), impacting profitability in the short term. After a temporary phase of unprofitability in 2019 and 2020, the business is witnessing steady margin improvements.

Its strategic focus remains on exploiting the significant e-commerce and fintech growth opportunities in Latin America, even at the cost of short-term profitability.

MercadoLibre's long-term bet? That this strategy will yield increased market share and a stronger foothold in its key markets.

Let’s look at the most recent quarter!